- The current sideways movement is seen as a bullish formation.

- The upper median line (uml) stands as an important upside target.

- The US data should bring high action today.

The USD/JPY price is trading at 148.02 at the time of writing and looks overbought in the short term. After the recent rally, the pair may correct lower amid profit-taking.

–Are you interested to learn more about scalping brokers? Check our detailed guide-

The price edged higher yesterday as the Chicago PMI, Pending Home Sales, and Unemployment Claims came in better than expected, while Core PCE Price Index, Personal Income, and Personal Spending aligned with expectations.

Today, the price retreated a little as the Japanese Unemployment Rate came in at 2.5% versus 2.6% expected, Final Manufacturing PMI was reported higher at 48.3 points versus 48.1 points forecasted, while Capital Spending matched expectations.

Later, the US data should move the market. The ISM Manufacturing PMI is expected to jump from 46.7 points to 47.9 points, Final Manufacturing PMI could remain steady at 49.4 points, ISM Manufacturing Prices could jump to 46.1 points, while Construction Spending may announce a 0.4% growth again. In addition, the Fed Chair Powell’s speeches and the US Wards Total Vehicle Sales should have an impact.

USD/JPY Price Technical Analysis: Leg Higher

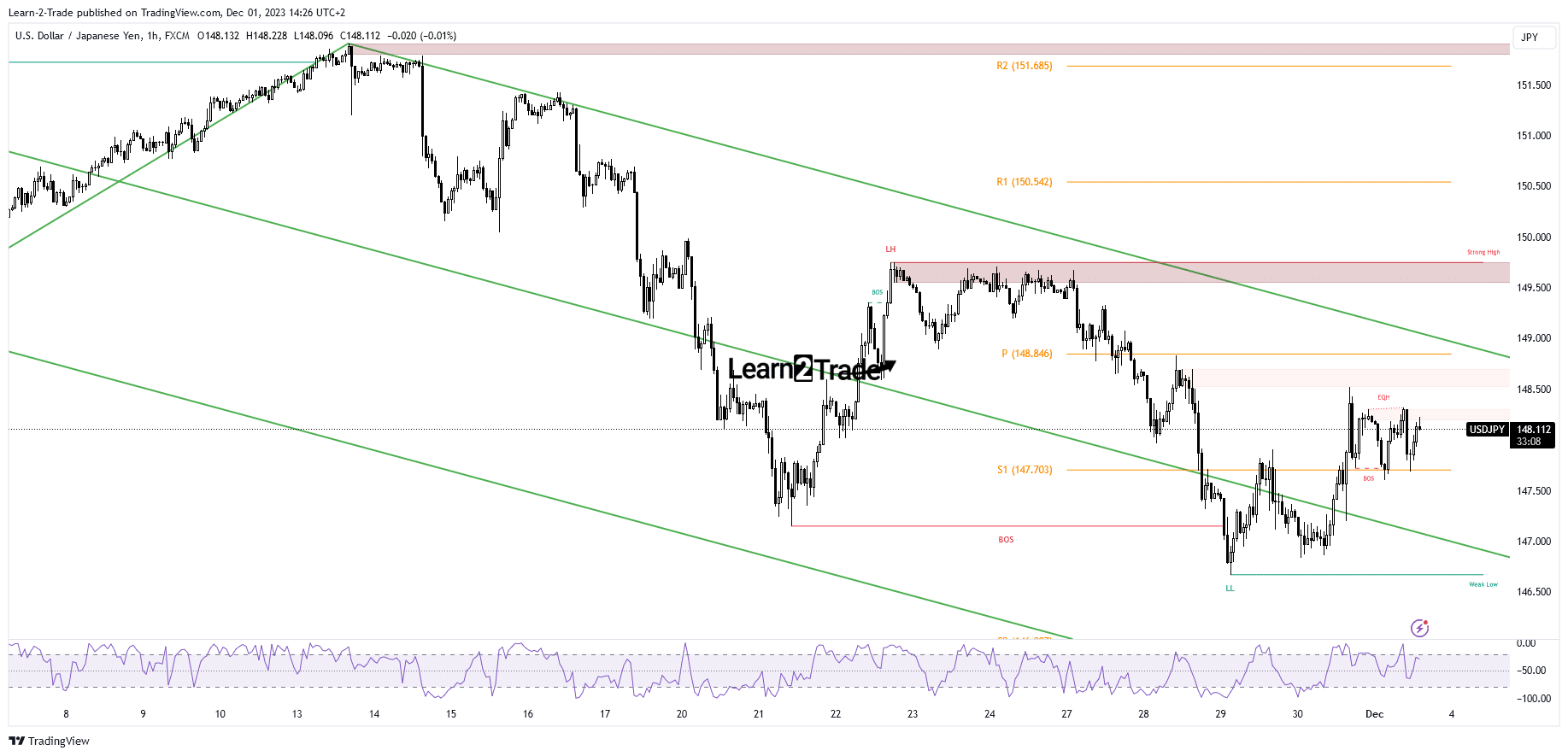

Technically, the USD/JPY price moves sideways, above the weekly S1 of 147.70, trying to accumulate more bullish energy before jumping higher. The current range could represent an accumulation, a bullish continuation pattern.

–Are you interested to learn about forex robots? Check our detailed guide-

Still, only making a new higher high activates more gains ahead. The descending pitchfork’s upper median line represents the next major upside target. This stands as a dynamic resistance.

A larger growth could be activated only after taking out this upside obstacle. I believe the upside continuation could be invalidated only if the rate makes a new lower low, if it drops and closes below the S1.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/blog/2023/12/01/usd-jpy-price-accumulating-bullish-energy-ahead-of-us-ism/

- :is

- 1

- 46

- 49

- 7

- 70

- 9

- a

- above

- Accounts

- Accumulate

- accumulation

- Action

- activated

- addition

- afford

- After

- again

- ahead

- aligned

- Amid

- an

- analysis

- and

- Announce

- AS

- At

- BE

- before

- believe

- below

- Better

- bring

- Bullish

- came

- CAN

- capital

- CFDs

- Chair

- check

- chicago

- Chicago PMI

- claims

- Closes

- Consider

- construction

- continuation

- Core

- correct

- could

- Current

- data

- detailed

- Drops

- dynamic

- energy

- expectations

- expected

- Fed

- Fed Chair

- final

- forex

- formation

- from

- Gains

- Growth

- Have

- High

- higher

- Home

- HTTPS

- i

- if

- Impact

- important

- in

- Income

- index

- interested

- Invest

- investor

- IT

- Japanese

- jump

- larger

- LEARN

- Line

- little

- LOOKS

- lose

- losing

- Low

- lower

- major

- MAKES

- Making

- manufacturing

- Market

- matched

- max-width

- May..

- money

- more

- move

- movement

- moves

- New

- next

- now

- obstacle

- of

- only

- our

- out

- pair

- Pattern

- pce

- pending

- personal

- plato

- Plato Data Intelligence

- PlatoData

- pmi

- points

- Powell’s

- price

- Prices

- provider

- rally

- range

- Rate

- recent

- remain

- Reported

- represent

- represents

- Resistance

- retail

- Risk

- sales

- Scalping

- seen

- Short

- should

- sideways

- speeches

- Spending

- stands

- steady

- Take

- taking

- Target

- Technical

- Technical Analysis

- term

- than

- The

- the Fed

- The Weekly

- this

- time

- to

- today

- Total

- trade

- Trading

- trying

- unemployment

- unemployment rate

- Upside

- us

- USD/JPY

- vehicle

- Versus

- was

- weekly

- when

- whether

- while

- with

- writing

- yesterday

- you

- Your

- zephyrnet