The esports sector has

skyrocketed in popularity over the past five years and there are now 454

million competitive gaming fans spread across the globe. It has enjoyed a rapid

rise from niche pursuit to multibillion-dollar industry and its potential for

future growth is immense.

The esports scene appeals to a young, tech-savvy audience and it

is bursting with dynamism, excitement and innovation. It mirrors the

cryptocurrency movement in many ways and there are a number of synergies

between both industries, so it is unsurprising to see them becoming

increasingly intertwined.

Teenage Gamers Become Multimillionaires

For the uninitiated, esports essentially involves teenagers and

young adults playing video games against one another in a bid to win prizes.

The world’s leading Dota 2 players just converged upon Shanghai to contest The

International 2019 and the prize money on offer was $34.3 million.

The team that won, OG, shared $15.5 million, meaning $3.1

million apiece for each of the five team members – N0tail, JerAx, ana, Ceb and

Topson. The winner of the solo event this year’s Fortnite World Cup, a

16-year-old from Pennsylvania called Bugha, walked off with $3 million, so we

are talking about serious money here.

The winners of Wimbledon, The Masters and the Indy 500 received

less than that, showing just how far esports has come in recent years. Major

companies from a wide spectrum of industries are piling in, as sponsors of big

teams and tournaments include MasterCard, Intel, Coca-Cola, Audi, KFC, Samsung

and many, many more.

The Consumers of the Future

They know that esports fans are the consumers of the future, and

sponsoring tournaments is a great way to target them. Securing sponsorship from

these huge firms is beneficial to the competitive gaming sector, as it allows

players to earn more money and it makes the scene more professional, but they

can sometimes feel clunky. Bud Light’s foray into esports was one such disaster.

The crypto sector has no such worries. It can be woven

seamlessly into competitive gaming, and both industries can flourish alongside

one another.

The reason the prize pool for The International 2019 was so high

is down to the compendium model that developer Valve uses. Dota 2 players buy a

“battle pass” each year and a portion of that cash is funnelled into the prize

money for The International.

Revolutionising In-Game Transactions

Blockchain technology can be used to make those battle pass

transactions quicker, simpler and safer. The biggest esports operate on a free

to play model whereby they make money from charging players for optional

in-game extras, including cosmetic upgrades and new skills. Dota 2, League of

Legends, CS:GO, Fortnite, Overwatch, Hearthstone and more all use this economic

model.

And it is big business. The esports industry is worth $1.1

billion in 2019, according to NewZoo, but that only factors in media rights

deals, ticket sales, commercial tie-ins and merchandising. The games that are

thriving because of their popularity within the esports sector make a lot more

money than that.

League of Legends, for instance, made more than $3.5 billion for

developer Riot Games in 2017 and 2018. Fortnite developer Epic Games makes

billions each year by charging for in-game microtransactions and it is targeting

esports in order to achieve longevity for the popular battle royale title.

A Decentralised Currency

Yet these in-game transactions are currently far from perfect.

It is difficult to receive money from around the world, and developers like

Valve have used platforms such as Steam to circumnavigate the issue. Yet it can

be slow, laborious and rife with middlemen taking a cut. Cryptocurrency can

negate all of that in one fell swoop.

The likes of Bitcoin, Ether, Bitcoin Cash and Litecoin are set

up as decentralised digital currencies that transcend international boundaries

with ease. Banks are out of the loop, so there are no middlemen taking a cut

and no central governments threatening the transaction.

It is also a lot more secure for gamers and developers alike.

There is no need for gamers to insert private details into web forms and hand

over credit card details, which can be targeted by hackers. Crypto transactions

are anonymous, peer-to-peer trades and it represents the best way for gaming

companies to sell in-game extras to hundreds of millions of players around the

world.

Crypto Firms Invest in Esports

A number of crypto firms are investing heavily in the space.

Bitrefill, for example, is a crypto trading platform that allows gamers to

purchase vouchers for online gaming services like as Steam and Blizzard’s

Battle.net, with Bitcoin. GamerAll allows CS:GO players to buy skins, keys and

items with a huge range of cryptocurrencies, from Bitcoin, Ripple and Bitcoin

Cash to Monero, Stratis and ZCash.

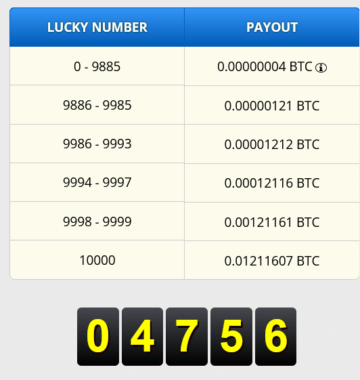

Unikrn, a site dedicated to esports betting, tips and news, is

another great example of an esports pioneer investing heavily in the cypto

sector. Using the Ethereum blockchain, it can process up to 9,000 wagers per

second, and if you check

out esports betting markets here you will see just how many betting

options there are.

“We have the safest wagering experience,” said Ryan Jurado, head of global content at Unikrn.

“Traditional wagering does a perfectly fine job, but being able to incorporate

blockchain makes everything easier for the customer, makes everything easier

for us and makes everything easier for regulators. And it lets us unlock new

functionality down the road.”

A Wealth of Potential

Cryptocurrency is impacting upon esports and the wider video

gaming industry in a huge number of ways, and they will only become more

interwoven in future in mutually beneficial ways.

Gamers have been accustomed to trading in fiat currencies for

digital currencies that can be spent on in-game purchases for more than a

decade, so it is an easy sell to them. The target demographic for these two

sectors is very similar and it is growing with each passing year, so the

potential is huge.

- Bitcoin

- blockchain

- blockchain compliance

- blockchain conference

- BMC

- coinbase

- coingenius

- Consensus

- crypto conference

- crypto mining

- cryptocurrency

- decentralized

- DeFi

- Digital Assets

- ethereum

- machine learning

- non fungible token

- plato

- plato ai

- Plato Data Intelligence

- Platoblockchain

- PlatoData

- platogaming

- Polygon

- Press Release

- proof of stake

- Telefónica

- TheCoinsPost

- W3

- zephyrnet