So Emergence Capital put together a great report here on B2B startups, “Beyond Benchmarks 2024”, with a ton of great data across 664 software startups.

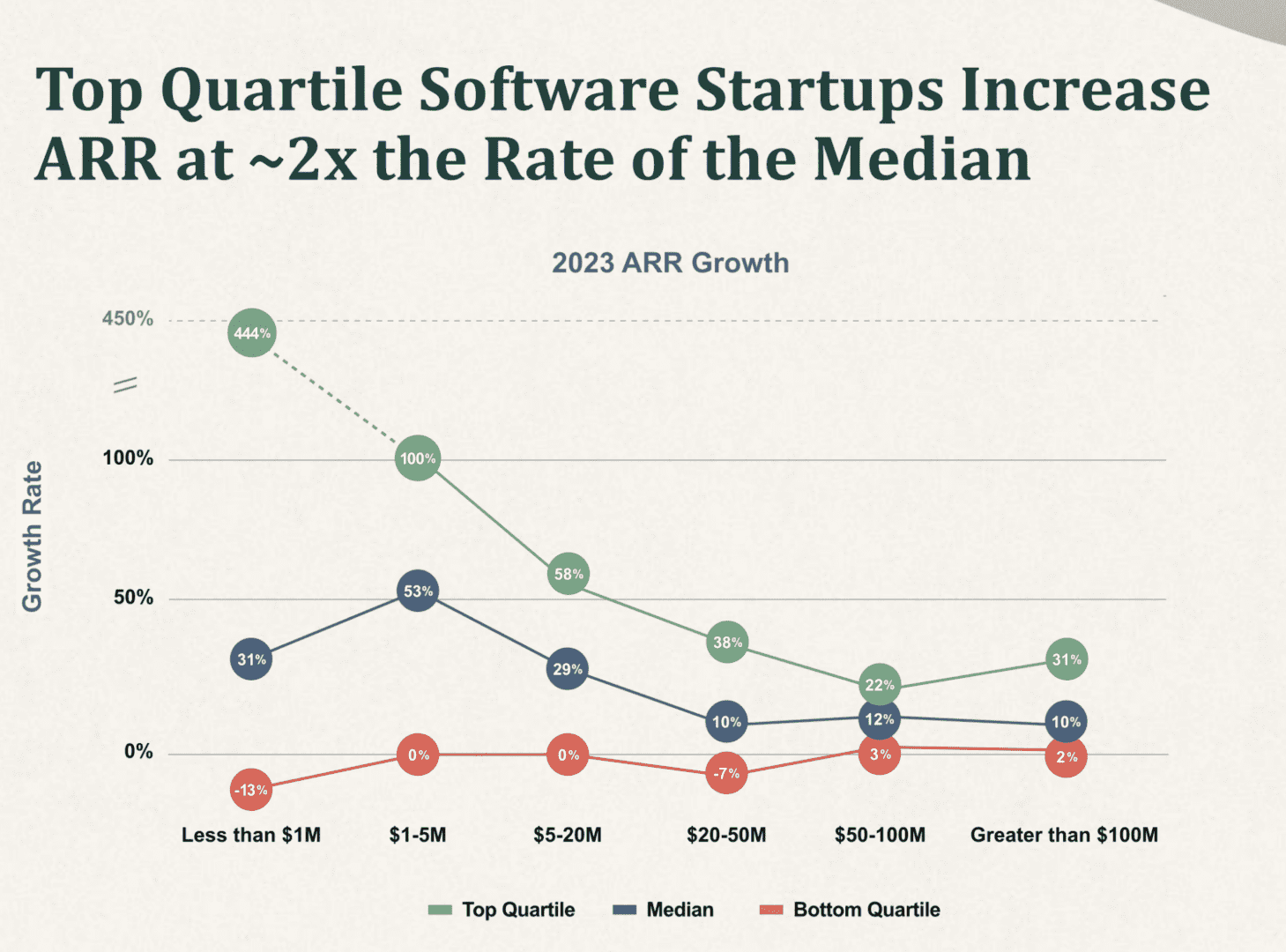

One piece I loved is how 2023 growth rates compared to 2022 for Top Quartile Software Startups.

Now to be clear, and I know this is a bit brutal — “Top Quartile” isn’t in general enough to get funded by VCs. They’re looking for Top Decile, or more specifically, startups that can at least Triple Triple Double Double from $1m ARR on. More on that here:

But top quartile is still a great benchmark to compare and learn from your peers:

- From $1m-$5m ARR, top quartile startups are growing 100% still. But the median is only growing 53%. A huge gap.

- From $5m-$20m ARR, top quartile startups are growing 58%. The media is 29%. Not fundable, but still a growth rate that can compound to something awesome over time.

- Things get tough from $20m-$50m. Top quartile still are growing 38% — but the bottom are shrinking at -7%. The wall many in SaaS hit if they don’t push through it. When new entrants and change pass them by.

A few other interesting data points:

- 60% of B2B startups have already integrated GenAI in their products

- It takes 22 months now to raise a Series A, and 25 months to raise a Series B

- NRR is down across the board, but top quartile startups all still have 100%+ NRR on average

- As startups cross $50m ARR, 40% of their new bookings come from upsell

- True CACs on average are still at 20+ months across all categories

- Startups at $5m+ ARR are already crossing $200,000 in revenue per employee

- Actually, 79% of startups did not increase pricing last year

Lots more good stuff in the report here.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.saastr.com/emergence-top-quartile-startups-are-still-growing/

- :is

- :not

- 000

- 2022

- 2023

- 22

- 24

- 25

- 799

- a

- across

- All

- already

- and

- ARE

- At

- average

- awesome

- B2B

- BE

- Benchmark

- benchmarks

- Bit

- board

- bookings

- Bottom

- but

- by

- CAN

- capital

- change

- clear

- come

- compare

- compared

- Compound

- Cross

- crossing

- data

- data points

- DID

- Dont

- double

- down

- emergence

- Emergence Capital

- enough

- entrants

- few

- For

- from

- funded

- gap

- genai

- General

- get

- good

- great

- Growing

- Growth

- Have

- here

- High

- Hit

- How

- HTTPS

- huge

- i

- if

- in

- Increase

- integrated

- interesting

- IT

- jpg

- Know

- Last

- LEARN

- least

- looking

- loved

- many

- max-width

- Media

- months

- more

- New

- now

- of

- on

- only

- or

- Other

- over

- pass

- peers

- per

- piece

- plato

- Plato Data Intelligence

- PlatoData

- points

- pricing

- Push

- put

- raise

- Rate

- Rates

- report

- revenue

- SaaS

- Series

- Series A

- Software

- something

- specifically

- Startups

- Still

- stuff

- takes

- that

- The

- their

- Them

- they

- this

- Through

- time

- to

- together

- Ton

- top

- tough

- Triple

- VCs

- Wall

- when

- with

- Your

- zephyrnet

More from SaaStr

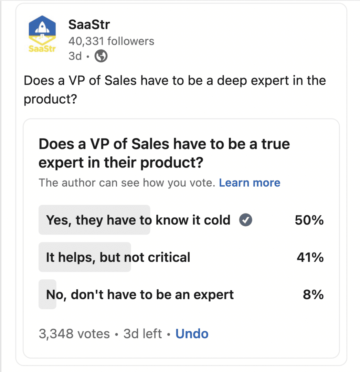

Does Your VP of Sales Need to be An Expert In Your Product?

Source Node: 2031703

Time Stamp: Mar 25, 2023

Dear SaaStr: What Are The Characteristics of a Good SaaS Product? | SaaStr

Source Node: 2208993

Time Stamp: Aug 12, 2023

The SaaStr MiniGuide to Pitching, Raising and Closing VC Funding | SaaStr

Source Node: 2207340

Time Stamp: Aug 11, 2023

Dear SaaStr: What Are Some Best Practices for Selling a New Product Into Existing Customers? | SaaStr

Source Node: 2387997

Time Stamp: Nov 18, 2023

Dear SaaStr: Can Founders Still Sell Some of Their Shares in Venture Rounds in 2023?

Source Node: 1921450

Time Stamp: Jan 26, 2023

SAP: Actually, The Cloud Is Still On Fire. Their $15 Billion Cloud Business is Accelerating. | SaaStr

Source Node: 2345318

Time Stamp: Oct 24, 2023

5 Interesting Learnings From Zoom at $4.6 Billion in ARR | SaaStr

Source Node: 2564761

Time Stamp: May 1, 2024

Just Seeing High App Usage Isn’t Enough. They May Still Be Preparing to Leave.

Source Node: 1405089

Time Stamp: Nov 5, 2021

5 Interesting Learnings From ZoomInfo at ~$1.3 Billion in ARR | SaaStr

Source Node: 2374020

Time Stamp: Nov 8, 2023

TAM is Great. But What Really Matters is That You Believe You Can Hit $100m ARR in 7 Years.

Source Node: 1973055

Time Stamp: Feb 22, 2023