- Canada’s GDP expected to improve

- US PCE Core Prices projected to stay steady at 0.2%

The Canadian dollar has posted losses on Friday. In the European session, USD/CAD is trading at 1.3446, down 0.28%.

Canada’s GDP expected to post 0.1% gain

I have noticed the phrase “US exceptionalism” being bandied about lately. This is in reference to the impressive strength of the US economy in the face of rising interest rates, in comparison to other major economies most of which are struggling. For proof, one has to go no further than the northern neighbor of the US, as Canada’s economy contracted by 0.2% m/m in July, with weakness reported across the economy. The labour market, which held strong as the Bank of Canada piled on higher interest rates, has slowed. Inflation rose in August to 4.0%, up sharply from 3.3% in July and well above the 2% target. Two of three core inflation measures also climbed, raising concerns that the central bank may be forced to raise interest rates before the end of the year.

Canada releases the August GDP report later today, with the markets expecting a small gain of 0.1% m/m. This would essentially point to stagnation, but that would be better than a second straight reading of negative growth, which would technically mean that the economy is in a recession. The Canadian dollar has held its own in September despite this grim backdrop, helped by rising oil prices which are fast approaching $100.

In the US, the markets will be keeping an eye on Core PCE Prices, which is considered the Fed’s preferred inflation indicator. The index was unchanged in July at 0.2% m/m, but the annual rate remains quite high at 4.2%. The consensus estimate is unchanged at 0.2%, and an unexpected reading could affect the movement of the US dollar.

.

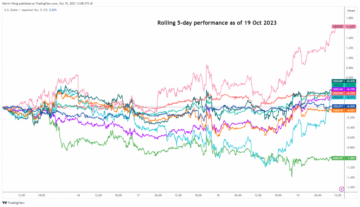

USD/CAD Technical

- USD/CAD is testing resistance at 1.3468. The next resistance line is 1.3553

- 1.3408 and 1.3323 are the next support lines

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.marketpulse.com/fundamental/canadian-dollar-extends-gains-ahead-of-gdp/kfisher

- :has

- :is

- :not

- $UP

- 1

- 2%

- 2012

- 2023

- 400

- a

- About

- above

- access

- across

- advice

- affect

- affiliates

- ahead

- Alpha

- also

- an

- analysis

- analyst

- and

- annual

- any

- approaching

- ARE

- AS

- At

- AUGUST

- author

- authors

- award

- backdrop

- Bank

- bank of canada

- based

- BE

- been

- before

- being

- below

- Better

- Box

- broad

- business

- but

- buy

- by

- Canada

- Canadian

- Canadian Dollar

- central

- Central Bank

- Climbed

- COM

- Commentary

- Commodities

- comparison

- Concerns

- Consensus

- considered

- contact

- content

- contributor

- Core

- core inflation

- could

- covers

- daily

- Despite

- Directors

- Dollar

- down

- economies

- economy

- end

- Equities

- essentially

- estimate

- Ether (ETH)

- European

- expected

- expecting

- experienced

- extends

- eye

- Face

- FAST

- financial

- Financial Market

- Find

- Focus

- For

- forced

- forex

- found

- Friday

- from

- fundamental

- further

- Gain

- Gains

- GDP

- General

- Global

- global markets

- Go

- grim

- Growth

- Have

- Held

- helped

- High

- higher

- highly

- his

- HTTPS

- if

- impressive

- in

- Inc.

- Including

- index

- Indicator

- Indices

- inflation

- information

- interest

- Interest Rates

- investing

- investment

- Israel

- IT

- ITS

- jpg

- July

- keeping

- kenneth

- Labour

- lately

- later

- like

- Line

- losses

- major

- Market

- MarketPulse

- Markets

- max-width

- May..

- mean

- measures

- more

- most

- movement

- necessarily

- negative

- news

- next

- no

- of

- officers

- Oil

- on

- ONE

- online

- only

- Opinions

- or

- Other

- out

- own

- pce

- plato

- Plato Data Intelligence

- PlatoData

- please

- Point

- Post

- posted

- Posts

- preferred

- Prices

- Produced

- projected

- proof

- publications

- published

- purposes

- raise

- raising

- range

- Rate

- Rates

- Reading

- recession

- reference

- Releases

- remains

- report

- Reported

- Resistance

- rising

- ROSE

- rss

- Second

- Securities

- seeking

- Seeking Alpha

- sell

- September

- service

- Services

- session

- several

- sharing

- since

- site

- small

- solution

- STAGNATION

- stay

- steady

- straight

- strength

- strong

- Struggling

- subsidiaries

- support

- Target

- technically

- Testing

- than

- that

- The

- this

- three

- to

- today

- Trading

- two

- Unexpected

- us

- US Dollar

- US economy

- USD/CAD

- v1

- Visit

- was

- weakness

- WELL

- which

- will

- winning

- with

- Work

- would

- year

- you

- zephyrnet