Introduction

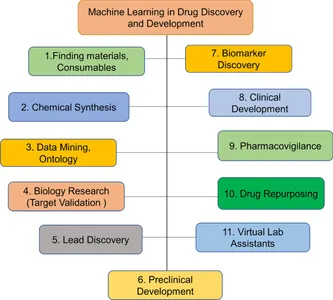

From Alan Turing’s “Computing Machinery and Intelligence,” which introduced the seminal concept of The Imitation Game, to the remarkable achievements of Devin AI – the world’s foremost fully autonomous AI software engineer – the journey in advancing artificial intelligence has been extraordinary. Artificial intelligence (AI) has made significant inroads across various sectors such as healthcare, education, retail, Marketing and Advertising.

But what about AI in trading? Has AI penetrated online trading? This sector has long adopted artificial intelligence (AI), leveraging machine learning algorithms to automate trading, optimize portfolios, and manage risks. Yet, the emergence of generative AI heralds a transformative era, promising to revolutionize the industry in unprecedented ways. Generative AI, a cutting-edge technology, is revolutionizing online trading by leveraging advanced algorithms to analyze market trends and make informed decisions. This article explores the impact of Generative AI on online trading, its evolution, and its role in the financial sector.

Table of contents

Understanding Generative AI and its Impact on Online Trading

Firstly, let’s understand the Generative AI market:

In 2022, the generative AI market reached a valuation of USD 29.00 billion. Forecasts indicate robust growth, with the market expected to climb from USD 43.87 billion in 2023 to a staggering USD 667.96 billion by 2030, showcasing a notable compound annual growth rate (CAGR) of 47.5% during the forecast period spanning 2023 to 2030. Notably, North America held a significant portion of this market, boasting a value of USD 14.49 billion in 2022.

Brief Introduction of GenAI

Generative AI refers to artificial intelligence systems that can create new data or content based on patterns and information fed to them. In online trading, Generative AI is crucial in generating trading strategies, enhancing market analysis, and improving risk management.

GenAI in Stock Market Trading

AI enhances trading processes by instilling consistency through adherence to predefined rules and parameters, regardless of market fluctuations. This diminishes the influence of human biases, thereby augmenting overall trading effectiveness. Conventionally, trading signals, a staple tool in trading, have been crafted through human analysis employing technical indicators or mathematical algorithms grounded in market behavior, often supplemented by economic indicators.

While automated trading systems execute trades based on predetermined rules and indicators, generative AI adopts a more sophisticated approach by integrating machine learning algorithms. This renders generative AI indispensable for traders aiming to optimize their performance and maintain competitiveness in the ever-changing trading milieu. The advancement in trading, fueled by recent strides in AI technology, has unlocked novel opportunities for traders and brokers alike. Many successful traders rely on bots to enhance profitability, representing a notable progression from the nascent stages of automated trading and trading signals.

The Evolution of Online Trading with Generative AI

Online trading has evolved significantly with the integration of Generative AI. Traders now have access to sophisticated tools that can analyze vast amounts of data in real-time, enabling them to make more informed decisions and execute trades precisely. One such tool in the market is: NexusTrade. By leveraging machine learning algorithms, financial institutions can automate trading processes, optimize investment strategies, and mitigate risks effectively.

Generative AI in Stock Market Trading

Here’s how GenAI in online trading is useful:

- Signal Generation in Trading: With AI capabilities, GenAI meticulously scrutinizes vast datasets to uncover subtle patterns and trends that often evade human perception. This analytical acumen not only facilitates the development of innovative trading strategies but also enhances the identification of lucrative opportunities and enables more sophisticated risk management techniques.

- Application in Algorithmic Trading: GenAI finds applications in algorithmic trading by scrutinizing market data trends and real-time conditions to forecast future market movements. This process automates trading activities across various financial instruments, leveraging data analysis and algorithmic pattern recognition.

- Evaluating Risks and Detecting Fraud: GenAI excels at identifying subtle anomalies that could evade human scrutiny by leveraging its capacity to process vast datasets. Promptly flagging irregularities and potential fraudulent activities bolsters security measures and effectively mitigates financial risks.

In a nutshell, Generative AI algorithms enhance risk management strategies by evaluating risk factors, forecasting potential losses, and suggesting mitigation techniques. Integrating AI-driven risk management tools empowers traders to minimize losses and optimize their trading portfolios, bolstering their overall effectiveness in navigating the complexities of online trading. - Tailored Financial Solutions: GenAI analyzes individual financial histories, spending patterns, and investment preferences to craft bespoke financial solutions and guidance. This personalized approach enhances customer satisfaction and engagement, empowering clients to make well-informed financial decisions.

- Modeling Market Dynamics: AI algorithms adeptly model market dynamics through the generation of synthetic data, facilitating the development of innovative trading strategies and bolstering portfolio management practices. The integration of generative AI promises to refine trading decisions and optimize investment portfolios.

- Simulating Risk Scenarios: Generative AI models simulate diverse risk scenarios, including market crashes and extreme price fluctuations, enabling traders to better prepare for varying market conditions and enhance risk management strategies.

These applications underscore GenAI’s potential to revolutionize online trading through advanced data analysis, automated trading processes, enhanced risk management capabilities, and tailored financial offerings. Nonetheless, the successful implementation of GenAI necessitates careful attention to challenges such as data privacy, security concerns, and mitigating algorithmic biases. Moreover, it revolutionizes market analysis. Generative AI tools revolutionize market analysis by processing real-time data, recognizing trends, and uncovering potential trading prospects. By automating these analytical processes, traders gain a competitive edge, staying abreast of market dynamics and capitalizing on emerging trends effectively.

Also read: How Generative AI Is Reshaping Business, Healthcare, and the Arts?

Optimize Trading with NexusTrade: AI-Powered Financial Research Platform

NexusTrade is an intuitive AI-driven trading platform enabling users to develop, test, and deploy automated trading strategies effortlessly. It caters to both novices and seasoned traders, prioritizing accessibility and simplicity.

A standout feature of NexusTrade is its AI Chat, Aurora, which streamlines strategy creation by allowing users to articulate their ideas in plain language. This function expedites strategy development while facilitating thorough financial research.

As of January 4th, 2023, NexusTrade supports trading with stocks (Forex) and select cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), Dogecoin (DOGE), Litecoin (LTC), Chainlink (LINK), and Shiba Inu (SHIB). Additionally, it provides a dedicated library for users to store and manage their trading strategies, conditions, and indicators, fostering efficient reuse and referencing across multiple portfolios.

In essence, NexusTrade offers a comprehensive solution that integrates AI assistance, strategy development, backtesting, and portfolio management to cater to diverse needs within the algorithmic trading community.

Here are 3 major features of NexusTrade:

- Trading Strategy Automation: NexusTrade provides tools and capabilities to automate trading strategies. This means that users can set up predefined rules and conditions for buying or selling assets, and the platform will execute these trades automatically based on real-time market data. Automation can help users save time and ensure consistent execution of their trading strategies without needing to monitor the market at all times manually.

- Financial Analysis: NexusTrade offers tools and resources for conducting in-depth financial analysis. This may include access to historical market data, technical indicators, financial reports, and other relevant information that can help users make informed trading decisions. Financial analysis tools provided by NexusTrade can assist users in evaluating the performance and potential risks associated with various assets or investment opportunities.

- Intelligent Stock Screening: NexusTrade incorporates intelligent algorithms and screening mechanisms to help users identify potential investment opportunities within the stock market. This feature allows users to filter through many stocks based on specific criteria such as price, volume, market capitalization, and fundamental indicators. Using intelligent stock screening, users can efficiently narrow their options and focus on assets aligning with their investment goals and strategies.

Some potential features such a NexusTrade platform could offer include:

- AI-driven market analysis and forecasting models to identify trends, patterns, risks, etc.

- Natural language processing analyzes large amounts of financial data, news, reports, etc.

- Automated report generation summarizing research and providing investment recommendations.

- AI assistants or chatbots to help investors/traders get customized research and answers to queries.

- Predictive analytics for factors like stock pricing, company valuations, economic indicators, etc.

- Quantitative investment strategy backtesting and optimization using AI models.

Let’s give a prompt to NexusTrade:

Auroro Prompt: Analyze TSLA’s Cash Flow for q3 2023

The Output

For more detailed information, refer to the source: – SEC Filing for Tesla Inc.

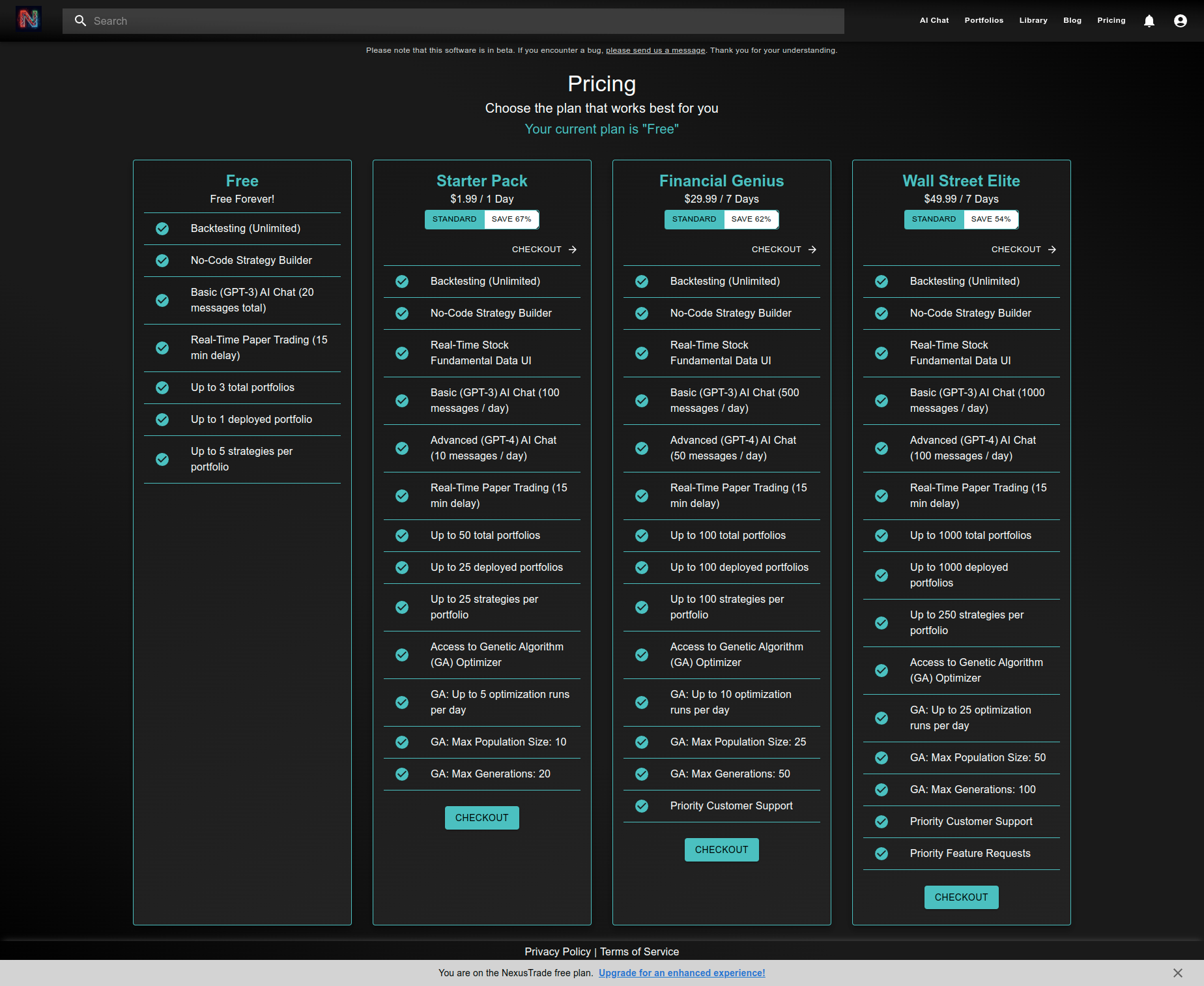

Pricing Model of NexusTrade

Note: NexusTrade is for Forex and Cryptocurrencies

Candlestick Chart Analysis of Nifty 50 by Google Gemini

In this section, we will analyze the Nifty 50 chart. We will use Google Gemini as it has access to real-time data from the internet.

Firstly, you need to sign up for Google Gemini and to do so, use your Gmail ID.

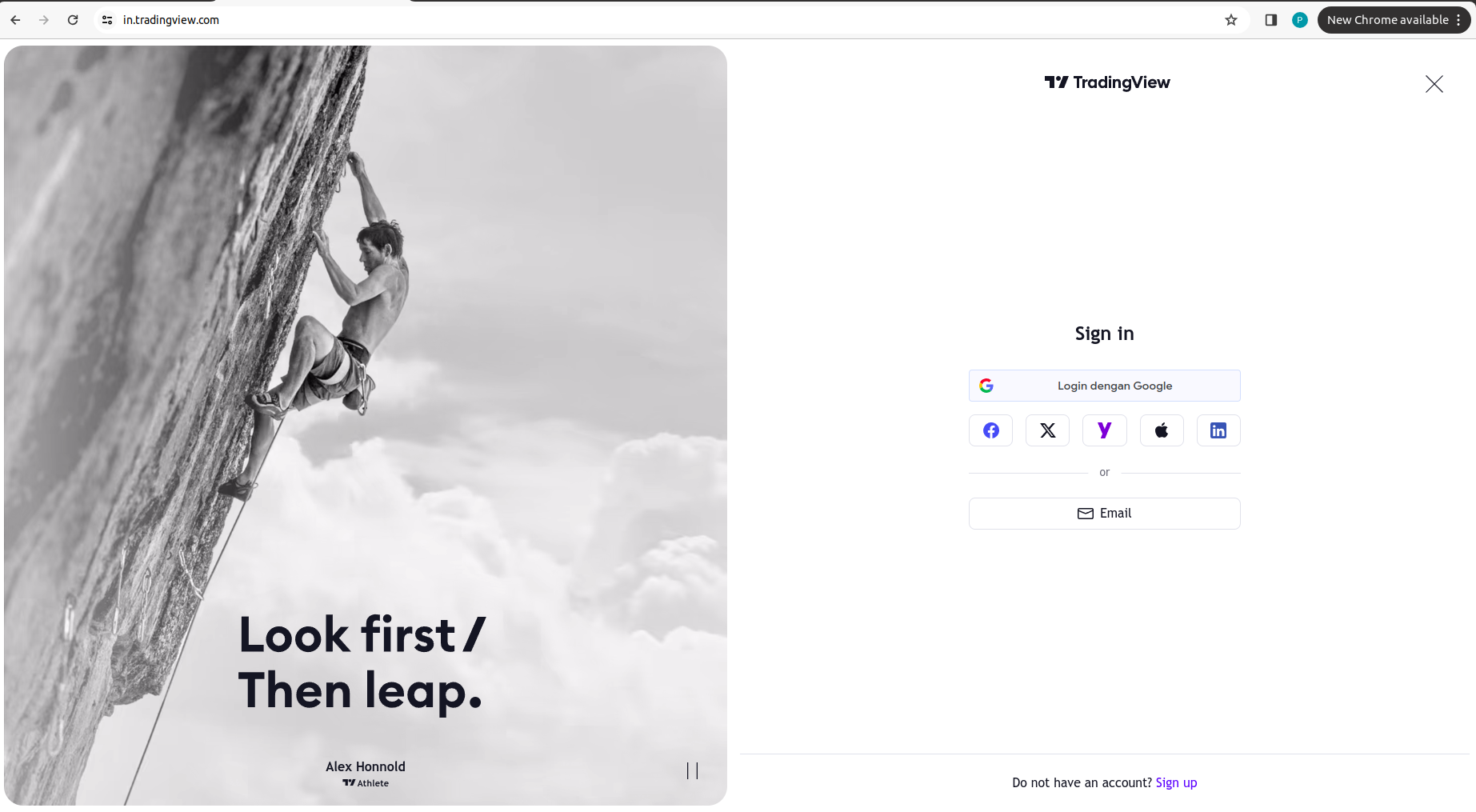

We will go to the Trading View website to download the candlestick chart.

After signing up, click on the Nifty 50 shown on the Trading View dashboard, or you can search for any stock and click on the launch chart.

After selecting Nifty 50, we will download the chart by selecting the duration. Here, we will do a daily analysis by selecting one month in 30-minute intervals.

Now, open Gemini and paste the photo in the “Enter Prompt section.” You can do it easily by clicking the “upload image” button.

After uploading the chart, you can get the information you need about the chart by just entering the prompt.

For instance, let’s give it a prompt

What is the trend of this chart?

If we ask – What is the trend of this chart today?

Output

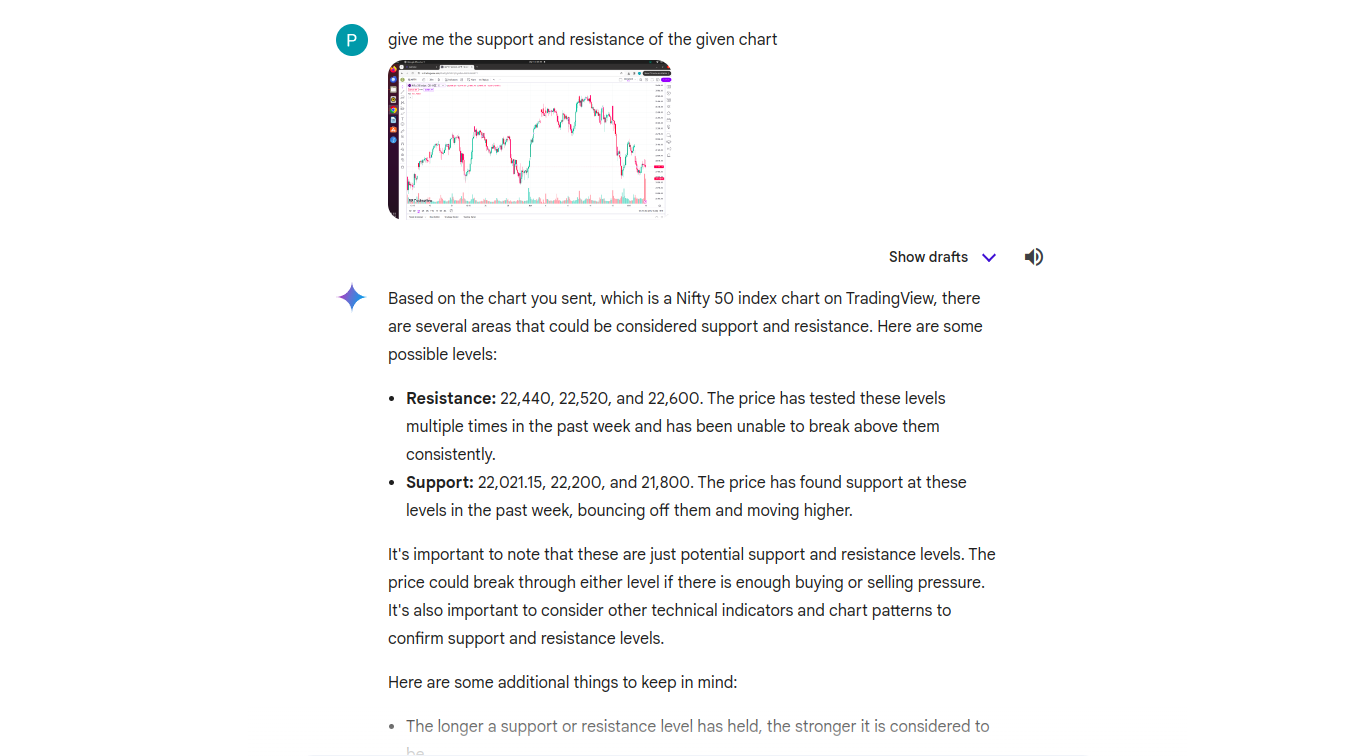

Now, let’s find out the support and resistance of the Nifty 50 chart

Prompt: Give me the support and resistance of the given chart

Output

It’s intriguing, right? Similarly, you can analyze the chart of any stock (Reliance, Adani, and more) using Generative AI tools. Are you using Google Gemini for stock analysis? I’m interested in hearing about your experiences with it!

Generative AI vs Traditional AI in Stock Market Trading

GenAI and traditional AI possess distinct yet complementary applications within trading. While traditional AI relies on established algorithms and predefined rules to analyze market data and make trading decisions, GenAI leverages advanced generative capabilities to uncover nuanced patterns and trends, often surpassing the limitations of traditional methods. Individually, traditional AI excels in tasks like data analysis, risk assessment, and algorithmic trading execution.

On the other hand, GenAI offers novel solutions by generating synthetic data, modeling complex market dynamics, and facilitating innovative trading strategies. These two approaches can create a powerful synergy, enhancing trading efficiency, accuracy, and adaptability in dynamic market environments.

AI in Stock Market Trading: Challenges and Opportunities

Challenges of Implementing Generative AI in Stock Market Trading

Despite its numerous benefits, implementing Generative AI in online trading poses several challenges, including data privacy concerns, regulatory compliance issues, and the need for skilled AI professionals. Overcoming these challenges is crucial for the widespread adoption of AI in online trading.

Opportunities for Growth and Innovation in Online Trading with Generative AI

Generative AI presents a transformative opportunity in online trading by enhancing predictive analytics, risk management, and personalized user experiences. Through generative models, trading platforms can develop dynamic strategies, optimize portfolios, and simulate market scenarios with unprecedented accuracy. This technology enables algorithmic trading to adapt swiftly to evolving market conditions, reducing human error and enhancing efficiency.

Moreover, generative AI fosters innovation by generating synthetic data for back-testing strategies and creating novel trading indicators. Embracing generative AI in online trading empowers traders with advanced decision-making tools and opens doors to new frontiers of growth and innovation in the financial markets.

Future Trends for AI in Stock Market Trading

The Future of Online Trading: Predictions and Trends with Generative AI

The future of online stock trading is undergoing a profound shift, propelled by the ongoing integration of Generative AI. Forecasts indicate that AI-driven trading systems will evolve to unprecedented levels of sophistication, empowering traders to make rapid, precise decisions and seize lucrative market opportunities with heightened efficiency.

As Generative AI technology advances, it promises to revolutionize the trading landscape by unlocking insights from vast datasets and uncovering nuanced patterns previously inaccessible to human traders. With the capacity to analyze complex market dynamics and anticipate future trends, AI-powered trading platforms will enable traders to stay ahead of the curve and adapt swiftly to evolving market conditions.

Innovations in Online Trading Platforms Using Generative AI

Online trading platforms are continuously innovating to incorporate Generative AI into their systems. By developing AI-driven tools for market analysis, risk management, and trade execution, these platforms can enhance users’ trading experience and drive growth in the online trading industry.

Conclusion

Generative AI is reshaping online trading by revolutionizing how traders analyze market trends, generate trading strategies, and manage risks. As AI technology continues to evolve, the future of online trading looks promising, with new opportunities for growth, innovation, and profitability. Embracing Generative AI is essential for traders looking to stay ahead of the curve and succeed in today’s dynamic trading environment.

Ready to elevate your AI skills to new heights? Join the GenAI Pinnacle Program and revolutionize your AI learning and development journey. Benefit from personalized 1:1 mentorship with experts who dive deep into an advanced curriculum with over 200 hours of immersive learning. Mastering over 26 cutting-edge GenAI tools and libraries. Don’t miss this opportunity to become a leader in the AI landscape. Enroll now and unlock your full potential in artificial intelligence!

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.analyticsvidhya.com/blog/2024/03/the-perfect-duo-impact-of-generative-ai-on-online-trading/

- :has

- :is

- :not

- $UP

- 00

- 1

- 14

- 200

- 2022

- 2023

- 2030

- 26

- 29

- 49

- 4th

- 50

- 87

- a

- About

- access

- accessibility

- accuracy

- achievements

- across

- activities

- acumen

- adani

- adapt

- adaptability

- Additionally

- adherence

- adopted

- Adoption

- advanced

- advancement

- advances

- advancing

- Advertising

- ahead

- AI

- AI models

- AI-powered

- Aiming

- Alan

- algorithmic

- algorithmic trading

- algorithms

- aligning

- alike

- All

- Allowing

- allows

- also

- america

- amounts

- an

- analysis

- Analytical

- analytics

- analyze

- analyzes

- and

- annual

- answers

- anticipate

- any

- applications

- approach

- approaches

- ARE

- article

- articulate

- artificial

- artificial intelligence

- Artificial intelligence (AI)

- Arts

- AS

- ask

- assessment

- Assets

- assist

- Assistance

- assistants

- associated

- At

- attention

- Aurora

- automate

- Automated

- Automated Trading

- automates

- automatically

- automating

- Automation

- autonomous

- Backtesting

- based

- BCG

- become

- been

- behavior

- benefit

- benefits

- bespoke

- Better

- biases

- Billion

- Bitcoin

- boasting

- bolstering

- bolsters

- both

- bots

- brokers

- BTC

- business

- but

- button

- Buying

- by

- CAGR

- CAN

- Can Get

- capabilities

- Capacity

- capitalization

- capitalizing

- careful

- Cash

- cash flow

- cater

- caters

- Chainlink

- chainlink (link)

- challenges

- Chart

- chat

- chatbots

- click

- clicking

- clients

- climb

- community

- company

- competitive

- competitiveness

- complementary

- complex

- complexities

- compliance

- Compound

- comprehensive

- concept

- Concerns

- conditions

- conducting

- consistency

- consistent

- content

- continues

- continuously

- could

- craft

- crafted

- create

- Creating

- creation

- criteria

- crucial

- cryptocurrencies

- Curriculum

- curve

- customer

- Customer satisfaction

- customized

- cutting-edge

- cutting-edge technology

- daily

- dashboard

- data

- data analysis

- data privacy

- datasets

- Decision Making

- decisions

- dedicated

- deep

- deploy

- detailed

- detecting

- develop

- developing

- Development

- Devin

- distinct

- dive

- diverse

- do

- Doge

- Dogecoin

- Dogecoin (DOGE)

- Dont

- doors

- download

- drive

- duo

- duration

- during

- dynamic

- dynamics

- easily

- Economic

- economic indicators

- Edge

- Education

- effectively

- effectiveness

- efficiency

- efficient

- efficiently

- effortlessly

- ELEVATE

- embracing

- emergence

- emerging

- employing

- empowering

- empowers

- enable

- enables

- enabling

- engagement

- engineer

- enhance

- enhanced

- Enhances

- enhancing

- enroll

- ensure

- entering

- Environment

- environments

- Era

- error

- essence

- essential

- established

- etc

- ETH

- ethereum

- ethereum (ETH)

- evade

- evaluating

- ever-changing

- evolution

- evolve

- evolved

- evolving

- execute

- execution

- expected

- expedites

- experience

- Experiences

- experts

- explores

- extraordinary

- extreme

- facilitates

- facilitating

- factors

- Feature

- Features

- Fed

- Filing

- filter

- financial

- financial data

- Financial institutions

- Financial Instruments

- Financial sector

- Find

- finds

- flow

- fluctuations

- Focus

- For

- Forecast

- forecasts

- foremost

- forex

- Forex Trading

- fostering

- fosters

- fraud

- fraudulent

- from

- Frontiers

- fueled

- full

- fully

- function

- fundamental

- future

- Gain

- game

- Gemini

- genai

- generate

- generating

- generation

- generative

- Generative AI

- get

- Give

- given

- gmail

- Go

- Goals

- grounded

- Growth

- guidance

- hand

- Have

- healthcare

- hearing

- heightened

- heights

- Held

- help

- heralds

- here

- High

- historical

- histories

- HOURS

- How

- HTTPS

- human

- ID

- ideas

- Identification

- identify

- identifying

- immersive

- immersive learning

- Impact

- implementation

- implementing

- improving

- in

- in-depth

- inaccessible

- include

- Including

- incorporate

- incorporates

- indicate

- Indicators

- indispensable

- individual

- Individually

- industry

- influence

- information

- informed

- innovating

- Innovation

- innovative

- insights

- instance

- institutions

- instruments

- Integrates

- Integrating

- integration

- Intelligence

- Intelligent

- interested

- Internet

- into

- intriguing

- introduced

- Introduction

- intuitive

- Inu

- investment

- investment goals

- investment opportunities

- investment recommendations

- Investment strategy

- Investopedia

- issues

- IT

- ITS

- January

- join

- journey

- jpg

- just

- landscape

- language

- large

- launch

- leader

- learning

- levels

- leverages

- leveraging

- libraries

- Library

- like

- limitations

- LINK

- Litecoin

- Litecoin (LTC)

- Long

- looking

- LOOKS

- losses

- LTC

- lucrative

- machine

- machine learning

- machinery

- made

- maintain

- major

- make

- manage

- management

- Management Tools

- manually

- many

- Market

- Market Analysis

- Market Capitalization

- market conditions

- market crashes

- Market Data

- market opportunities

- Market Trends

- Marketing

- Markets

- Mastering

- mathematical

- max-width

- May..

- me

- means

- measures

- mechanisms

- Mentorship

- methods

- meticulously

- milieu

- minimize

- miss

- Mitigate

- mitigating

- mitigation

- model

- modeling

- models

- Monitor

- Month

- more

- Moreover

- movements

- multiple

- narrow

- nascent

- navigating

- necessitates

- Need

- needing

- needs

- New

- news

- Nifty

- nonetheless

- North

- north america

- notable

- notably

- novel

- novices

- now

- nuanced

- numerous

- numerous benefits

- Nutshell

- of

- offer

- Offerings

- Offers

- often

- on

- ONE

- ongoing

- online

- only

- open

- opens

- opportunities

- Opportunity

- optimization

- Optimize

- Options

- or

- Other

- out

- over

- overall

- overcoming

- parameters

- Pattern

- patterns

- perception

- perfect

- performance

- period

- Personalized

- photo

- pinnacle

- Plain

- platform

- Platforms

- plato

- Plato Data Intelligence

- PlatoData

- portfolio

- portfolio management

- portfolios

- portion

- poses

- possess

- potential

- powerful

- practices

- precise

- precisely

- Predictions

- predictive

- Predictive Analytics

- preferences

- Prepare

- presents

- previously

- price

- Price Fluctuations

- pricing

- prioritizing

- privacy

- process

- processes

- processing

- professionals

- profitability

- profound

- progression

- promises

- promising

- promptly

- propelled

- prospects

- provided

- provides

- providing

- Q3

- queries

- rapid

- Rate

- reached

- Read

- real-time

- real-time data

- recent

- recognition

- recognizing

- recommendations

- reducing

- refer

- referencing

- refers

- refine

- Regardless

- regulatory

- Regulatory Compliance

- relevant

- reliance

- relies

- rely

- remarkable

- renders

- report

- Reports

- representing

- research

- reshaping

- Resistance

- Resources

- retail

- reuse

- revolutionize

- revolutionizes

- Revolutionizing

- right

- Risk

- risk assessment

- risk factors

- risk management

- risks

- robust

- Role

- rules

- satisfaction

- Save

- scenarios

- screening

- scrutiny

- Search

- seasoned

- SEC

- Section

- sector

- Sectors

- security

- security measures

- Seize

- select

- selecting

- Selling

- set

- several

- SHIB

- Shiba

- Shiba Inu

- Shiba Inu (SHIB)

- shift

- showcasing

- shown

- sign

- signals

- significant

- significantly

- signing

- Similarly

- simplicity

- simulate

- skilled

- skills

- So

- Software

- Software Engineer

- solution

- Solutions

- sophisticated

- sophistication

- Source

- spanning

- specific

- Spending

- stages

- staggering

- standout

- stay

- staying

- stock

- stock market

- stock trading

- Stocks

- store

- strategies

- Strategy

- streamlines

- strides

- subtle

- succeed

- successful

- such

- support

- Supports

- surpassing

- swiftly

- synergy

- synthetic

- synthetic data

- Systems

- tailored

- tasks

- Technical

- techniques

- Technology

- Tesla

- test

- that

- The

- The Future

- the information

- The Source

- their

- Them

- thereby

- These

- this

- thorough

- Through

- time

- times

- to

- today

- today’s

- tool

- tools

- trade

- Traders

- trades

- Trading

- Trading Platform

- Trading Platforms

- Trading Strategies

- TradingView

- traditional

- transformative

- Trend

- Trends

- two

- uncover

- undergoing

- underscore

- understand

- unlock

- unlocked

- unlocking

- unprecedented

- Uploading

- USD

- use

- useful

- User

- users

- using

- Valuation

- Valuations

- value

- various

- varying

- Vast

- View

- volume

- vs

- ways

- we

- Website

- What

- What is

- which

- while

- WHO

- widespread

- will

- with

- within

- without

- world’s

- yet

- you

- Your

- zephyrnet