A handful of cryptocurrency exchanges have suddenly become billion-dollar companies. An explosion in Bitcoin’s popularity has supercharged previously small-time platforms into powerhouses generating millions of dollars in revenues. And, it’s not just Bitcoin either, with other altcoins recording immense surges as well.

Źródło: MFW

Crypto is “risky” and opens “unwanted doors”

The same was the subject of a blog recently published by the IMF (Międzynarodowy Fundusz Walutowy). The report observed,

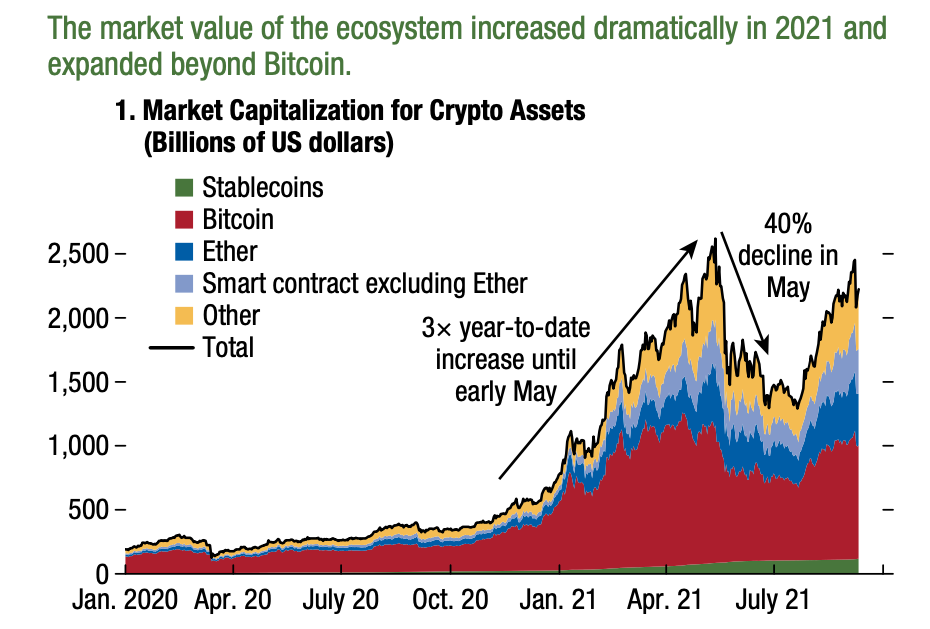

“The total market value of all the crypto-assets surpassed $2 trillion as of September 2021—a 10-fold increase since early 2020. An entire ecosystem is also flourishing, replete with exchanges, wallets, miners, and stablecoin issuers.

The IMF wasn’t done, however, with the raport also shedding light on the global risks associated with these assets. Many of these entities lack strong operational, governance, and risk practices. Crypto-exchanges, for instance, have faced significant disruptions during periods of market turbulence. Meanwhile,

“There are also several high-profile cases of hacking-related thefts of customer funds. So far, these incidents have not had a significant impact on financial stability,”the report noted.

Nevertheless, as crypto gains more traction, “their importance in terms of potential implications for the wider economy is set to increase.” In addition to this, according to the agency, the (pseudo) anonymity of crypto-assets creates data gaps for regulators.

This could give way to “unwanted doors for money laundering, as well as terrorist financing.”

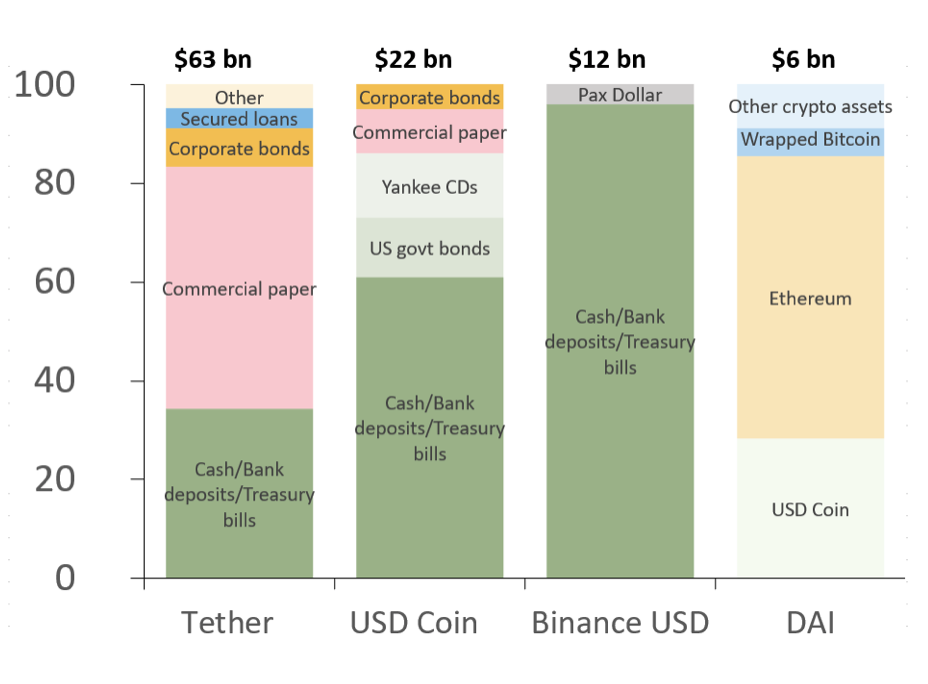

The report also took aim at stablecoins. According to the same,

„Biorąc pod uwagę skład ich rezerw, niektóre stablecoiny mogą podlegać runom, z efektem domina dla systemu finansowego. Biegi mogą być spowodowane obawami inwestorów o jakość ich rezerw lub szybkość, z jaką rezerwy mogą zostać zlikwidowane w celu sprostania potencjalnym umorzeniu.

Źródło: MFW

Now, different firms across the globe have incorporated these assets within their system, irrespective of the noise (against it). In fact, the report observed that “emerging and developing countries appeared to be leading the way with their use…”

According to the IMF, this risks damaging the ability of central banks to effectively implement monetary policy. This also fuels financial stability risks, it added.

Any solutions out there?

Well, the IMF certainly seems to think so. For starters, the financial institution feels monitoring rapid developments in the crypto-ecosystem and tackling data gaps is the way to go. What’s more,

“… regulations should be proportionate to the risks they pose and the economic functions they serve. For example, rules should be aligned with entities that provide similar products (e.g., bank deposits or money market funds).”

Gdzie inwestować?

Zapisz się do naszego newslettera

Source: https://ambcrypto.com/imf-now-the-latest-to-warn-against-cryptos-opening-unwanted-doors/