- The pound extended gains made on Friday due to upbeat retail sales data.

- The dollar was weaker as markets in the US closed for the President’s Day holiday.

- This week, traders will focus on the FOMC meeting minutes and speeches from Fed policymakers.

Monday’s GBP/USD forecast showed a bullish outlook, driven by the pound’s continued ascent following Friday’s impressive retail sales data. Meanwhile, the dollar was weaker as markets in the US closed for the President’s Day holiday.

–Are you interested to learn more about automated forex trading? Check our detailed guide-

Last week, the dollar rallied as inflation data showed the Fed still had more work to do. Consequently, investors now expect interest rate cuts to start in June. Additionally, experts now believe the chances of a soft landing by the Fed have gone down. Therefore, there is a high chance of a recession.

This week, traders will focus on the FOMC meeting minutes and speeches from Fed policymakers. These will keep shaping the outlook for monetary policy in the US.

Meanwhile, the pound rose on Friday after the UK released an upbeat retail sales report. Still, there was little impact on the outlook for rate cuts in the UK. Investors still see the Bank of England cutting rates by 64bps in 2024.

The expectations for rate cuts in the UK remain the lowest among major central banks like the Fed and the ECB. Markets believe the BoE will take its time before cutting rates. Moreover, they will cut by much less than the Fed in 2024. As a result, the pound has remained mostly steady against the dollar this year.

GBP/USD key events today

It will likely be a slow session for the pair amid a holiday in the US. Moreover, there won’t be any key reports from the US or the UK.

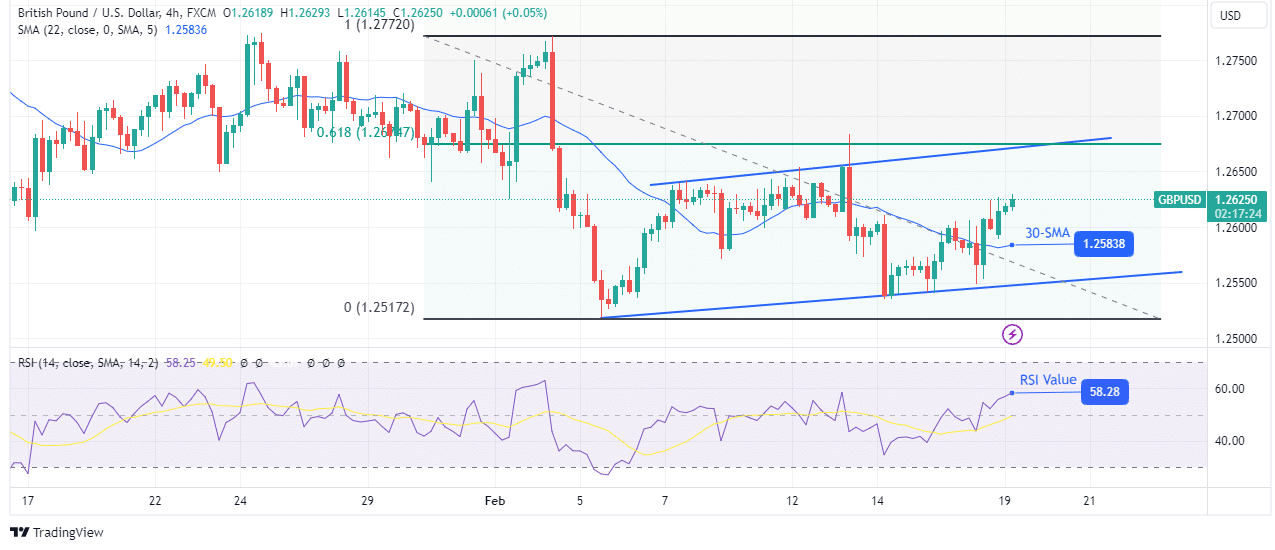

GBP/USD technical forecast: Aiming to test resistance

On the charts, the pound is trading in a shallow bullish channel, with the price currently approaching the channel resistance. The price trades above the 30-SMA while the RSI sits above 50, making the bias bullish. However, the shallow trend shows that the price might currently be in a corrective move.

–Are you interested to learn more about forex signals? Check our detailed guide-

Moreover, the shallow trend comes after a sharp decline, showing there has been a drop in momentum. Therefore, if this is a pause in the decline, the price might reverse at the nearest resistance. At the moment, that could be the resistance zone comprising the channel resistance and the 0.618 Fib level.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/blog/2024/02/19/gbp-usd-forecast-fridays-positive-sales-boosting-pound/

- :has

- :is

- 1

- 2024

- 50

- a

- About

- above

- Accounts

- Additionally

- afford

- After

- against

- Aiming

- Amid

- among

- an

- and

- any

- approaching

- AS

- ascent

- At

- Bank

- Bank of England

- Banks

- BE

- been

- before

- believe

- bias

- BoE

- boosting

- Bullish

- by

- CAN

- central

- Central Banks

- CFDs

- Chance

- chances

- Channel

- Charts

- check

- closed

- comes

- comprising

- Consequently

- Consider

- continued

- could

- Currently

- Cut

- cuts

- cutting

- data

- day

- Decline

- detailed

- do

- Dollar

- down

- driven

- Drop

- due

- ECB

- England

- events

- expect

- expectations

- experts

- extended

- Fed

- Focus

- following

- FOMC

- For

- Forecast

- forex

- Friday

- from

- Gains

- GBP/USD

- gone

- had

- Have

- High

- Holiday

- However

- HTTPS

- if

- Impact

- impressive

- in

- inflation

- interest

- INTEREST RATE

- interested

- Invest

- investor

- Investors

- ITS

- june

- Keep

- Key

- landing

- LEARN

- less

- Level

- like

- likely

- little

- lose

- losing

- lowest

- made

- major

- Making

- Markets

- max-width

- Meanwhile

- meeting

- might

- minutes

- moment

- Momentum

- Monetary

- Monetary Policy

- money

- more

- Moreover

- mostly

- move

- much

- now

- of

- on

- or

- our

- Outlook

- pair

- pause

- plato

- Plato Data Intelligence

- PlatoData

- policy

- policymakers

- positive

- pound

- price

- provider

- Rate

- Rates

- recession

- released

- remain

- remained

- report

- Reports

- Resistance

- result

- retail

- Retail Sales

- reverse

- Risk

- ROSE

- rsi

- s

- sales

- see

- session

- shallow

- shaping

- sharp

- should

- showed

- showing

- Shows

- sits

- slow

- Soft

- speeches

- start

- steady

- Still

- Take

- Technical

- test

- than

- that

- The

- the Fed

- the UK

- There.

- therefore

- These

- they

- this

- this year

- time

- to

- trade

- Traders

- trades

- Trading

- Trend

- Uk

- upbeat

- us

- was

- weaker

- week

- when

- whether

- while

- will

- with

- Work

- year

- you

- Your

- zephyrnet

- zone