The Grayscale investors want the SEC to allow GBTC transition to Bitcoin spot ETF as they show frustration with the commissions’ reluctance towards the spot ETFs saying they don’t feel protected right now so let’s find out more in today’s latest Bitcoin news.

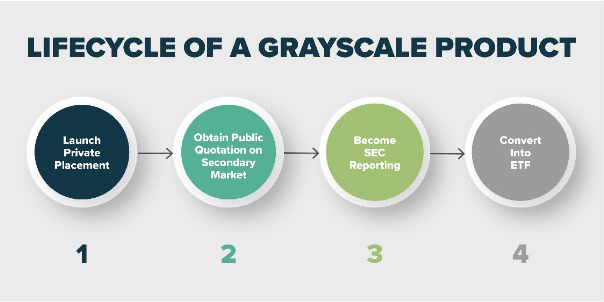

The Grayscale investors want the SEC to allow for a transition of a GBTC to BTC spot ETF and the company already had its longest attempts to become a spot-based Bitcoin ETF which was denied multiple times by the SEC which is why the investors are speaking out against this and sent more than 200 letters to the commission in support of the fund transition.

The SEC recieved over 170 letters from Grayscale investors and this followed a public solicitation from the regulator last week and asked for their thoughts on the Grayscale recent application and the potential BTC spot ETFs that are present as a vehicle for fraud. The ETF is a basket of securities that track an underlying index and the public is free to buy the shares of such funds and to gain exposure to the given asset. Most of these products emerged across the world to track the value of BTC and ETH but none landed in the US. The SEC allowed some Bitcoin Futures ETFs to emerge that are backed by futures contracts rather than the actual crypto.

The CEO of Grayscale Michael Sonnenshein reached out to the investors and encouraged them to send letters to the SEC about the fund conversion to an ETF and even said investors displayed support for the conversation so far. A lot of the letters were echoing what Grayscale has been saying for some time now and continues to do so as Sonnenshein noted, saying that investors were patient and deserve a spot Bitcoin ETF.

Grayscale Bitcoin trust is now a trust fund and under this format, the share prices can’t be traded to reflect the market sentiment accurately. As a result, the fund’s shares traded at a discount to the underlying BTC for up to a year. The shares dropped 17% since 2022 started and compared to Bitcoin’s drop, the prices closed now 25% below the value of the Bitcoin holdings. Grayscale investors are able to feel the pain and all of the letters from the investors concerned the commission’s refusal to permit a BTC spot ETF. The investor named Clay Craven said:

“I don’t feel I’m being protected by the SEC. It’s past time for the SEC to approve the GBTC ETF conversion and stop harming investors and the country by outsourcing capital to foreign countries where spot BTC ETFs are already trading and approved by regulators.”

Investor protection is the main concern SEC Chairman Gary Gensler noted when expressing the preference for BTC futures ETFs over the spot ones.

- 2022

- 7

- About

- across

- All

- already

- Application

- approve

- approved

- asset

- being

- Bitcoin

- Bitcoin ETF

- Bitcoin Futures

- Bitcoin News

- BTC

- buy

- capital

- ceo

- chairman

- closed

- commission

- company

- compared

- continues

- contracts

- contribute

- Conversation

- Conversion

- countries

- country

- crypto

- Crypto News

- Discount

- Drop

- dropped

- Editorial

- ETF

- ETFs

- ETH

- expertise

- First

- format

- fraud

- Free

- fund

- funds

- Futures

- GBTC

- Grayscale

- HTTPS

- index

- investor

- Investors

- latest

- Market

- more

- most

- news

- offer

- Outsourcing

- Pain

- policies

- present

- Products

- protection

- public

- Regulators

- Said

- SEC

- Securities

- sentiment

- set

- Share

- Shares

- So

- solicitation

- Spot

- standards

- started

- support

- the world

- time

- times

- track

- Trading

- Trust

- us

- value

- vehicle

- Website

- week

- What

- world

- year