Web3 gaming has come a long way since CryptoKitties exploded onto the scene and almost crippled Ethereum back in 2017. And yet for all the advances in scalability and gameplay since that first major bull run, most native crypto game tokens still lack utility, their value deriving purely from market speculation.

This is something gaming firms must tackle to make the most of opportunities in today’s bull cycle.

Web3 Games Need Greater Token Utility

Precious few games, web3 or otherwise, have stood the test of time, a consequence of gamer fatigue, the constant conveyor belt of new releases, and the failure of developers to keep concepts fresh.

Single-game tokens that have no utility beyond one release, therefore, face an uphill battle for relevance, their popularity (and that of the game) oscillating according to the whims of traders/players and the ability of devs to deliver value.

What is the solution to this lack of sustainability? In simple terms, increased utility. Gaming tokens must be imbued with greater powers, sufficient to ensure their health even if the buzz generated by a single-hit game dies down. This can mean that they do more within a game, but also that they do more outside of it.

Imagine, for example, that a series of games were released under the Marvel Cinematic Universe (MCU) franchise, and its corresponding $CMU token could be used by players in Captain America, Iron Man, The Avengers, Black Panther, Spider-Man, Ant-Man and Black Widow. Even if one or two of these games bombed, the token would maintain its worth due to the success of the other titles and the value conferred by its multitudinous use cases.

A decline in the fortunes of game tokens more generally, meanwhile, would not dent the popularity of the MCU gaming world itself, ensuring continued interest in the utility token.

The web3 gaming landscape does not have its own version of the Marvel Cinematic Universe, of course. But the idea of a multi-utility ‘studio token’ is certainly coming to the fore.

The antithesis of the unsustainable, volatile and sometimes useless game token, examples of which aren’t difficult to find, studio tokens have practical applications beyond the confines of a single game, making them more equipped to store long-term value.

Studio Tokens in the Wild

Perhaps the best example of a studio token is $OAS, the native token of eco-friendly gaming blockchain Oasys. The $OAS token plays a vital role in the ecosystem: gas fees are denominated in it, game developers must deposit $OAS when creating their own Verse (a Layer-2 blockchain anchored to the Oasys mainnet or Hub Layer), and micropayments in all Oasys-based games are paid in $OAS.

As well as functioning as the core currency of the Oasys ecosystem, $OAS also grants holders governance powers as the platform transitions into a DAO, meaning they can have a say on key proposals and treasury allocations. Moreover, $OAS tokens generate staking rewards as an incentive for long-term holding and ecosystem support.

$OAS, it should be said, isn’t the only token in the Oasys ecosystem. Individual Verses can have their own, and some will undoubtedly prove more successful than others. These assets (vFT/vNFTs) can only be minted and used on Verse-Layers, though. While there are interoperable tokens that can also be minted on the Hub-Layer and used throughout the Verse-Layer (oFT/oNFTs), they have less utility than $OAS.

The $OAS token has been climbing in value since last October and its price recently hit an all-time high (ATH) amid a number of major developments. These included partnerships with leading South Korean video game giants Kakao Games and Com2uS, as well as Pacific Meta, a company that delivers marketing services to web3 ventures in the Japanese and East Asian markets. Indeed, Oasys’ focus on Asia nourishes confidence in the project more generally given the size of the market in gaming terms.

Azarus is another example of a web3 platform that follows the studio token approach. A browser extension that enables users to play games during livestreams and spend their winnings in its integrated store, Azarus’ token, AzaCoin ($AZA), is not tied to the fortunes of any one game.

AzaCoin holders also get various perks, such as the ability to vote on-stream, stake, receive early access to livestreams and make governance decisions. Brands, meanwhile, can drop $AZA directly to viewers as a reward, sponsor games to gain visibility, and earn the token by listing items (such as NFTs) in the marketplace.

With a recent report suggesting the blockchain gaming market could be worth $614 billion by the end of the decade, projects like Oasys and Azarus favoring a multi-utility token model seem to be in a better position than publishers who pin all their hopes on that one moonshot game. While the market will continue attracting degens hellbent on finding said moonshot token, the stability of studio tokens ensure their success regardless of market conditions.

Link: https://www.analyticsinsight.net/token-utility-will-determine-success-of-web3-gaming-companies-in-cryptos-latest-bull-cycle/?utm_source=pocket_saves

Source: https://www.analyticsinsight.net

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.fintechnews.org/token-utility-will-determine-success-of-web3-gaming-companies/

- :has

- :is

- :not

- 2017

- a

- ability

- access

- According

- advances

- All

- allocations

- almost

- also

- america

- Amid

- an

- anchored

- and

- Another

- any

- applications

- approach

- ARE

- AS

- asia

- asian

- Assets

- ATH

- attracting

- Azarus

- back

- Battle

- BE

- been

- BEST

- Better

- better position

- Beyond

- Billion

- Black

- blockchain

- blockchain gaming

- brands

- browser

- bull

- Bull Run

- but

- by

- CAN

- cases

- certainly

- cinematic

- Climbing

- Com2Us

- come

- coming

- Companies

- company

- concepts

- conditions

- conferred

- confidence

- consequence

- constant

- continue

- continued

- Core

- Corresponding

- could

- course

- Creating

- crypto

- Cryptokitties

- Currency

- cycle

- DAO

- decade

- decisions

- Decline

- degens

- deliver

- delivers

- Denominated

- deposit

- deriving

- Determine

- developers

- developments

- Devs

- difficult

- directly

- do

- does

- down

- Drop

- due

- during

- Early

- earn

- East

- Eco-friendly

- ecosystem

- enables

- end

- ensure

- ensuring

- equipped

- ethereum

- Even

- example

- examples

- extension

- external

- Face

- Failure

- fatigue

- favoring

- Fees

- few

- Find

- finding

- firms

- First

- Focus

- follows

- For

- fore

- fortunes

- Franchise

- fresh

- from

- functioning

- Gain

- game

- gameplay

- Games

- gaming

- gaming market

- GAS

- gas fees

- generally

- generate

- generated

- get

- giants

- given

- governance

- grants

- greater

- Have

- Health

- Hit

- holders

- holding

- hopes

- HTTPS

- Hub

- idea

- if

- in

- Incentive

- included

- increased

- indeed

- individual

- integrated

- interest

- interoperable

- into

- iron man

- IT

- items

- ITS

- itself

- Japanese

- jpg

- Kakao

- Keep

- Key

- Korean

- Lack

- landscape

- Last

- layer

- leading

- less

- like

- listing

- Long

- long-term

- mainnet

- maintain

- major

- make

- Making

- man

- Market

- market conditions

- Marketing

- marketplace

- Markets

- marvel

- max-width

- MCU

- mean

- meaning

- Meanwhile

- Meta

- micropayments

- minted

- model

- MoonShot

- more

- Moreover

- most

- multi-utility

- must

- native

- Native Token

- Need

- New

- NFTs

- no

- number

- OASYS

- october

- of

- on

- ONE

- only

- onto

- opportunities

- or

- Other

- Others

- otherwise

- outside

- own

- Pacific

- paid

- partnerships

- perks

- PIN

- platform

- plato

- Plato Data Intelligence

- PlatoData

- Play

- players

- plays

- popularity

- position

- powers

- Practical

- Practical Applications

- price

- project

- projects

- Proposals

- Prove

- publishers

- purely

- receive

- recently

- Regardless

- release

- released

- Releases

- relevance

- Reward

- Rewards

- Role

- Run

- Said

- say

- Scalability

- scene

- seem

- Series

- Services

- should

- Simple

- since

- single

- solution

- some

- something

- sometimes

- South

- south korean

- speculation

- spend

- sponsor

- Sponsored

- Stability

- stake

- Staking

- Staking Rewards

- Still

- stood

- store

- studio

- success

- successful

- such

- sufficient

- support

- Sustainability

- tackle

- terms

- test

- than

- that

- The

- The Buzz

- their

- Them

- There.

- therefore

- These

- they

- this

- though?

- throughout

- Tied

- time

- titles

- to

- today’s

- token

- Token Utility

- Tokens

- transitions

- treasury

- two

- ugc

- under

- undoubtedly

- Universe

- unsustainable

- use

- used

- useless

- users

- utility

- Utility Token

- value

- various

- Ventures

- Verse

- version

- Video

- video game

- viewers

- visibility

- vital

- volatile

- Vote

- Way..

- Web3

- web3 gaming

- WELL

- were

- when

- which

- while

- WHO

- will

- winnings

- with

- within

- world

- worth

- would

- yet

- zephyrnet

More from Fintech News

Merchants fight back as AI, Big Data offer unprecedented cyber defenses

Source Node: 1068349

Time Stamp: Sep 4, 2021

The Worldwide EMS and ODM Industry is Expected to Reach $958.6 Billion by 2026 – ResearchAndMarkets.com

Source Node: 1583605

Time Stamp: Jan 14, 2022

NewHomesMate Expands to Atlanta, Connecting Buyers With the City’s Growing Stock of New Homes

Source Node: 2355569

Time Stamp: Oct 29, 2023

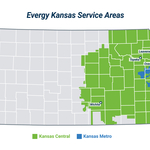

Evergy reaches unanimous settlement with parties to Kansas rate case

Source Node: 2299744

Time Stamp: Sep 29, 2023

Nanowear Announces FDA 510(k) Clearance for AI-enabled Continuous Blood Pressure Monitoring and Hypertension Diagnostic Management: SimpleSense-BP

Source Node: 2429750

Time Stamp: Jan 5, 2024

Twitter to add Bitcoin investing in partnership with eToro

Source Node: 2057219

Time Stamp: Apr 14, 2023

What’s Ahead for Cryptocurrencies and DeFi? The Future of Financial Inclusion

Source Node: 1975685

Time Stamp: Feb 23, 2023

Global Edge Data Center Market to 2027 – Size, Share & Industry Trends Analysis Report – ResearchAndMarkets.com

Source Node: 1437205

Time Stamp: Jun 17, 2022

Somalytics Closes Seed Funding Round, Attracts Additional Investors

Source Node: 1645483

Time Stamp: Aug 30, 2022