“`html

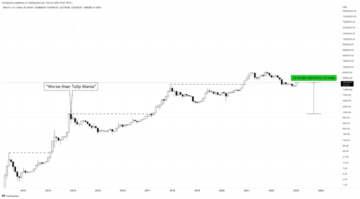

(Bloomberg) — Indications from the options market suggest that cryptocurrency enthusiasts are setting their sights on an unprecedented peak for Bitcoin, following its surge past the $50,000 mark—a two-year apex attained earlier in the week.

Top Stories from Bloomberg

At Deribit, the preeminent crypto options trading platform, there’s a noticeable uptick in the open interest for call options with expiration dates of March 29 at strike prices of $60,000, $65,000, and $75,000. The record-high Bitcoin valuation of approximately $69,000 was established back in November 2021.

Interest in these call options persists despite Bitcoin’s break in its most consistent winning run in the past year, a streak that was interrupted when prices exceeded $50,000 on Monday. According to traders, Tuesday’s minor retreat was likely caused by speculators pausing to collect gains after a solid week of progressive climbs.

“There’s a trend in the overall options market leaning towards the anticipation of sustained progress in the months ahead,” mentions Vetle Lunde, a lead analyst at K33 Research. “Recently, we’re seeing that a considerable volume of the market is favoring bullish trends, with significant activity around calls that are notably above the current price levels.”

Even though call options with a strike price at $50,000 maintain the majority of open interest as we approach the end of March, it’s noteworthy that calls significantly outstrip puts in terms of the premium they command, remarks Lunde.

Call options are essentially contracts offering buyers the choice to purchase the underlying assets at a predetermined rate within a specified timeframe.

“Trades executed in the 75K-100K strike range might actually reflect more of a wager on the recalibration of longer-term implied volatility as opposed to a straightforward directional bet. However, having said that, these call options inherently capitalize on an upsurge in both value and volatility,” explains DeFi analyst Chris Newhouse from Cumberland Labs.

Experts point to possible rate decreases and the anticipated Bitcoin halving event as key catalysts that might fuel a rise in Bitcoin valuation.

“The options market is certainly abuzz with speculation, as evidenced by the funding rates on perpetual exchanges that show little to no major short interest to counterbalance by purchasing calls. Thus, it appears the demand for calls is primarily a wager on directional movement and volatility,” adds Newhouse.

Top Reads from Bloomberg Businessweek

©2024 Bloomberg L.P.

“`

#Bitcoin #Options #Show #Traders #Setting #Sights #Record #High

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://cryptoinfonet.com/crypto-trading/traders-target-fresh-peak-as-bitcoin-options-signal-potential-for-new-record-high/

- :is

- ][p

- 000

- 2021

- 29

- a

- above

- According

- activity

- actually

- Adds

- After

- ahead

- an

- analyst

- and

- Anticipated

- anticipation

- Apex

- appears

- approach

- approximately

- ARE

- around

- AS

- Assets

- At

- attained

- back

- Bet

- Bitcoin

- Bitcoin halving

- bitcoin options

- Bitcoin Valuation

- Bloomberg

- both

- Break

- Bullish

- buyers

- by

- call

- Calls

- capitalize

- catalysts

- caused

- certainly

- choice

- Chris

- collect

- considerable

- consistent

- continue

- continues

- contracts

- crypto

- cryptocurrency

- CryptoInfonet

- Current

- Dates

- decreases

- DeFi

- Demand

- deribit

- Despite

- Earlier

- Elm

- end

- enthusiasts

- essentially

- established

- Event

- evidenced

- exceeded

- Exchanges

- executed

- expiration

- Explains

- finance

- following

- For

- fresh

- from

- Fuel

- funding

- funding rates

- Gains

- Halving

- having

- High

- However

- HTML

- HTTPS

- implied

- in

- indications

- inherently

- interest

- interrupted

- IT

- ITS

- Key

- Labs

- lead

- levels

- likely

- LINK

- little

- maintain

- major

- Majority

- March

- Market

- mentions

- might

- minor

- Monday

- months

- more

- most

- movement

- Navigation

- New

- no

- notably

- noteworthy

- noticeable

- November

- November 2021

- of

- offering

- on

- open

- open interest

- opposed

- Options

- Options Trading

- overall

- past

- pausing

- Peak

- Perpetual

- persists

- platform

- plato

- Plato Data Intelligence

- PlatoData

- Point

- possible

- potential

- preeminent

- Premium

- price

- Prices

- primarily

- Progress

- progressive

- purchase

- purchasing

- Puts

- range

- Rate

- Rates

- Reading

- record

- reflect

- research

- Retreat

- Rise

- Run

- Said

- seeing

- setting

- Short

- show

- Sights

- Signal

- significant

- significantly

- solid

- specified

- speculation

- Stories

- Story

- straightforward

- strike

- suggest

- surge

- surge past

- sustained

- Target

- terms

- that

- The

- their

- These

- they

- though?

- Thus

- timeframe

- to

- towards

- Traders

- Trading

- Trading Platform

- Trend

- Trends

- underlying

- unprecedented

- Valuation

- value

- Vetle Lunde

- Volatility

- volume

- was

- we

- week

- when

- winning

- with

- within

- Yahoo

- year

- zephyrnet