- The CHF is the second-best performing major currency against the USD based on a one-month rolling basis.

- The recent four weeks of up move of USD/CHF has flashed out bullish exhaustion conditions that advocate the potential continuation of its medium-term impulsive down move.

- 0.8800/8830 is the key resistance zone to watch on the USD/CHF.

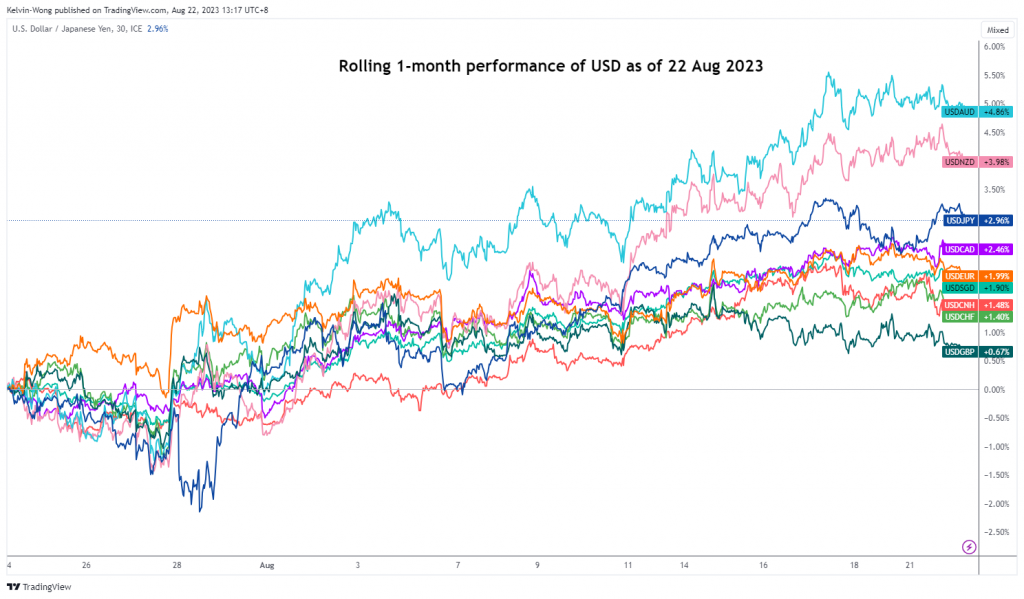

In the past four weeks, the Swiss Franc (CHF) is the second best-performing major currency against the USD where the CHF just depreciated by -1.40% with the GBP that has come in the first place (-0.67% against the USD) based on a one-month rolling calculation as of 22 August 2023 at this time of the writing.

Fig 1: Rolling 1-month performance of USD against major currencies as of 22 August 2023 (Source: TradingView, click to enlarge chart)

In the lens of technical analysis, the rally of +269 pips that was seen on the USD/CHF from its 27 July 2023 low of 0.8553 to the recent 21 August 2023 high of 0.8828 is likely to be a corrective rebound within a medium-term downtrend that is still intact since its 8 March 2023 due to the emergence of several bullish exhaustion elements.

Daily bearish candlestick emerged right at descending channel resistance

Fig 2: USD/CHF medium-term trend as of 22 Aug 2023 (Source: TradingView, click to enlarge chart)

Yesterday’s price action of USD/CHF has staged a bearish reaction right at the upper boundary of the medium-term descending channel that coincides with the downward-sloping 50-day moving average with both acting as a confluence of resistance at 0.8830.

Started to evolve into a minor downtrend

Fig 3: USD/CHF minor short-term trend as of 22 Aug 2023 (Source: TradingView, click to enlarge chart)

Since its 21 August 2023 high of 0.8828, the price actions of USD/CHF have started to oscillate into a minor downtrend in a series of “lower highs and lower lows”.

Watch the 0.8800 key short-term pivotal resistance a break below 0.8755 near-term support (also the 20-day moving average) exposing the next support at 0.8700 (minor swing lows of 4/10 August 2023) in the first step.

On the flip side, a clearance above 0.8800 negates the bearish tone to set sight again on the 0.8830 medium-term resistance.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- ChartPrime. Elevate your Trading Game with ChartPrime. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://www.marketpulse.com/forex/usd-chf-technical-potential-continuation-of-medium-term-downtrend/kwong

- :has

- :is

- :not

- :where

- $UP

- 1

- 15 years

- 15%

- 2023

- 22

- 27

- 700

- 8

- a

- About

- above

- access

- acting

- Action

- actions

- addition

- advice

- advocate

- affiliates

- again

- against

- also

- an

- analysis

- and

- any

- ARE

- around

- AS

- At

- Aug

- AUGUST

- author

- authors

- avatar

- average

- award

- based

- basis

- BE

- bearish

- below

- both

- Box

- Break

- Bullish

- business

- buy

- by

- Channel

- Chart

- chf

- clearance

- click

- COM

- combination

- come

- Commodities

- conditions

- conducted

- Connecting

- contact

- content

- continuation

- courses

- currencies

- Currency

- Directors

- down

- due

- elements

- Elliott

- emerged

- emergence

- enlarge

- Ether (ETH)

- evolve

- exchange

- experience

- expert

- financial

- Find

- First

- Flip

- flow

- For

- foreign

- foreign exchange

- forex

- found

- four

- Franc

- from

- fund

- fundamental

- GBP

- General

- Global

- global markets

- Have

- High

- Highs

- HTTPS

- if

- impulsive

- in

- Inc.

- Indices

- information

- into

- investment

- IT

- ITS

- July

- just

- Kelvin

- Key

- key resistance

- Last

- Lens

- levels

- like

- likely

- Low

- lower

- Lows

- Macro

- major

- major currency

- March

- Market

- market outlook

- market research

- MarketPulse

- Markets

- max-width

- minor

- more

- move

- moving

- moving average

- necessarily

- news

- next

- numerous

- of

- officers

- on

- one-month

- only

- Opinions

- or

- out

- Outlook

- over

- passionate

- past

- performance

- performing

- perspectives

- photo

- pivotal

- Place

- plato

- Plato Data Intelligence

- PlatoData

- please

- positioning

- Posts

- potential

- price

- PRICE ACTION

- Produced

- providing

- purposes

- rally

- reaction

- rebound

- recent

- research

- Resistance

- retail

- Reversal

- right

- Rolling

- rss

- Second

- Securities

- seen

- sell

- senior

- Series

- service

- Services

- set

- several

- sharing

- short-term

- side

- Sight

- since

- Singapore

- site

- solution

- Source

- specializing

- started

- Step

- Still

- stock

- Stock markets

- Strategist

- support

- Swing

- Swiss

- Technical

- Technical Analysis

- ten

- that

- The

- this

- thousands

- time

- to

- TONE

- Traders

- Trading

- TradingView

- Training

- Trend

- unique

- us

- USD

- USD/CHF

- using

- v1

- Visit

- was

- Watch

- Wave

- Weeks

- WELL

- winning

- with

- within

- wong

- would

- writing

- years

- you

- zephyrnet