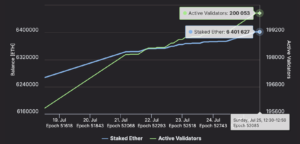

Ethereum has suddenly jumped while bitcoin remains somewhat stable at $28,000 in an unusual move after weeks of bitcoin leading.

Eth rose and with some speed from $1,760 to $1,820 while bitcoin remained flat, with it not too clear whether there has been any eth specific event.

It might however just be the ratio. Eth’s value against bitcoin has plunged since the 12th of March when the banking crisis began.

It dived from 0.072 bitcoin per eth, to 0.062, or by about $280, with it rising to 0.064 today as the ratio potentially starts a recovery.

That indicates bitcoin has so far been the main crypto asset for investors or speculators running out of banking, in part because it is the most integrated crypto asset with the financial system.

Whether this eth jump suggests that fleeing from banking has slowed down, is not clear, especially as there are some indications of better market sentiment.

The First Republic Bank, which had $212 billion in total assets last year, saw its stock price dive 50% on Monday in a spectacular crash.

It has bounced today pre-market by about 15%, in part because the Treasury Secretary Janet Yellen is to suggest in a speech that the government may backstop effectively all banks that have the potential for systemic contagion.

First Republic made $1.5 billion in net income last year and the taxpayer did not see a penny of it, but their gambles and losses in municipality bonds, that being lending to local councils or the state government, might have to be covered by the taxpayer.

In addition there’s some talk JP Morgan is giving advice to First Republic as they see whether it can be sold or whether it can raise capital.

Credit Suisse also saw its stock fall 50% to the price given by UBS for the buyout which wiped out some $17 billion held by a specific class of bond holders, those who invested in additional tier one (AT1) bank debt.

These are complex instruments that basically amount to lending to banks to shore up their capital ratio.

There is no default as such for these bonds as they are either converted to equity once the capital ratio typically hits 5.125% or 7%, or they’re wiped out depending on the terms of the bond. Making them risky bonds which attract a higher yield.

In this case they were wiped out, but the bond holders are complaining that the stock holders – technically the bank owners – received some $3 billion while they as creditors received nothing.

The media and some central banks, like the ECB and the Bank of England, seem to be backing these bond holders but on the surface it does sound like their role was to take a fall in precisely the sort of situation Credit Suisse found itself in.

The whole market for these AT1 bonds moreover is only $250 billion, so rather than a big story as some suggested early on, this might turn out to be a footnote.

That might suggest the crisis is over, at least for now, as no new name has been added to the list for some time now and because the government did not quite let any of them fail as far as depositors are concerned.

There should hopefully be some debate however in regards to how the taxpayer can get some of the profits as well in the good times to cushion these banks in rougher waters, but where crypto is concerned the slowdown in this bank collapses narrative might also mean a slow down in bitcoin’s speed of the price rise.

So giving some room to eth to rise, which is what makes its spike noteworthy, but there is also of course another interpretation that is either complementary or an alternative.

That being that $28,000 is obviously a resistance line as it faces the $30,000 number. Bitcoin took it and has maintain it, but some chilling out here to see if it is all for real, is what you’d expect.

As bitcoin rose far more than other cryptos because it took all the attention, investors and traders naturally will look and have looked at the ratio differences and see that eth’s ratio has maybe fallen a bit too much.

And so they buy to rebalance, and we get a spike to bring our little ethy to the table because the kid has been too queit.

Ping pong we call it, this back and forth between bitcoin and eth, but whether this is the beginning of eth’s show or just a cat bounce in First Bank may well depend on whether these bank runs are really over.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://www.trustnodes.com/2023/03/21/eth-spikes

- :is

- $3

- $UP

- 000

- 15%

- a

- About

- added

- addition

- Additional

- advice

- After

- against

- All

- alternative

- amount

- and

- Another

- ARE

- AS

- asset

- Assets

- At

- attention

- back

- backing

- backstop

- Bank

- Bank of England

- Banking

- Banks

- Basically

- BE

- because

- began

- Beginning

- being

- Better

- between

- Big

- Billion

- Bit

- Bitcoin

- bond

- Bonds

- Bounce

- bring

- buy

- Buyout

- by

- call

- CAN

- Can Get

- capital

- case

- CAT

- central

- Central Banks

- class

- clear

- complementary

- complex

- concerned

- Contagion

- converted

- course

- covered

- Crash

- credit

- credit suisse

- creditors

- crisis

- crypto

- crypto asset

- cryptos

- debate

- Debt

- Default

- Depending

- depositors

- DID

- differences

- down

- Early

- ECB

- effectively

- either

- England

- equity

- especially

- ETH

- ethereum

- Event

- expect

- faces

- FAIL

- Fall

- Fallen

- far

- financial

- financial system

- First

- flat

- For

- For Investors

- found

- from

- get

- given

- Giving

- good

- Government

- Have

- Held

- here

- higher

- Hits

- holders

- holds

- Hopefully

- How

- However

- HTTPS

- in

- Income

- indicates

- indications

- instruments

- integrated

- interpretation

- invested

- Investors

- IT

- ITS

- itself

- jp morgan

- jump

- Kid

- Last

- Last Year

- leading

- lending

- like

- Line

- List

- little

- local

- Look

- looked

- losses

- made

- Main

- maintain

- MAKES

- Making

- March

- Market

- market sentiment

- Media

- might

- Monday

- more

- Moreover

- Morgan

- most

- move

- name

- NARRATIVE

- naturally

- net

- New

- noteworthy

- number

- of

- on

- ONE

- Other

- owners

- part

- plato

- Plato Data Intelligence

- PlatoData

- plunged

- Pong

- potential

- potentially

- precisely

- price

- price rise

- profits

- raise

- rather

- ratio

- real

- rebalance

- received

- recovery

- regards

- remained

- remains

- Republic

- Resistance

- Rise

- rising

- Risky

- Role

- Room

- ROSE

- running

- secretary

- sentiment

- should

- show

- since

- situation

- slow

- Slowdown

- So

- so Far

- sold

- some

- somewhat

- Sound

- specific

- spectacular

- speech

- speed

- spike

- stable

- starts

- State

- steady

- stock

- Story

- such

- Suggests

- Suisse

- Surface

- Surges

- system

- systemic

- table

- Take

- Talk

- Taxpayer

- terms

- that

- The

- The Capital

- The State

- their

- Them

- These

- tier

- Tier One

- time

- times

- to

- today

- too

- Total

- Traders

- treasury

- treasury secretary

- Trustnodes

- TURN

- typically

- ubs

- unusual

- value

- Waters

- webp

- Weeks

- WELL

- What

- whether

- which

- while

- WHO

- will

- with

- year

- yellen

- Yield

- zephyrnet