The cryptocurrency market is currently experiencing significant fluctuations, with the LORDS token as a notable example. Presently, the token is trading at $0.4641. It has sharply declined by 26.47% in the last 24 hours. Additionally, it has experienced a substantial drop from its 7-day high of $0.6459. Over the past week, LORDS has decreased in value by 18.48%. This decrease is a stark contrast to its all-time high of $1.09 in early 2022. Despite these setbacks, the trading volume has surged by 121.60% in the last 24 hours. This surge signals increased activity and potential interest from traders and investors.

The market capitalisation of the token stands at approximately $57,059,148. It has a circulating supply of 123,564,664 out of a total and maximum supply of 500,000,000 LORDS. This supply situation showcases the token’s current utility and distribution strategies. Specifically, it is utilised within the StarkNet ecosystem for transactions. Additionally, it serves as a reward for holders of Realms NFTs.

Comparative Analysis: LORDS Underperforms Amidst a 13.10% Market Uptick

The broader cryptocurrency market is sending mixed signals. However, Bitcoin has achieved a significant year-to-date gain of 22%, elevating the total market capitalisation above $2 trillion. This surge is attributed partly to the introduction of US exchange-traded funds (ETFs) and the anticipation surrounding the upcoming Bitcoin halving event. Conversely, Ethereum has experienced a slower recovery, especially in the wake of the TerraUSD crisis, with its price currently at $2,785.

When we look at the recent 13.10% increase in the global cryptocurrency market and the 12.70% rise among cryptocurrencies within the Ethereum ecosystem, LORDS seems to underperform. Nevertheless, this performance gap may signal a potential undervaluation. It could also represent a buying opportunity for investors convinced of the token’s long-term value within the StarkNet and Realms NFTs infrastructure.

Strategic Outlook: Active Market Despite Price Decline

The recent price dip in the LORDS token, alongside a significant increase in trading volume, suggests a volatile but engaged market. Investors should consider the broader market’s bullish outlook towards Bitcoin and how Ethereum’s slower recovery might influence Ethereum-based tokens like LORDS.

Strategically, LORDS holders and potential investors are advised to monitor the token’s integration and utility within its native platforms, given its significant role in StarkNet and the anticipated massively multiplayer strategy game. Positive developments or increased adoption within these platforms could favourably affect LORDS’ valuation.

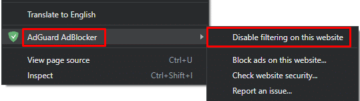

Moreover, MetaMask integration facilitates easier access and management of LORDS tokens, potentially expanding its user base and investment appeal. Monitoring macroeconomic factors, including Bitcoin’s performance and regulatory developments, will be vital in evaluating the future trajectory of the LORDS token.

Investor Advice: Keep an Eye on LORDS’ Role in the StarkNet Ecosystem

The immediate outlook for LORDS indicates considerable market pressure. However, the increased trading volume and its key role in emerging platforms suggest a potential for recovery and growth. Investors should remain informed about broader market trends. They should also pay attention to specific developments within the LORDS ecosystem. Employing a diversified and informed investment strategy is crucial to navigating the cryptocurrency market’s volatility.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.financebrokerage.com/lords-token-sheds-26-47-today-prospects-for-rebound/

- :has

- :is

- 000

- 09

- 12

- 121

- 13

- 2022

- 24

- 26

- 500

- a

- About

- above

- access

- achieved

- active

- activity

- Additionally

- Adoption

- advice

- advised

- affect

- alongside

- also

- amidst

- among

- an

- analysis

- and

- Anticipated

- anticipation

- appeal

- approximately

- ARE

- AS

- At

- attention

- base

- BE

- Bitcoin

- Bitcoin halving

- broader

- but

- Buying

- by

- Capitalisation

- circulating

- Consider

- considerable

- contrast

- conversely

- convinced

- could

- crisis

- crucial

- cryptocurrencies

- cryptocurrency

- cryptocurrency market

- Current

- Currently

- data

- decrease

- decreased

- Despite

- developments

- Dip

- distribution

- diversified

- Drop

- Early

- easier

- ecosystem

- elevating

- emerging

- employing

- engaged

- especially

- ETFs

- ethereum

- Ethereum ecosystem

- Ethereum-based

- Ethereum's

- evaluating

- Event

- example

- exchange-traded

- expanding

- experienced

- experiencing

- eye

- facilitates

- factors

- fluctuations

- For

- For Investors

- from

- funds

- future

- Gain

- game

- gap

- given

- Global

- Growth

- Halving

- High

- holders

- HOURS

- How

- However

- http

- HTTPS

- immediate

- in

- Including

- Increase

- increased

- indicates

- influence

- informed

- Infrastructure

- integration

- interest

- Introduction

- investment

- Investment strategy

- Investors

- IT

- ITS

- Keep

- Key

- Last

- like

- long-term

- Look

- Lords

- Macroeconomic

- management

- Market

- Market capitalisation

- Market Trends

- massively

- maximum

- May..

- MetaMask

- might

- mixed

- Monitor

- monitoring

- multiplayer

- native

- navigating

- Nevertheless

- NFTs

- notable

- of

- on

- Opportunity

- or

- out

- Outlook

- over

- past

- Pay

- performance

- Platforms

- plato

- Plato Data Intelligence

- PlatoData

- positive

- potential

- potentially

- presently

- pressure

- price

- prospects

- realms

- rebound

- recent

- recovery

- regulatory

- remain

- represent

- Reward

- Rise

- Role

- seems

- sending

- serves

- Setbacks

- should

- showcases

- Signal

- signals

- significant

- situation

- specific

- specifically

- stands

- stark

- starknet

- strategies

- Strategy

- substantial

- suggest

- Suggests

- supply

- surge

- Surged

- Surrounding

- TerraUSD

- The

- The Future

- These

- they

- this

- to

- today

- token

- Tokens

- Total

- towards

- Traders

- Trading

- trading volume

- trajectory

- Transactions

- Trends

- Trillion

- upcoming

- us

- User

- utility

- Valuation

- value

- vital

- volatile

- Volatility

- volume

- W3

- Wake

- we

- webp

- week

- will

- with

- within

- zephyrnet