He came, he saw, he left and that’s where the story ends according to betting markets.

Sam Bankman-Fried, the man who stole billions of customers money and spent it on reckless bets, remains free as far as it is know a week after the fraud was revealed.

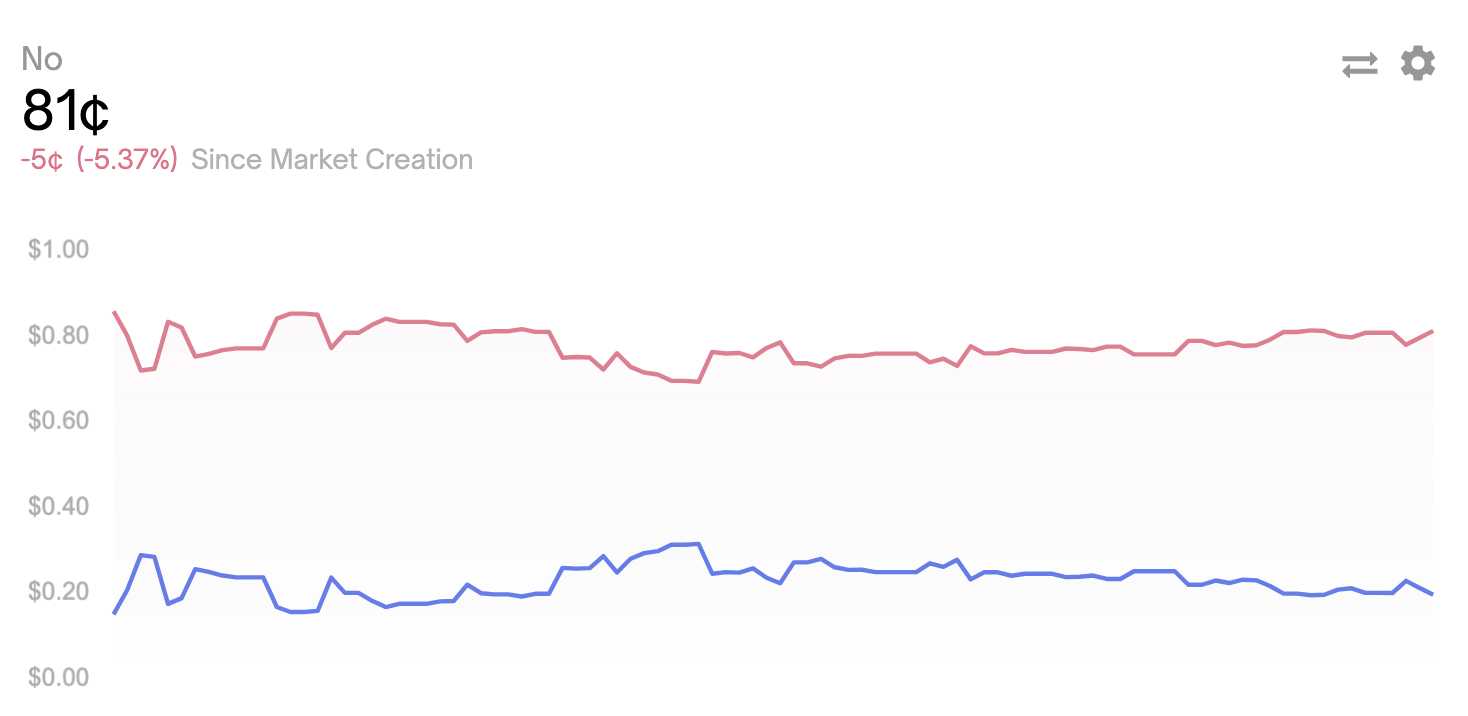

And that’s how it will stay, betting markets are stating. 81% are wagering that Sam Bankman-Fried (SBF) will not be federally indicted by the end of the year. Only 19% think he will.

This astonishingly low figure for what is pretty much theft in that he gave customer’s money to another entity, Alameda, is probably due to an overall perception that Bankman-Fried is very well connected.

His father apparently was the boss of SEC chair Gary Gensler when the latter was ‘teaching’ on blockchain at MIT.

His mother founded the hot donor network Mind the Gap which donates to Democrats. Bankman-Fried himself donated $36 million to Democrats this midterm.

“Billions of dollars that were theoretically going to flow to lobbying operations, super PACs, scientists, newsrooms and data forecasters just went poof as Sam Bankman-Fried’s global crypto exchange, FTX, declares bankruptcy,” says Theodore Schleifer reporting for Puck.

Then there’s corporate media. Apparently Bankman-Fried has invested in Vox, The Intercept, ProPublica, The Law and Justice Journalism Project and most prominently Semafor.

A New York Times article caught flak for whitewashing what many see as outright theft.

“The MSM needs to take accountability for its role in contributing to the legitimization and high status of this insolvent ponzi,” Jesse Powell, Kraken’s CEO said before adding:

“Without the media’s backing and the endless puff pieces, victims would not have been so trusting with their savings. Even now, they downplay the story.”

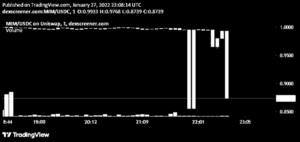

The betting market in question, Polymarket, has a fairly low liquidity of just $4,000 and overall volumes of $20,000.

While betting markets tend to be correct as in theory they can allow for fast communication of all information, including private information, it’s not too clear how much that applies with such low liquidity.

Yet, instead of being interrogated by the police, Bankman-Fried may instead appear in front of the House Financial Services Committee.

“The Committee expects to hear from the companies and individuals involved, including Sam Bankman-Fried, Alameda Research, Binance, FTX, and related entities, among others,” a statement said.

The big picture however is overall known at this stage. A hole developed on Alameda after the Luna collapse as lenders called in the loans. This hole was cover with FTX’s deposited money from exchange customers. Alameda’s hole became FTX’s hole, with it all worsened by a crash in the FTT price.

As such, you’d expect any investigation at this stage to be carried out by the police for the appropriation of customer’s money, or theft.

The lack of it and the lack of an indictment will of course be an indictment on corruption.

- Big Image

- Bitcoin

- blockchain

- blockchain compliance

- blockchain conference

- coinbase

- coingenius

- Consensus

- crypto

- crypto conference

- crypto mining

- cryptocurrency

- decentralized

- DeFi

- Digital Assets

- ethereum

- machine learning

- news

- non fungible token

- plato

- plato ai

- Plato Data Intelligence

- Platoblockchain

- PlatoData

- platogaming

- Polygon

- proof of stake

- Trustnodes

- W3

- zephyrnet