Funding to Seattle startups has shriveled this year amid a statewide investment downturn that exceeds the slowdown we’ve seen nationwide.

So far in 2023, Seattle-based startups have pulled in $1.1 billion in seed through growth-stage financing, per Crunchbase data. That’s a decline of 57% from the same period last year, which was itself well below the 2021 peak.

For a sense of how the numbers are trending, we charted out citywide investment totals and round counts for the past six calendar years below:

Meanwhile, for the state of Washington, trendlines look similar, showing the declines aren’t limited to Seattle proper.

Of course, venture funding has fallen sharply pretty much everywhere this year. The first half of 2023 was down 51% year over year globally.

Late-stage and mega-rounds dry up

This begs the question: Is the Seattle-area decline just a reflection of broader geographic trends, or does it point to specific weaknesses in the local startup ecosystem?

While we can’t offer a definitive answer, we can peruse large deals and demographic trends to see what clues they offer.

We turned first to look at the state of mega-sized funding rounds, which tend to happen at the late stage.

It wasn’t pretty. So far this year, Washington state has seen just one $100 million-plus round: A $102 million August Series D for Pivotal Commware, which develops software-defined antennas and radios based on a technology it calls Holographic Beam Forming.

By contrast, in 2021 and 2022, there were 43 funding rounds of $100 million or more. This included a $750 million Series A last year for nuclear energy startup TerraPower.

Still, there are some sizable rounds getting done this year. After Pivotal, the next-largest 2023 round was an $86.5 million Series C for Viome, a gut microbiome health startup. There were also two $75 million financings, one to DexCare, a health care software platform, and another to Temporal Technologies, a developer of tools for coders.

Early-stage action

So far this year, we’ve seen 35 Series A and B rounds in Washington, collectively pulling in $820 million. That’s roughly a third of the total from the same period a year ago.

Things are down even further compared to the peak. In 2021 and 2022, Washington companies pulled in nearly $6.5 billion altogether in Series A and B deals.

Seed stage hasn’t declined quite so much. Washington companies have pulled in roughly $281 million in seed investment in 2023 — a drop of roughly 35% from the same period last year. That’s similar to what we’ve seen in other locales, as seed investors don’t expect near-term exits and are less impacted by market cycles.

Growth, livability and exits

As cities go, Seattle isn’t for everyone. Traffic is bad, winters are gray, crime rose in recent years, and homebuying is out of reach for most workers. In 2021, the population of the city and surrounding King County actually declined for the first time in nearly half a century, fueled in part by remote workers seeking sunnier pastures elsewhere.

On the other hand, there’s much to like as well, from spectacular summers, abundant natural beauty and an urban populace known for both its creative energy and tech talent. By the most recent measure, the Seattle-area population is increasing again, and Washington ranks among the fastest-growing U.S. states.

On the exit front, meanwhile, the Seattle area has seen a steady clip of local companies making it to public markets. Per Crunchbase data, there have been at least 20 IPOs of local, venture-backed companies over the past five years.

While none are showing signs of becoming the next Amazon or Microsoft, there are some with market caps over $1 billion on the list. This includes cross-border payments service Remitly, B2B contact provider ZoomInfo, and pet care marketplace Rover.

So, all this is to say the data doesn’t support a narrative that startup folks are fleeing Seattle or Washington state in droves. However, funding activity has definitely slowed in recent quarters, more so than many other founder hubs, and we wouldn’t be surprised it takes a while longer to rebound.

Related Crunchbase Pro queries:

Illustration: Li-Anne Dias

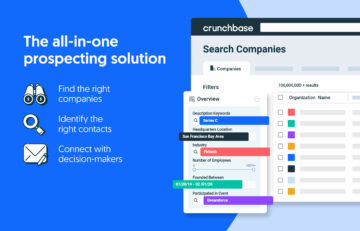

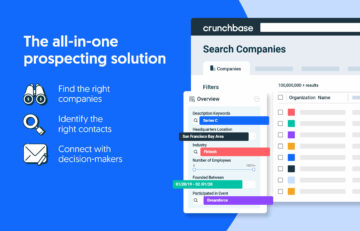

Search less. Close more.

Grow your revenue with all-in-one prospecting solutions powered by the leader in private-company data.

Stay up to date with recent funding rounds, acquisitions, and more with the Crunchbase Daily.

AI, space and biotech were the big winners, raising more than $2 billion in the top five rounds. The last several weeks have definitely seen the big…

More than 172,192 workers at U.S.-based tech companies have been laid off in mass job cuts so far in 2023, per a Crunchbase News tally. See who the…

Vacations are over, everyone’s back in school, football’s here and we are in the full swing of fall. That means some pretty fascinating rounds may…

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://news.crunchbase.com/venture/seattle-startup-stats-2023-terrapower/

- :has

- :is

- $1 billion

- $100 million

- $UP

- 1

- 2021

- 2022

- 2023

- 35%

- a

- abundant

- acquisitions

- activity

- actually

- After

- again

- ago

- All

- all-in-one

- also

- altogether

- Amid

- among

- an

- and

- Another

- answer

- ARE

- AREA

- AS

- At

- AUGUST

- Axios

- b

- B2B

- back

- Bad

- based

- BE

- Beam

- Beauty

- becoming

- been

- below

- Big

- Billion

- biotech

- both

- broader

- by

- Calendar

- Calls

- CAN

- caps

- care

- Century

- Cities

- City

- Close

- collectively

- Companies

- compared

- contact

- contrast

- county

- course

- Creative

- Crime

- cross-border

- cross-border payments

- CrunchBase

- cuts

- cycles

- daily

- data

- Date

- Deals

- Decline

- Declines

- definitely

- definitive

- demographic

- Developer

- develops

- does

- Doesn’t

- done

- Dont

- down

- DOWNTURN

- Drop

- dry

- ecosystem

- elsewhere

- end

- energy

- Even

- everyone

- everyone’s

- everywhere

- exceeds

- Exit

- exits

- expect

- Fall

- Fallen

- far

- fascinating

- financing

- First

- first time

- five

- For

- founder

- from

- front

- fueled

- full

- funding

- funding rounds

- further

- geographic

- getting

- Globally

- Go

- gray

- Half

- hand

- happen

- Have

- Health

- Health Care

- here

- holographic

- How

- However

- http

- HTTPS

- hubs

- impacted

- in

- In other

- included

- includes

- increasing

- investment

- Investors

- IPOs

- IT

- ITS

- itself

- Job

- job cuts

- jpg

- just

- just one

- King

- known

- large

- Last

- Last Year

- Late

- leader

- least

- less

- like

- Limited

- List

- local

- longer

- Look

- Making

- many

- Market

- Market Caps

- marketplace

- Markets

- Mass

- May..

- means

- Meanwhile

- measure

- Microbiome

- million

- mojo

- more

- most

- much

- NARRATIVE

- Natural

- nearly

- news

- next

- None

- nuclear

- Nuclear Energy

- numbers

- of

- off

- offer

- on

- ONE

- or

- Other

- out

- over

- part

- past

- payments

- Peak

- per

- period

- pet

- pivotal

- platform

- plato

- Plato Data Intelligence

- PlatoData

- Point

- population

- powered

- pretty

- Pro

- proper

- provider

- public

- pulling

- queries

- question

- raising

- reach

- rebound

- recent

- Recent Funding

- reflection

- remote

- remote workers

- revenue

- roughly

- round

- rounds

- s

- same

- say

- School

- Seattle

- see

- seed

- seeking

- seen

- sense

- Series

- Series A

- Series C

- service

- several

- show

- showing

- Signs

- similar

- SIX

- sizable

- Slowdown

- So

- so Far

- Software

- software platform

- Solutions

- some

- Space

- specific

- spectacular

- Stage

- startup

- startup ecosystem

- Startups

- State

- States

- stats

- stay

- steady

- support

- surprised

- Surrounding

- Swing

- takes

- Talent

- Tally

- tech

- tech companies

- tech talent

- Technology

- than

- that

- The

- The State

- There.

- they

- Third

- this

- this year

- Through

- time

- to

- tools

- top

- Total

- traffic

- trending

- Trends

- Turned

- two

- u.s.

- urban

- venture

- venture-funding

- was

- washington

- washington state

- we

- weaknesses

- Weeks

- WELL

- were

- What

- which

- while

- WHO

- winners

- with

- workers

- year

- years

- Your

- zephyrnet