Financial guru and author of “Rich Dad Poor Dad,” Robert Kiyosaki, has hinted at significant Bitcoin investment opportunities in early 2024.

In a recent post, Kiyosaki urged the investing public to closely monitor Bitcoin (BTC), particularly in the context of its fast-approaching halving. He advised carefully observing the firstborn crypto in the months leading to the halving expected in April 2024.

“A Bitcoin halving is fast approaching. Please pay attention to Bitcoin halving, gold, and silver in January, February, and March,” Kiyosaki recommended.

I Hesitate Saying This: yet I believe it needs to be said. “One reason the poor and middle class remain poor is because they have poor friends and family.” If you want to be rich it is essential to have rich friends or at minimum friends who want to be rich. A Bitcoin halving is…

— Robert Kiyosaki (@theRealKiyosaki) January 4, 2024

Why Pay Attention to Bitcoin Halving?

Historically, Bitcoin halvings have consistently laid the foundation for Bitcoin to reach unprecedented all-time highs.

This occurrence, marked by a reduction in Bitcoin rewards and an ensuing scarcity in circulation, frequently serves as a bullish catalyst in Bitcoin and the broader crypto market.

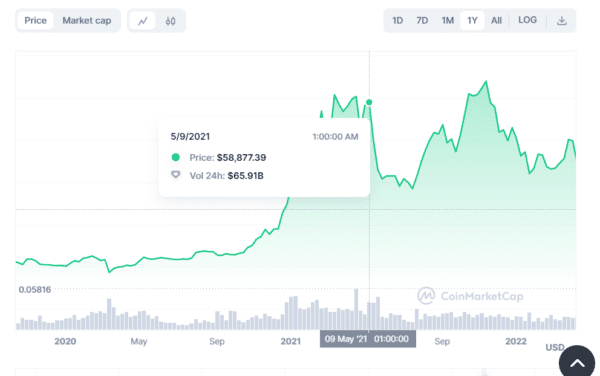

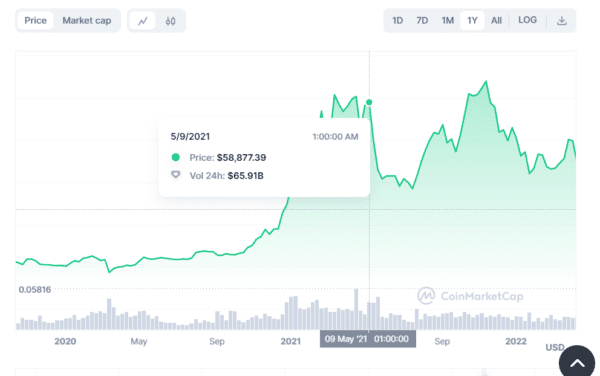

For instance, the third and most recent Bitcoin halving occurred in May 2020 when the token traded between $8,000 and $9,000.

– Advertisement –

Subsequently, Bitcoin embarked on an upward trend starting in October 2020. The uptrend culminated in the asset reaching the $58,000 range just a year after the halving event.

Kiyosaki’s advice to closely monitor Bitcoin through January, February, and March implies that this period might present a favorable entry point for potentially profitable opportunities in the months ahead.

Besides, the financial expert has been a long-standing advocate for Bitcoin as a hedge against government-induced dangers like hyperinflation.

Current Bitcoin Price Trend

Notably, Bitcoin commenced a pre-halving run in October, largely driven by U.S.-backed Bitcoin spot ETF speculation.

However, market sentiments took a downturn following a report, largely considered FUD, indicating that the U.S. regulator might reject all Bitcoin spot ETF proposals this month.

Consequently, Bitcoin experienced a substantial decline. This led to a broader market downturn, with most cryptocurrencies trading in the red since yesterday.

Despite this short-term setback, Bitcoin has seen an impressive 155.24% increase in the last 52 weeks. Experts, banking on insider knowledge, have maintained that Bitcoin spot ETF endorsement will materialize this month.

At press time, Bitcoin is trading for $43,324, a price level that has proven challenging to surpass over the past 30 days.

Follow Us on Twitter and Facebook.

Disclaimer: This content is informational and should not be considered financial advice. The views expressed in this article may include the author’s personal opinions and do not reflect The Crypto Basic’s opinion. Readers are encouraged to do thorough research before making any investment decisions. The Crypto Basic is not responsible for any financial losses.

-Advertisement-

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://thecryptobasic.com/2024/01/04/robert-kiyosaki-points-to-january-march-as-bitcoin-golden-window-before-price-boom/?utm_source=rss&utm_medium=rss&utm_campaign=robert-kiyosaki-points-to-january-march-as-bitcoin-golden-window-before-price-boom

- :has

- :is

- :not

- 000

- 11

- 2020

- 2024

- 30

- 9

- a

- Advertisement

- advice

- advised

- After

- against

- ahead

- All

- all-time highs

- an

- and

- any

- approaching

- April

- April 2024

- ARE

- article

- AS

- asset

- At

- attention

- author

- Banking

- basic

- BE

- because

- been

- before

- believe

- between

- Bitcoin

- Bitcoin halving

- Bitcoin investment

- Bitcoin Price

- bitcoin rewards

- Bitcoin spot etf

- boom

- broader

- BTC

- Bullish

- by

- carefully

- Catalyst

- challenging

- Chart

- Circulation

- class

- closely

- commenced

- considered

- consistently

- content

- context

- crypto

- Crypto Market

- cryptocurrencies

- Dad

- dangers

- data

- Days

- decisions

- Decline

- do

- DOWNTURN

- driven

- Early

- embarked

- encouraged

- Endorsement..

- entry

- essential

- ETF

- Ether (ETH)

- Event

- expected

- experienced

- expert

- experts

- expressed

- family

- FAST

- favorable

- February

- financial

- financial advice

- following

- For

- Foundation

- frequently

- friends

- FUD

- Gold

- Golden

- Halving

- Have

- he

- hedge

- High

- Highs

- hinted

- http

- HTTPS

- hyperinflation

- i

- ID

- if

- impressive

- in

- include

- Increase

- indicating

- Informational

- Insider

- instance

- investing

- investment

- investment opportunities

- IT

- ITS

- January

- just

- Kiyosaki

- knowledge

- largely

- Last

- leading

- Led

- Level

- like

- long-standing

- losses

- maintained

- Making

- March

- marked

- Market

- materialize

- max-width

- May..

- Middle

- might

- minimum

- Monitor

- Month

- months

- most

- needs

- observing

- occurred

- occurrence

- october

- of

- on

- Opinion

- Opinions

- opportunities

- or

- over

- particularly

- past

- Pay

- period

- personal

- plato

- Plato Data Intelligence

- PlatoData

- please

- Point

- points

- poor

- Post

- potentially

- present

- press

- price

- price chart

- profitable

- Proposals

- proven

- public

- range

- reach

- reaching

- readers

- reason

- recent

- recommended

- Red

- reduction

- reflect

- regulator

- remain

- research

- responsible

- Rewards

- Rich

- ROBERT

- robert kiyosaki

- Run

- s

- Said

- saying

- Scarcity

- seen

- sentiments

- serves

- short-term

- should

- significant

- Silver

- since

- speculation

- Spot

- spot etf

- Starting

- substantial

- surpass

- TAG

- that

- The

- The Crypto Basic

- they

- Third

- this

- Through

- time

- to

- token

- took

- traded

- Trading

- Trend

- true

- u.s.

- unprecedented

- uptrend

- upward

- views

- W3

- want

- webp

- Weeks

- when

- WHO

- will

- window

- with

- year

- year after

- yesterday

- yet

- you

- zephyrnet