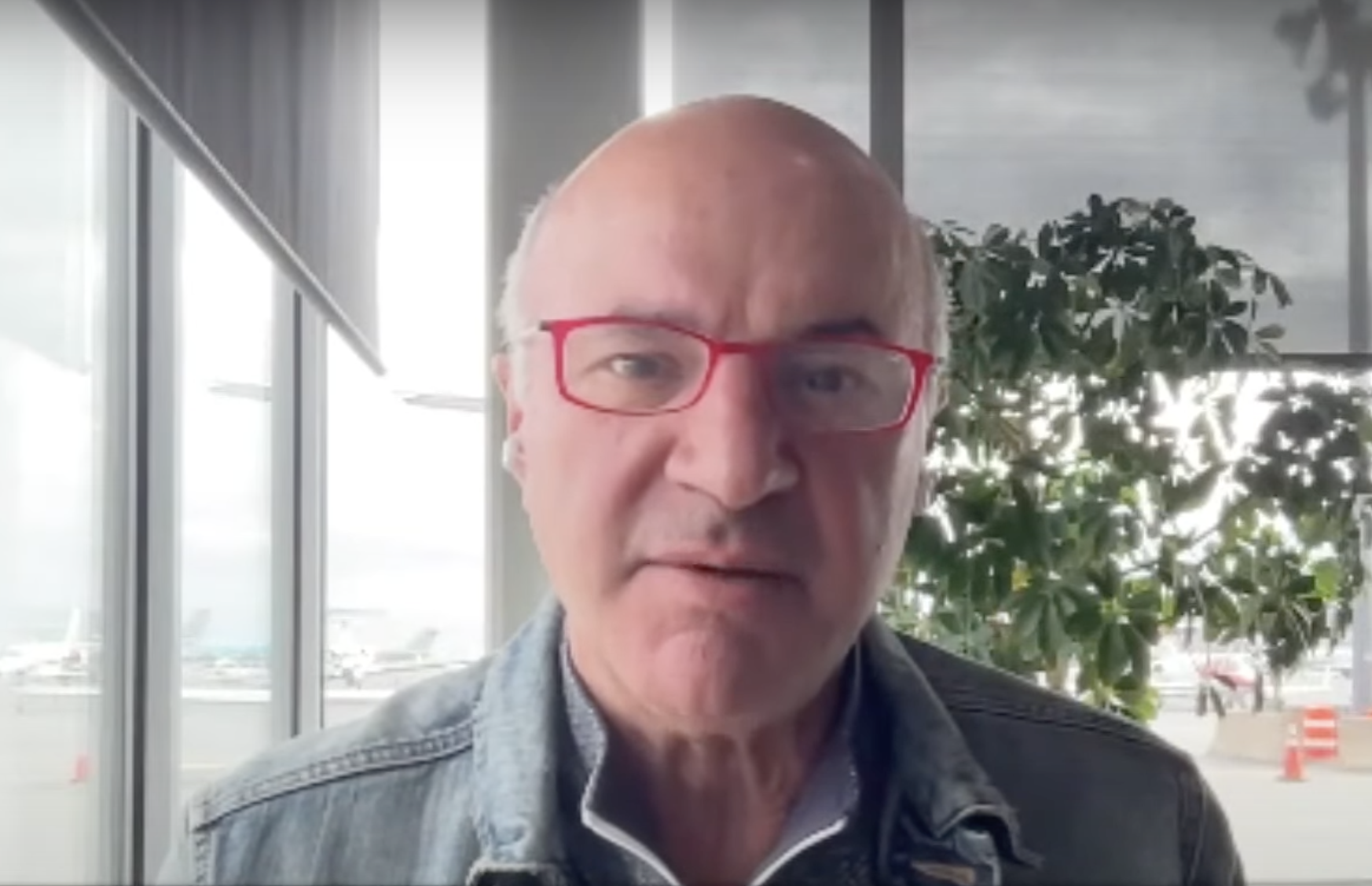

Kevin O’Leary, a TV personality and VC with a net-worth of half a billion, stated he will still invest in crypto despite the FTX debacle.

“I am still going to invest in crypto. I lost money in the accounts there, they have a gate on them now. It doesn’t stop me from buying more and I’m gone do just that,” O’Leary said, further adding:

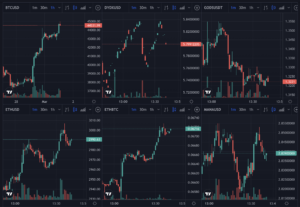

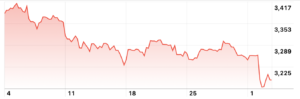

“I’m gone take advantage of the fact that most of these currencies, tokens and coins, have absolutely been beaten to the ground as a result of this and are probably a buying opportunity, that’s the way I look at.”

O’Leary was an investor in FTX international. He said he made a bad bet, but he’ll learn from it.

VCs and institutional investors have come under scrutiny for missing all the red flags at FTX, including their relationship with Alameda Research and the complex corporate structure.

This is the first time such crypto institutional investors are met with this sort of situation as they began entering the crypto space in 2020.

Just how aware they were that someone could abscond with the funds, that due processes in regards to custody are crucial, is unclear.

They didn’t do a good job however in engaging in due diligence probably because they’re still fairly new to crypto, but O’Leary says this won’t happen again.

He claims institutional investors and VCs simply won’t fund new crypto exchanges unless they’re regulated.

The only regulation he mentioned however is the Stablecoin Transparency Act which requires an audit of stablecoin issuers like USDc or USDt.

But this abuse of trust at FTX had nothing to do with stablecoins. It was instead an embezzlement of customers’ funds, theft in plain terms in that the funds were used to gamble on investments without the permission of customers.

The base issue here therefore is custody and the crypto space had largely solved that matter prior to FTX through requiring Proof of Reserves, preferably at least quarterly audits, an internal insurance fund and at this stage all crypto holdings should be externally insured too.

Coinbase for example says it “carries crime insurance that protects a portion of digital assets held across our storage systems against losses from theft, including cybersecurity breaches.”

However, except for prison, arguably there isn’t any regulation that can prevent a CEO from just stealing or misusing the funds he/she has been given, but there are systems in crypto that minimize it, including the use of multi-sig for transfers.

That can be an internal multi-sig, but also external where a third party has one of the keys. There’s debates on making external custody a requirement, but that comes with the risk of concentration of funds which can turn a fairly manageable situation into too big to ‘bail’ or insure.

The only real solution to all this is self-custody because it is a fiat problem as to deal in USD you require a centralized bank account, thus you have to hand over assets to someone that can abuse that trust.

O’Leary pointing out he’ll still invest in crypto therefore suggests institutional investors are aware that in many ways FTX has nothing to do with crypto, it’s a product of the fiat system.

Nor is that problem crypto specific or even due to regulation or lack of it. There was Theranos just recently, the Archegos hedge fund, Wirecard.

The problem instead is fundamental to the paper system, which fiat is still based on as even in digital transfers you require a malleable centralized database.

And arguably it is not a solvable problem as long as men or women can cheat, because this system allows them to cheat.

Which is why, looking two or three generations ahead, everything will be crypto and if systems like stablecoins are integrated, then there won’t be a necessity for centralized custodians.

The solution to hacks, theft or lost private keys then will probably have to be insurance.

Rather than shaking confidence in crypto therefore, for cryptonians this strengthens confidence as it shows just what crypto is trying to solve by having its own integrated and immutable global payment systems with complex operations in ethereum that allow for allocation of capital or provision of liquidity, which is what traditional banking is for.

Modern banking however systematizes FTX like operations where deposited stocks, for example, are lent out for short-selling without the customer’s permission and without any reward for the customer.

The only difference is they get bailed out while in crypto we’re working on the slow and gradual transition to a system where fiduciary relations are not required and therefore trust can not be abused.

That’s still at a nascent stage and so for now we still have to deal with the flaws of the fiat system, but ultimately the fundamental solution is not regulation, it is crypto.

- Bitcoin

- blockchain

- blockchain compliance

- blockchain conference

- coinbase

- coingenius

- Consensus

- crypto

- crypto conference

- crypto mining

- cryptocurrency

- decentralized

- DeFi

- Digital Assets

- ethereum

- featured

- machine learning

- news

- non fungible token

- plato

- plato ai

- Plato Data Intelligence

- Platoblockchain

- PlatoData

- platogaming

- Polygon

- proof of stake

- Trustnodes

- W3

- zephyrnet