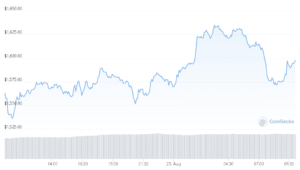

Ethereum’s bear flag price charts show that ETH could drop to $2000 and analysts expect the coin to hold the long-term bullish bias on the bets that its upgrade will be successful so let’s read more today in our latest Ethereum news.

Ethereum’s native token dropped by 20% in the past three weeks and hit a monthly low of $2900 but despite the rebounding above the $3000 price level, technicals suggest another downside is possible in the near term. Ethereum’s bear flag signal appeared as the price consolidates higher inside the ascending parallel channel after a strong downward move and resolves after the price broke out of the channel to drop further. The ETH price turned lower after testing the bear flag upper trendline and now eyes are on the extended drop to the lower trendline near $2700. if the pattern pans out, the price can drop furhter with its target being at length to the flagpole height as it can be shown in the charts.

At -2.8% supply growth a year post Merge, #ethereum will see about 3.3 million ETH a year burned.

By the end of the decade total ETH supply will drop under 100 million.

Or put another way, we will burn the equivalent of ALL ETH currently sitting on exchanges!!!! pic.twitter.com/zqr54TGCzC

— Lark Davis (@TheCryptoLark) April 6, 2022

As a result, Ether’s bear flag setup risked a potential retest of $2000 in the second quarter. Ethereum’s correlation with BTC and the area of traditional markets increased the downside risks in the past few months. For example, the correlation coefficient between Nasdaq and ETH was 0.95, and a coefficient of 1 means that the assets are moving in perfect tandem. ETH’s price is down by 19% since the start of 2022 and in the meantime, BTC, stock and other riskier markets also dropped this year with the investors seeing the FED’s willingness to raise rates and reduce the $9 trillion balance sheet.

More or less, ETH’s fall came mainly because of sentiments that will be less cash available to buy riskier assets. However, the speculators remained hopeful about the long-term uptrend because of its much-anticipated protocol upgrade dubbed the Merge that will be released after June. One analyst noted:

“ETH is still experiencing selling pressure from the people that wanted to make a quick buck on the Merge. At some moment in time we will find equilibrium, I’m not interested in predicting this bottom, I just want to accumulate as much as I can before we get there.”

The months running up to the technical update coincided with a downtrend of ETH held by exchanges with the number of non-zero ETH addresses increasing and more ETH flowing into the Merge’s official smart contract. The analyst at Seeking Alpha Kenan Mell, argued that ETH’s style of running shadow forks before the Merge launch only increases the possibility to become successful before launch.

- 100

- 2022

- About

- addresses

- All

- analyst

- Another

- AREA

- Assets

- available

- become

- being

- BTC

- Bullish

- buy

- Cash

- Charts

- Coin

- contract

- could

- decade

- Despite

- down

- Drop

- dropped

- ETH

- eth price

- ethereum

- Ethereum News

- ETHUSD

- example

- Exchanges

- expect

- further

- Growth

- height

- higher

- hold

- HTTPS

- increased

- increasing

- interested

- Investors

- IT

- launch

- Level

- long-term

- Markets

- million

- months

- more

- move

- moving

- Nasdaq

- Near

- news

- number

- official

- Other

- Pattern

- People

- perfect

- possibility

- possible

- potential

- pressure

- price

- protocol

- Quarter

- raise

- Rates

- reduce

- released

- remained

- risks

- running

- seeking

- Shadow

- smart

- smart contract

- So

- some

- start

- stock

- strong

- style

- successful

- supply

- Target

- Technical

- Testing

- time

- today

- token

- traditional

- Update

- wanted

- year