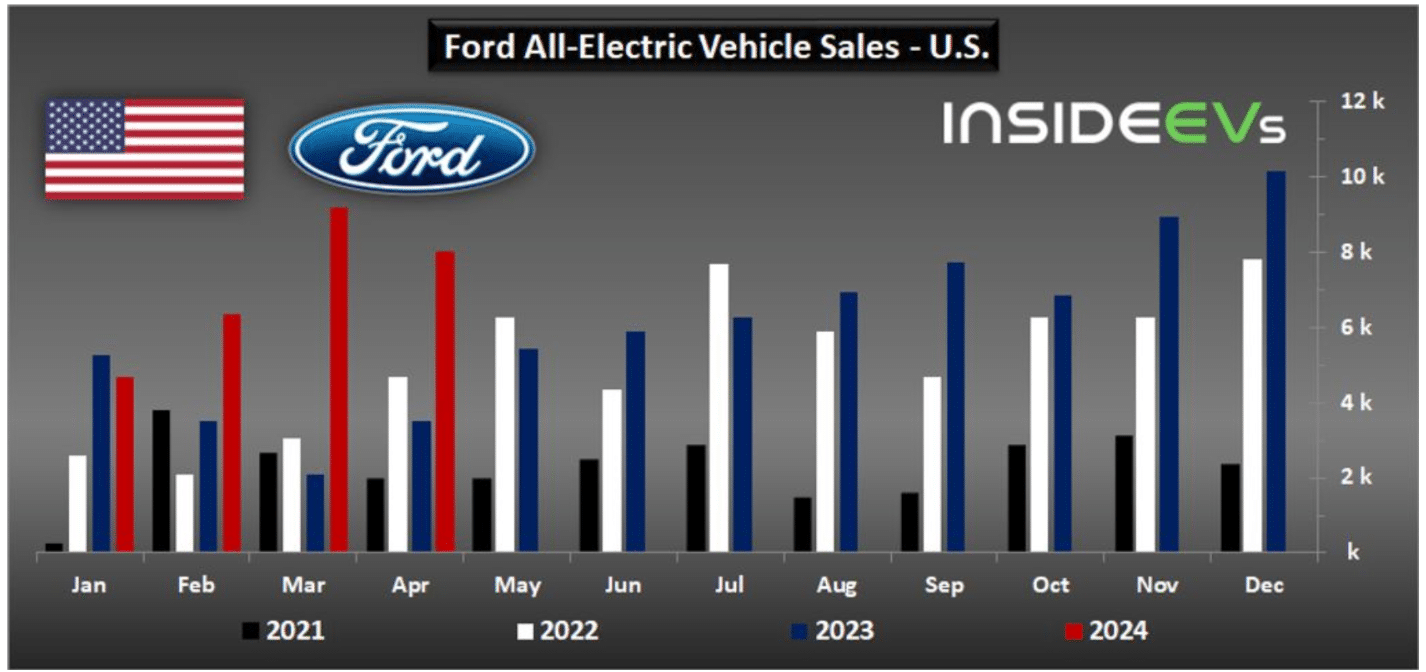

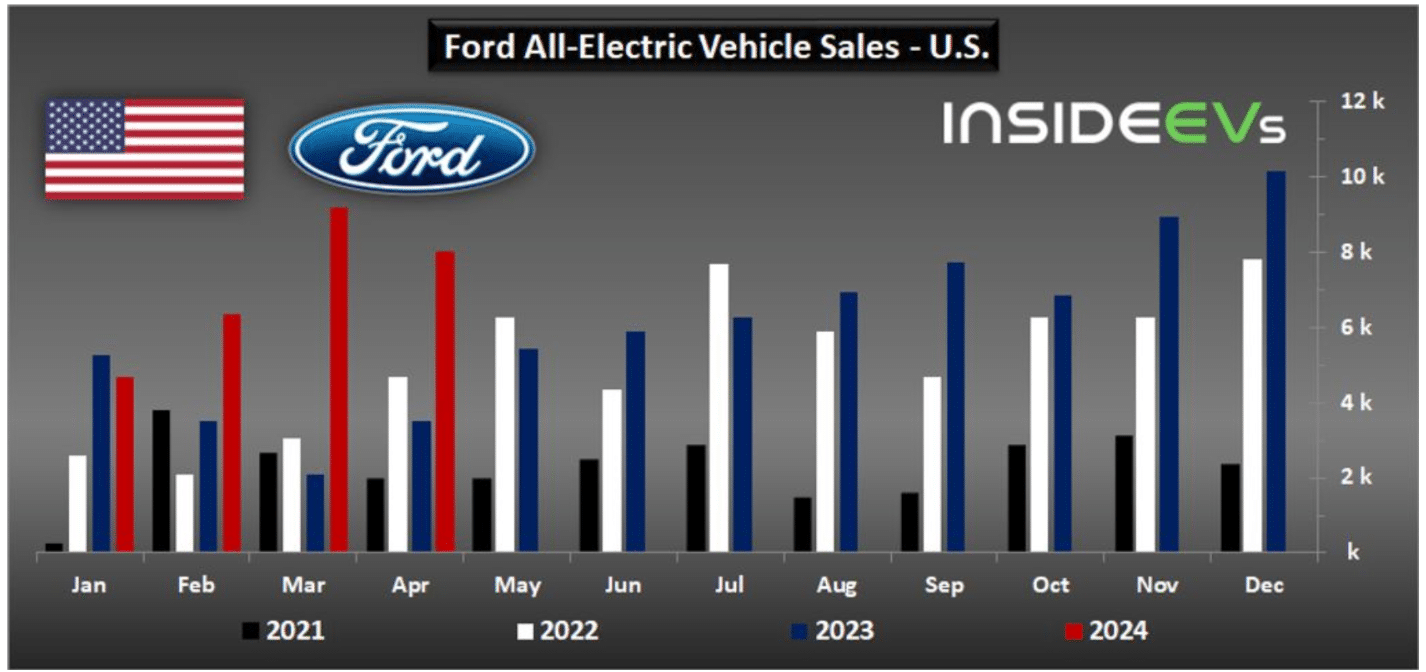

The American automaker reported 179,588 new vehicle sales in April, which reflects a slight decrease of 2.4% year-over-year. However, in the first four months of the year, Ford recorded 687,671 vehicle sales, marking a 4.2% increase compared to the same period last year.

Despite the overall softer performance compared to the previous year, Ford’s sales of electric vehicles (EVs) notably surged.

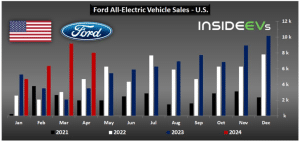

In April, Ford achieved a notable increase in EV sales, with 8,019 units sold, representing a remarkable 129% growth from the previous year. This surge in EV sales is promising for the company’s performance in the second quarter.

Additionally, the proportion of EVs out of Ford’s total sales volume increased significantly, reaching 4.7%, up from 2.0% a year ago.

All three of Ford’s EV models contributed to this growth. The company sold 4,893 units of the Mustang Mach-E (up 205% year-over-year), 2,090 units of the F-150 Lightning (up 57% year-over-year), and 1,036 units of the E-Transit (up 86% year-over-year).

In the U.S. market, Ford has sold over 28,000 all-electric vehicles so far this year, marking a substantial 97% increase from the previous year. These EV sales constitute about 4.3% of Ford’s total sales volume.

Looking ahead, Ford aims to reach 100,000 units of EV sales this year. The company anticipates further growth, particularly in the sales of the F-150 Lightning, despite a slower start in 2024 compared to expectations. Ford recently resumed shipping the 2024 model year of the F-150 Lightning after a hiatus of over two months, accompanied by new pricing adjustments.

In April, the Ford Mustang Mach-E sales reached 4,893 units, reflecting a significant 205% increase from the previous year. However, production levels of the Mach-E in Mexico have decreased compared to last year, possibly due to supply outpacing demand.

The Ford E-Transit van also experienced robust sales growth in April, with 1,036 units sold, marking an 86% increase year-over-year. However, Ford does not disclose sales figures for other plug-in models, such as the Ford Escape PHEV, and Lincoln’s PHEV sales data remains undisclosed as well.

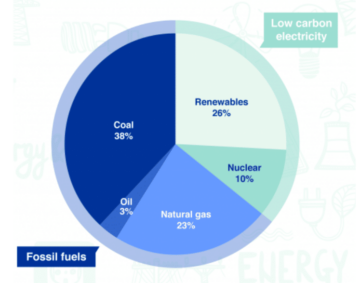

Powering the EV Surge

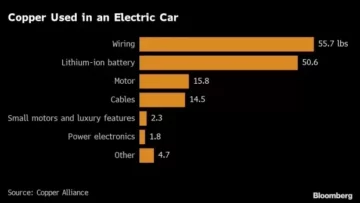

Same with other automakers, Ford’s EV surge rely on a critical mineral hailed as “white gold” – lithium. Lithium is a key component in the batteries that power EVs.

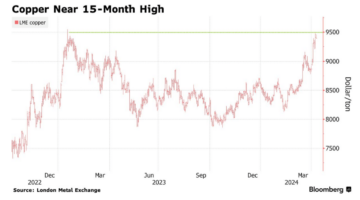

According to a report by S&P Global, lithium prices saw a slight increase in March. This uptick can be attributed to several factors, including production cuts, auction outcomes, and a more positive outlook regarding demand for traction batteries.

Many lithium producers have highlighted the challenge of accurately predicting the prices they will receive for their products during their fourth-quarter 2023 earnings calls. In response to changing market conditions, the world’s largest lithium producers adjusted or modified their investment strategies.

Nevertheless, strategic investments aimed at securing future lithium supply are on the rise, with major automakers and lithium producers committing over $1 billion in 2023 alone.

For example, GM invested $650 million in Lithium Americas, while Albemarle allocated $110 million to lithium developer Patriot Battery Metals. Projections say this trend will persist as companies strive to ensure their access to raw materials for EV batteries.

Securing Lithium for Global EV Expansion

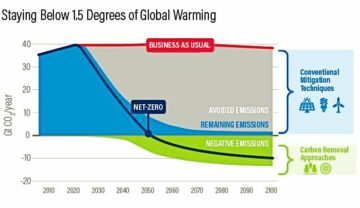

As EV penetration expands worldwide, the demand for lithium is projected to surpass supply, particularly as EVs become mainstream.

The German luxury carmaker, Mercedes-Benz, recently revealed its all-electric truck, the G-Wagon. Meanwhile, the EV giant, Tesla, reported a dip in its profits with lower vehicle sales, but production targets remain strong.

Batteries constitute a substantial portion of EV costs, presenting an opportunity for EV makers to either boost profits per vehicle sold or, more likely, reduce prices to stay competitive as competitors do the same. Lower prices typically attract more buyers, leading to increased demand for lithium.

Ford’s recent sales report reveals a mixed performance in overall vehicle sales but shows a significant surge in EV sales, signaling promising growth while underlining Ford’s commitment to electric mobility that aligns with broader EV market trends.

As Ford targets 100,000 units of EV sales this year, strategic investments in securing future lithium supply and the global expansion of EV penetration are pivotal.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://carboncredits.com/fords-ev-sales-in-u-s-surge-by-over-200/

- :has

- :is

- :not

- ][p

- $1 billion

- $UP

- 000

- 1

- 100

- 12

- 179

- 2%

- 2023

- 2024

- 28

- 33

- 4

- 5

- 8

- a

- About

- access

- accompanied

- accurately

- achieved

- Adjusted

- adjustments

- After

- ago

- ahead

- aimed

- aims

- Albemarle

- Aligns

- All

- all-electric

- all-electric vehicles

- allocated

- alone

- also

- American

- Americas

- amidst

- an

- and

- anticipates

- April

- ARE

- AS

- Assistant

- At

- attract

- Auction

- auto

- automakers

- batteries

- battery

- BE

- become

- Billion

- boost

- broader

- but

- buyers

- by

- Calls

- CAN

- challenge

- changing

- commitment

- committing

- Companies

- company

- Company’s

- compared

- competitive

- competitors

- component

- conditions

- constitute

- continues

- contributed

- Costs

- critical

- cuts

- Dark

- data

- decrease

- decreased

- Demand

- Despite

- Developer

- developments

- Dip

- Disclose

- do

- does

- driving

- Drop

- due

- during

- Earnings

- earnings calls

- either

- Electric

- electric vehicle

- electric vehicles

- electrification

- electrify

- ensure

- escape

- EV

- EV batteries

- evs

- example

- expands

- expansion

- expectations

- experienced

- explore

- factors

- false

- far

- Figures

- First

- For

- Ford

- Ford Motor Company

- four

- from

- further

- future

- German

- giant

- Global

- global expansion

- GM

- Growth

- Have

- Highlighted

- However

- HTTPS

- in

- Including

- Increase

- increased

- invested

- investment

- Investments

- ITS

- Key

- largest

- Last

- Last Year

- leading

- levels

- LG

- lightning

- likely

- lithium

- lower

- Luxury

- Mainstream

- major

- Makers

- March

- Market

- market conditions

- Market Trends

- marking

- materials

- max-width

- Meanwhile

- Metals

- Mexico

- million

- mineral

- mixed

- mobility

- model

- models

- modified

- months

- more

- Motor

- New

- notable

- notably

- of

- on

- Opportunity

- or

- Other

- out

- outcomes

- Outlook

- over

- overall

- particularly

- penetration

- per

- percent

- performance

- period

- pivotal

- plato

- Plato Data Intelligence

- PlatoData

- portion

- positive

- possibly

- power

- predicting

- presenting

- previous

- Prices

- pricing

- Producers

- Production

- Products

- profits

- projected

- projections

- promising

- proportion

- Quarter

- Raw

- reach

- reached

- reaching

- receive

- recent

- recently

- recorded

- reduce

- reflecting

- reflects

- regarding

- relative

- rely

- remain

- remains

- remarkable

- report

- Reported

- representing

- response

- Revealed

- Reveals

- Rise

- robust

- s

- S&P

- S&P Global

- sales

- sales figures

- Sales Volume

- same

- saw

- say

- Second

- second quarter

- sector

- securing

- several

- Shipping

- Shows

- significant

- significantly

- slight

- slower

- So

- so Far

- sold

- start

- stay

- Strategic

- strategies

- Strategy

- strive

- strong

- substantial

- such

- supply

- surge

- surpass

- targets

- that

- The

- their

- These

- they

- this

- this year

- three

- to

- Total

- traction

- transport

- Trend

- Trends

- truck

- two

- typically

- u.s.

- units

- us

- van

- vehicle

- Vehicles

- volume

- WELL

- which

- while

- will

- with

- world’s

- worldwide

- year

- zephyrnet