<!–

–>

Bitcoin ETF approval has now become the most anticipated event in the cryptocurrency industry. Meanwhile, Bloomberg Intelligence estimates that the Spot BTC ETF if approved, will be worth approximately $100 billion in the current market valuation.

The fluctuation in the Bitcoin Price is evidence of what happens when such news spreads around the market. Retail and institutional investors are all eyeing the first Bitcoin Spot ETF approval. The current decision to approve any of the filings is still under the scrutiny of the US Securities and Exchange Commission (SEC).

<!–

adClient.showBannerAd({

adUnitId: “34683725-0f88-4d49-ac24-81fc2fb7de8b”,

containerId: “my-banner-ad”

});

–>

The current scenario however looks stable as experts have predicted that the first Bitcoin Spot ETF would go live around January.

Financial Giants Waiting for Bitcoin ETF Approval

With the likes of BlackRock, Fidelity, and Invesco expected to enter the market, experts believe that the Bitcoin Spot ETF market may grow to $100 billion or more.

Galaxy Digital Holdings Ltd., which is working on an application with Invesco, recently hosted a call with roughly 300 investing professionals to discuss Bitcoin allocation ideas as the ETF launch approaches. Notably, Jeff Janson, a wealth adviser at Summit Wealth who manages over $550 million, is preparing for the debut and anticipates strong institutional interest once the SEC approves it.

Recommended Articles

As per experts, the upcoming ETFs will provide a cost-effective, direct route for investors to access pure Bitcoin, bypassing additional expenses from futures-based options.

var AdButler = AdButler || {}; AdButler.ads = AdButler.ads || [];

var abkw = window.abkw || ”;

var plc653687 = window.plc653687 || 0;

document.write(”);

AdButler.ads.push({handler: function(opt){ AdButler.register(180936, 653687, [728,90], ‘placement_653687_’+opt.place, opt); }, opt: { place: plc653687++, keywords: abkw, domain: ‘servedbyadbutler.com’, click:’CLICK_MACRO_PLACEHOLDER’ }});

–>

Also Read: Japan’s First Digital Securities Trading Unveiled By OSAKA Digital Exchange

Bitcoin Transaction Fees Surges Amid BTC ETF Saga

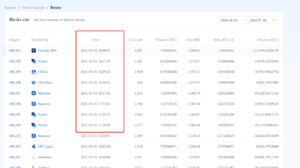

With the recent hype in awaited Bitcoin ETF approval, Bitcoin transaction fees have surged second time within the year. According to the data by Ycharts, Bitcoin’s average TXN fees spiked from $7 to $18.67 on 17 November with a 506.9% increase in a year.

This is the second-highest in a year and third within 6 months. The last time Bitcoin transaction fees hiked on May and was around $30. Currently, the transaction fees have come down to $10.

Market watchers suggest that a spot BTC ETF is projected to attract institutional investors’ funds, potentially leading to Bitcoin’s price reaching new highs in the coming months. Moreover, Bloomberg experts project a 90% likelihood that authorities will approve all bids in the same batch come January.

As of writing, the Bitcoin price was up 1.90% over the past 24 hours to $37,168.96, while its trading volume jumped 41.84% to $15.99 billion at the same time.

Also Read: Banco Santander Offers Bitcoin & Ethereum Trading In Switzerland

<!–

–>

<!–

–>

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://coingape.com/spot-bitcoin-etf-market-poised-to-hit-100-billion-bloomberg/

- :has

- :is

- :not

- $UP

- 1

- 10

- 14

- 15%

- 17

- 20

- 200

- 2019

- 2023

- 24

- 30

- 300

- 41

- 67

- 72

- 90

- a

- access

- According

- Ad

- Additional

- Adds

- Ads

- adviser

- agencies

- All

- allocation

- Amid

- an

- and

- Anticipated

- anticipates

- any

- Application

- approaches

- approval

- approve

- approved

- approximately

- ARE

- around

- article

- articles

- AS

- At

- attract

- author

- Authorities

- avatar

- average

- awaited

- BE

- become

- before

- believe

- BEST

- Billion

- Bitcoin

- Bitcoin ETF

- Bitcoin Price

- Bitcoin spot etf

- Bitcoin Transaction

- BlackRock

- Bloomberg

- Bloomberg Intelligence

- BTC

- BTC ETF

- by

- call

- Category

- ceo

- click

- Clock

- Coingape

- COM

- come

- coming

- commission

- comprises

- condition

- Container

- content

- contributed

- cost-effective

- cover

- crypto

- cryptocurrencies

- cryptocurrency

- Current

- Currently

- data

- day

- debut

- decision

- digital

- Digital Securities

- direct

- discuss

- Disrupt

- do

- document

- does

- domain

- down

- editors

- Enter

- ETF

- ETFs

- Ether (ETH)

- ethereum

- Event

- evidence

- exchange

- Exchange Commission

- expected

- expenses

- experienced

- experts

- experts believe

- explore

- fact

- Fees

- fidelity

- filings

- financial

- firing

- firms

- First

- fluctuation

- For

- For Investors

- Francisco

- from

- funds

- Games

- giants

- Globally

- Go

- Grow

- happens

- Have

- HBAR

- here

- High

- Highs

- Hit

- hold

- Holdings

- hosted

- HOURS

- However

- HTTPS

- Hype

- ideas

- if

- image

- in

- include

- Increase

- industry

- Institutional

- Institutional Interest

- institutional investors

- Intelligence

- interest

- Invesco

- investing

- Investors

- IT

- ITS

- January

- Japan

- JavaScript

- jpg

- keywords

- Last

- launch

- Leadership

- leading

- likelihood

- likes

- List

- live

- LOOKS

- loss

- Ltd

- Main

- manages

- Market

- market research

- Marketing

- Marketing Firms

- max-width

- May..

- Meanwhile

- Middle

- million

- months

- more

- Moreover

- most

- native

- Near

- New

- news

- notably

- November

- now

- of

- Offers

- on

- once

- OP

- OpenAI

- Opinion

- Options

- or

- over

- past

- per

- personal

- photo

- Picks

- Place

- plato

- Plato Data Intelligence

- PlatoData

- plugin

- poised

- Post

- potentially

- predicted

- preparing

- present

- presented

- price

- professionals

- project

- Project A

- projected

- provide

- Publication

- rather

- reaching

- Read

- recent

- recently

- research

- responsibility

- retail

- roughly

- round

- Route

- ROW

- s

- Sam

- same

- San

- San Francisco

- Santander

- scenario

- script

- SEC

- Second

- Securities

- Securities and Exchange Commission

- Share

- Spot

- spot etf

- spot market

- Spreads

- stable

- Still

- strong

- subject

- such

- suggest

- Summit

- Surged

- Surges

- TAG

- team

- TechCrunch

- TechCrunch Disrupt

- text

- than

- that

- The

- The US Securities and Exchange Commission

- Third

- this

- time

- to

- Tokens

- Trading

- trading volume

- transaction

- Transaction Fees

- transition

- true

- TURN

- type

- Unexpected

- unveiled

- upcoming

- updated

- us

- Valuation

- volume

- Waiting

- was

- Wealth

- Web3

- web3 games

- What

- when

- which

- while

- WHO

- will

- window

- with

- within

- working

- worth

- would

- writers

- writing

- year

- Your

- zephyrnet