- The USD/JPY pair has risen well past the $152 level.

- Safe-haven demand for the dollar rose after Iran attacked Israel over the weekend.

- Investors are now monitoring the $155 level for a possible intervention.

The USD/JPY outlook is strongly bullish as the greenback soars after expectations for Fed rate cuts dwindle and the demand for safe-haven assets grows. Investors continued scaling back rate-cut bets after last week’s inflation report. At the same time, Middle East tensions added safe-haven demand for the dollar.

-Are you looking for the best AI Trading Brokers? Check our detailed guide-

The USD/JPY pair has risen well past the $152 level, raising concerns that Japanese authorities will intervene. The rally started when investors realized the Fed would delay rate cuts until September. Last week’s CPI report significantly boosted the dollar and Treasury yields. As a result, the yen weakened.

Notably, Japan’s Finance Minister Shunichi Suzuki said they were ready to act to stop further declines in the yen. Consequently, investors are now monitoring the $155 level as the line in the sand.

Furthermore, data on sales will show whether consumer spending in the US has increased. Another positive report will likely send the USD/JPY pair higher.

Meanwhile, safe-haven demand for the dollar rose after Iran attacked Israel over the weekend. This could mean an escalation of the war into Iran, which has raised concerns in the market. In times of geopolitical uncertainty, investors scramble for safety in safe-haven assets. However, Iran’s attack on Israel caused minor damage. Moreover, Iran has said it has concluded the matter with Israel.

USD/JPY key events today

- US core retail sales

- Empire State Manufacturing Index

- US retail sales

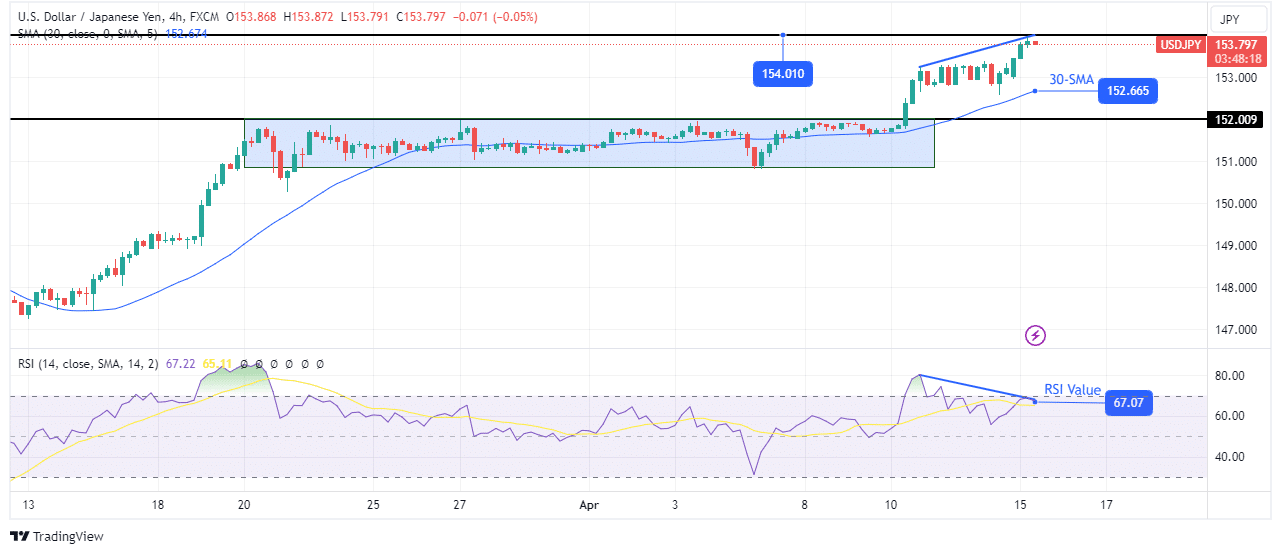

USD/JPY technical outlook: RSI divergence

On the charts, the USD/JPY price has broken out of its tight consolidation, signaling a continuation of the previous bullish trend. The price now sits well above the 30-SMA, and the RSI is nearly overbought. Bulls will likely soon hit the 154.01 resistance level.

-Are you looking for the best MT5 Brokers? Check our detailed guide-

However, the recent surge shows weaker momentum as the RSI has made a bearish divergence. If it plays out, the price will retest or break below the 30-SMA to retest the 152.00 key level. A retest of the SMA could allow bulls to make another high. However, a break below the SMA would signal a shift in sentiment. Therefore, it would likely lead to lower prices.

Looking to trade forex now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/blog/2024/04/15/usd-jpy-outlook-dollar-shines-on-rate-cut-outlook/

- :has

- :is

- 00

- 01

- 1

- 152

- a

- above

- Accounts

- Act

- added

- afford

- After

- allow

- an

- and

- Another

- ARE

- AS

- Assets

- At

- attack

- attacked

- Authorities

- back

- bearish

- bearish divergence

- below

- BEST

- Bets

- Boosted

- Break

- Broken

- Bullish

- Bulls

- CAN

- caused

- CFDs

- Charts

- check

- Concerns

- concluded

- Consequently

- Consider

- consolidation

- consumer

- continuation

- continued

- Core

- could

- CPI

- Cut

- cuts

- damage

- data

- Declines

- delay

- Demand

- detailed

- Divergence

- Dollar

- East

- escalation

- events

- expectations

- Fed

- finance

- FINANCE MINISTER

- Finance Minister Shunichi Suzuki

- For

- forex

- further

- geopolitical

- Greenback

- Grows

- High

- higher

- Hit

- However

- HTTPS

- if

- in

- increased

- inflation

- intervene

- intervention

- into

- Invest

- investor

- Investors

- Iran

- Israel

- IT

- ITS

- Japan’s

- Japanese

- Key

- Last

- lead

- Level

- likely

- Line

- looking

- lose

- losing

- lower

- made

- make

- manufacturing

- Market

- Matter

- max-width

- mean

- Middle

- Middle East

- minister

- minor

- Momentum

- money

- monitoring

- Moreover

- nearly

- now

- of

- on

- or

- our

- out

- Outlook

- over

- pair

- past

- plato

- Plato Data Intelligence

- PlatoData

- plays

- positive

- possible

- previous

- price

- Prices

- provider

- raised

- raising

- rally

- Rate

- ready

- realized

- recent

- report

- Resistance

- result

- retail

- Risen

- Risk

- ROSE

- rsi

- Safety

- Said

- sales

- same

- SAND

- scaling

- send

- sentiment

- September

- shift

- shines

- should

- show

- Shows

- Signal

- significantly

- sits

- SMA

- Soars

- Soon

- Spending

- started

- State

- Stop

- strongly

- surge

- Take

- Technical

- tensions

- that

- The

- the Fed

- therefore

- they

- this

- time

- times

- to

- trade

- Trading

- treasury

- Treasury yields

- Trend

- Uncertainty

- until

- us

- USD/JPY

- war

- weaker

- weekend

- WELL

- were

- when

- whether

- which

- will

- with

- would

- Yen

- yields

- you

- Your

- zephyrnet