- The bias remains bullish as long as it stays above the 150% line.

- A new higher high activates further growth.

- The US data could bring action on XAU/USD.

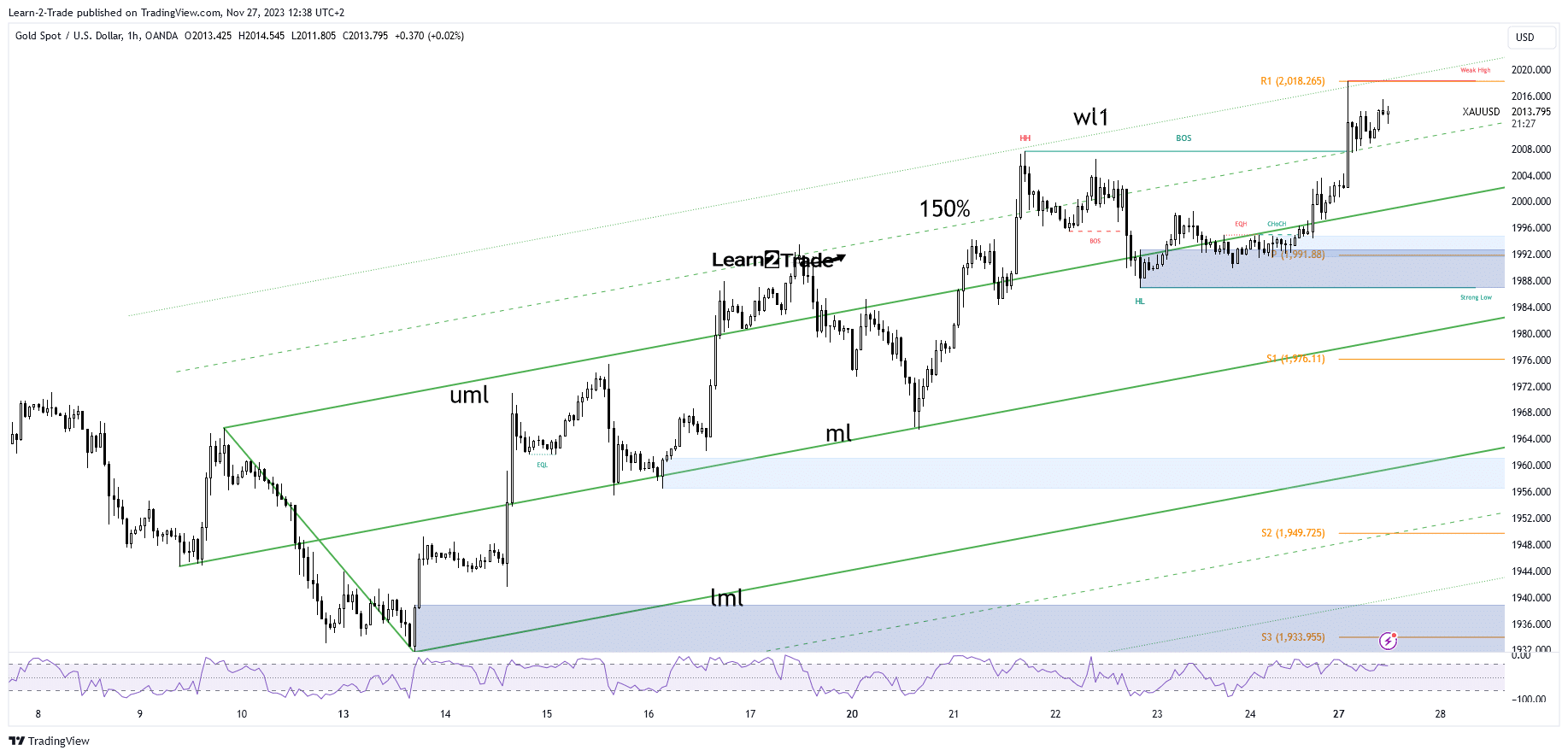

The gold price rallied to a new higher high of $2,018. The precious metal has retreated a little and is trading at $2,014 at the time of writing.

–Are you interested to learn more about scalping brokers? Check our detailed guide-

The greenback’s downside continuation helped the XAU/USD to extend its growth. The bias is bullish, so further gains are on the cards.

Fundamentally, the yellow metal reached fresh highs as the US Flash Manufacturing PMI came in worse than expected on Friday, at 49.4 points versus 49.9 points expected, confirming contraction.

Today, the US New Home Sales is expected to drop from 759K to 724K. Poor economic data should weaken the greenback and could help the XAU/USD to hit new highs.

On the contrary, positive data could save the USD from the downside, while the price of gold may drop again.

Also, ECB President Lagarde’s Speaks could have a significant impact. The US CB Consumer Confidence is seen as a high-impact event and may bring sharp movements tomorrow. The HPI and the S&P/CS Composite-20 HPI data will be released as well.

Gold Price Technical Analysis: Bulls Pause by $2,018

From the technical point of view, the XAU/USD rallied after coming back above the upper median line (UML) of the ascending pitchfork. The metal has ignored the 150% Fibonacci line, reaching the warning line (wl1). This represents a dynamic resistance, and the rate printed only a false breakout with great separation, signaling exhausted buyers.

–Are you interested to learn about forex robots? Check our detailed guide-

Still, the bias remains bullish as long as it stays above the 150% Fibonacci line and the former high of $2,007. A small consolidation above these immediate support levels may announce an upside continuation. However, a new higher high may activate further growth. On the other hand, dropping below the short-term support levels could trigger a correction.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/gold-price-stalls-at-2018-eying-us-new-home-sales-data/

- :has

- :is

- 49

- 9

- a

- above

- Accounts

- Action

- afford

- After

- again

- an

- analysis

- and

- Announce

- ARE

- AS

- At

- back

- BE

- below

- bias

- breakout

- bring

- Bullish

- Bulls

- buyers

- by

- came

- CAN

- Cards

- CB

- CFDs

- check

- coming

- confidence

- Consider

- consolidation

- consumer

- continuation

- contraction

- contrary

- could

- data

- detailed

- downside

- Drop

- Dropping

- dynamic

- ECB

- ECB President

- Economic

- Event

- expected

- extend

- false

- Fibonacci

- Flash

- forex

- Former

- fresh

- Friday

- from

- further

- Gains

- Gold

- gold price

- great

- Greenback

- Growth

- hand

- Have

- help

- helped

- High

- higher

- Highs

- Hit

- Home

- However

- HTTPS

- immediate

- Impact

- in

- interested

- Invest

- investor

- IT

- ITS

- LEARN

- levels

- Line

- little

- Long

- lose

- losing

- manufacturing

- max-width

- May..

- metal

- money

- more

- movements

- New

- now

- of

- on

- only

- Other

- our

- pause

- plato

- Plato Data Intelligence

- PlatoData

- pmi

- Point

- Point of View

- points

- poor

- positive

- Precious

- president

- price

- provider

- Rate

- reached

- reaching

- released

- remains

- represents

- Resistance

- retail

- Risk

- sales

- Save

- Scalping

- seen

- sharp

- short-term

- should

- significant

- small

- So

- Speaks

- support

- support levels

- Take

- Technical

- Technical Analysis

- than

- The

- These

- this

- time

- to

- tomorrow

- trade

- Trading

- trigger

- Upside

- us

- US CB Consumer Confidence

- US New Home Sales

- USD

- Versus

- View

- warning

- WELL

- when

- whether

- while

- will

- with

- worse

- writing

- XAU/USD

- yellow

- you

- Your

- zephyrnet