President Joe Biden’s signature climate legislation, the Inflation Reduction Act (IRA), has sparked a multibillion-dollar market for clean energy tax credits within a short span of time. This surge in activity is driven by a provision in the IRA that allows project developers and manufacturers to directly sell their credits for cash, thereby facilitating the “transferability” of tax breaks.

Guidance from the US Treasury Department and Internal Revenue Service confirmed that this provision covers 11 types of tax credits.

Revolutionizing Clean Energy Financing

Previously, developers had to navigate more restrictive and complex tax equity deals, which limited their access to capital from a relatively small pool of investors, mainly large financial institutions. The IRA has changed this landscape, freeing up capital for deployment at a faster pace.

Frank Burkhartsmeyer, CFO of battery storage developer GridStor LLC, noted that the IRA has accelerated the energy storage industry’s ability to deliver cost-competitive zero-emission capacity. This is particularly true in areas where renewables have outpaced capacity market growth.

GridStor recently announced its first tax credit sale to JPMorgan Chase & Co. to support its California Goleta Battery Storage Project. The transaction exemplifies a broader trend of record solar PV and battery storage installations in the US. This is driven by the IRA’s impact on clean power financing.

The IRA has particularly boosted the battery storage business by providing new investment tax incentives and offering an alternative to traditional tax equity financing structures. Now, developers have the option to sell tax credits for cash, attracting more corporate taxpayers to support various projects.

Market participants and analysts emphasize that the IRA has diversified the pool of potential investors. This leads to more competitive pricing and attractive financing structures for financial giants like JPMorgan Chase and Bank of America.

Arevon Energy Inc. President and CEO Kevin Smith highlighted the importance of a robust tax credit transferability market to meet the needs of the renewable energy industry, noting that:

“There’s no question that in order for the financial markets to meet the requirements of the growing renewable energy industry, it’s going to take a robust tax credit transferability market…That means we need other players entering into the market, and we are seeing other players entering in.”

Arevon recently secured financing for its Condor Battery Storage Project in California with $350 million. This comes along with commitments from Stifel Financial Corp. to purchase investment tax credits.

Unleashing the Potential of Clean Energy Tax Credits

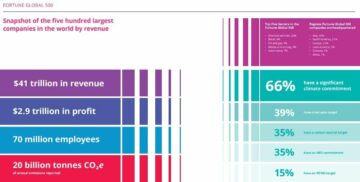

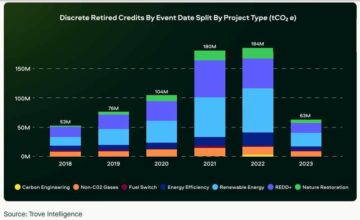

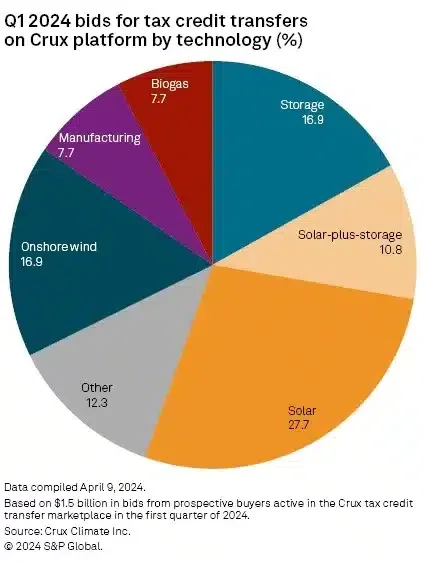

The tax credit transfer market saw a significant surge in activity in 2023, reaching an estimated $7 billion to $9 billion, according to Crux Climate Inc. This momentum is expected to continue, with Crux CEO Alfred Johnson anticipating the market to double in size in 2024.

Crux has witnessed substantial interest, with nearly $9 billion in tax credits available for sale on its platform. Buyers are submitting around $1.5 billion in bids in the first quarter of 2024, primarily targeting renewable energy and battery storage projects.

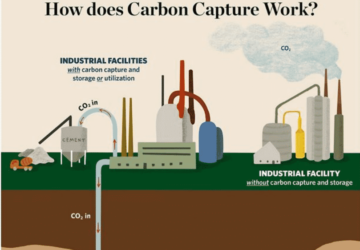

The surging renewables and battery storage markets will fuel the growth of the clean energy tax credits market. Some analysts believe that this financial mechanism is more effective than carbon pricing.

That’s because a carbon price, though generating revenue for the government, results in the highest electricity prices. In contrast, energy costs are lesser in clean energy tax credits market.

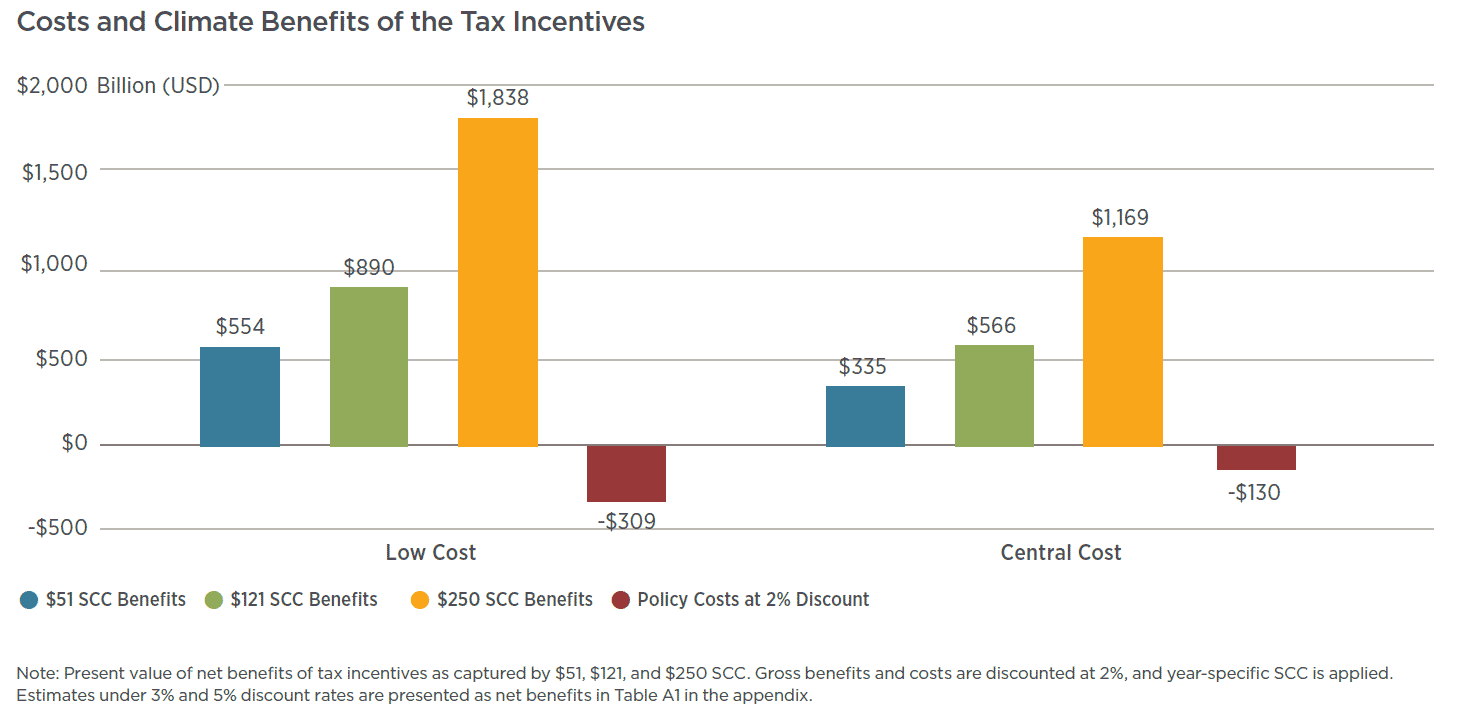

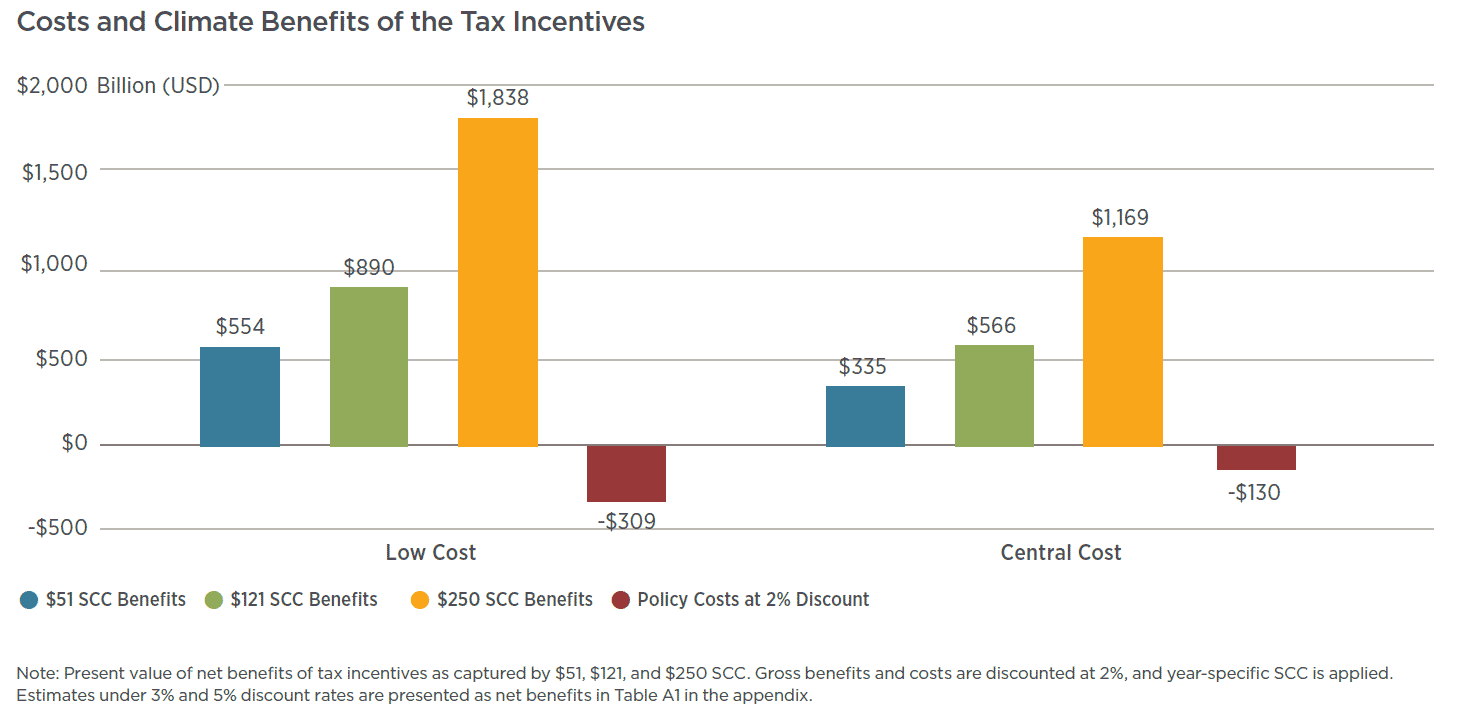

For instance, a study conducted on a clean energy tax revealed that its benefits are 4x higher than its costs. The chart shows the cost and benefits of the “Build Back Better” policy.

Moreover, the authors found that on a cost per tonne of CO2, the tax incentives tend to bring higher emission reductions than other climate policies available.

Scaling Up for the Clean Energy Future

Johnson from Crux emphasized the need for the clean energy tax credit market to scale up considerably to meet future demand, aiming for a $50 billion market by the end of the decade. This expansion requires increased participation, efficiency, and standardization across the market.

Diversifying the pool of tax credit buyers, including large banks, smaller financial services firms, and companies from various industries such as industrial, energy, retail, and technology, can help mitigate economic uncertainties and regulatory challenges. By broadening the participation base, the market becomes more resilient to shocks affecting specific sectors.

Reunion Infrastructure Inc., another marketplace for tax credit transfers, has also experienced significant growth, with over $6 billion in credits available for sale on its platform. CEO Andy Moon projected the market to exceed $80 billion by 2030, indicating robust long-term growth potential.

The market’s rapid expansion is evident from various industry estimates, with projections ranging from $4 billion – $9 billion in 2023. S&P Global Commodity Insights executive emphasized the market’s extraordinary growth rate, despite being fundamentally unproven.

This growth trajectory underscores the market’s potential to become a significant player in clean energy financing. As more deals are completed and more buyers enter the market, the transfer credit market would become increasingly robust and will play a pivotal role in accelerating the transition to a sustainable energy future.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://carboncredits.com/multi-billion-dollar-u-s-clean-energy-tax-credits-are-here/

- :has

- :is

- :where

- ][p

- $9 Billion

- $UP

- 11

- 2023

- 2024

- 2030

- 425

- 5

- a

- ability

- accelerated

- accelerating

- access

- According

- across

- Act

- activity

- affecting

- Aiming

- alfred

- allows

- along

- also

- alternative

- america

- an

- Analysts

- and

- andy

- announced

- Another

- anticipating

- ARE

- areas

- around

- AS

- At

- attracting

- attractive

- authors

- available

- back

- Bank

- Bank of America

- Banks

- base

- battery

- battery storage

- because

- become

- becomes

- being

- believe

- benefit

- benefits

- Billion

- Boosted

- breaks

- bring

- broader

- business

- buyers

- by

- california

- CAN

- Capacity

- capital

- Cash

- ceo

- cfo

- challenges

- changed

- Chart

- chase

- clean

- clean energy

- Climate

- CO

- co2

- comes

- commitments

- commodity

- Companies

- competitive

- Completed

- complex

- conducted

- CONFIRMED

- considerably

- continue

- contrast

- Corp

- Corporate

- Cost

- Costs

- covers

- credit

- credit transfers

- Credits

- crux

- Deals

- decade

- deliver

- Demand

- Department

- deployment

- Despite

- Developer

- developers

- directly

- diversified

- Dollar

- double

- driven

- Economic

- Effective

- efficiency

- electricity

- emission

- emphasize

- emphasized

- end

- energy

- Enter

- entering

- equity

- equity financing

- estimated

- estimates

- Ether (ETH)

- evident

- exceed

- executive

- exemplifies

- expansion

- expected

- experienced

- extraordinary

- facilitating

- false

- faster

- financial

- Financial institutions

- financial services

- financing

- firms

- First

- For

- found

- freeing

- from

- Fuel

- fundamentally

- future

- generating

- giants

- Global

- going

- Government

- Growing

- Growth

- growth potential

- had

- Have

- help

- here

- higher

- highest

- Highlighted

- HTTPS

- Impact

- importance

- in

- Inc.

- Incentives

- Including

- increased

- increasingly

- indicating

- industrial

- industries

- industry

- industry’s

- inflation

- Infrastructure

- insights

- instance

- institutions

- interest

- internal

- Internal Revenue Service

- into

- investment

- Investors

- IRA

- ITS

- joe

- Johnson

- JPMorgan

- jpmorgan chase

- landscape

- large

- Leads

- Legislation

- lesser

- like

- Limited

- LLC

- long-term

- mainly

- Manufacturers

- Market

- marketplace

- Markets

- max-width

- means

- mechanism

- Meet

- million

- Mitigate

- Momentum

- Moon

- more

- Navigate

- nearly

- Need

- needs

- New

- new investment

- no

- noted

- noting

- now

- of

- offering

- on

- Option

- order

- Other

- over

- Pace

- participants

- participation

- particularly

- per

- pivotal

- platform

- plato

- Plato Data Intelligence

- PlatoData

- Play

- player

- players

- policies

- policy

- pool

- potential

- power

- president

- Prices

- pricing

- primarily

- project

- projected

- projections

- projects

- providing

- provision

- purchase

- Q1

- Quarter

- question

- ranging

- rapid

- Rate

- reaching

- recently

- record

- reduction

- reductions

- regulatory

- relatively

- Renewable

- renewable energy

- Renewables

- Requirements

- requires

- resilient

- Restrictive

- Results

- retail

- Revealed

- revenue

- robust

- Role

- s

- S&P

- S&P Global

- sale

- saw

- Scale

- Sectors

- Secured

- seeing

- sell

- service

- Services

- Short

- Shows

- signature

- significant

- Size

- small

- smaller

- smith

- solar

- some

- span

- sparked

- specific

- standardization

- Stifel Financial Corp

- storage

- structures

- submitting

- substantial

- such

- support

- surge

- surging

- sustainable

- Sustainable Energy

- Take

- targeting

- tax

- tax credit

- taxpayers

- Technology

- tend

- than

- that

- The

- their

- thereby

- this

- though?

- time

- to

- traditional

- trajectory

- transaction

- transfer

- transfers

- transition

- treasury

- Treasury Department

- Trend

- true

- types

- u.s.

- uncertainties

- underscores

- us

- US Treasury

- Us Treasury Department

- various

- we

- webp

- which

- will

- with

- within

- witnessed

- would

- zephyrnet