Olge esimene, kes teab, kui uus selline sisu saadaval on!

Liituge meie uudiskirjaga, et saada teateid uute postituste, kohalike uudiste ja valdkonna kohta.

Aitäh! Teie esildis on laekunud!

Oih! Vormi saatmisel läks midagi valesti.

Cannabiz Media has been tracking cannabis and hemp licenses globally since 2015. Over those seven years, we have aggregated a mass of data on licenses, companies, and transactions that result in change of license ownership.

After compiling 500 transactions in our Kanepi luure™ platform, we wanted to take a closer look at how key publicly traded MSOs were adding to their store footprints. Our goal was to determine which stores were “built” versus those that were “bought”.

Peamised järeldused

- Almost 12% of US cannabis stores are owned by a public company.

- 338 of these stores have changed hands, and 29 public companies were involved in these transactions.

- Almost 60% of the store acquisitions occurred in five states (Florida, Colorado, Pennsylvania, California, and Arizona).

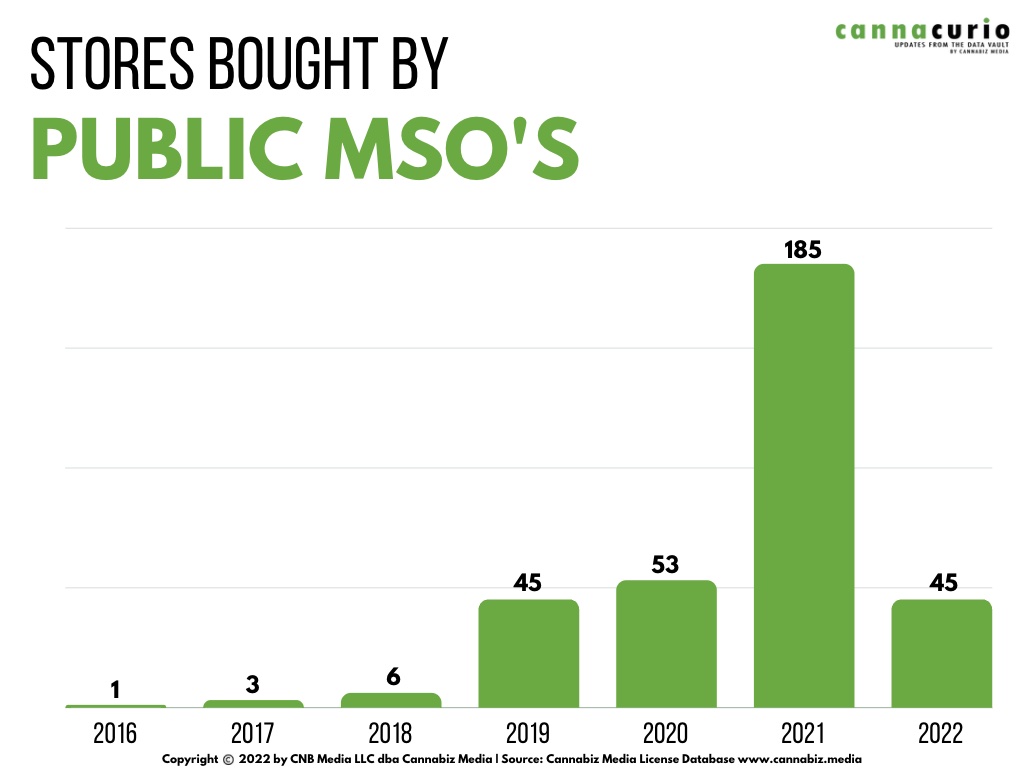

- The number of stores changing hands has increased every year. In 2021, we found 185 stores that were purchased, up from 53 in 2020.

Taust

Vastavalt Cannabizi meedialitsentside andmebaas, there are currently 8,909 stores/dispensaries in the US. Of those licenses, 1,048 (11.8%) are owned by public companies, and we found 338 stores that changed hands. A total of 29 public companies were involved in these transactions.

The graph below shows the number of stores that have changed hands. We only included closed deals.

Edetabel

In trying to assess the footprint impact, we compiled the number of stores bought against the number built or awarded. The Leaderboard below shows public MSOs that bought at least 10 stores.

Based on our analysis, Trulieve has bought the most stores (54), and that accounts for 32% of its footprint. AYR Wellness purchased 42, accounting for 62% of its stores. Curaleaf, a company with a very large footprint, has only acquired 15 stores. $1.2B was spent by these firms to acquire these licenses.

- In the table above, Schwazze bought 77% of its licenses with AYR Wellness at 62%. Cresco comes in third at 56% though this will change once the Columbia Care acquisition is complete.

- Verano spent the most at $202 million with Cresco at $178 million and Trulieve at $176 million.

- Verano paid the most per store at $9.64 million while Schwazze paid the least at $1.79 million.

Geograafia

More stores were acquired in limited license states rather than unlimited license states. Limited license environments are more predictable thanks to the oligopolistic protections afforded by the regulations. Early entrants are well positioned when the inevitable adult use market opens, and they have advantages including customers, marketing, branding, real estate and established relationships with regulators.

The M&A Hotspots Table shows the states that public MSO’s invested in.

Järeldus

We do not see this trend ending anytime soon. The latest blockbuster deal of Cresco and Columbia Care will run into license cap issues in some states, and this will require divestiture. In future posts, we plan to look at the license cap issue and delve into which states have had their licenses MSO’d – like Connecticut. We welcome your questions as well, so reach out directly to ekeating @cannabiz.media.

Metoodika

Analysis like this is as much art as science, so here is some of the logic we applied:

- Only active licenses are counted. Pending and applied are not included, nor are future licenses that a company has the right to operate. This approach makes some of the Pennsylvania licenses look very expensive as operators bought these licenses knowing they could run multiple stores.

- In large deals where a variety of assets were acquired, we backed out the value of cultivation/manufacturing assets based on comparable transactions when available.

- We strive to be comprehensive but we may not have caught every deal, and in some cases, the MSO may have deemed a small acquisition as immaterial.

- In addition to the Cannabiz Intelligence platform, the team derived deal data from SEC and SEDAR filings as well as company press releases, investor decks, and investor relations staff.

Ed Keating on Cannabiz Media kaasasutaja ja jälgib ettevõtte andmete uurimist ja valitsussuhetega seotud jõupingutusi. Ta on oma karjääri veetnud teabeettevõtetega töötades ja nende nõustamisel vastavuse valdkonnas. Ed on juhtinud tooteid, turundust ja müüki, jälgides samal ajal keerulisi mitut jurisdiktsiooni hõlmavaid tootesarju väärtpaberi-, ettevõtete, UCC-, ohutus-, keskkonna- ja inimressursside turgudel.

Shea Sanford is Product Manager for Cannabiz Media’s Cannabiz Intelligence product. He’s responsible for sleuthing out corporate transactions and keeping track of MSOs, SSOs, REITs, SPACs and any other acronyms we can find.

Cannabiz Media kliendid saavad nende ja muude uute litsentsidega kursis olla meie uudiskirjade, hoiatuste ja aruannete moodulite kaudu. Telli meie uudiskiri et saada need iganädalased aruanded teie postkasti. Või saate ajakava demo lisateabe saamiseks selle kohta, kuidas ise pääseda juurde Cannabizi meedialitsentsi andmebaasile, et nendesse andmetesse süveneda.

/hr>

Cannacurio on Cannabiz Media iganädalane veerg, mis sisaldab teadmisi kõige põhjalikumalt litsentsiandmete platvormilt. Vaadake Cannacurio postitusi ja taskuhäälingusaateid uusimate värskenduste ja teabe saamiseks.

- SEO-põhise sisu ja PR-levi. Võimenduge juba täna.

- Platoblockchain. Web3 metaversiooni intelligentsus. Täiustatud teadmised. Juurdepääs siia.

- Allikas: https://www.cannabiz.media/blog/cannacurio-57-do-public-msos-build-or-buy-their-cannabis-stores

- 1

- 10

- 11

- 2020

- 2021

- 7

- a

- MEIST

- üle

- juurdepääs

- raamatupidamine

- Kontod

- omandama

- omandatud

- omandamine

- ülevõtmised

- Akronüümid

- aktiivne

- lisamine

- Täiskasvanud

- eelised

- nõustamine

- võimaldatud

- vastu

- analüüs

- ja

- rakendatud

- lähenemine

- arizona

- kunst

- vara

- saadaval

- anda

- tagatud

- põhineb

- alla

- pomm

- ostnud

- branding

- ehitama

- ehitatud

- ostma

- California

- Kanepi

- Cannabizi meedia

- kork

- mis

- Karjäär

- juhtudel

- püütud

- muutma

- muutuv

- suletud

- lähemale

- Asutaja

- Colorado

- Columbia

- Veerg

- Ettevõtted

- ettevõte

- Ettevõtte omad

- võrreldav

- täitma

- keeruline

- Vastavus

- terviklik

- Connecticut

- sisu

- Korporatiivne

- võiks

- Praegu

- Kliendid

- andmed

- Andmeplatvorm

- andmebaas

- tegelema

- Pakkumised

- esitatud

- Tuletatud

- Määrama

- otse

- Varajane

- ed

- jõupingutusi

- sissetulev

- keskkonna-

- keskkondades

- asutatud

- kinnisvara

- Iga

- kallis

- Lisaks

- leidma

- ettevõtetele

- esimene

- Florida

- Jalajälg

- vorm

- avastatud

- Alates

- edasi

- tulevik

- saama

- Ülemaailmselt

- eesmärk

- Valitsus

- graafik

- Käed

- Kanep

- siin

- Kuidas

- Kuidas

- HTTPS

- inim-

- INIMRESSURSS

- mõju

- in

- lisatud

- Kaasa arvatud

- kasvanud

- tööstus

- Tööstuse ülevaade

- vältimatu

- info

- teadmisi

- Intel

- Intelligentsus

- investeerinud

- investor

- seotud

- probleem

- küsimustes

- pidamine

- Võti

- Teadma

- Teades

- suur

- hiljemalt

- litsents

- Litsentsid

- piiratud

- liinid

- nimekiri

- kohalik

- Vaata

- Ühinemised ja ülevõtmised

- TEEB

- juhitud

- juht

- Turg

- Turundus

- turud

- Mass

- Meedia

- miljon

- Moodulid

- rohkem

- kõige

- mitmekordne

- Uus

- uudised

- Uudiskiri

- Infolehed

- number

- toimunud

- Avaneb

- töötama

- ettevõtjad

- Muu

- omanikuks

- omandiõigus

- makstud

- Pennsylvania

- kava

- inimesele

- Platon

- Platoni andmete intelligentsus

- PlatoData

- Saated

- paigutatud

- Postitusi

- ennustatav

- vajutage

- Pressiteated

- Toode

- tootejuht

- avalik

- aktsiaseltsid

- avalikult

- ostetud

- Küsimused

- jõudma

- reaalne

- kinnisvara

- saama

- määrused

- Regulaatorid

- suhted

- Suhted

- Pressiteated

- Aruanded

- nõudma

- teadustöö

- ressurss

- vastutav

- kaasa

- jooks

- ohutus

- müük

- teadus

- SEC

- Väärtpaberite

- seitse

- Näitused

- alates

- väike

- So

- mõned

- midagi

- Varsti

- Ruum

- kasutatud

- Personal

- Ühendriigid

- jääma

- salvestada

- kauplustes

- püüdma

- esitamine

- tabel

- Võtma

- meeskond

- .

- oma

- Kolmas

- Läbi

- et

- Summa

- jälgida

- Jälgimine

- kaubeldakse

- Tehingud

- Trend

- piiramatu

- ajakohane

- Uudised

- us

- kasutama

- väärtus

- sort

- Versus

- tagaotsitav

- iga nädal

- teretulnud

- Heaolu

- mis

- kuigi

- will

- töö

- Vale

- aasta

- aastat

- Sinu

- ise

- sephyrnet