Solana price analysis shows a bearish market after the prices were unable to challenge the near-term resistance of $60.0 and started to fall towards the key support at $48.5.The bears are in control of the market as the prices are currently trading below all the important moving averages. The prices have been hovering around a range of $48.05 to $53.44 in the last 24 hours. SOL market closed yesterday’s trading chart at $50.06.

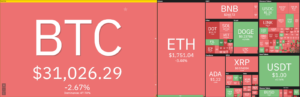

The recent price drop has been caused by multiple factors including the sell-off in Bitcoin, Ethereum, and the overall cryptocurrency market. The bulls will need to push the prices above $60.0 to take back control of the market. Meanwhile, the key support levels to watch out for are $48.5 and $45.0.

SOL/USD price analysis: Technical indications

Solana price analysis shows the overall market sentiment is bearish as the prices have been struggling to sustain above $60.0. The technical indicators are also giving bearish signals as the MACD is about to cross below the signal line in the next few hours and the RSI is currently well below 50 levels, which indicates that the prices may continue to fall in the near term.

The key support and resistance levels to watch out for are $48.5 and $60.0 respectively. The SMA50 (Simple Moving Average for 50 periods) and SMA200 (Simple Moving Average for 200 periods) are currently located at $52.59 and $54.68 respectively, which indicates that the prices may find some support around these levels in the near term. Solana price has shed 4.23 percent of its price in the last 24 hours while in the last 2 weeks the prices have fallen by over 60 percent.

Solana is a cryptocurrency project that is focused on providing high-performance decentralized finance (DeFi) solutions. It is one of the fastest-growing projects in the DeFi space and has a large community of developers and users. The native token of the Solana blockchain is SOL and it is used to pay for transaction fees and participate in governance.

SOL/USD 4-hour price analysis: Latest developments

Solana price analysis illustrates that the present condition of the market demonstrates positive potential as the price moves downward. Furthermore, the cryptocurrency market’s volatility follows a little closing movement, making it more vulnerable to sudden swings in either direction. As a result, the Bollinger Band’s upper bound is set at $57, marking SOL’s strongest resistance. The Bollinger’s band has a lower limit of $49, functioning as a support point for SOL.

The Relative Strength Index (RSI) score is 40, indicating that Solana is stable and falling under the neutral region. In addition, the RSI score dips slightly, indicating that buying activity is comparable to selling activity as it approaches decreasing trends.

The price of the SOL/USD has fallen below the Moving Average curve, indicating a bearish trend. The analysis, nevertheless, notes that the market’s volatility is decreasing today. Furthermore, the SOL/USD price appears to be moving toward support, indicative of a possible reversal movement, which might potentially break the bearish trend.

Solana price analysis conclusion

Solana price analysis reveals that the cryptocurrency is facing strong resistance at $60.0 and the bears are currently in control of the market. The prices may continue to fall towards the key support levels of $48.5 and $45.0 in the near term. The technical indicators are also giving bearish signals, which indicates that the prices may fall further in the near term.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

- About

- activity

- addition

- advice

- All

- analysis

- around

- average

- bearish

- Bears

- before

- below

- Bitcoin

- blockchain

- Bulls

- Buying

- caused

- challenge

- closed

- closing

- community

- condition

- continue

- control

- cryptocurrency

- cryptocurrency market

- Currently

- curve

- decentralized

- Decentralized Finance

- decisions

- DeFi

- developers

- Drop

- ethereum

- facing

- factors

- Fees

- finance

- focused

- follows

- functioning

- further

- Furthermore

- Giving

- governance

- holds

- HTTPS

- image

- important

- Including

- index

- information

- investment

- Investments

- IT

- Key

- large

- latest

- liability

- Line

- little

- made

- major

- Making

- Market

- might

- more

- movement

- moving

- multiple

- Near

- Nevertheless

- Notes

- overall

- participate

- Pay

- percent

- periods

- Point

- positive

- possible

- potential

- present

- price

- Price Analysis

- professional

- project

- projects

- providing

- qualified

- range

- recommend

- research

- sentiment

- set

- Simple

- SOL

- Solana

- Solutions

- some

- Space

- started

- strength

- strong

- support

- Technical

- today

- token

- towards

- Trading

- transaction

- Trends

- users

- Volatility

- Vulnerable

- Watch

- while