Nine months after temporarily shuttering its services and three months after being acquired by EasyKnock, Ribbon is now offering cash backing to buyers in Atlanta and Charlotte once again.

Inman Connect is LIVE Aug. 8-10! Join us for impactful interviews, cutting-edge conversations and networking with thousands of real estate pros. Get valuable takeaways to thrive in a rapidly shifting market. Can’t come to Vegas? Register now for a virtual ticket.

Three months after being acquired by residential sale-leaseback company EasyKnock, power buyer Ribbon has relaunched its RibbonCash service to homebuyers in Atlanta and Charlotte.

Jared Kessler

“The EasyKnock and Ribbon teams could not be more excited to announce the return of RibbonCash to Charlotte and Atlanta” EasyKnock CEO Jarred Kessler said in a statement Thursday. “We believe the Southeast maintains a culture of homeownership that withstands shifts in the market. Mortgage rates and inventory may ebb and flow, but achieving homeownership — and seeking the leading tools to compete — has not.”

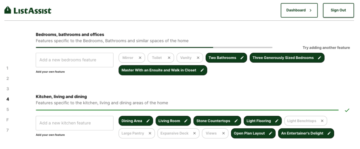

With RibbonCash, real estate agents are able to request a cash offer on behalf of their clients by uploading a fully verified pre-underwritten pre-approval to the Ribbon platform. Ribbon’s team will then confirm the details with a loan officer and agree to back a homebuyer up to the pre-approval amount.

When homebuyer finds a home and completes the inspection process, they’ll upload those documents to the Ribbon platform for Ribbon’s internal team to review. Once the inspection process is complete, a homebuyer can use RibbonCash and close with their lender for a 1.25 percent fee.

If they use RibbonCash and Ribbon Closing, the fee increases to 3 percent — however, they also have the option to rent the home from Ribbon for up to seven months while they secure financing. Once the financing is secure, the homebuyer purchases the home back from Ribbon at the original contract price.

Both homebuyer cash and closing options offer guaranteed closing after the inspection period, no financing or home sale contingencies, and no appraisal contingencies. However, Ribbon’s 20-day closing guarantee and rent-back option are only available for buyers who use RibbonCash and Ribbon Closing.

Kessler said Ribbon had strong performances in the southeast in 2022, with the company accounting for 2 percent of all closings in Atlanta before facing a litany of challenges during the third and fourth quarters of the year.

“We continue to be bullish on Atlanta, Charlotte, and the Southeast overall,” he said. “Together, Ribbon and EasyKnock are ushering in a new chapter for the real estate industry, creating a one-stop shop for financial solutions that serve homeowners, buyers, and sellers across the country.”

Ribbon’s woes began in July 2022, when the company announced it laid off 136 — or one-third — of its employees. CEO Shaival Shah said the company had done everything it could to avoid layoffs; however, it had to adapt to a “very significant shift in the market” and slim down its operations to the most essential team members.

“How long this market volatility continues is uncertain,” Shah said in July. “We need a financial plan that provides a clear achievable path to profitability.”

The company seemed to be on the path to recovery in September and October with five market expansions, but things quickly took a turn for the worse in November when Ribbon announced the suspension of its RibbonCash platform and another round of layoffs that whittled the employee count down to 30.

EasyKnock saved Ribbon from the ashes in May when the company announced it had acquired Ribbon for an undisclosed amount. Kessler and Shah said the companies could supercharge growth for the other, with EasyKnock serving homeowners and Ribbon serving homebuyers.

“There’s a lot of technology that has been [developed] by both sides, which the teams have been feverishly integrating over the last several days,” Shah said in May. “I think what the market climate showed us in the past year is that you have to be really, really resilient to different cycles and seasonality. And so by increasing the product suite, you actually hedge against the market.”

“They helped thousands of first-time homebuyers move up and purchase their home,” added Kessler in a joint statement. “And we have come to a conclusion that in this market right now, there are amazing features that are providing liquidity solutions in the residential home market. But the problem is going to be going forward is you don’t have economies of scale. And we believe consolidation is the way to go.”

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- ChartPrime. Elevate your Trading Game with ChartPrime. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://www.inman.com/2023/08/10/ribbon-relaunches-power-buying-services-following-9-month-hiatus/

- :has

- :is

- :not

- $UP

- 1

- 2022

- 25

- 30

- 32

- 9

- a

- Able

- Accounting

- achieving

- acquired

- across

- actually

- adapt

- added

- After

- again

- against

- agents

- All

- also

- amazing

- amount

- an

- and

- Announce

- announced

- Another

- appraisal

- ARE

- At

- Atlanta

- Aug

- available

- avoid

- back

- backing

- BE

- been

- before

- began

- behalf

- being

- believe

- both

- Both Sides

- Bullish

- but

- BUYER..

- buyers

- Buying

- by

- CAN

- Cash

- ceo

- challenges

- Chapter

- Charlotte

- clear

- clients

- Climate

- Close

- closing

- COM

- come

- Companies

- company

- compete

- complete

- Completes

- conclusion

- Confirm

- Connect

- consolidation

- continue

- continues

- contract

- conversations

- could

- country

- Creating

- Culture

- cutting-edge

- cycles

- Days

- details

- developed

- different

- documents

- done

- Dont

- down

- during

- economies

- Economies of Scale

- Employee

- employees

- essential

- estate

- estate industry

- everything

- excited

- facing

- Features

- fee

- financial

- financing

- finds

- five

- flow

- For

- Forward

- Fourth

- from

- fully

- get

- Go

- going

- Growth

- guarantee

- guaranteed

- had

- Have

- he

- hedge

- helped

- Home

- However

- HTTPS

- impactful

- in

- Increases

- increasing

- industry

- Integrating

- internal

- Interviews

- inventory

- IT

- ITS

- joint

- jpg

- July

- Last

- layoffs

- leading

- lender

- Liquidity

- live

- loan

- Long

- Lot

- maintains

- Market

- market volatility

- max-width

- May..

- Members

- months

- more

- Mortgage

- most

- move

- Need

- networking

- New

- no

- November

- now

- october

- of

- offer

- offering

- Officer

- on

- once

- One-third

- only

- Operations

- Option

- Options

- or

- original

- Other

- over

- overall

- past

- path

- percent

- performances

- period

- plan

- platform

- plato

- Plato Data Intelligence

- PlatoData

- power

- price

- Problem

- process

- Product

- profitability

- PROS

- provides

- providing

- purchase

- purchases

- quickly

- rapidly

- Rates

- real

- real estate

- really

- recovery

- relaunched

- Rent

- request

- residential

- resilient

- return

- review

- Ribbon

- right

- round

- Said

- sale

- Scale

- secure

- seeking

- seemed

- Sellers

- September

- serve

- service

- Services

- serving

- seven

- several

- shift

- SHIFTING

- Shifts

- Shop

- showed

- Sides

- significant

- So

- Solutions

- Statement

- strong

- suite

- Supercharge

- suspension

- Takeaways

- team

- Team members

- teams

- Technology

- that

- The

- their

- then

- There.

- they

- things

- Think

- Third

- this

- those

- thousands

- three

- Thrive

- thursday

- ticket

- to

- took

- tools

- TURN

- Uncertain

- Uploading

- us

- use

- Valuable

- VEGAS

- verified

- Virtual

- Volatility

- Way..

- we

- What

- when

- which

- while

- WHO

- will

- with

- worse

- year

- you

- zephyrnet