EtherFi accounts for 36% of the $4.65B locked in liquid staking protocols.

EtherFi, the leading liquid restaking protocol, has closed a $23M Series A funding round.

Announced on Feb. 28, the round was led by Bullish Capital and CoinFund, and also attracted participation from Consensys, OKX Ventures, and Draper Dragon. Prominent web3 founders behind Aave, Polygon, Kraken, and Curve also partook in the round.

“EtherFi has seen remarkable growth and we are thrilled to welcome the backing of leading crypto investors to support our continued expansion,” said Mike Silagadze, EtherFi’s CEO and co-founder. “Global market participants are shifting their focus to the Ethereum ecosystem, where… its transition to proof of stake delivers staking and restaking rewards to those who participate.

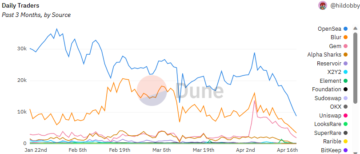

The news follows explosive growth in the liquid restaking token (LRT) sector, which has ballooned from a combined total value locked (TVL) of $281.4M at the start of the year to $4.65B today, according to DeFi Llama.

LRT projects allow users to access restaking yields via EigenLayer, the pioneering Ethereum restaking protocol, without needing to lock up their assets.

EigenLayer allows users to earn additional yields on top Ethereum staking rewards by also securing third-party services at the same time. EigenLayer users can either deposit liquid staking tokens to its capped pools or deposit natively staked Ether without limit. EigenLayer’s TVL currently sits at $9B, accounting for 8.7% of staked Ether and ranking it as the fourth-largest DeFi protocol.

Most LRT protocols offer users exposure to native restaking, with depositors receiving tokens representing their restaked position — which can then be used in DeFi protocols or traded to bypass restaking withdrawal delays.

EtherFi innovated the liquid restaking sector and currently boasts the largest TVL at $1.67B. Puffer Finance comes in second with $1.17B, followed by Renzo with $625M, and Kelp DAO with $604M.

EtherFi said its TVL has grown by 15 times since the beginning of 2024, attracting deposits from roughly 71,000 unique wallets.

“Restaking has the potential to solve the cold start challenge new projects face by leveraging the existing strength of the Ethereum validator set and become a central part of digital asset infrastructure for the long term,” said Alasdair Foster, president of Bullish Capital. EtherFi has pioneered how to do this in a capital-efficient manner through liquid restaking, and we are excited to partner with them on further developing this innovative technology.”

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://thedefiant.io/etherfi-closes-usd23m-series-a-round-as-eigenlayer-tvl-surpasses-usd9b

- :has

- $UP

- 000

- 15%

- 2024

- 28

- 8

- a

- aave

- access

- According

- Accounting

- Accounts

- Additional

- allow

- allows

- also

- and

- ARE

- AS

- asset

- Assets

- At

- attracted

- attracting

- backing

- BE

- become

- Beginning

- behind

- boasts

- Bullish

- by

- bypass

- CAN

- capital

- capital-efficient

- capped

- central

- ceo

- challenge

- closed

- Closes

- Co-founder

- CoinFund

- cold

- combined

- comes

- ConsenSys

- continued

- crypto

- Crypto investors

- Currently

- curve

- DAO

- DeFi

- DeFi llama

- DEFI PROTOCOL

- DeFi protocols

- delays

- delivers

- deposit

- depositors

- deposits

- developing

- digital

- Digital Asset

- do

- Dragon

- draper

- earn

- ecosystem

- either

- Ether

- ethereum

- Ethereum ecosystem

- ethereum staking

- excited

- existing

- expansion

- Exposure

- Face

- Feb

- finance

- Focus

- followed

- follows

- For

- Foster

- founders

- from

- funding

- Funding Round

- further

- grown

- Growth

- How

- How To

- HTTPS

- in

- Infrastructure

- innovative

- innovative technology

- Investors

- IT

- ITS

- Kraken

- largest

- leading

- Led

- leveraging

- LIMIT

- Liquid

- liquid staking

- Llama

- lock

- locked

- Long

- manner

- Market

- mike

- native

- natively

- needing

- New

- news

- of

- offer

- OKX

- on

- or

- our

- part

- participants

- participate

- participation

- partner

- pioneered

- Pioneering

- plato

- Plato Data Intelligence

- PlatoData

- Polygon

- Pools

- position

- potential

- president

- projects

- prominent

- proof

- Proof-of-Stake

- protocol

- protocols

- Ranking

- receiving

- remarkable

- representing

- Rewards

- roughly

- round

- Said

- same

- Second

- sector

- securing

- seen

- Series

- Series A

- Series A funding

- Series A funding round

- series a round

- Services

- set

- SHIFTING

- since

- sits

- SOLVE

- stake

- Staked

- Staking

- Staking Rewards

- start

- strength

- support

- surpasses

- Technology

- term

- The

- The Defiant

- their

- Them

- then

- third-party

- this

- those

- thrilled

- Through

- time

- times

- to

- today

- token

- Tokens

- top

- Total

- total value locked

- traded

- transition

- TVL

- unique

- used

- users

- Validator

- value

- Ventures

- Wallets

- was

- we

- Web3

- webp

- welcome

- which

- WHO

- with

- withdrawal

- without

- year

- yields

- youtube

- zephyrnet