- The European Central Bank paused its aggressive monetary policy tightening.

- The US economy expanded by nearly 5% during the third quarter.

- Futures markets are almost certain the Fed won’t raise rates in November.

In the EUR/USD weekly forecast, the winds are blowing with a distinctly bearish tone due to the recent decision by the ECB to hit the brakes on its rate hike campaign.

Ups and downs of EUR/USD

EUR/USD had a bearish week, where the European Central Bank paused its aggressive monetary policy tightening. Meanwhile, rising tensions in the Middle East and positive data supported the dollar.

-If you are interested in automated forex trading, check our detailed guide-

Since July 2022, the ECB has increased interest rates by 4.5 percentage points to address soaring inflation. However, they pledged to halt further rate hikes last month. This decision comes as the record-high borrowing costs are beginning to impact the economy.

Elsewhere, the US economy expanded by nearly 5% during the third quarter. This growth was driven by increased wages resulting from a tight labor market.

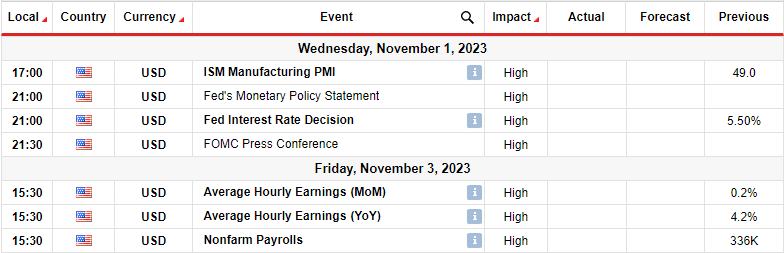

Next week’s key events for EUR/USD

Next week will be eventful for the EUR/USD as the Federal Reserve will hold its monetary policy meeting. Moreover, the US will release data on employment.

Futures markets are almost certain the Fed won’t raise rates in November. Moreover, they give an 80% probability of rate stability in December, as per CME’s FedWatch Tool. Policymakers plan to maintain the current key rate through most of 2024, which is longer than markets had expected.

Meanwhile, the employment report could continue showing a robust labor market.

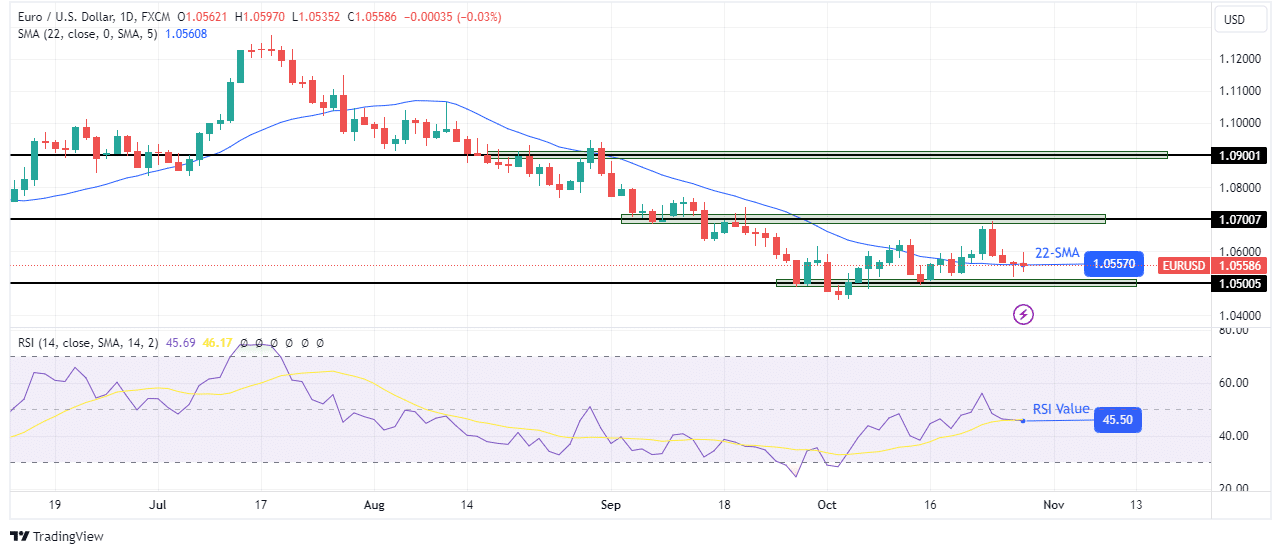

EUR/USD weekly technical forecast: Bulls rally to reverse the trend.

The EUR/USD price has gone above the 22-SMA on the daily chart. The move shows that bulls are attempting to reverse the trend. However, the RSI is still in bearish territory below 50, showing bears are also still strong.

If you are interested in guaranteed stop-loss forex brokers, check our detailed guide-

The price found strong resistance at the 1.0700 key level, where the price paused and fell to retest the 22-SMA. If the SMA is firm as support, the price will likely ascend in the coming week to retest and take out the 1.0700 resistance.

However, if bears are still strong, as seen in the RSI, the price might break below the SMA and the 1.0500 key support level. Such a move would signal the continuation of the downtrend as it would lead to a lower low.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/eur-usd-weekly-forecast-ecbs-hike-campaign-grinds-to-a-halt/

- :has

- :is

- :where

- 1

- 2022

- 2024

- 50

- a

- above

- Accounts

- address

- afford

- aggressive

- almost

- also

- an

- and

- ARE

- AS

- ascend

- At

- attempting

- Bank

- BE

- bearish

- Bears

- Beginning

- below

- Blowing

- Borrowing

- Break

- brokers

- Bulls

- by

- Campaign

- CAN

- central

- Central Bank

- certain

- CFDs

- Chart

- check

- comes

- coming

- Consider

- continuation

- continue

- Costs

- could

- Current

- daily

- data

- December

- decision

- detailed

- distinctly

- Dollar

- downs

- driven

- due

- during

- East

- ECB

- economy

- employment

- EUR/USD

- European

- European Central Bank

- eventful

- events

- expanded

- expected

- Fed

- Federal

- federal reserve

- Firm

- For

- Forecast

- forex

- Forex Brokers

- Forex Trading

- found

- from

- further

- Give

- gone

- Growth

- had

- High

- Hike

- Hikes

- Hit

- hold

- However

- HTTPS

- if

- Impact

- in

- increased

- inflation

- interest

- Interest Rates

- interested

- Invest

- investor

- IT

- ITS

- July

- Key

- labor

- labor market

- Last

- lead

- Level

- likely

- longer

- lose

- losing

- Low

- lower

- maintain

- Market

- Markets

- max-width

- Meanwhile

- meeting

- Middle

- Middle East

- might

- Monetary

- Monetary Policy

- money

- Month

- Moreover

- most

- move

- nearly

- November

- now

- of

- on

- our

- out

- paused

- per

- percentage

- plan

- plato

- Plato Data Intelligence

- PlatoData

- points

- policy

- policymakers

- positive

- price

- probability

- provider

- Quarter

- raise

- rally

- Rate

- Rate Hike

- rate hikes

- Rates

- recent

- release

- report

- Reserve

- Resistance

- resulting

- retail

- reverse

- rising

- Risk

- robust

- rsi

- s

- seen

- should

- showing

- Shows

- Signal

- SMA

- soaring

- Stability

- Still

- strong

- such

- support

- support level

- Supported

- Take

- Technical

- tensions

- territory

- than

- that

- The

- the Fed

- they

- Third

- this

- Through

- tightening

- to

- TONE

- tool

- trade

- Trading

- Trend

- us

- US economy

- wages

- was

- week

- weekly

- when

- whether

- which

- will

- winds

- with

- would

- you

- Your

- zephyrnet