1CAS Key Laboratory of Quantum Information, University of Science and Technology of China, Hefei, 230026, China

2Origin Quantum Computing, Hefei, China

3Institute of Artificial Intelligence, Hefei Comprehensive National Science Center

4CAS Center for Excellence and Synergistic Innovation Center in Quantum Information and Quantum Physics, University of Science and Technology of China, Hefei, 230026, China

5Hefei National Laboratory, University of Science and Technology of China, Hefei 230088, China

Find this paper interesting or want to discuss? Scite or leave a comment on SciRate.

Abstract

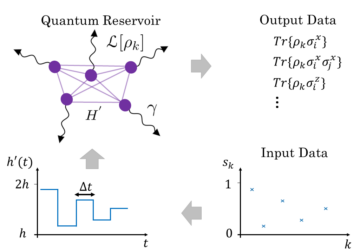

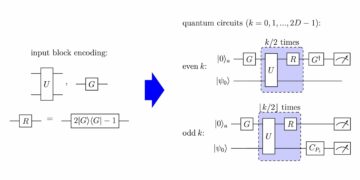

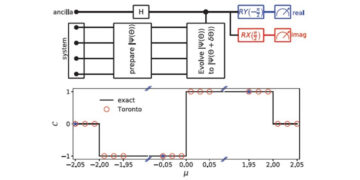

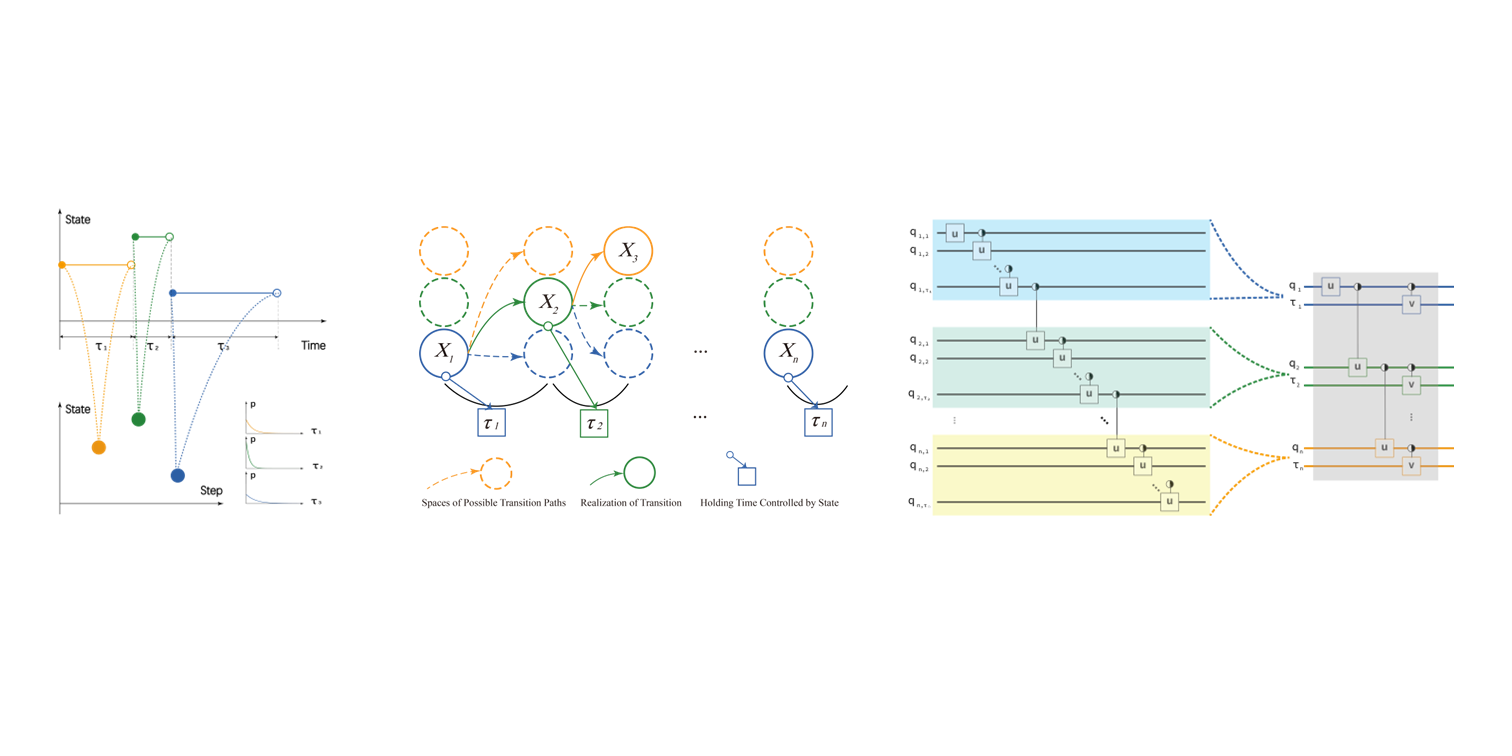

Modeling stochastic phenomena in continuous time is an essential yet challenging problem. Analytic solutions are often unavailable, and numerical methods can be prohibitively time-consuming and computationally expensive. To address this issue, we propose an algorithmic framework tailored for quantum continuous time stochastic processes. This framework consists of two key procedures: data preparation and information extraction. The data preparation procedure is specifically designed to encode and compress information, resulting in a significant reduction in both space and time complexities. This reduction is exponential with respect to a crucial feature parameter of the stochastic process. Additionally, it can serve as a submodule for other quantum algorithms, mitigating the common data input bottleneck. The information extraction procedure is designed to decode and process compressed information with quadratic acceleration, extending the quantum-enhanced Monte Carlo method. The framework demonstrates versatility and flexibility, finding applications in statistics, physics, time series analysis and finance. Illustrative examples include option pricing in the Merton Jump Diffusion Model and ruin probability computing in the Collective Risk Model, showcasing the framework’s ability to capture extreme market events and incorporate history-dependent information. Overall, this quantum algorithmic framework provides a powerful tool for accurate analysis and enhanced understanding of stochastic phenomena.

Featured image: Featured image: The basic idea of how to encoding the continuous time stochastic process is illustrated. Left: The continuous process is embedded into a discrete sequence of states and their holding time. Middle: For a wide range of processes, this embedding can be efficiently implemented via state transition and holding time operators. Right: This method can efficiently reduce not only qubits number but also circuit depth.

Popular summary

► BibTeX data

► References

[1] Antonis Papapantoleon. “An introduction to lévy processes with applications in finance” (2008).

[2] Ole E Barndorff-Nielsen, Thomas Mikosch, and Sidney I Resnick. “Lévy processes: theory and applications”. Springer Science & Business Media. (2001).

https://doi.org/10.1007/978-1-4612-0197-7

[3] Thomas Milton Liggett. “Continuous time markov processes: an introduction”. Volume 113. American Mathematical Soc. (2010).

https://doi.org/10.1090/gsm/113

[4] William J Anderson. “Continuous-time markov chains: An applications-oriented approach”. Springer Science & Business Media. (2012).

https://doi.org/10.1007/978-1-4612-3038-0

[5] Angelos Dassios and Ji-Wook Jang. “Pricing of catastrophe reinsurance and derivatives using the cox process with shot noise intensity”. Finance and Stochastics 7, 73–95 (2003).

https://doi.org/10.1007/s007800200079

[6] Sheldon M Ross, John J Kelly, Roger J Sullivan, William James Perry, Donald Mercer, Ruth M Davis, Thomas Dell Washburn, Earl V Sager, Joseph B Boyce, and Vincent L Bristow. “Stochastic processes”. Volume 2. Wiley New York. (1996).

https://doi.org/10.1137/1026096

[7] Yuriy V Kozachenko, Oleksandr O Pogorilyak, Iryna V Rozora, and Antonina M Tegza. “Simulation of stochastic processes with given accuracy and reliability”. Elsevier. (2016).

https://doi.org/10.1016/C2016-0-02585-8

[8] Richard P Feynman. “Quantum mechanical computers”. Optics news 11, 11–20 (1985).

https://doi.org/10.1007/BF01886518

[9] David P DiVincenzo. “The physical implementation of quantum computation”. Fortschritte der Physik: Progress of Physics 48, 771–783 (2000).

<a href="https://doi.org/10.1002/1521-3978(200009)48:9/113.0.CO;2-E”>https://doi.org/10.1002/1521-3978(200009)48:9/11<771::AID-PROP771>3.0.CO;2-E

[10] Frank Arute, Kunal Arya, Ryan Babbush, Dave Bacon, Joseph C Bardin, Rami Barends, Rupak Biswas, Sergio Boixo, Fernando GSL Brandao, David A Buell, et al. “Quantum supremacy using a programmable superconducting processor”. Nature 574, 505–510 (2019).

https://doi.org/10.5061/dryad.k6t1rj8

[11] Roman Orus, Samuel Mugel, and Enrique Lizaso. “Quantum computing for finance: overview and prospects”. Reviews in Physics 4, 100028 (2019).

https://doi.org/10.1016/j.revip.2019.100028

[12] Daniel J Egger, Claudio Gambella, Jakub Marecek, Scott McFaddin, Martin Mevissen, Rudy Raymond, Andrea Simonetto, Stefan Woerner, and Elena Yndurain. “Quantum computing for finance: state of the art and future prospects”. IEEE Transactions on Quantum Engineering (2020).

https://doi.org/10.1109/TQE.2020.3030314

[13] Dylan Herman, Cody Googin, Xiaoyuan Liu, Alexey Galda, Ilya Safro, Yue Sun, Marco Pistoia, and Yuri Alexeev. “A survey of quantum computing for finance” (2022).

[14] Sascha Wilkens and Joe Moorhouse. “Quantum computing for financial risk measurement”. Quantum Information Processing 22, 51 (2023).

https://doi.org/10.1007/s11128-022-03777-2

[15] Sam McArdle, Suguru Endo, Alan Aspuru-Guzik, Simon C Benjamin, and Xiao Yuan. “Quantum computational chemistry”. Reviews of Modern Physics 92, 015003 (2020).

https://doi.org/10.1103/RevModPhys.92.015003

[16] Carlos Outeiral, Martin Strahm, Jiye Shi, Garrett M Morris, Simon C Benjamin, and Charlotte M Deane. “The prospects of quantum computing in computational molecular biology”. Wiley Interdisciplinary Reviews: Computational Molecular Science 11, e1481 (2021).

https://doi.org/10.1002/wcms.1481

[17] Prashant S Emani, Jonathan Warrell, Alan Anticevic, Stefan Bekiranov, Michael Gandal, Michael J McConnell, Guillermo Sapiro, Alán Aspuru-Guzik, Justin T Baker, Matteo Bastiani, et al. “Quantum computing at the frontiers of biological sciences”. Nature MethodsPages 1–9 (2021).

https://doi.org/10.1038/s41592-020-01004-3

[18] He Ma, Marco Govoni, and Giulia Galli. “Quantum simulations of materials on near-term quantum computers”. npj Computational Materials 6, 1–8 (2020).

https://doi.org/10.1038/s41524-020-00353-z

[19] Yudong Cao, Jhonathan Romero, and Alán Aspuru-Guzik. “Potential of quantum computing for drug discovery”. IBM Journal of Research and Development 62, 6–1 (2018).

https://doi.org/10.1147/JRD.2018.2888987

[20] Maria Schuld and Francesco Petruccione. “Supervised learning with quantum computers”. Volume 17. Springer. (2018).

https://doi.org/10.1007/978-3-319-96424-9

[21] Lov Grover and Terry Rudolph. “Creating superpositions that correspond to efficiently integrable probability distributions” (2002).

[22] Almudena Carrera Vazquez and Stefan Woerner. “Efficient state preparation for quantum amplitude estimation”. Physical Review Applied 15, 034027 (2021).

https://doi.org/10.1103/PhysRevApplied.15.034027

[23] Arthur G Rattew and Bálint Koczor. “Preparing arbitrary continuous functions in quantum registers with logarithmic complexity” (2022).

[24] Thomas J Elliott and Mile Gu. “Superior memory efficiency of quantum devices for the simulation of continuous-time stochastic processes”. npj Quantum Information 4 (2018).

https://doi.org/10.1038/s41534-018-0064-4

[25] Thomas J Elliott, Andrew JP Garner, and Mile Gu. “Memory-efficient tracking of complex temporal and symbolic dynamics with quantum simulators”. New Journal of Physics 21, 013021 (2019).

https://doi.org/10.1088/1367-2630/aaf824

[26] Thomas J Elliott. “Quantum coarse graining for extreme dimension reduction in modeling stochastic temporal dynamics”. PRX Quantum 2, 020342 (2021).

https://doi.org/10.1103/PRXQuantum.2.020342

[27] Kamil Korzekwa and Matteo Lostaglio. “Quantum advantage in simulating stochastic processes”. Physical Review X 11, 021019 (2021).

https://doi.org/10.1103/PhysRevX.11.021019

[28] Ashley Montanaro. “Quantum speedup of monte carlo methods”. Proceedings of the Royal Society A: Mathematical, Physical and Engineering Sciences 471, 20150301 (2015).

https://doi.org/10.1098/rspa.2015.0301

[29] Patrick Rebentrost, Brajesh Gupt, and Thomas R Bromley. “Quantum computational finance: Monte carlo pricing of financial derivatives”. Physical Review A 98, 022321 (2018).

https://doi.org/10.1103/PhysRevA.98.022321

[30] Nikitas Stamatopoulos, Daniel J Egger, Yue Sun, Christa Zoufal, Raban Iten, Ning Shen, and Stefan Woerner. “Option pricing using quantum computers”. Quantum 4, 291 (2020).

https://doi.org/10.22331/q-2020-07-06-291

[31] Ana Martin, Bruno Candelas, Ángel Rodríguez-Rozas, José D Martín-Guerrero, Xi Chen, Lucas Lamata, Román Orús, Enrique Solano, and Mikel Sanz. “Toward pricing financial derivatives with an IBM quantum computer” (2019).

https://doi.org/10.1103/PhysRevResearch.3.013167

[32] Stefan Woerner and Daniel J Egger. “Quantum risk analysis”. npj Quantum Information 5, 1–8 (2019).

https://doi.org/10.1038/s41534-019-0130-6

[33] Carsten Blank, Daniel K Park, and Francesco Petruccione. “Quantum-enhanced analysis of discrete stochastic processes”. npj Quantum Information 7, 1–9 (2021).

https://doi.org/10.1038/s41534-021-00459-2

[34] Vittorio Giovannetti, Seth Lloyd, and Lorenzo Maccone. “Quantum random access memory”. Physical review letters 100, 160501 (2008).

https://doi.org/10.1103/PhysRevLett.100.160501

[35] Vittorio Giovannetti, Seth Lloyd, and Lorenzo Maccone. “Architectures for a quantum random access memory”. Physical Review A 78, 052310 (2008).

https://doi.org/10.1103/PhysRevA.78.052310

[36] Fang-Yu Hong, Yang Xiang, Zhi-Yan Zhu, Li-Zhen Jiang, and Liang-Neng Wu. “Robust quantum random access memory”. Physical Review A 86, 010306 (2012).

https://doi.org/10.1103/PhysRevA.86.010306

[37] David Applebaum. “Lévy processes-from probability to finance and quantum groups”. Notices of the AMS 51, 1336–1347 (2004). url: https://community.ams.org/journals/notices/200411/fea-applebaum.pdf.

https://community.ams.org/journals/notices/200411/fea-applebaum.pdf

[38] David Lando. “On cox processes and credit risky securities”. Review of Derivatives research 2, 99–120 (1998).

https://doi.org/10.1007/BF01531332

[39] Robert C Merton. “Applications of option-pricing theory: twenty-five years later”. The American Economic Review 88, 323–349 (1998). url: https://www.jstor.org/stable/116838.

https://www.jstor.org/stable/116838

[40] Yue-Kuen Kwok. “Mathematical models of financial derivatives”. Springer Science & Business Media. (2008).

https://doi.org/10.1007/978-3-540-68688-0

[41] Fischer Black and Myron Scholes. “The pricing of options and corporate liabilities”. In World Scientific Reference on Contingent Claims Analysis in Corporate Finance: Volume 1: Foundations of CCA and Equity Valuation. Pages 3–21. World Scientific (2019).

[42] Robert C Merton. “Option pricing when underlying stock returns are discontinuous”. Journal of financial economics 3, 125–144 (1976).

https://doi.org/10.1016/0304-405X(76)90022-2

[43] Hans U Gerber and Elias SW Shiu. “On the time value of ruin”. North American Actuarial Journal 2, 48–72 (1998).

https://doi.org/10.1080/10920277.1998.10595671

[44] Mark B Garman. “Market microstructure”. Journal of financial Economics 3, 257–275 (1976).

https://doi.org/10.1016/0304-405X(76)90006-4

[45] Ananth Madhavan. “Market microstructure: A survey”. Journal of financial markets 3, 205–258 (2000).

https://doi.org/10.1016/S1386-4181(00)00007-0

[46] Hans U Gerber and Elias SW Shiu. “From ruin theory to pricing reset guarantees and perpetual put options”. Insurance: Mathematics and Economics 24, 3–14 (1999).

https://doi.org/10.1016/S0167-6687(98)00033-X

[47] Olga Choustova. “Quantum-like viewpoint on the complexity and randomness of the financial market”. Coping with the Complexity of EconomicsPages 53–66 (2009).

https://doi.org/10.1007/978-88-470-1083-3_4

[48] Yutaka Shikano. “From discrete time quantum walk to continuous time quantum walk in limit distribution”. Journal of Computational and Theoretical Nanoscience 10, 1558–1570 (2013).

https://doi.org/10.1166/jctn.2013.3097

[49] Yen-Jui Chang, Wei-Ting Wang, Hao-Yuan Chen, Shih-Wei Liao, and Ching-Ray Chang. “Preparing random state for quantum financing with quantum walks” (2023).

[50] Steven A Cuccaro, Thomas G Draper, Samuel A Kutin, and David Petrie Moulton. “A new quantum ripple-carry addition circuit” (2004).

Cited by

[1] Sascha Wilkens and Joe Moorhouse, “Quantum computing for financial risk measurement”, Quantum Information Processing 22 1, 51 (2023).

[2] Yewei Yuan, Chao Wang, Bei Wang, Zhao-Yun Chen, Meng-Han Dou, Yu-Chun Wu, and Guo-Ping Guo, “An Improved QFT-Based Quantum Comparator and Extended Modular Arithmetic Using One Ancilla Qubit”, arXiv:2305.09106, (2023).

The above citations are from SAO/NASA ADS (last updated successfully 2023-10-04 03:51:29). The list may be incomplete as not all publishers provide suitable and complete citation data.

On Crossref’s cited-by service no data on citing works was found (last attempt 2023-10-04 03:51:27).

This Paper is published in Quantum under the Creative Commons Attribution 4.0 International (CC BY 4.0) license. Copyright remains with the original copyright holders such as the authors or their institutions.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://quantum-journal.org/papers/q-2023-10-03-1127/

- :has

- :is

- :not

- ][p

- 1

- 10

- 100

- 11

- 12

- 13

- 14

- 15%

- 16

- 17

- 19

- 1985

- 1996

- 1998

- 1999

- 20

- 2000

- 2001

- 2008

- 2009

- 2010

- 2012

- 2013

- 2015

- 2016

- 2018

- 2019

- 2020

- 2021

- 2022

- 2023

- 22

- 23

- 24

- 25

- 26

- 27

- 28

- 29

- 30

- 31

- 32

- 33

- 36

- 39

- 40

- 41

- 46

- 49

- 50

- 51

- 7

- 8

- 9

- 98

- a

- ability

- above

- ABSTRACT

- acceleration

- access

- accuracy

- accurate

- addition

- Additionally

- address

- addressing

- ADvantage

- affiliations

- AL

- Alan

- algorithmic

- algorithms

- All

- also

- American

- an

- Ana

- analysis

- Analytic

- and

- anderson

- andrea

- Andrew

- applications

- applied

- approach

- ARE

- Art

- Arthur

- artificial

- artificial intelligence

- AS

- At

- attempt

- author

- authors

- b

- baker

- basic

- BE

- been

- Benjamin

- biology

- Black

- both

- bottlenecks

- Break

- Bruno

- business

- but

- by

- calculation

- CAN

- capture

- carlos

- Center

- chains

- challenge

- challenging

- chang

- Charlotte

- chemistry

- chen

- Cheng

- China

- citing

- claims

- CO

- Collective

- comment

- Common

- Commons

- complete

- complex

- complexities

- complexity

- components

- comprehensive

- computation

- computer

- computers

- computing

- consists

- consumption

- continuous

- copyright

- Corporate

- corporate finance

- Cox

- credit

- crucial

- Daniel

- data

- Data Preparation

- Dave

- David

- Davis

- Dell

- demonstrates

- Den

- depth

- Derivatives

- designed

- Development

- Devices

- Diffusion

- Dimension

- discovery

- discuss

- distribution

- distributions

- donald

- draper

- drug

- drug discovery

- due

- dynamics

- e

- E&T

- Economic

- Economics

- efficiency

- efficiently

- Elliott

- embedded

- embedding

- Engineering

- enhanced

- equity

- essence

- essential

- Ether (ETH)

- events

- examples

- Excellence

- expanding

- expensive

- exponential

- extending

- extraction

- extreme

- far-reaching

- Feature

- featured

- finance

- financial

- Financial Derivatives

- Financial Market

- financing

- finding

- Flexibility

- For

- formidable

- found

- Foundations

- Framework

- frank

- from

- Frontiers

- functions

- future

- garner

- given

- Group’s

- guarantees

- handle

- harvard

- he

- holders

- holding

- Hong

- How

- How To

- However

- HTTPS

- i

- IBM

- ibm quantum

- idea

- IEEE

- image

- Impact

- implementation

- implemented

- improved

- in

- In other

- include

- incorporate

- information

- information extraction

- Innovation

- input

- institutions

- insurance

- Intelligence

- interesting

- International

- into

- Introduction

- issue

- IT

- ITS

- james

- JavaScript

- joe

- John

- jonathan

- journal

- jp

- jump

- Justin

- Key

- laboratory

- Lack

- Last

- later

- learning

- Leave

- left

- liabilities

- License

- LIMIT

- List

- Long

- Marco

- maria

- mark

- Market

- Markets

- Martin

- materials

- mathematical

- mathematics

- max-width

- May..

- measurement

- mechanical

- Media

- Memory

- Mercer

- method

- methods

- Michael

- Middle

- Milton

- mitigating

- model

- modeling

- models

- Modern

- modular

- molecular

- Month

- more

- National

- National Science

- Nature

- New

- New York

- news

- no

- Noise

- North

- number

- numerical

- Oct

- of

- offering

- often

- on

- ONE

- only

- open

- operators

- optics

- Option

- Options

- or

- original

- Other

- overall

- overview

- pages

- Paper

- parameter

- Park

- patrick

- Perpetual

- physical

- Physics

- plato

- Plato Data Intelligence

- PlatoData

- powerful

- preparation

- pricing

- probability

- Problem

- procedure

- procedures

- Proceedings

- process

- processes

- processing

- Processor

- programmable

- Progress

- propose

- proposes

- prospects

- provide

- provides

- published

- publisher

- publishers

- put

- quadratic

- Quantum

- quantum algorithms

- Quantum Computer

- quantum computers

- quantum computing

- quantum information

- quantum physics

- Qubit

- qubits

- R

- RAMI

- random

- randomness

- range

- realm

- reduce

- reduces

- reduction

- reference

- references

- registers

- reliability

- remains

- research

- research and development

- respect

- resulting

- returns

- review

- Reviews

- Richard

- right

- Risk

- Risky

- ROBERT

- royal

- ruin

- Ryan

- s

- Sam

- Science

- Science and Technology

- SCIENCES

- scientific

- scott

- Securities

- Sequence

- Series

- serve

- shot

- showcasing

- significant

- Simon

- simulation

- simulations

- Society

- solution

- Solutions

- Space

- Space and Time

- specifically

- State

- States

- statistics

- stefan

- steven

- stock

- Successfully

- such

- suitable

- Sullivan

- Sun

- Survey

- symbolic

- synergistic

- T

- tackling

- tailored

- Technology

- that

- The

- the information

- their

- theoretical

- theory

- this

- time

- Time Series

- time-consuming

- Title

- to

- tool

- Tracking

- Transactions

- transition

- two

- under

- underlying

- understanding

- university

- University of Science and Technology of China

- updated

- URL

- used

- using

- Valuation

- value

- versatility

- via

- vincent

- volume

- walk

- wang

- want

- was

- we

- when

- wide

- Wide range

- william

- with

- works

- world

- wu

- X

- xi

- xiao

- year

- years

- yet

- york

- Yuan

- zephyrnet