No one can predict the future of real estate, but you can prepare. Find out what to prepare for and pick up the tools you’ll need at Virtual Inman Connect on Nov. 1-2, 2023. And don’t miss Inman Connect New York on Jan. 23-25, 2024, where AI, capital and more will be center stage. Bet big on the future and join us at Connect.

The “lock-in effect” isn’t the only reason homeowners have been reluctant to put houses on the market as mortgage rates surged, and a decline in rates won’t necessarily produce a flood of for-sale listings, researchers at Fannie Mae say.

The mortgage lock-in effect is the disincentive for existing homeowners to sell their homes because they don’t want to give up the low rate they locked in when buying a home or refinancing during the pandemic.

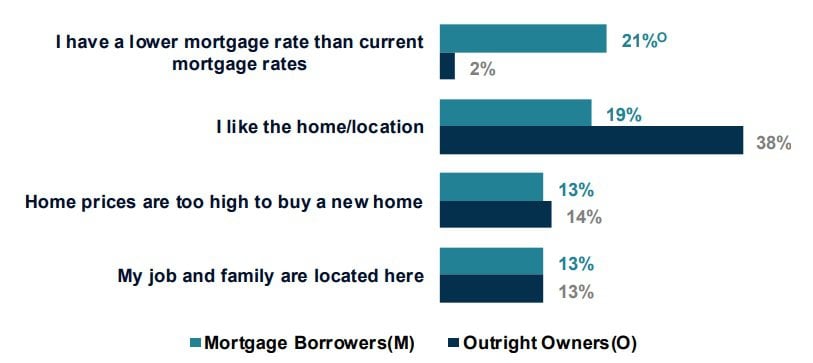

But in surveying homeowners this year, Fannie Mae researchers said they found that only 29 percent of homeowners with a mortgage planned to stay in their homes longer than they’d originally intended when they bought it. Among that group, only one in five (21 percent) said having a low mortgage rate was the primary reason for their change in plans.

That means the lock-in effect is the biggest factor delaying a move for only about 6 percent of all homeowners with mortgages.

“These survey results lead us to conclude that there are multiple factors contributing to the historically low supply of existing homes for sale,” Fannie Mae researchers said in reporting their findings Monday. “While the lock-in effect is real for many consumers, the full range of reasons provided by mortgage borrowers and outright owners for planning to stay in their homes longer paints a significantly more nuanced picture.”

Primary reasons for staying in a home longer than expected

Source: Fannie Mae National Housing Survey Special Topics Report, Oct. 2023.

Among homeowners with a mortgage who said they plan to stay in their homes longer, 19 percent said the primary reason was that they like their home or its location. Another 13 percent said prices are too high to buy another home, while an equal number cited their home’s proximity to job and family.

“Going into the study, our hypothesis was that a large majority of mortgage borrowers would say they planned to stay in their homes longer than originally intended due to having a significantly lower mortgage rate than current rates,” Fannie Mae Deputy Chief Economist Mark Palim wrote in a piece co-authored by Market Research Advisor Rachel Zimmerman. “However, the research findings did not show this.”

Instead, it appears “a confluence of factors” are contributing to the lack of housing inventory, including the likelihood that the historic low mortgage rates early in the pandemic pulled forward listings and sales that would otherwise have been distributed more evenly over several years, and demographic and generational shifts.

Baby Boomers represent 32 percent of homeowners, Palim and Zimmerman noted, and more than 80 percent plan to “age in place.”

There’s also been a long-term trend of people of all age groups tending to move less often. While 16.8 percent of households moved in 2006, the percentage of annual movers had dropped to 12.6 percent in 2022.

“For more homeowners to be incentivized to put their homes on the market, other factors beyond mortgage rates may have to change, such as older generations aging out of their homes,” Fannie Mae researchers concluded. “As it stands now, and given these results, even if mortgage rates were to decline meaningfully in the intermediate term, we would not expect to see a surge in home listings.”

Get Inman’s Mortgage Brief Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.inman.com/2023/10/30/impact-of-lock-in-effect-on-listings-may-have-been-overstated/

- :has

- :is

- :not

- :where

- $UP

- 12

- 13

- 16

- 19

- 2006

- 2022

- 2023

- 2024

- 29

- 32

- 8

- 80

- a

- About

- advisor

- age

- Aging

- AI

- All

- also

- among

- an

- and

- annual

- Another

- appears

- ARE

- AS

- At

- BE

- because

- been

- Bet

- Beyond

- Big

- Biggest

- borrowers

- bought

- but

- buy

- Buying

- by

- CAN

- capital

- Center

- center stage

- change

- chief

- cited

- COM

- conclude

- concluded

- confluence

- Connect

- Consumers

- contributing

- Current

- Decline

- delivered

- demographic

- deputy

- DID

- distributed

- Dont

- dropped

- due

- during

- Early

- Economist

- effect

- equal

- estate

- Ether (ETH)

- Even

- evenly

- Every

- existing

- expect

- factor

- factors

- family

- Find

- findings

- five

- flood

- For

- Forward

- found

- full

- future

- generational

- generations

- Give

- given

- Group

- Group’s

- had

- Have

- having

- here

- High

- historic

- historically

- Home

- Homes

- households

- houses

- housing

- HTTPS

- if

- Impact

- in

- incentivized

- Including

- intended

- Intermediate

- into

- inventory

- IT

- ITS

- Jan

- Job

- join

- Join us

- jpg

- Lack

- large

- lead

- less

- like

- likelihood

- Listings

- location

- locked

- long-term

- longer

- Low

- lower

- Majority

- many

- mark

- Market

- market research

- matt

- max-width

- May..

- means

- miss

- Monday

- more

- Mortgage

- Mortgages

- move

- moved

- Movers

- multiple

- necessarily

- Need

- New

- news

- noted

- now

- number

- Oct

- of

- often

- older

- on

- ONE

- only

- or

- originally

- Other

- otherwise

- our

- out

- outright

- over

- overstated

- owners

- pandemic

- People

- percent

- percentage

- pick

- picture

- piece

- Place

- plan

- planned

- planning

- plans

- plato

- Plato Data Intelligence

- PlatoData

- predict

- Prepare

- Prices

- primary

- produce

- provided

- put

- range

- Rate

- Rates

- real

- real estate

- reason

- reasons

- represent

- research

- researchers

- Results

- right

- roundup

- Said

- sale

- sales

- say

- see

- sell

- several

- Shifts

- show

- significantly

- special

- Stage

- stands

- stay

- staying

- Study

- subscribe

- such

- supply

- surge

- Surged

- Survey

- term

- than

- that

- The

- The Future

- the world

- their

- There.

- These

- they

- this

- this year

- to

- too

- tools

- Topics

- Trend

- us

- want

- was

- we

- Wednesday

- weekly

- were

- What

- when

- while

- WHO

- will

- with

- world

- would

- wrote

- year

- years

- you

- Your

- zephyrnet