Yes, there are STILL rental property mortgages with low interest rates AND low money down, even in 2023. These investment property loans are unknown to most real estate investors simply because they don’t know where to look or who to ask about them. Which loans are we talking about? Stick around because today, we’re uncovering all the ways that YOU can finance and fund your real estate deals in 2023 and 2024, even when getting a loan is harder than ever before.

If you’ve been struggling to put properties under contract because your financing keeps falling through, this is the episode for you. After running into numerous closing table conundrums and non-stop financing fatigue, many real estate investors are giving up on buying new properties due to banks’ lack of liquidity and eye-watering loan requirements. But that isn’t stopping David, Rob, or today’s guest, Zach Lemaster, from closing deals.

In this episode, we’ll go through the loan options that WORK in 2023 and 2024, the creative financing you can use to fund your next deal, and the often unknown loans that STILL offer only three percent mortgage rates or just five percent down on rental properties (seriously). If you haven’t tried these loans yet, you could be missing out on some of the best deals of the decade.

Click here to listen on Apple Podcasts.

Listen to the Podcast Here

Read the Transcript Here

Coming soon…

Watch the Episode Here

Help Us Out!

Help us reach new listeners on iTunes by leaving us a rating and review! It takes just 30 seconds and instructions can be found here. Thanks! We really appreciate it!

In This Episode We Cover:

- The underrated, often overlooked rental property loans with low interest rates and low down payments

- Why getting a thirty-year fixed-rate loan may NOT make sense in 2023 and 2024

- Whether to secure the debt or the deal first on your next real estate investment

- Loan “covenants” you MUST look out for before getting any new mortgage

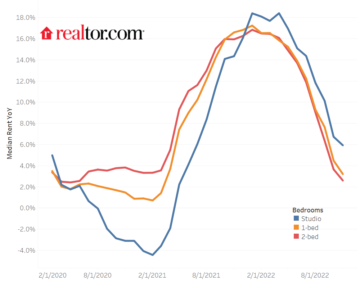

- Mortgage rate predictions and where interest rates could be over the next five years

- How to build a relationship with banks/lenders so you ALWAYS get funding

- And So Much More!

Links from the Show

Book Mentioned in the Show

Connect with Zach:

Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email [email protected].

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.biggerpockets.com/blog/real-estate-847

- :is

- :not

- :where

- $UP

- 1

- 2023

- 24

- 30

- a

- About

- After

- All

- always

- and

- any

- Apple

- appreciate

- ARE

- around

- ask

- author

- BE

- because

- becoming

- been

- before

- BEST

- border

- build

- but

- Buying

- by

- CAN

- closing

- contract

- could

- cover

- David

- deal

- Deals

- Debt

- decade

- Display

- do

- Dont

- due

- episode

- estate

- Ether (ETH)

- Even

- EVER

- Falling

- fatigue

- finance

- financing

- First

- five

- For

- found

- from

- fund

- get

- getting

- Giving

- Go

- Guest

- harder

- Hidden

- How

- How To

- HTTPS

- if

- in

- instructions

- interest

- Interest Rates

- into

- investment

- Investors

- IT

- iTunes

- jpg

- just

- Know

- Lack

- learning

- leaving

- LG

- Liquidity

- listen

- listeners

- loan

- Loans

- Look

- Low

- make

- May..

- mentioned

- missing

- money

- more

- Mortgages

- most

- must

- necessarily

- New

- next

- None

- now

- numerous

- of

- offer

- often

- on

- open

- Opinions

- Options

- or

- out

- over

- partner

- percent

- plato

- Plato Data Intelligence

- PlatoData

- player

- podcast

- Podcasts

- properties

- property

- protected

- put

- Rate

- Rates

- rating

- reach

- real

- real estate

- really

- relationship

- relative

- Rental

- represent

- Requirements

- right

- rob

- round

- running

- seconds

- secure

- seriously

- So

- some

- Sponsors

- Stick

- Still

- stopping

- table

- takes

- talking

- than

- that

- The

- Them

- These

- they

- this

- three

- Through

- to

- today

- today’s

- Transcript

- tried

- under

- Underrated

- unknown

- us

- use

- Video

- ways

- we

- when

- which

- WHO

- with

- Work

- written

- yet

- you

- Your

- yourself

- youtube

- zach

- zephyrnet