At Inman Connect Las Vegas, July 30-Aug. 1 2024, the noise and misinformation will be banished, all your big questions will be answered, and new business opportunities will be revealed. Join us.

It’s been a little over 7 years since real estate franchise giant RE/MAX launched Motto Mortgage, and that means the franchise agreements it signed with early adopters are coming up for renewal.

Since launching Motto Mortgage in October 2016, Motto Franchising LLC continues to inch toward RE/MAX’s long-term goal of growing its national mortgage brokerage franchise brand to 1,000 offices.

In the meantime, it’s celebrating decisions by two original Motto franchise owners to renew their licenses.

Franchisees sign 7-year agreements directly with Motto Franchising — there are no regional franchise rights in the system — and 2024 is the first full year Motto has had offices come up for renewal.

Dustin Oldfather, the founder of Motto Mortgage Prosperity and The Oldfather Group of Compass Real Estate, exemplifies where Motto Franchising is getting most of its new business these days: from real estate brokerages and teams that aren’t affiliated with RE/MAX.

Dustin Oldfather

“Partnering with the Motto brand to implement its turnkey mortgage brokerage-in-a-box solution was a strategic move to enable our real estate companies to participate directly in the mortgage process and has helped create a more seamless homebuying experience for our clients,” Oldfather said in a statement.

Mark Scuderi, broker-owner of Motto Mortgage Supreme and RE/MAX Supreme, is an example of where Motto Franchising has historically found most of its franchisees — real estate brokerages affiliated with RE/MAX.

Mark Scuderi

“Owning a Motto Mortgage franchise has given us the competitive edge of in-house mortgage services and has provided our loan originators unparalleled access to a wide variety of wholesale lenders and unique loan products that help make homeownership more attainable,” Scuderi said in a statement.

Motto Mortgage doesn’t make loans but is a technology, compliance, training and marketing solution for mortgage brokers, who help homebuyers shop for financing from a menu of wholesale lenders like UWM, the nation’s biggest mortgage lender.

RE/MAX also provides third-party loan processing services to mortgage brokers through another subsidiary, wemlo, which it acquired in 2020.

Motto Mortgage office count, monthly revenue per office

Source: RE/MAX 2023 annual report to investors.

Motto Franchising sold 27 franchise licenses in 2023, down from 64 in 2021, finishing the year with 246 open offices. That means 66 percent of the 371 Motto franchises that have been sold since 2016 are still open, with 125 offices either out of business or no longer affiliated with Motto.

“While not all Motto franchises succeed, over the first six years of their existence, Motto franchisees have had a higher success rate than the comparable average small business operating in the financial services industry,” RE/MAX disclosed in its most recent annual report to investors, citing data from the U.S. Bureau of Labor Statistics on private sector failure rates.

Rising mortgage rates made 2023 a difficult year for lenders. By the end of the year, 56 Motto offices were receiving short-term financial relief and weren’t being billed or had fees deferred, RE/MAX disclosed. That’s down from 58 offices receiving relief at the end of 2022, but up from 31 offices in 2021.

But the average fee revenue each office generates for RE/MAX has climbed steadily over the years, from an average of $3,000 per month in 2019 to $3,700 a month last year.

Both RE/MAX and Motto are 100 percent franchised, meaning the company does not own any of the real estate or mortgage brokerages that operate under those brands.

Motto Franchising and wemlo generate revenue through fixed monthly fees, franchise sales and renewals, and loan processing.

New offices pay no monthly fees to Motto Franchising for six months after purchasing a franchise license. After that, fees are ramped up through escalating tiers that top out at $4,650 a month after 13 months. More than 9 in 10 offices (91 percent) were in the highest monthly fee tier at the end of last year, RE/MAX reported.

Motto offices also pay mortgage loan processing fees to wemlo, which went up by $100 on Jan. 1 to $825 per loan. Wemlo charges most customers that aren’t part of the Motto network $995 per loan.

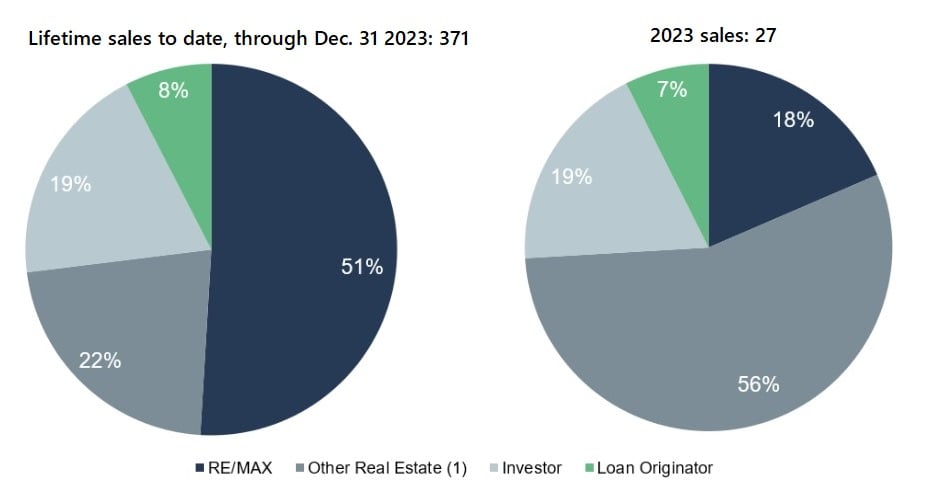

Most Motto Mortgage franchisees are real estate brokers

“Other Real Estate” includes national franchisees other than RE/MAX, local brokerages, and teams from other brands. Source: RE/MAX 2023 annual report to investors.

Motto helps franchisees establish independent mortgage brokerage companies, “with a model designed to comply with complex regulations, essentially providing a ‘mortgage brokerage in a box,’” RE/MAX said in its 2023 annual report.

“This model not only creates an ancillary business opportunity for current real estate brokerage firms and professionals but also offers opportunities for mortgage professionals seeking to open their own businesses and other independent investors interested in financial services.”

Historically, close to three-quarters (73 percent) of Motto franchise sales have been made to real estate brokerages that want to get into mortgage lending. While RE/MAX-affiliated real estate brokerages have accounted for most (51 percent) franchise sales to date, most new franchisees are not RE/MAX.

Last year, sales to national franchisees other than RE/MAX, local brokerages, and teams from other brands accounted for 56 percent of Motto franchise sales.

Brokerages affiliated with RE/MAX accounted for a much smaller slice of the 2023 franchise sales pie — 18 percent.

Investors represented 19 percent of 2023 Motto franchise sales, with loan originators accounting for the remaining 7 percent.

Get Inman’s Mortgage Brief Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.inman.com/2024/04/12/re-maxs-motto-mortgage-out-to-re-up-original-franchise-owners/

- :has

- :is

- :not

- :where

- $3

- $UP

- 000

- 1

- 10

- 100

- 125

- 13

- 150

- 19

- 2016

- 2019

- 2021

- 2022

- 2023

- 2024

- 27

- 31

- 51

- 58

- 66

- 7

- 700

- 73

- 9

- 91

- a

- access

- accounted

- Accounting

- adopters

- Affiliated

- After

- agreements

- All

- also

- an

- and

- annual

- Another

- any

- ARE

- At

- Attainable

- average

- BE

- been

- being

- Big

- Biggest

- billed

- Box

- brand

- brands

- brokerage

- brokerages

- brokers

- Bureau

- bureau of labor statistics

- business

- businesses

- but

- by

- Celebrating

- charges

- citing

- clients

- Climbed

- Close

- COM

- come

- coming

- Companies

- company

- comparable

- Compass

- competitive

- complex

- compliance

- comply

- Connect

- continues

- count

- create

- creates

- Current

- Customers

- data

- Date

- Days

- decisions

- delivered

- designed

- directly

- does

- Doesn’t

- down

- each

- Early

- early adopters

- Edge

- either

- enable

- end

- escalating

- essentially

- establish

- estate

- estate companies

- Every

- example

- exemplifies

- existence

- experience

- Failure

- fee

- Fees

- financial

- financial services

- financing

- finishing

- firms

- First

- fixed

- For

- found

- founder

- Franchise

- from

- full

- generate

- generates

- get

- getting

- giant

- given

- Group

- Growing

- had

- Have

- help

- helped

- helps

- here

- higher

- highest

- historically

- HTML

- HTTPS

- implement

- in

- includes

- independent

- industry

- interested

- into

- Investors

- IT

- ITS

- Jan

- jpg

- July

- labor

- LAS

- Last

- Last Year

- launched

- launching

- lender

- lenders

- lending

- License

- licenses

- like

- little

- LLC

- loan

- Loans

- local

- long-term

- longer

- made

- make

- Marketing

- matt

- max-width

- meaning

- means

- meantime

- Menu

- Misinformation

- model

- Month

- monthly

- monthly fee

- MONTHLY FEES

- months

- more

- Mortgage

- Mortgages

- most

- Motto

- move

- much

- National

- Nations

- network

- New

- news

- no

- Noise

- october

- of

- Offers

- Office

- offices

- on

- only

- open

- operate

- operating

- opportunities

- Opportunity

- or

- original

- originators

- Other

- our

- out

- over

- own

- owners

- part

- participate

- Pay

- per

- percent

- plato

- Plato Data Intelligence

- PlatoData

- private

- private sector

- PRNewswire

- process

- processing

- Products

- professionals

- prosperity

- provided

- provides

- providing

- purchasing

- Questions

- Rate

- Rates

- real

- real estate

- receiving

- recent

- regional

- regulations

- relief

- remaining

- Renewals

- report

- Reported

- represented

- Revealed

- revenue

- right

- rights

- roundup

- s

- Said

- sales

- seamless

- SEC

- sector

- seeking

- Services

- Shop

- short-term

- sign

- signed

- since

- Since 2016

- SIX

- Six months

- Slice

- small

- small business

- smaller

- sold

- solution

- Source

- Statement

- statistics

- steadily

- Still

- Strategic

- subscribe

- subsidiary

- succeed

- success

- Supreme

- system

- teams

- Technology

- than

- that

- The

- the world

- their

- There.

- These

- third-party

- those

- Through

- tier

- to

- top

- toward

- Training

- turnkey

- two

- u.s.

- under

- unique

- unparalleled

- us

- variety

- want

- was

- Wednesday

- weekly

- went

- were

- which

- WHO

- wholesale

- wide

- will

- with

- world

- year

- years

- Your

- zephyrnet