Canada’s carbon price increase officially goes into effect today (April 1st, 2024). A “cornerstone policy” of Prime Minister Justin Trudeau’s minority Liberal government, the tax is wrapped up in controversy with provincial leaders across the country calling for a halt over affordability concerns.

The increase will be a hard hit at the gas station and on energy bills in provinces and territories where the federal backstop plan applies.

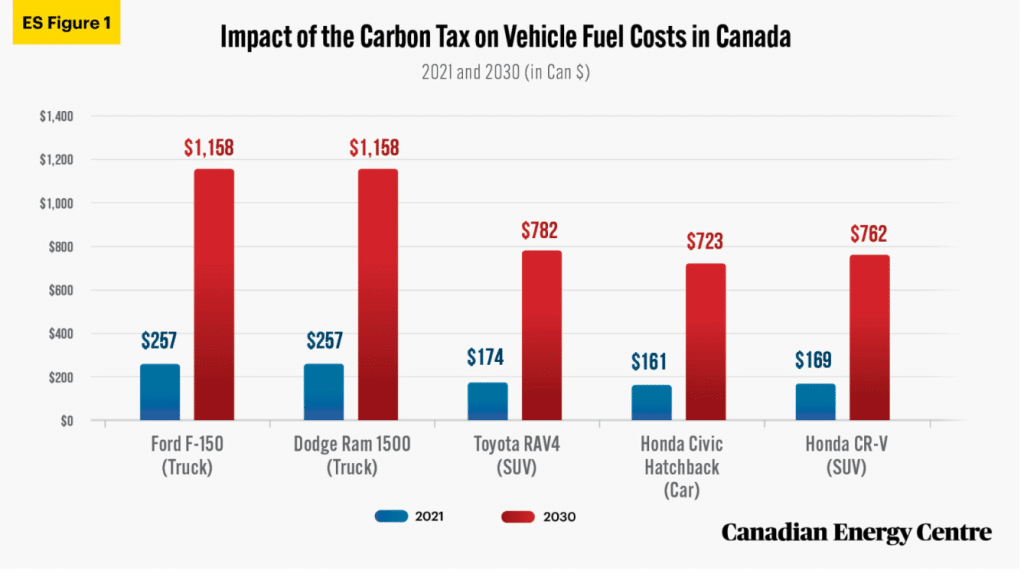

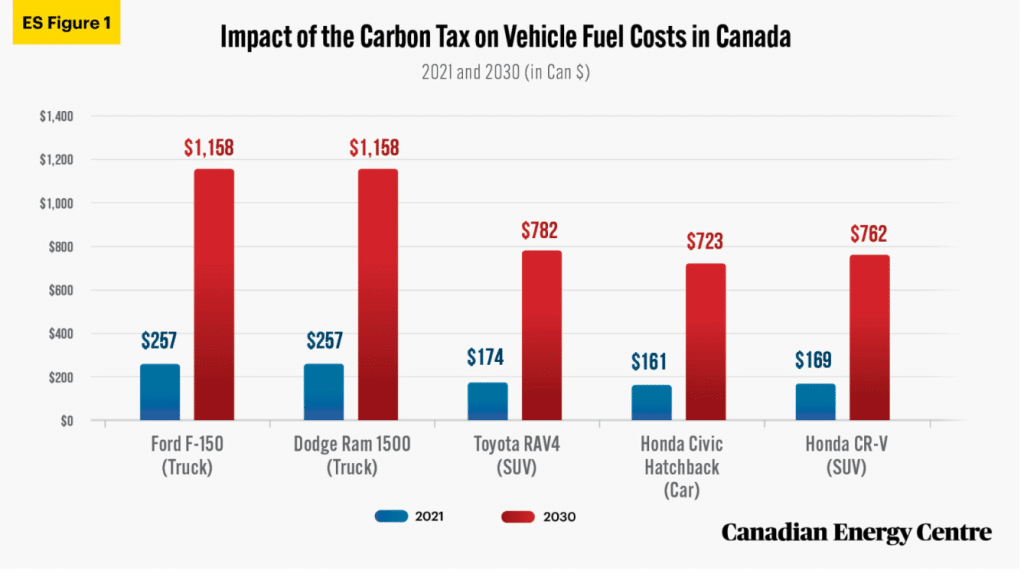

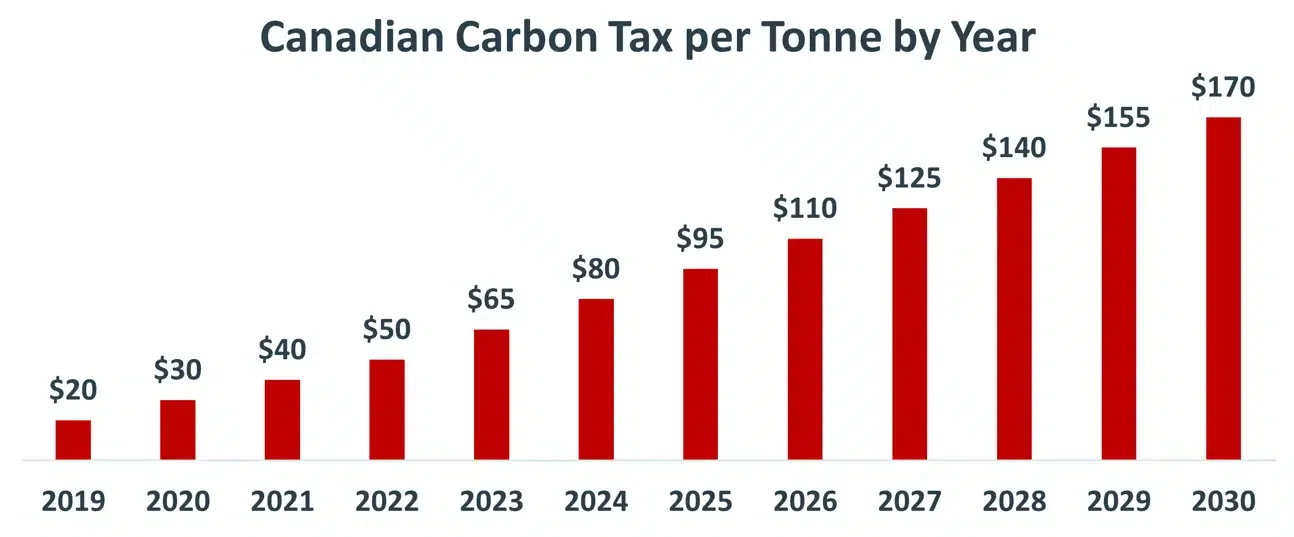

Starting today, a litre of gasoline will cost an extra 3.3 cents across Canada. A recent study on the carbon tax fuel costs for Canada’s top five vehicles showed that the federal carbon price between now and 2030 will have a significant impact on gasoline prices – that these higher carbon taxes could make prices jump as much as 350% !

Source:Canadian Energy Centre

Source:Canadian Energy Centre

What Else Will Today’s Increase Adversely Affect?

While it’s April Fools’ Day, things won’t be so funny for Canadians and their wallets. Several things are going to cost Canadians more.

- Beer and alcohol: everyone’s favorite wine, beer and spirit will see the federal excise tax rise two per cent on April 1st with a max cap at two per cent through 2026.

- Food, clothing and other consumer goods: indirectly, or directly the new higher costs of carbon pricing will increase the basic cost of manufacturing goods and services, and companies that make your favorite brands will need to keep pace. On average, expect food and consumer goods to see bumps of 0.5 to 2% across the country.

- Electricity and power: natural gas, propane and other home operating fuels will see the carbon price increase add upwards of 3 to 5% per cubic meter of natural gas, and 2 to 3% for propane. The increases will also have major implications for Canada’s electricity sector and for jurisdictions that rely heavily on emitting forms of electricity.

Where Does The Carbon Tax Apply In Canada?

As of April 1st, 2024, the carbon tax applies to residents in Alberta, Saskatchewan, Manitoba, Ontario, Newfoundland and Labrador, New Brunswick, Nova Scotia, Prince Edward Island, Yukon and the Nunavut. And British Columbia, Quebec and the Northwest Territories have their own carbon-pricing mechanisms in line with federal standards.

Provinces and territories did have the option to adopt the federal pricing system voluntarily. For jurisdictions that didn’t price carbon or don’t have a similar system in place that meets the minimum national stringency standards, they were subject to the federal pricing system.

While the government aims to strike a balance between environmental sustainability and economic affordability, there are is a group of provinces that have demanded the carbon price increase be paused including Alberta, Saskatchewan, Ontario, New Brunswick, Nova Scotia, Prince Edward Island and Newfoundland and Labrador.

And many local leaders are calling on Prime Minister Trudeau to call an emergency meeting of leaders from across the country to further discuss potential alternatives to the federal carbon price increases.

Premier Andrew Furey, of Liberal Newfoundland and Labrador, voiced concerns on the behalf of Canadians and their mounting fears of financial strain on households. Still, Trudeau’s administration remains steadfast, emphasizing the role of carbon pricing in incentivizing emission reduction. It also serves as a signal to investors on the importance of transitioning to a low-carbon economy.

The government’s commitment to addressing climate change is evident in its long-term vision, which includes steadily increasing the carbon price to achieve emission reduction targets.

The current carbon pricing stands at C$65 per tonne, slated to rise to C$80 per tonne on April 1. Then it will increase annually thereafter by C$15 until reaching C$170 per tonne by 2030. Price in Canadian dollars.

Will The Rebate Help Soften the Blow?

The Canadian government is offering the Canada Carbon Rebate, formerly known as the climate action incentive payment, to eligible Canadians impacted by the federal carbon price. This rebate aims to mitigate the financial burden and ensure that the transition to a low-carbon economy is fair.

Approximately 80% of Canadians receive more from the rebates than they pay in carbon pricing, according to the government’s data.

To receive a rebate, Canadians will need to file an income tax return and payments will come every three months with the first one scheduled to arrive as early as April 15th. Listed below are the rebate amounts most Canadians can expect to receive quarterly:

Single Adult Person:

$225 in Alberta

$150 in Manitoba

$140 in Ontario

$188 in Saskatchewan

$95 in New Brunswick

$103 in Nova Scotia

$110 in Prince Edward Island

$149 in Newfoundland and Labrador

Family of Four or More:

$450 in Alberta

$300 in Manitoba

$280 in Ontario

$376 in Saskatchewan

$190 in New Brunswick

$206 in Nova Scotia

$220 in Prince Edward Island

$298 in Newfoundland and Labrador

While research studies have shown that carbon taxes can play a role in reducing emissions, this increase is just another burden Canadians will deal with in the coming years. This along with unrealistic home ownership costs, rising inflation, sky rocketing interest rates and an economy that can be reasonably described, as stagnant. Oh! Canada.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://carboncredits.com/how-will-canadas-carbon-price-increase-affect-you/

- :is

- :where

- $UP

- 1

- 15th

- 1st

- 2%

- 2024

- 2026

- 2030

- 5

- a

- According

- Achieve

- across

- Action

- add

- addressing

- administration

- adopt

- Adult

- adversely

- affect

- aims

- alberta

- Alcohol

- along

- also

- alternatives

- amounts

- an

- and

- Andrew

- Annually

- Another

- applies

- Apply

- April

- ARE

- arrive

- AS

- At

- average

- backstop

- Balance

- basic

- BE

- beer

- behalf

- below

- between

- Bills

- blow

- brands

- British

- British Columbia

- burden

- by

- call

- calling

- CAN

- Canada

- Canadian

- Canadians

- cap

- carbon

- cent

- cents

- change

- Climate

- climate action

- Climate change

- Clothing

- Columbia

- come

- coming

- coming years

- commitment

- Companies

- Concerns

- consumer

- controversy

- Cost

- Costs

- could

- country

- cubic

- Current

- data

- day

- deal

- demanded

- described

- DID

- directly

- discuss

- does

- dollars

- Dont

- Early

- Economic

- economy

- Edward

- effect

- electricity

- eligible

- else

- emergency

- emission

- Emissions

- emphasizing

- energy

- ensure

- environmental

- Environmental Sustainability

- Every

- everyone’s

- evident

- expect

- extra

- fair

- false

- Favorite

- fears

- Federal

- File

- financial

- First

- five

- food

- For

- formerly

- forms

- four

- from

- Fuel

- fuels

- funny

- further

- GAS

- gasoline

- Goes

- going

- goods

- Government

- Group

- Hard

- Have

- heavily

- help

- higher

- Hit

- Home

- households

- How

- HTML

- HTTPS

- Impact

- impacted

- implications

- importance

- in

- Incentive

- incentivizing

- includes

- Including

- Income

- income tax

- Increase

- Increases

- increasing

- inflation

- interest

- Interest Rates

- into

- Investors

- island

- IT

- ITS

- jump

- jurisdictions

- just

- Justin

- Keep

- known

- leaders

- Line

- Listed

- LLC

- local

- long-term

- low-carbon

- major

- make

- manufacturing

- many

- max

- max-width

- mechanisms

- meeting

- Meets

- minimum

- minister

- minority

- Mitigate

- months

- more

- most

- much

- National

- Natural

- Natural Gas

- Need

- New

- now

- of

- offering

- Officially

- on

- ONE

- Ontario

- operating

- Option

- or

- Other

- over

- own

- ownership

- Pace

- paused

- Pay

- payment

- payments

- per

- person

- Place

- plan

- plato

- Plato Data Intelligence

- PlatoData

- Play

- potential

- power

- price

- Price Increase

- Prices

- pricing

- Prime

- prime minister

- Prince

- provinces

- Provincial

- Quebec

- Rates

- reaching

- Rebate

- rebates

- receive

- recent

- reducing

- reducing emissions

- reduction

- rely

- remains

- research

- residents

- return

- Rise

- rising

- Role

- s

- scheduled

- sector

- see

- serves

- Services

- several

- showed

- shown

- Signal

- significant

- similar

- sky

- So

- spirit

- standards

- stands

- station

- steadfast

- steadily

- Still

- strike

- studies

- Study

- subject

- Sustainability

- system

- targets

- tax

- tax return

- Taxes

- territories

- than

- that

- The

- their

- then

- There.

- These

- they

- things

- this

- three

- Through

- to

- today

- today’s

- top

- transition

- transitioning

- Trudeau

- two

- until

- upwards

- Vehicles

- vision

- voluntarily

- Wallets

- webp

- were

- which

- will

- WINE

- with

- Wrapped

- yearly

- years

- you

- Your

- zephyrnet