Coinbase is down from $80 to $65 following potential legal action by the Securities and Exchanges Commission which gave the exchange a Wells notice.

“We are right on the law, confident in the facts, and welcome the opportunity for Coinbase (and by extension the broader crypto community) to get before a court,” said Coinbase’s co-founder Brian Armstrong.

Investors nonetheless are reacting to the news with only Coinbase’s (COIN) stock affected as MSTR for example is up 3%.

What the market is calculating exactly is not too clear. It may well be that it is just a knee jerk speculative reaction based on how others might react, as you’d expect after this sort of announcement.

In that case it might be just a five minutes show as lawyers then get on with their business and the rest get on with their business too, keeping SEC busy in court.

Some might obviously have concerns about Coinbase’s position in US and whether this changes that, but if it does it would arguably only do so for the better.

Because Coinbase had no choice. The alternative to not going to court would have been ditching billions worth of business lines and tons of revenue and profits.

Staking is a clear example. He has to compete against defi and decentralized staking tokens, or tokenized staking dapps, like stETH.

Kraken for example decided to just not provide staking after SEC threatened, and in the process they’re giving away a lot of profits for the cost of just a million in lawyer fees.

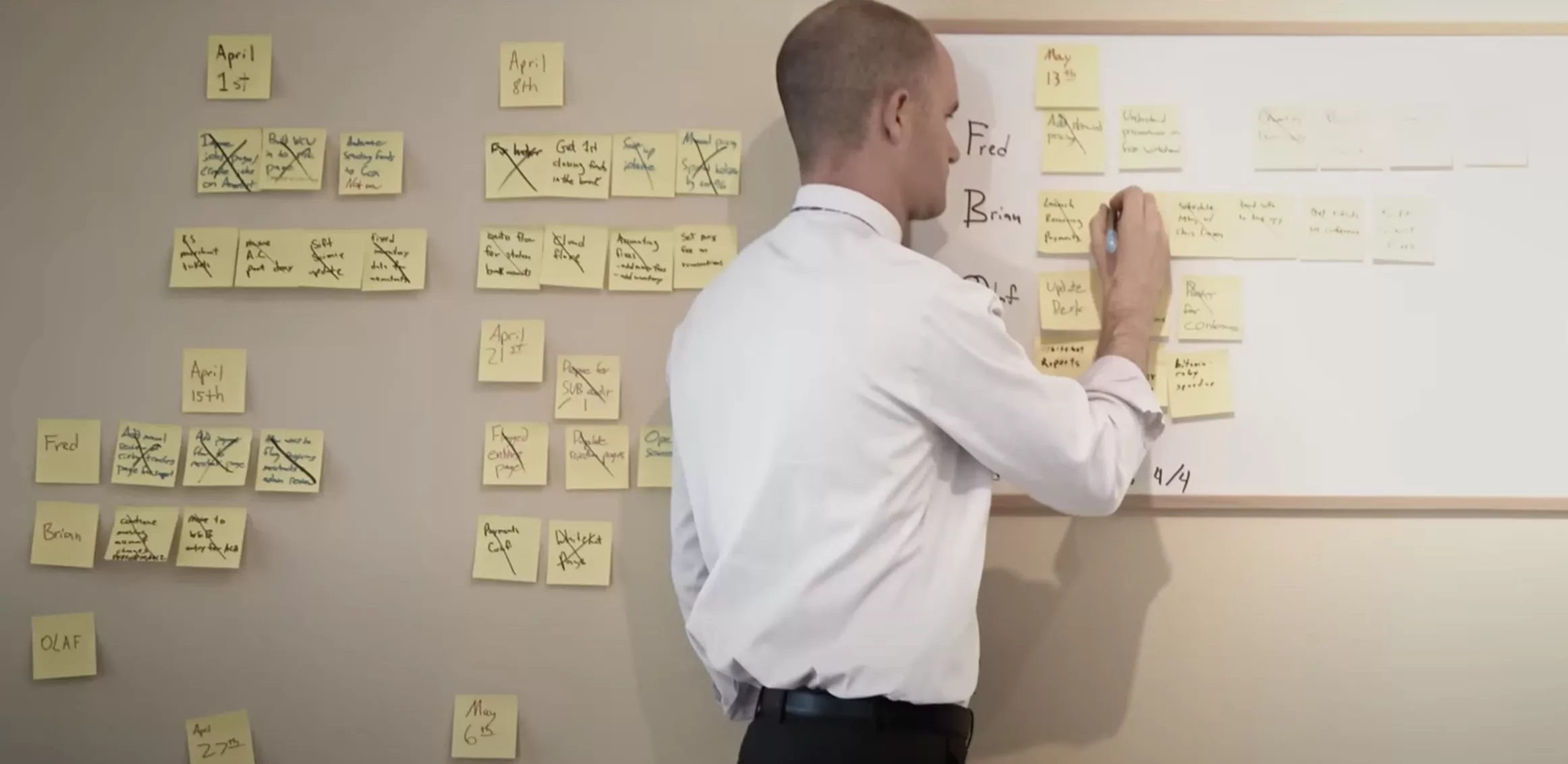

Coinbase instead is deciding to go to court both to argue that SEC doesn’t have jurisdiction, but crucially from a pure business point, to get the court to clarify that if they have to comply, then how exactly do they do that.

This is therefore a can’t lose lolsuit as some are calling it because if they do lose, then they get clarity on what exactly do they need to do to satisfy what is required of them.

Coinbase has spent millions to get that clarity, without success so far, making that court battle a necessary step.

“From the very beginning Brian Armstrong made the decision that Coinbase should play by the rules, engage with regulators and lawmakers, and behave like a responsible actor in what used to be a nascent industry.

We should be proud of this exact kind of US-born responsible innovation and leadership,” said David Marcus, the former president of PayPal and Vice President of Messaging Products at Facebook.

This isn’t therefore some sort of rebellion or a distraction – Coinbase has an army of lawyers whose job is to lawyer things – this is instead a lolsuite, a new term that means a calculated business decision and just a business cost.

For crypto more widely, though us calling it a lolsuite might seem juvenile – well they did call emojis a security – this is also a clear sign that crypto is now playing in the big league and this is what that looks like.

Some of us, certainly Mr Armstrong himself, may remember back when we were dealing with officials deep down in some department that no one had heard of, giving us the enduring meme: bitcorn.

This rose because some superintendent, dressed with that cowboy hat like a discount sherif – they’re apparently real – was all officially saying that bitcorn had to this or that.

No one could hear exactly what he was saying however because he said bitcorn. That showed he had just learned the name of this currency, and had no clue whatever of what it was, or just what its name is, and yet was telling us that bitcoin is a scam and they liked to say just for criminals back then.

Now, we’re in respected courts, and Coinbase in fact is at the Supreme Court today for an unrelated matter regarding a lawsuit by some guy who says he fell for a scam, unrelated to Coinbase itself, but Coinbase should reimburse him nonetheless.

That’s the stuff you have to deal with as crypto scales up, but that bitcorn episode is just as relevant today as it was back then, though it is now front offices rather than back offices.

That’s because SEC’s chair Gary Gensler has probably never seen a terminal in his life, and if he was reading he would probably be thinking we’re talking about some train station terminal.

Not only has he never written a line of code, but he has probably never put a command on a terminal.

And that means just like that supernintendo, Gensler has no clue whatever what he is talking about either, because emojis are obviously not a security, nor are tokens that run computer networks.

He can claim he gave blockchain lectures at MIT, but he doesn’t code, and you can’t have blockchain without code. You know, blockchain is not just a word.

Here, not only are we not concerned at all about this court case, or its outcome – though obviously we have a preferred one – but we effectively take it as an announcement that crypto is now a respectable business and a professional industry.

That’s a change. Subtle, very subtle, and yet we’ve just arrived at a new level and we’ll navigate it just as well as we’ve navigated all levels up to here.

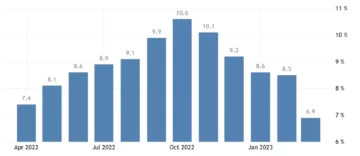

Going back to Coin, this has been an outperformer this year, even against bitcoin and bitcoin has outperformed everything and by far, as the corn tends to do of course.

The Coinbase stock was shining and maybe this dims it a bit temporarily, but the effect so far has been to bring it to same performance as bitcoin.

Is that fair? It’s for the market to say, but Coinbase has profits, they’re selling shovels in the gold rush, and it performing better therefore was probably to some extent because people expect it to perform better.

It is the only publicly listed regulated exchange, and the only prominent close to crypto native company trading on the stock market.

Its real re-pricing, in our view anyway, won’t come from this day to day business as SEC now is or is trying to be, but from the listing of other crypto companies including Kraken.

SEC is helping Coinbase there because it has been sitting on a number of IPO applications by crypto companies for more than a year, and until that changes Coinbase offers something very unique in the stock market, both to traditional finance and to crypto finance.

That the reaction has been limited to Coinbase moreover shows the crypto market is now sophisticating. That’s in part because those that are leading this market are now maturing – Armstrong was in his 20s when he started Coinbase, now 40 – but also because we are very used to SEC now and their lolsuites.

Some might even see it as a party of sorts, a court party – certainly for lawyers – and we now need court reporters because that’s what comes with moving on up.

And so, fourteen years on, it’s good for bitcoin still holds, because it is true.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://www.trustnodes.com/2023/03/23/coinbase-dives-15

- :is

- $UP

- 15%

- a

- About

- Action

- After

- against

- All

- alternative

- and

- Announcement

- applications

- ARE

- argue

- Armstrong

- Army

- AS

- At

- back

- based

- Battle

- BE

- because

- before

- Beginning

- Better

- Big

- billions

- Bit

- Bitcoin

- blockchain

- Brian

- brian armstrong

- bring

- broader

- business

- by

- calculated

- calculating

- call

- calling

- CAN

- case

- certainly

- Chair

- change

- Changes

- choice

- claim

- clarity

- clear

- Close

- Co-founder

- code

- Coin

- coinbase

- Coinbase Stock

- Coinbase’s

- come

- commission

- community

- Companies

- company

- compete

- computer

- concerned

- Concerns

- confident

- Cost

- could

- course

- Court

- Courts

- Criminals

- crucially

- crypto

- crypto community

- crypto companies

- Crypto Market

- Currency

- DApps

- David

- David Marcus

- day

- deal

- dealing

- decentralized

- decided

- Deciding

- decision

- deep

- DeFi

- Department

- DID

- Discount

- Doesn’t

- down

- effect

- effectively

- either

- enduring

- engage

- Even

- everything

- exactly

- example

- exchange

- Exchanges

- expect

- extension

- extent

- fair

- far

- Fees

- finance

- following

- For

- Former

- from

- front

- Gary

- Gary Gensler

- Gensler

- get

- Giving

- Go

- going

- Gold

- good

- Guy

- hat

- Have

- hear

- heard

- helping

- here

- holds

- How

- However

- HTTPS

- in

- Including

- industry

- Innovation

- instead

- IPO

- IT

- ITS

- itself

- Job

- jurisdiction

- keeping

- Kind

- Know

- Kraken

- Law

- lawmakers

- lawsuit

- lawyer

- Lawyers

- Leadership

- leading

- League

- learned

- lectures

- Legal

- Legal Action

- Level

- levels

- Life

- like

- Limited

- Line

- lines

- Listed

- listing

- LOOKS

- lose

- Lot

- made

- Making

- Marcus

- Market

- Matter

- means

- meme

- messaging

- might

- million

- millions

- minutes

- MIT

- more

- Moreover

- moving

- MSTR

- name

- nascent

- native

- Navigate

- necessary

- Need

- networks

- New

- news

- number

- of

- Offers

- offices

- Officially

- officials

- on

- ONE

- Opportunity

- Other

- Others

- Outcome

- part

- party

- PayPal

- People

- perform

- performance

- performing

- plato

- Plato Data Intelligence

- PlatoData

- Play

- playing

- Point

- position

- potential

- preferred

- president

- probably

- process

- Products

- professional

- profits

- prominent

- proud

- provide

- publicly

- publicly listed

- put

- rather

- React

- reaction

- Reading

- real

- regarding

- regulated

- Regulators

- relevant

- remember

- required

- respectable

- respected

- responsible

- REST

- revenue

- ROSE

- rules

- Run

- rush

- Said

- same

- says

- scales

- Scam

- SEC

- Securities

- security

- Selling

- should

- show

- Shows

- sign

- Sitting

- So

- so Far

- some

- something

- spent

- Staking

- started

- station

- Step

- stETH

- Still

- stock

- stock market

- success

- Supreme

- Supreme Court

- Take

- talking

- Terminal

- that

- The

- the Law

- their

- Them

- therefore

- things

- Thinking

- this year

- to

- today

- tokenized

- Tokens

- tons

- too

- Trading

- traditional

- traditional finance

- Train

- true

- Trustnodes

- unique

- us

- Vice President

- View

- webp

- welcome

- WELL

- Wells

- What

- What is

- whether

- which

- WHO

- widely

- with

- without

- Word

- worth

- would

- written

- year

- years

- zephyrnet