The New Zealand dollar is sharply lower today. In the European session, NZD/USD is trading at 0.5761, down 0.95%.

Fed raises rates 0.75%, says more to come

It was a roller-coaster day for the financial markets on Wednesday, courtesy of Federal Reserve Chair Jerome Powell. There were no surprised faces after the Fed raised rates by 75 basis points, as the move had been well-telegraphed by the Fed. Equity markets initially rose, but then took a tumble after Powell delivered a hawkish message in his post-meeting comments. Powell stated that there was no indication that inflation had peaked and that it was “premature” to talk about a pause in rate hikes.

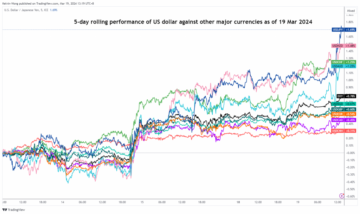

At the same time, Powell signalled that the Fed would slow the pace of tightening in December, which is what investors wanted to hear. Inflation remains the Fed’s top priority, and the battle to curb inflation is far from over. Powell’s hawkish message to the markets sent the US dollar higher against all the major currencies, with risk currencies like the New Zealand dollar taking a tumble, as the kiwi has fallen to a 2-week low.

In New Zealand, the semi-annual financial stability report, released on Wednesday found that the country’s financial system remains resilient, but there were plenty of ‘buts’ that followed. The report noted that households and businesses were being hit hard by rising interest rates and it expected the sharp drop in house prices to continue. The report warned that the global economic outlook was uncertain and a downturn in any of New Zealand’s trading partners could lead to lower demand for exports, which would have a negative impact on the economy.

.

NZD/USD Technical

- There is resistance at 0.5906 and 0.5999

- There is support at 0.5782 and 0.5689

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

- Bitcoin

- blockchain

- blockchain compliance

- blockchain conference

- coinbase

- coingenius

- Consensus

- crypto conference

- crypto mining

- cryptocurrency

- decentralized

- DeFi

- Digital Assets

- ethereum

- Fed Chair Powell

- Fed rate decision

- FX

- machine learning

- MarketPulse

- ND/USD

- New Zealand financial stability report

- Newsfeed

- non fungible token

- NZD

- plato

- plato ai

- Plato Data Intelligence

- Platoblockchain

- PlatoData

- platogaming

- Polygon

- proof of stake

- Technical Analysis

- USD

- W3

- zephyrnet