Coinbase has announced plans to launch cash-settled futures contract products for Dogecoin, Litecoin, and Bitcoin Cash as early as April 1, 2024. The announcement, made through three separate letters to the United States Commodity Futures Trading Commission (CFTC) on March 7, highlights Coinbase’s belief in Dogecoin’s “enduring popularity” and its transcendence from a mere meme to a staple in the crypto world.

Coinbase Derivatives, the exchange’s derivatives trading arm, intends to invoke the “self-certification” method to launch these futures contracts, ensuring compliance with the CFTC’s regulatory guidelines. This approach allows Coinbase to list the futures contracts on its platform without seeking official approval from the CFTC, as long as they adhere to the agency’s rules.

The decision to include Dogecoin in this lineup has garnered significant attention, given the cryptocurrency’s origins as a joke based on the popular Shiba Inu meme. However, Coinbase justifies its move by stating that Dogecoin’s persistent popularity and active community support suggest that it has evolved beyond its meme roots to become a fundamental part of the cryptocurrency ecosystem.

<!–

–>

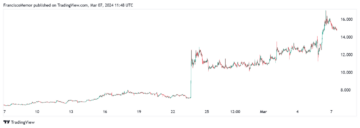

News of Coinbase’s plans has had an immediate impact on the market, with $DOGE currently (as of 10:00 a.m. UTC on March 21) trading at around $0.1518, up 13.8% in the past 24-hour period.

While some market commentators have expressed puzzlement over Coinbase’s decision, analysts have hinted at a potential strategic play behind the move. Bloomberg ETF analyst James Seyffart, in a March 20 post on X (formerly Twitter), suggested that the filings could be a calculated effort to force the Securities and Exchange Commission’s hand in classifying cryptocurrencies based on the same proof-of-work consensus mechanism as Bitcoin.

Seyffart questioned whether the SEC would object to these futures contracts being classified as “commodities futures” rather than “securities futures,” arguing that claiming “these are securities” would be difficult after the recent approval of spot Bitcoin ETFs.

Featured Image via Unsplash

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.cryptoglobe.com/latest/2024/03/coinbase-bets-big-on-dogecoin-doge-futures-defying-meme-coin-origins/

- :has

- :not

- $UP

- 00

- 1

- 10

- 13

- 20

- 2024

- 21

- 7

- 8

- a

- About

- active

- adhere

- Ads

- After

- All

- allows

- an

- analyst

- Analysts

- and

- announced

- Announcement

- approach

- approval

- April

- ARE

- ARM

- around

- AS

- At

- attention

- based

- BE

- become

- behind

- being

- belief

- Beyond

- Bitcoin

- Bitcoin Cash

- Bloomberg

- by

- calculated

- Cash

- CFTC

- claiming

- classified

- coinbase

- Coinbase’s

- commentators

- commission

- commodity

- community

- compliance

- Consensus

- consensus mechanism

- contract

- contracts

- could

- crypto

- cryptocurrencies

- cryptocurrency

- cryptocurrency ecosystem

- CryptoGlobe

- Currently

- decision

- Derivatives

- derivatives trading

- difficult

- Dogecoin

- Early

- ecosystem

- effort

- engage

- ensuring

- ETF

- ETFs

- evolved

- exchange

- expressed

- filings

- For

- Force

- formerly

- from

- fundamental

- Futures

- Futures Trading

- garnered

- given

- guidelines

- had

- hand

- Have

- highlights

- hinted

- However

- HTTPS

- if

- image

- immediate

- Impact

- in

- include

- industry

- intends

- Inu

- IT

- ITS

- james

- Job

- jpg

- just

- launch

- less

- like

- lineup

- List

- Litecoin

- Long

- made

- Making

- March

- Market

- mechanism

- meme

- mere

- method

- move

- moves

- my

- object

- of

- official

- on

- origins

- over

- part

- past

- period

- plans

- platform

- plato

- Plato Data Intelligence

- PlatoData

- Play

- Popular

- popularity

- Post

- potential

- Products

- Proof-of-Work

- Questioned

- rather

- recent

- regulatory

- roots

- rules

- same

- says

- Screen

- screens

- SEC

- Securities

- seeking

- separate

- Shiba

- Shiba Inu

- significant

- sizes

- some

- Spot

- States

- stating

- Strategic

- stuff

- suggest

- support

- Surges

- T

- than

- that

- The

- These

- they

- this

- three

- Through

- time

- to

- Trading

- true

- United

- United States

- use

- UTC

- via

- Way..

- we

- whether

- with

- without

- world

- would

- wouldn

- X

- zephyrnet