The ranks of The Crunchbase Unicorn Board have swelled in the past two years, adding almost 1,000 new companies and trillions of dollars in reported value. But now, as private company valuations go through a hard reset in a tough market, the board faces a reckoning.

Since the beginning of 2021, 925 companies have been added to the Unicorn Board and more than $400 billion was invested in those unicorns. But many of those same companies that raised in 2021 and the first half of 2022 will find their valuations — even just 18 months after their most recent funding — are too high in the current economy.

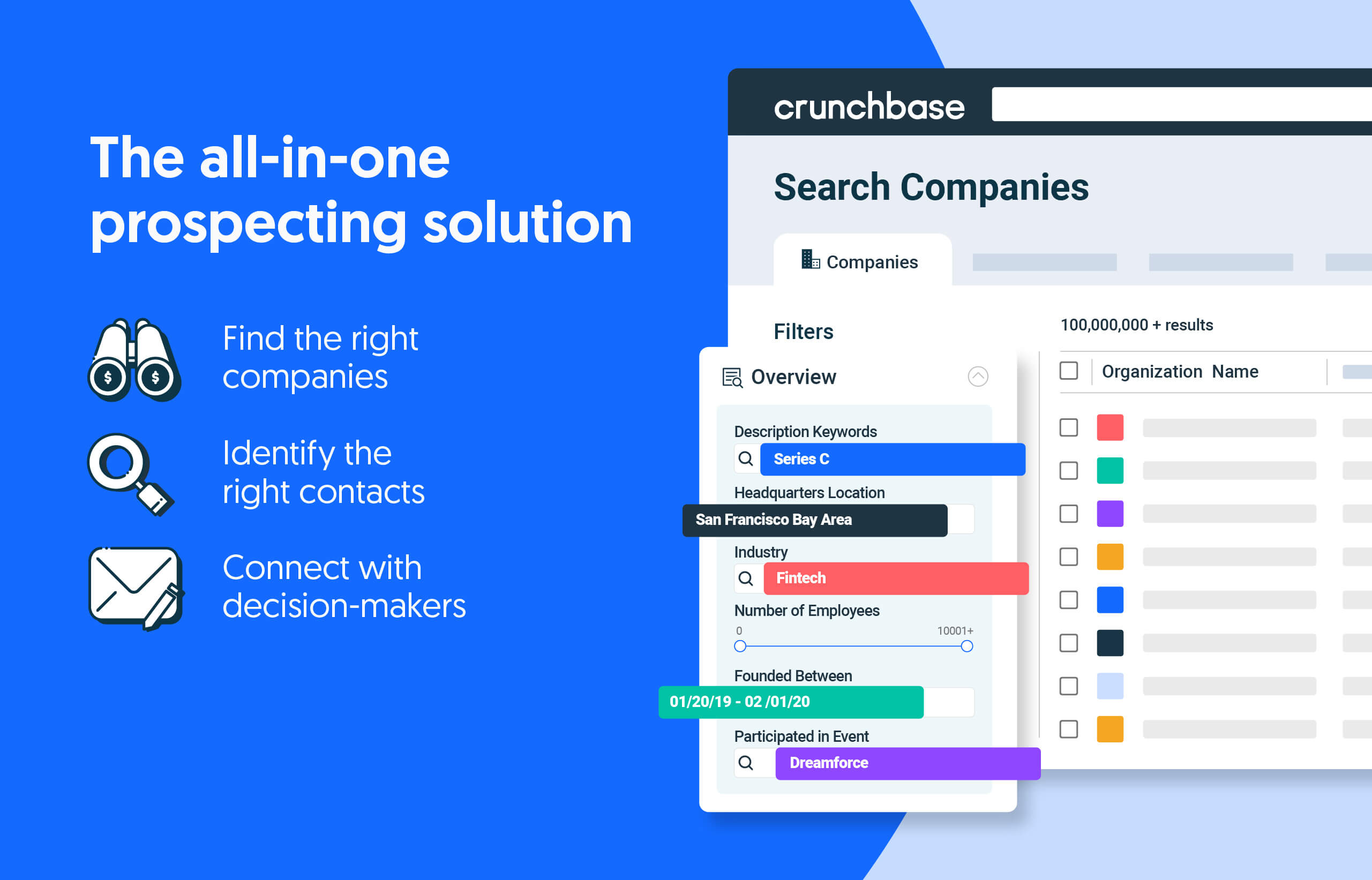

Search less. Close more.

Grow your revenue with all-in-one prospecting solutions powered by the leader in private-company data.

Of the 1,433 companies on the board, more than 1,100 — or 78% — had their valuations set in the past two years. Those companies with new valuations represent almost three quarters of the entire board’s total value.

Keep in mind, our Unicorn Board reflects disclosed valuations tied to a priced funding event — not other valuations, such as those set in an internal event via a 409a valuation, or when investors revalue their portfolios via writedowns. (That’s why, for example, the board still lists Stripe’s valuation at $95 billion, although the payments company has reportedly reset its internal valuation to $63 billion — the third time in fewer than 12 months it has trimmed its valuation.)

According to Forge, a private securities marketplace, investors are purchasing private company stock on the secondary market at a median discount of 50.5% compared to their most recent funding. If that discount were applied across the Unicorn Board, 821 companies — or 57% of the companies on the board — would drop off, and the value of the board would decline to $2.4 trillion from its current total valuation of $4.9 trillion.

Unicorns reset expectations

The funding environment has changed swiftly after a heady couple of years.

Valuations at 10x forward ARR in 2021 became “100x, 200x, and 400x multiples,” Tomasz Tunguz, previously a partner at Redpoint and now raising his own fund, wrote on his blog in April 2022.

Now, we’re seeing internal valuations revised downward — often drastically — for highly valued unicorns. Many companies are quietly raising extension rounds from existing investors, while those unable to do so sometimes crash and shut down. (That was the case with self-driving car technology company Argo AI, which shut down in the fourth quarter of 2022 after being unable to raise fresh capital).

In July 2022, Klarna lost $39 billion in value, plummeting from a $45 billion valuation to $6.7 billion in a new funding round.

Boston-based OutSystems, a low-code engineering platform, was valued at $9.5 billion in February 2021. It quietly raised funding eight months later, led by existing investor KKR — more than halving its valuation to $4.3 billion, according to Forbes.

And Oda, a door-to-door grocery delivery service based in Norway, was valued below a billion dollars in a December fundraising, dropping from the unicorn ranks entirely.

Crypto companies are also facing a harsh new reality. Crypto exchange FTX, valued at $32 billion in a January 2022 funding, is valued at nothing. Other crypto unicorns in bankruptcy proceedings include crypto wealth management platform BlockFi and blockchain lending platform Celsius Network.

The reset is here

While the stampede of companies joining the board has slowed to a trickle, it will be difficult to decipher the new valuations for current unicorn companies in 2023.

Companies that can avoid raising funding will do so. Many unicorn companies are opting for debt or convertible notes to avoid being revalued. Others are raising extension rounds in which mostly existing investors add capital, and values might not be disclosed as readily as those unicorn rounds.

All that adds up to a lot of uncertainty — and some dubious rankings — in the year ahead.

Crunchbase Pro queries listed for this article

All Crunchbase Pro queries are dynamic, with results updating over time. They can be adapted by location and/or timeframe for analysis.

Unicorn queries

Methodology

The Crunchbase Unicorn Board is a curated list that includes private unicorn companies with post-money valuations of $1 billion or more and is based on Crunchbase data. New companies are added to the Unicorn Board as they reach the $1 billion valuation mark as part of a funding round.

The unicorn board does not reflect internal company valuations — such as those set via a 409a process for employee stock options — as these differ from, and are more likely to be lower than, a priced funding round. We also do not adjust valuations based on investor writedowns, which change quarterly, as different investors will not value the same company consistently within the same quarter.

Funding to unicorn companies includes all private financings to companies that are tagged as unicorns, as well as those that have since graduated to The Exited Unicorn Board.

Please note that all funding values are given in U.S. dollars unless otherwise noted. Crunchbase converts foreign currencies to U.S. dollars at the prevailing spot rate from the date funding rounds, acquisitions, IPOs and other financial events are reported. Even if those events were added to Crunchbase long after the event was announced, foreign currency transactions are converted at the historic spot price.

Illustration: Dom Guzman

Stay up to date with recent funding rounds, acquisitions, and more with the Crunchbase Daily.

After a strong start to the year, this week slowed down. No round came close to $200 million, and only three rounds hit the $100 million mark. Health…

Shell says it will pay just $169 million to buy Volta Industries, which went public via SPAC in 2021.

After a relatively quiet year on the private markets, venture firms are getting back into the funding game.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://news.crunchbase.com/venture/unicorn-board-valuations-funding-crypto/

- $1 billion

- $1 Billion Valuation

- $100 million

- $6.7 billion

- 000

- 1

- 100

- 12 months

- 2021

- 2022

- 2023

- 7

- 9

- a

- acquisitions

- across

- adapted

- added

- Adds

- After

- ahead

- All

- all-in-one

- Although

- analysis

- and

- announced

- applied

- April

- back

- Bankruptcy

- bankruptcy proceedings

- based

- Beginning

- being

- below

- Billion

- Block

- blockchain

- Blog

- board

- buy

- capital

- car

- case

- change

- chopping

- Chopping Block

- Close

- Companies

- company

- compared

- converted

- Couple

- cover

- Crash

- CrunchBase

- crypto

- crypto exchange

- curated

- currencies

- Currency

- Current

- daily

- data

- Date

- Debt

- December

- Decipher

- Decline

- delivery

- differ

- different

- difficult

- Discount

- dollars

- down

- downward

- drastically

- Drop

- Dropping

- dynamic

- economy

- Employee

- Engineering

- Entire

- entirely

- Environment

- Even

- Event

- events

- example

- exchange

- existing

- extension

- faces

- facing

- financial

- Find

- firms

- First

- Forbes

- foreign

- foreign currency

- Forward

- Fourth

- fresh

- from

- fund

- funding

- Funding Round

- funding rounds

- Fundraising

- game

- getting

- given

- Go

- grocery

- Half

- Halving

- Hard

- Health

- High

- highly

- historic

- Hit

- HTTPS

- in

- include

- includes

- industries

- internal

- invested

- investor

- Investors

- IPOs

- IT

- January

- joining

- July

- leader

- Led

- lending

- lending platform

- likely

- List

- Listed

- Lists

- location

- Long

- Lot

- management

- many

- mark

- Market

- marketplace

- Markets

- might

- million

- mind

- months

- more

- most

- New

- New Funding

- Norway

- noted

- Notes

- Options

- Other

- Others

- otherwise

- own

- part

- partner

- past

- Pay

- payments

- platform

- plato

- Plato Data Intelligence

- PlatoData

- portfolios

- powered

- previously

- price

- private

- private markets

- Pro

- Proceedings

- process

- public

- purchasing

- Quarter

- quietly

- raise

- raised

- raising

- ranks

- Rate

- reach

- Reality

- recent

- Recent Funding

- reflect

- reflects

- relatively

- Reported

- represent

- Results

- revenue

- round

- rounds

- same

- secondary

- Secondary Market

- Securities

- seeing

- self-driving

- self-driving car

- service

- set

- Shut down

- since

- So

- Solutions

- some

- SPAC

- Spot

- start

- stay

- Still

- stock

- strong

- such

- Technology

- The

- The Chopping Block

- their

- Third

- this week

- three

- Through

- Tied

- time

- timeframe

- to

- too

- Total

- Transactions

- Trillion

- trillions

- u.s.

- U.S. Dollars

- Uncertainty

- unicorn

- unicorns

- updating

- Valuation

- Valuations

- value

- valued

- Values

- venture

- via

- Wealth

- wealth management

- week

- which

- while

- will

- within

- would

- year

- years

- Your

- zephyrnet