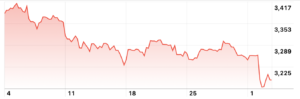

The newly airdropped token by Arbitrum (ARB) began trading at $8 just a few hours ago before steeply falling to a current price of $1.30.

A rush to sell had overloaded systems trying to keep the lines with some bridges running out of eth while MetaMask at times gave Json errors, can’t connect.

Yet what began with volumes of just $1.3 million at that $8.67 price has ballooned to fairly incredible trading volumes of $1.2 billion, or almost arb’s entire market cap.

Numerous exchanges are already trading this. Most prominently of course Uniswap, but also Binance, OKex, Kraken.

Even Coinbase is trading Arb, showing they are undeterred after receiving a Wells notice by the Securities and Exchanges Commission which thinks even emojis are a security.

This airdrop is crypto’s answer to that SEC: you keep barking, we keep bringing the future to the public.

The entire market cap of Arbitrum, at $1.7 billion in supply, has been given away entirely for free to all and any member of the public that just used the second layer.

Facebook never gave us nothing, or Twitter, or a long list of companies to which we gave our privacy and intellectual property for free.

Here, the public gets the free, because these are decentralized entities and therefore distributed ownership is a required and desired quality.

We are turning on its head the startup and even business model that has applied so far which has brought inequality to the levels of Marie Antoinette, by having the public participate at ground zero, at the edges of the frontier.

Gary Gensler and the rest, the centenarian Warren Buffet, are too old to understand, but it is in many ways far too simple.

Just recently the White House released a report where they said our cryptos are worthless. And what do you do with worthless things? Well, you give them away.

You can’t have it both ways, so it’s worthy to take a moment to commend Arbitrum for what some might see as bravery. And if they get sued we expect them to fight too because anyone who doesn’t at this point may well be called a coward and at the very least should run away to Europe where they can have more courage to keep building.

On the token itself, this has a DAO and the DAO presumably can vote for things that give the token some sort of revenue, like some component of the fees in the Arbitrum second layer being paid with Arb.

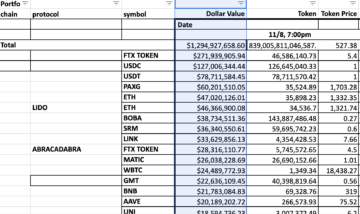

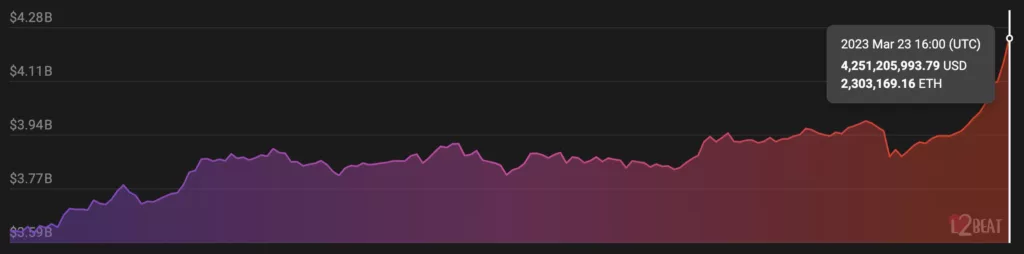

Arbitrum currently has $4.2 billion worth in assets, and has developed a gap with Optimism which has $2 billion.

They used to be neck and neck, both being a form of transactions or data compression that uses optimistic rollups to scale ethereum.

Arbitrum’s fees are at 17 cent per transaction with 1.2 million transactions processed as of yesterday, which is our latest data.

That’s more than ethereum itself at 1.1 million transactions, making this the first time that a second layer crosses eth in transactions as far as we are aware.

Their fees currently are set to be around as much as they have to pay onchain to settle the transactions, about $200,000 worth or about 120 eth.

For simplicity we can assume that these fees can be doubles, so 200 in eth and whatever 200 eth is in arb.

$200,000 a day, $2 million 10 days, $6 million a month or about $70 million a year, times 10.

Well that’s a lot, $7 billion, unless we’ve made a mistake somewhere but we can now move to the conservative side and suggest the $200k is maybe more a temporary boost because of the airdrop, but is that real onboarding so we’re not going to 50% discount, just 30%.

We will however add another 20% discount, partly to make our maths simple, because can they really double their fees when there’s significant competition.

So $3.5 billion. Is that realistic holistically? Well, depends if you’re talking circulating or total supply. Hodl value or trading value.

Trading, maybe. Hodl gets a bit more complicated, but for hodl we’d go back to $7 billion and then we’d need to get into some sort of a subjective exercise in regards to the potential for growth.

They were the first to launch and they are at the top of the leaderboard, but it is very early days with competing technologies vying for that scalability prize.

So 5x, maybe. That’s what we’d call the top anyway, $5, and the bottom at 70 cent, on the assumptions that we have made and on the data that is available today.

There is mass selling today, in part because there’s some reasonable debate in regards to their distribution which punishes casuals – one of the main source of growth – and there might be more selling for a day or two perhaps.

Obviously this could also spike, but investors might wait and see just how much that straight line for today does keep being straight with a spike usually coming after the rush to sell is cleared.

Naturally how many will decide to hodl is unknown, and by another measure, considering Optimism’s market cap is nearly $800 million, Arb’s value at twice it – which is the current level – might be its fair value by that comparative measure as Arbitrum holds twice the amount of assets in Optimism.

And with that we’ve covered all grounds that go up, down, or straight on, but at least we’ve given some bounds based on one method of evaluation, that being revenue potential.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://www.trustnodes.com/2023/03/23/arbitrum-gifts-1-7-billion-to-the-public

- :is

- $3

- $UP

- 000

- 1

- 10

- 67

- 7

- 70

- a

- About

- After

- airdrop

- All

- already

- amount

- and

- Another

- answer

- anyone

- applied

- arbitrum

- ARE

- around

- AS

- Assets

- At

- available

- back

- based

- BE

- because

- before

- began

- being

- Billion

- binance

- Bit

- boost

- Bottom

- bridges

- Bringing

- brought

- Buffet

- Building

- business

- business model

- by

- call

- called

- CAN

- cap

- circulating

- coinbase

- coming

- commission

- Companies

- competing

- competition

- complicated

- component

- Connect

- conservative

- considering

- could

- course

- covered

- cryptos

- Current

- Currently

- DAO

- data

- day

- Days

- debate

- decentralized

- decide

- depends

- developed

- Discount

- distributed

- distribution

- Doesn’t

- double

- down

- Early

- Entire

- entirely

- entities

- Errors

- ETH

- ethereum

- Europe

- evaluation

- Even

- Exchanges

- Exercise

- expect

- fair

- fairly

- Falling

- far

- Fees

- few

- fight

- First

- first time

- For

- form

- Free

- Frontier

- future

- gap

- Gensler

- get

- gifts

- Give

- given

- Go

- going

- Ground

- grounds

- Growth

- Have

- having

- head

- HODL

- holds

- HOURS

- House

- How

- However

- HTTPS

- in

- incredible

- Inequality

- intellectual

- intellectual property

- Investors

- IT

- ITS

- itself

- json

- Keep

- Kraken

- latest

- launch

- layer

- Level

- levels

- like

- Line

- lines

- List

- Long

- Lot

- made

- Main

- make

- Making

- many

- March

- Market

- Market Cap

- Mass

- max-width

- measure

- member

- MetaMask

- method

- might

- million

- mistake

- model

- moment

- Month

- more

- most

- move

- nearly

- Need

- of

- OKEx

- Old

- on

- Onboarding

- Onchain

- ONE

- Optimism

- Optimistic

- Optimistic Rollups

- ownership

- paid

- part

- participate

- Pay

- perhaps

- plato

- Plato Data Intelligence

- PlatoData

- Point

- potential

- price

- privacy

- prize

- property

- public

- quality

- real

- realistic

- reasonable

- receiving

- recently

- regards

- released

- report

- required

- REST

- revenue

- Rollups

- Run

- running

- rush

- Said

- Scalability

- Scale

- SEC

- Second

- Securities

- security

- sell

- Selling

- set

- settle

- should

- significant

- Simple

- simplicity

- So

- so Far

- some

- somewhere

- Source

- spike

- startup

- straight

- sued

- supply

- Systems

- Take

- talking

- Technologies

- temporary

- that

- The

- The Future

- their

- Them

- therefore

- These

- things

- Thinks

- time

- times

- to

- today

- token

- too

- top

- Total

- Trading

- trading volumes

- transaction

- Transactions

- Trustnodes

- Turning

- Twice

- understand

- Uniswap

- us

- usually

- value

- volumes

- Vote

- wait

- warren

- Warren Buffet

- ways

- webp

- WELL

- Wells

- What

- which

- while

- white

- White House

- WHO

- will

- with

- worth

- year

- zephyrnet

- zero