The September dot plot is always the most-interesting one of the year because it’s the closest thing to forward guidance that the FOMC offers.

Officials are required to place a year-end dot but there are only two meetings left so it basically says what they expect to happen in the next two meetings. Now that’s far from set-in-stone but with Sept hike odds down to 7% after the non-farm payrolls report, it will offer some intrigue at the Sept 20 decision.

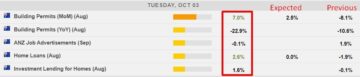

Here’s what the fixed income team at BMO is looking for (note that the current rate is 5.25-5.50%):

In terms of the

looming dotplot revisions, we anticipate the 2023 funds estimate will remain

unchanged at 5.6% (implying a 5.75% upper bound) and 2024 will be nudged higher

to 4.9% (signaling 75 bp of cuts next year). These expectations are relatively

consensus at present and predicated on the August CPI report confirming this

summer’s benign inflationary backdrop.

So the thinking is that the dot plot will still signal one more hike because that will be easier for Powell to walk back later than it would be if no hike was signalled and they had to later reverse course and indicate a hike.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- ChartPrime. Elevate your Trading Game with ChartPrime. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://www.forexlive.com/centralbank/the-dot-plot-comes-into-focus-as-the-market-prices-out-a-september-fed-hike-20230901/

- :is

- 20

- 2023

- 2024

- 75

- a

- After

- always

- and

- anticipate

- ARE

- AS

- At

- AUGUST

- back

- backdrop

- Basically

- BE

- because

- BMO

- bound

- BP

- but

- comes

- Consensus

- course

- CPI

- Current

- cuts

- decision

- DOT

- down

- easier

- estimate

- expect

- expectations

- far

- Fed

- Fed Hike

- fixed

- fixed income

- Focus

- FOMC

- For

- Forward

- from

- funds

- guidance

- had

- happen

- higher

- Hike

- HTTPS

- if

- in

- Income

- indicate

- Inflationary

- into

- IT

- jpg

- later

- left

- looking

- looming

- Market

- Market Prices

- meetings

- more

- next

- no

- Non-farm payrolls

- note

- now

- Odds

- of

- offer

- Offers

- on

- ONE

- only

- out

- Payrolls

- Place

- plato

- Plato Data Intelligence

- PlatoData

- Powell

- present

- Prices

- Rate

- relatively

- remain

- report

- required

- reverse

- revisions

- s

- says

- September

- Signal

- So

- some

- Still

- team

- terms

- than

- that

- The

- There.

- These

- they

- thing

- Thinking

- this

- to

- two

- was

- we

- What

- will

- with

- would

- year

- zephyrnet