We were fortunate enough to return to 20VC to help support the new format with multiple guests, and the deep dive on venture was a good one

Per Harry:

“VC markups have corrupted VC. We will see a rise of mega-funds once again and RIFs should be an embarrassment for all SaaS founders.

Not enough discussions are direct and honest.

Here are my 10 biggest lessons from our 20VC today with Jason M. Lemkin and Rick Zullo. 🔥 👇

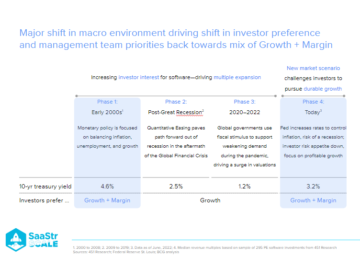

1. Why We Are Going to See More Large Funds, not Less

There will be reflation by the end of next year with mega-funds resurging in late 2024 and 2025. Everyone’s stuck looking backwards or making short term conclusions. Tough times don’t last. Things are starting to look slightly better, and when times are good, money floods back in.

2. Why You Should Never Have a Reduction in Force (RIF)

A great SaaS with high NRR should have a RIF because they have predictable, recurring revenue. It happens but it should be embarrassing for a B2B CEO to need one unless it’s a quiet talent reorg.

3. Get Back to Growth or it is Over:

“Everyone got a pass for a year, and it was a gift.” Founders with mediocre growth were given extra runway to figure out a better strategy. But the pass has expired. If you can’t triple and double in growth now, it’s over for B2B founders.

4. Markups Have Corrupted VC:

“The way we’ve done markups for smaller funds has corrupted the industry.” The impact has been worse than anticipated as it’s corrupted layers up and down the stack.

5. The Ponzi Scheme of Venture: LPs Win Also

Most people don’t know that the bigger LPs are compensated based on paper markups too. People didn’t realize where that cash was coming from in the unicorn explosion.

6. Why Pitching is Fake and BS

“Pitching is BS because it’s all about salesmanship.” [Rick’s point, not Jason’s] What’s more important is understanding the founder’s understanding of their company. They’d be better off with 10% less sales and 10% more substance.

7. Three Ways to get a meeting with one of the best VCs

1/ Does this company have decacorn potential to return the fund 5-10x over?

2/ Is it one of our top 10-15 internal ideas that we’re laser focused on hunting?

3/ Is this a once-in-a-generation founder?

8. The One Investing Rule

“Are you confident this next round will be 3x the previous valuation?”

If you’re confident, then do it. If every investment ends up a 3x, then you’ll have a 3x fund.

9. Two Ways to Invest in a $BN Company

“You can stair step it, or you can swing for the fences from the start.” Stair stepping is being confident the investment will be a 3x to the next round. Swinging for the fences is having the perfect idea match your thesis with a large TAM. Many abandoned stair stepping — maybe since it forces them to be more valuation sensitive.

10. Beware of Being an Orphaned Founder

Many venture investors at zombie VCs may not be there in 3-5 years. This is a major risk that no one’s talking about. Founders should select VCs for their board who’ll be there for the full company lifecycle.”

Jason Lemkin is the Founder @ SaaStr one of the best-performing early-stage venture funds focused on SaaS. In the past, Jason has led investments in Algolia, Pipedrive, Salesloft, TalkDesk, and RevenueCat to name a few. Prior to SaaStr, Jason was an entrepreneur, selling EchoSign to Adobe for $100M where it is now a $250M ARR product.

Rick Zullo is the Co-Founder and General Partner at Equal Ventures. Prior to co-founding Equal Ventures, Rick was an investor at Lightbank, Prior to Lightbank, Rick worked with investment firms Foundation Capital, Bowery Capital, and Lightview Capital.

In Today’s Episode We Discuss:

1. Why Venture Capital Needs It’s Jerry Maguire Moment:

- Why does Rick believe that VC needs it’s “Jerry Maguire” moment?

- What needs to change? What needs to stay the same?

- Why does Jason believe we will see even more mega funds in 2024 and 2025?

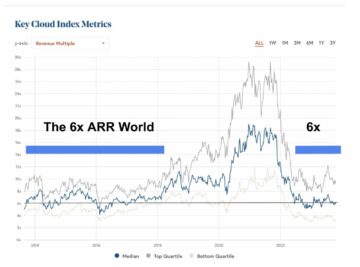

2. Unicorns are So 2019:

- Why does Jason believe that “unicorn investing is mostly dead for bigger funds and none of them are looking for a $1BN outcome anymore?”

- Why does Rick believe that multi-stage fund investing at seed simply does not make sense?

- What does Rick believe many founders need to know when they take multi-stage money at seed?

- Of the over 1,000 unicorns created over the last few years, how many of them do Rick and Jason feel are actually unicorns today?

3. Efficiency and Growth: We Need it All:

- Why does Jason believe, as a founder you should be embarrassed if you ever had a RIF (reduction in force)?

- Last year many founders got a pass on growth as they were more efficient. Is that pass over? Do they need to get back to growth?

- What is the single biggest reason that companies do not scale from seed to Series A?

- What happens to the many companies with years of runway but no product-market-fit?

- Are we entering a new age of efficient company building or will we go back to high burn environments and excessive spending?

4. Entering the World of LPs:

- If Jason and Rick were to advise LPs today on how much to discount the value of their venture books, what advice would they give?

- How have markups completely corrupted the venture ecosystem?

- How does LPs being incentivized by paper-marks make the industry even more screwed?

- What are the single biggest misalignments between GP and LP?

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- ChartPrime. Elevate your Trading Game with ChartPrime. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://www.saastr.com/saastr-on-20vc-mega-funds-will-come-back-why-markups-have-corrupted-vc-rifs-and-more-with-jason-lemkin-and-rick-zullo/

- :has

- :is

- :not

- :where

- $1bn

- $UP

- 000

- 1

- 10

- 2019

- 2024

- 2025

- a

- About

- actually

- Adobe

- advice

- advise

- again

- age

- All

- an

- and

- Anticipated

- anymore

- ARE

- AS

- At

- B2B

- back

- based

- BE

- because

- been

- being

- believe

- BEST

- Better

- between

- Beware

- bigger

- Biggest

- board

- Books

- Building

- burn

- but

- by

- Campaign

- CAN

- capital

- Cash

- ceo

- change

- Chapter

- Co-founder

- COM

- come

- coming

- Companies

- company

- compensated

- completely

- confident

- content

- converting

- corrupted

- created

- Customers

- data

- dead

- deep

- deep dive

- direct

- Discount

- discuss

- discussions

- do

- does

- done

- Dont

- double

- down

- early stage

- ecosystem

- efficient

- embed

- embedded

- end

- ends

- enough

- entering

- Entrepreneur

- environments

- episode

- equal

- Even

- EVER

- Every

- everyone’s

- explosion

- extra

- fake

- feel

- few

- Figure

- firms

- focused

- For

- Force

- Forces

- format

- fortunate

- Foundation

- founder

- founders

- from

- full

- fund

- funds

- General

- General Partner

- get

- gift

- Give

- given

- Go

- going

- good

- GP

- great

- Growth

- guests

- had

- happens

- Have

- having

- help

- High

- How

- HTTPS

- Hunting

- idea

- ideas

- if

- Impact

- important

- in

- incentivized

- industry

- internal

- into

- Invest

- investing

- investment

- investment firms

- Investments

- investor

- Investors

- IT

- jpg

- Know

- large

- laser

- Last

- Late

- layers

- Led

- less

- Lessons

- lifecycle

- Look

- looking

- LP

- LPs

- major

- make

- Making

- many

- Match

- May..

- maybe

- meeting

- Mega

- moment

- money

- more

- more efficient

- mostly

- much

- multiple

- my

- name

- Need

- needs

- never

- New

- next

- no

- None

- now

- of

- off

- on

- once

- ONE

- or

- our

- out

- Outcome

- over

- Paper

- partner

- pass

- past

- People

- perfect

- Pipedrive

- pitching

- plato

- Plato Data Intelligence

- PlatoData

- Point

- ponzi

- Ponzi Scheme

- potential

- Predictable

- previous

- Prior

- Product

- product-market-fit

- realize

- reason

- recurring

- reduction

- return

- revenue

- RIF

- Rise

- Risk

- round

- runway

- SaaS

- sales

- same

- Scale

- scheme

- see

- seed

- Selling

- sense

- sensitive

- Series

- Series A

- Short

- should

- simply

- since

- single

- site

- smaller

- So

- Spending

- stack

- start

- Starting

- stay

- Step

- stepping

- Strategy

- subscribers

- substance

- support

- Swing

- Take

- Talent

- talking

- TAM

- term

- than

- that

- The

- the world

- their

- Them

- then

- There.

- thesis

- they

- things

- this

- three

- times

- Title

- to

- today

- today’s

- too

- top

- tough

- Triple

- true

- two

- understanding

- unicorn

- unicorns

- Valuation

- value

- VC

- VCs

- venture

- venture capital

- Ventures

- visitors

- was

- Way..

- ways

- we

- were

- What

- when

- why

- will

- win

- with

- worked

- world

- worse

- would

- year

- years

- you

- Your

- youtube

- zephyrnet

- zombie