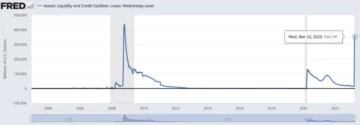

Quantitative Easing, the printing of money to buy government debt and mortgage securities, as well as corporate debt and at one point straight up stocks, is out as the Federal Reserve Banks keep selling bonds.

Something that has not yet gotten a new name however, which we are calling not-QE, is in though temporarily for only a year… if it is not needed after a year presumably.

“The balance sheet growth is not facilitating levering up of balance sheets and assets. It’s not QE,” says a Twitter avatar half naked doing some sort of yacht sport that belongs to someone called Andy Constan of Damped Spring Macro Research.

QE of course was a new word invented to not call it printing, and not-QE is similar in that regard because it too is basically printing.

$300 billion was added to the balance sheet of the Federal Reserve Banks last week, and much of it is loans to commercial banks following the announcement of a new facility whereby bonds held by these commercial banks will be valued at the price they were bought, not the current price.

A confidence trick, calls it the Economist, because this new facility basically tries to erase the distinction between unrealized and realized losses.

It creates a sort of magical world where there is no risk to lending, in this case to the government, because presumably they are arguing the market is wrong in its current valuation of bonds.

To simplify, if A lends B $1,000 and B is very credit worthy to the point all expect him to pay back that $1,000 in ten years, then the Fed says you can have $1,000 today for that $1,000 you’d get in ten years.

The market however is saying that $1,000 is worth $500 today, for numerous reasons. Chiefly inflation but also considerations like will Republicans really lift the debt ceiling?

Politics and theatre the latter, but the former is a lot more objective because we all know $1,000 in ten years will not have the same value as today.

For every such $1,000 therefore in this very very simplified example, Fed is printing $500 because half of the value of that $1,000 does not quite exist.

The money creation is done in the form of a loan. It has to be paid back and with interest, but what if it isn’t paid back?

These losses afterall are the customer’s deposits, which is another loan but this time from the public to the commercial banks and at almost 0% interest, banks that then take these deposits to gamble on bonds and whatever else.

If the public gets jittery and takes flight of those deposits, then the loans to Fed might not quite be paid back, which means Fed will add to their tens of billions of losses a month in their own bond holdings, which the taxpayer is already covering in countries like UK.

Because loans are risky of course and there can be defaults on loans, especially to insolvent entities, and those losses will either be covered by printing or by the current highest level of taxation in a century going higher still.

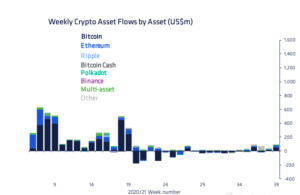

“Central banks are bankrupt,” Peter Thiel, the Venture Capitalist, said back in April last year when we didn’t take him quite seriously and put it down more to playing to the crypto crowd.

“We are at the end of the fiat money regime. And that’s sort of what [bitcoin] has priced in,” he added.

That same Thiel has been pin-pointed as the one that sparked the bank run at the Silicon Valley Bank, but the real cause is of course the shift from zero to 5% interest rates in just months.

That has led to huge losses in central bank holdings, and some $620 billion in unrealized losses in US commercial banks according to FDIC, amounting to about a third of their equity.

By another measure, looking at what can be classified as unrealized losses in fixed term say ten year loans to non government entities, we’d have to add another $2 trillion according to research by Erica Jiang of the University of Southern California and co-authors.

There is of course no loss until you sell, bitcoiners like to say, and that applies here too, with Fed trying to – in theory – make that selling a choice even if it normally would have been necessary.

And it might work, but it is printing. The irony is that despite it, we might see another rate hike next week on the heels of a 0.5% rise in interest rates by the European Central Bank (ECB).

ECB tied its hands a bit in the previous meeting by stating they were going to hike in March by 0.5%, so they did. They’re also at a far lower rate than Fed, but at this point it is interest rates that are causing inflation.

On two fronts. First, rents are rising because mortgage costs are rising with the spike in rent costs accounting for 70% of the increase in month on month inflation in February according to the US Bureau of Labour Statistics.

The other front is bank losses, which are being covered by printing, with those losses likely to increase the further interest rates rise.

Now book theories say differently, but as we have seen by the inflationary experience in some countries, at some point interest rates as a tool become damaging and there’s some evidence we might be near that point in US.

Not that anyone cares about a 0.25% on near 5% in light of billions sloshing around with the Swiss central bank now allowing Credit Suisse to borrow up to $50 billions.

But Fed has a different sort of credibility to show at this point and not on tackling inflation, but on whether they really understand just what exactly is going on.

Some however claim this Silicon Valley bank collapse is exactly what Fed wanted to tame inflation, to scare market actors into tightening up, but that might sound a bit too much like bear exuberance and delusion.

Because there’s now an environment of uncertainty, and a very contradictory environment if Fed is printing on one hand while bond crashing on the other which might require ever more printing and… a vicious loop that they have to avoid.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://www.trustnodes.com/2023/03/17/not-qe-is-back

- :is

- $UP

- 000

- a

- About

- According

- Accounting

- actors

- added

- After

- All

- Allowing

- already

- and

- Announcement

- Another

- anyone

- April

- ARE

- around

- AS

- Assets

- At

- avatar

- avoid

- back

- Balance

- Balance Sheet

- balance sheets

- Bank

- Bank run

- bankrupt

- Banks

- Basically

- BE

- Bear

- because

- become

- being

- between

- Billion

- billions

- Bit

- Bitcoin

- bitcoiners

- bond

- Bonds

- book

- borrow

- bought

- Bureau

- buy

- by

- california

- call

- called

- calling

- Calls

- CAN

- case

- Cause

- causing

- ceiling

- central

- Central Bank

- Century

- choice

- claim

- classified

- Collapse

- commercial

- confidence

- considerations

- Corporate

- Costs

- countries

- course

- covered

- covering

- Crashing

- creates

- creation

- Credibility

- credit

- credit suisse

- crowd

- crypto

- Current

- damaging

- Debt

- defaults

- deposits

- Despite

- DID

- different

- doing

- down

- easing

- ECB

- Economist

- either

- entities

- Environment

- equity

- Erica

- especially

- European

- European Central Bank

- Even

- EVER

- Every

- evidence

- exactly

- example

- expect

- experience

- facilitating

- Facility

- far

- fdic

- February

- Fed

- Federal

- federal reserve

- Fiat

- Fiat Money

- First

- fixed

- flight

- following

- For

- form

- Former

- from

- front

- further

- Gamble

- get

- going

- Government

- Government Entities

- Growth

- Half

- hand

- Hands

- Have

- Held

- here

- higher

- highest

- Hike

- Holdings

- However

- HTTPS

- huge

- in

- Increase

- inflation

- Inflationary

- insolvent

- interest

- Interest Rates

- Invented

- IT

- ITS

- Keep

- Know

- Labour

- Last

- Last Year

- Led

- lending

- Level

- light

- like

- likely

- loan

- Loans

- looking

- loss

- losses

- Lot

- Macro

- make

- March

- Market

- means

- measure

- meeting

- might

- money

- Month

- months

- more

- Mortgage

- name

- Near

- necessary

- needed

- New

- next

- next week

- normally

- numerous

- objective

- of

- on

- ONE

- Other

- own

- paid

- Pay

- Peter

- Peter Thiel

- plato

- Plato Data Intelligence

- PlatoData

- playing

- Point

- previous

- price

- public

- put

- QE

- Rate

- Rate Hike

- Rates

- real

- realized

- reasons

- regime

- Rent

- Republicans

- require

- research

- Reserve

- Rise

- rising

- Risk

- Risky

- Run

- same

- says

- Securities

- sell

- Selling

- shift

- show

- Silicon

- Silicon Valley

- silicon valley bank

- similar

- simplified

- simplify

- So

- some

- Someone

- Sound

- Southern

- spike

- Sport

- spring

- statistics

- Still

- Stocks

- straight

- such

- Suisse

- Swiss

- Take

- takes

- Taxation

- Taxpayer

- ten

- that

- The

- The Economist

- the Fed

- theatre

- their

- therefore

- These

- Third

- Tied

- tightening

- time

- to

- today

- too

- tool

- Trillion

- Trustnodes

- Uk

- Uncertainty

- understand

- university

- University of Southern California

- us

- Valley

- Valuation

- value

- valued

- venture

- wanted

- webp

- week

- WELL

- What

- whether

- which

- while

- will

- with

- Word

- Work

- world

- worth

- would

- Wrong

- Yacht

- year

- years

- zephyrnet

- zero