The term “Web3” may not have the buzz it did this time last year, but that doesn’t mean all investors have forgotten about it.

Venom Foundation, a Layer-1 blockchain licensed and regulated by the Abu Dhabi Global Market, and Iceberg Capital have partnered to launch a $1 billion venture fund called Venom Ventures Fund.

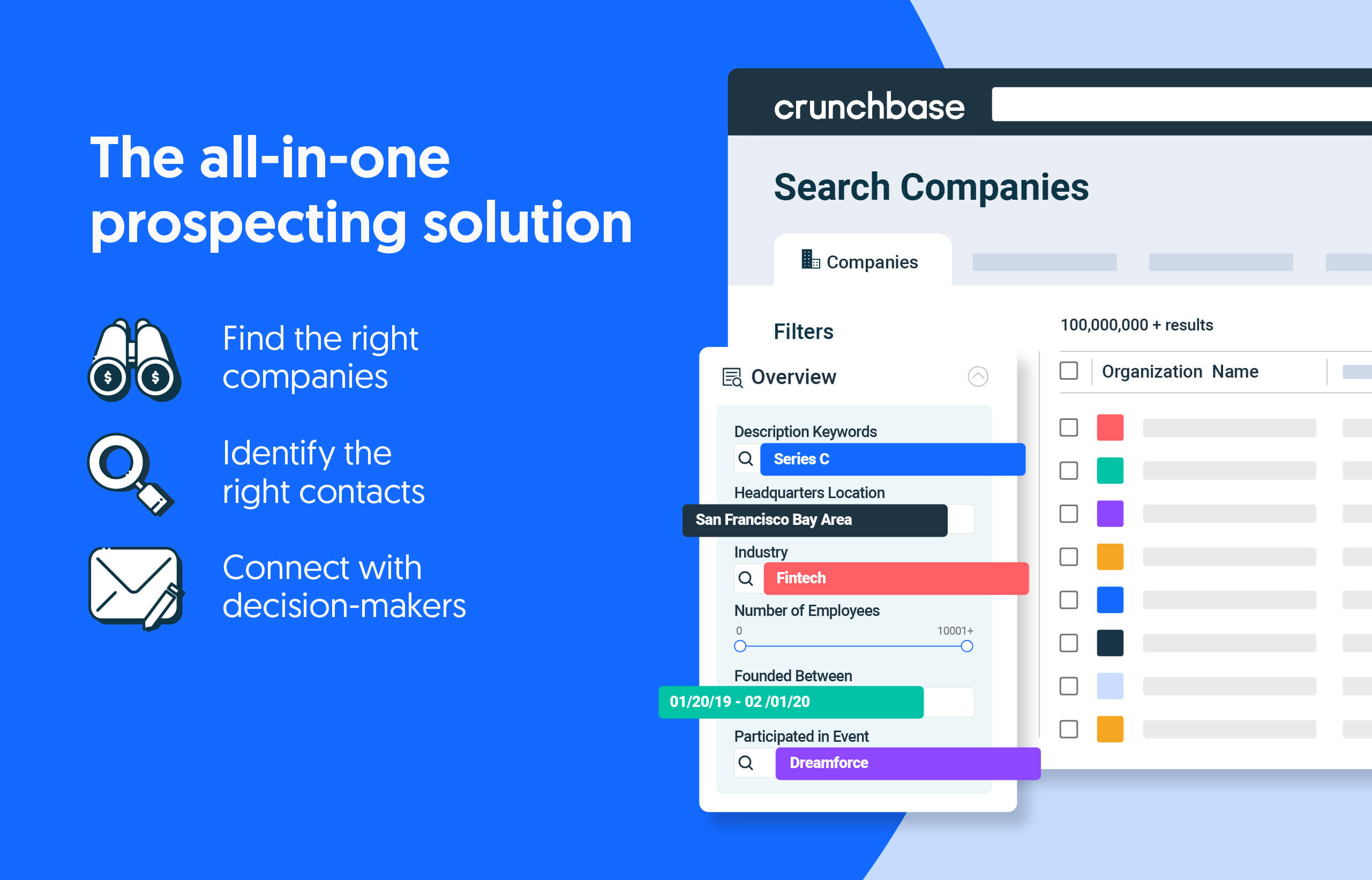

Search less. Close more.

Grow your revenue with all-in-one prospecting solutions powered by the leader in private-company data.

The fund will invest in protocols and Web3 decentralized applications, concentrating on areas such as payments, asset management, DeFi, banking services and gaming.

The fund will be investing in projects and teams from pre-seed to Series A rounds.

Web3 funding slows

After a record year in 2021, when VC-backed startups in Web3 raised more than $30 billion, 2022 was a very different story.

Last year’s fourth quarter saw less than $2.4 billion roll into startups in the space, the lowest total since just about $1 billion went to startups in Q4 2020. The fourth quarter in 2021 saw a high of nearly $9.3 billion invested in the space.

That is not entirely surprising, as the venture market is in the midst of a significant pullback. In 2022, venture funding globally hit $445 billion — a 35% decline year over year from the $681 billion invested in 2021 — according to Crunchbase data.

The decline likely affected Web3 startups more, as the technology is relatively new and many investors are not nearly as familiar with it as they are in other industries.

On top of that, the FTX debacle and crypto winter undoubtedly exacerbated the investment slowdown.

Despite the overall drop in venture, the new Venom fund is not the only large fund in the news recently. Earlier this week, it also was reported that Khosla Ventures has filed to raise $3 billion across three new funds.

Further reading:

Illustration: Dom Guzman

Stay up to date with recent funding rounds, acquisitions, and more with the Crunchbase Daily.

Parsing through the quarter-by-quarter numbers for active investors, it’s clear 2022 wasn’t entirely a clean-up-the-mess year.

Asia could not buck the global trend of venture capital pullback in 2022, as total funding for the year dropped 39% compared to the record-setting…

Current market conditions being what they are could make it a tough couple of years for startups seeking funding. What’s a founder to do? Ripple…

While players in the pre-owned vehicle business are navigating the most challenging market conditions in years, Crunchbase data shows that venture…

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://news.crunchbase.com/business/venom-foundation-iceberg-capital-launch-1b-web3-venture-fund/

- $1 billion

- $3

- 2020

- 2021

- 2022

- 35%

- a

- About

- about IT

- According

- acquisitions

- across

- active

- All

- all-in-one

- and

- applications

- areas

- asset

- asset management

- Axios

- Banking

- being

- Billion

- blockchain

- business

- called

- capital

- challenging

- clear

- Close

- compared

- conditions

- could

- Couple

- cover

- CrunchBase

- crypto

- Crypto Winter

- daily

- data

- Date

- decentralized

- Decentralized Applications

- Decline

- DeFi

- Dhabi

- DID

- different

- Doesn’t

- Drop

- dropped

- Earlier

- entirely

- familiar

- For Startups

- forgotten

- Foundation

- founder

- Fourth

- from

- fund

- funding

- funding rounds

- funds

- gaming

- Global

- Globally

- High

- Hit

- HTTPS

- in

- In other

- industries

- Invest

- invested

- investing

- investment

- Investors

- IT

- large

- Last

- Last Year

- launch

- leader

- Licensed

- likely

- make

- management

- many

- Market

- market conditions

- more

- most

- navigating

- nearly

- New

- New Funds

- news

- numbers

- Other

- overall

- partnered

- payments

- plato

- Plato Data Intelligence

- PlatoData

- players

- powered

- pre-seed

- projects

- protocols

- pullback

- Quarter

- raised

- Reading

- recent

- Recent Funding

- recently

- record

- regulated

- relatively

- revenue

- Ripple

- Roll

- rounds

- seeking

- Series

- Series A

- Services

- Shows

- significant

- since

- Slowdown

- Solutions

- Space

- Startups

- stay

- Story

- such

- surprising

- teams

- Technology

- The

- The Buzz

- this week

- three

- Through

- time

- to

- top

- Total

- Trend

- undoubtedly

- vehicle

- venture

- venture capital

- VENTURE FUND

- Ventures

- Web3

- week

- What

- will

- Winter

- year

- years

- Your

- zephyrnet