Crypto loans without collateral are gradually becoming a major part of the crypto lending industry.

Crypto loans encompass various lending arrangements involving cryptocurrencies as assets. Commonly, this is where people borrow against crypto collateral in order to receive either fiat, stablecoins, or another cryptocurrency.

Conversely, crypto loans can also involve individuals using fiat currency as collateral to obtain cryptocurrencies in return. When borrowers pledge their crypto assets as collateral for a loan, it is commonly known as a crypto-backed loan.

There are plenty of questions, such as, “can you get a crypto loan without collateral?” Let’s find out!

First of all, crypto loans without collateral operate differently. In these cases, individuals receive cryptocurrencies without the need to provide any collateral as security. These loans are often referred to as non-collateralized loans.

To make a long story short, borrowers acquire cryptocurrency with the understanding that they are obliged to return the borrowed asset without any assets being held as collateral by the lending provider during the lending process.

Interesting facts about crypto loans

Crypto loans without collateral play a crucial role in providing liquidity to the cryptocurrency market. They allow traders, investors, and businesses to access funds quickly without the time-consuming process of providing collateral, which is common in traditional lending.

Arbitrage opportunities: Traders can use unsecured crypto loans to exploit arbitrage opportunities across different cryptocurrency exchanges. They can borrow funds, conduct trades, and repay the loan, taking advantage of price discrepancies to make a profit.

Economic inclusion: These loans have the potential to promote economic inclusion by enabling individuals who lack traditional assets to access financing. People from underserved regions or with limited financial resources can participate in DeFi ecosystems and access funds for various purposes.

DeFi ecosystem growth: Unsecured crypto loans are a vital component of the DeFi ecosystem, contributing to its rapid growth. They enhance the utility and versatility of DeFi platforms, attracting more users and capital to the space.

Advantages of crypto loans without collateral

Let’s focus on the advantages of crypto loans without collateral.

Accessibility: The most significant advantage of unsecured crypto loans is their accessibility. They democratize access to financing by allowing anyone with an internet connection to borrow funds, regardless of their location or financial background.

Speed: Traditional loan processes can be time-consuming and involve extensive paperwork. Crypto loans without collateral are typically processed quickly because they rely on smart contracts. Borrowers can access funds within minutes, making them ideal for time-sensitive opportunities.

No collateral risk: Borrowers don’t risk losing collateral assets in the event of default, as there is no collateral involved. This reduces the fear of asset forfeiture, a common concern in traditional lending.

Global reach: These loans aren’t constrained by geographical boundaries. Borrowers and lenders from around the world can participate in the DeFi ecosystem, contributing to its global nature.

Cost-efficiency: The absence of collateral reduces the costs associated with loan origination and management. This often translates into lower interest rates and fees for borrowers compared to traditional loans.

Disadvantages of crypto loans without collateral

We also need to analyze the disadvantages.

High interest rates: One of the primary disadvantages of unsecured crypto loans is the relatively high interest rates. Lenders charge higher rates to compensate for the increased risk of default, as there is no collateral to fall back on.

Risk of default: Borrowers aren’t required to provide collateral, which means lenders have limited recourse in the event of default. This risk can lead to significant losses for lenders.

Volatility risk: Cryptocurrencies are known for their price volatility. Borrowers may face challenges in repaying loans if the value of the borrowed cryptocurrency significantly depreciates during the loan term.

Smart contract vulnerabilities: Unsecured crypto loans rely on smart contracts to execute and enforce loan agreements. Vulnerabilities in these contracts can lead to unexpected outcomes, including the loss of funds for borrowers or lenders.

Regulatory uncertainty: The regulatory environment for DeFi and crypto lending is still evolving. Borrowers and lenders may face legal and regulatory risks as governments and authorities implement new rules and regulations.

Lack of consumer protection: Unlike traditional loans, unsecured crypto loans may not offer the same level of consumer protection. Borrowers may have limited recourse in cases of disputes or fraudulent activities.

Crypto flash loans

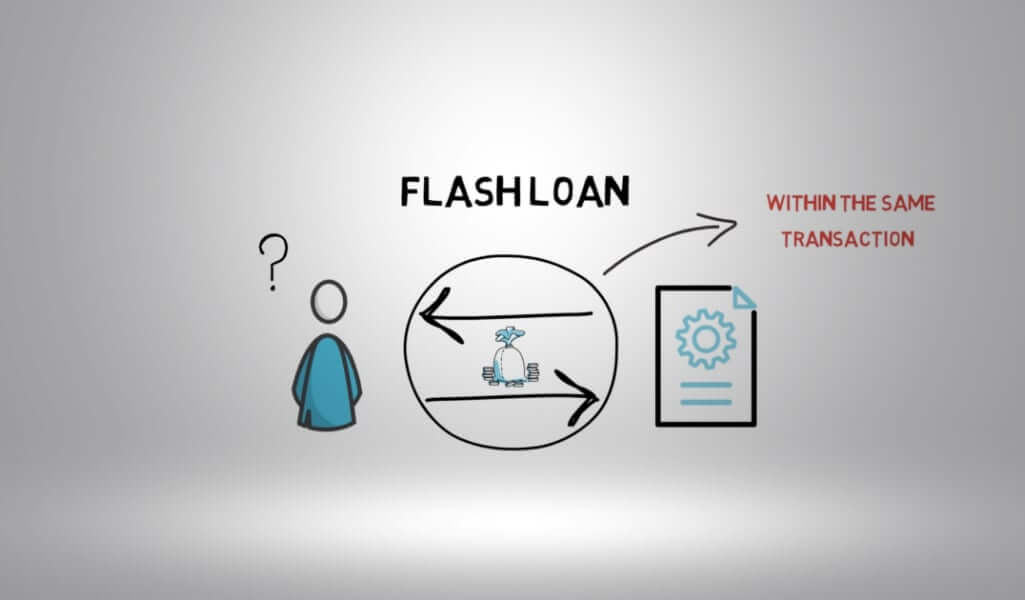

Flash loans are one of the most common forms of crypto loans that allow borrowers to access funds temporarily for specific arbitrage or trading strategies.

These loans provide borrowers with the unique opportunity to obtain a significant amount of cryptocurrency and immediately use those borrowed funds to execute a transaction or a sequence of transactions. However, there’s a crucial caveat: the borrowed assets must be returned to their original location within the same blockchain block.

What are crypto flash loans exactly?

To provide a comprehensive answer to the question “what are crypto flash loans?” it’s crucial to delve into how they operate. A user initiates a smart contract to borrow a specified amount of cryptocurrency.

Subsequently, they configure the contract to immediately send the borrowed asset, usually to a cryptocurrency exchange. Afterward, the user leverages this asset for investments, generating profits, which are subsequently sent back to the smart contract to repay the borrowed amount or its equivalent value.

This intricate process comprises multiple transactions; in the conventional sense, they must all occur within one blockchain block, forming a unified blockchain transaction.

If these series of transactions result in a profit, the borrower retains the profits. Conversely, if the process encounters any losses or fails to complete successfully, all the transactions are nullified, and the borrowed asset is returned to its original source.

Consequently, the lender is shielded from potential losses, ensuring their capital remains secure. In successful transactions, the lender recovers their principal, and the borrower retains their profits, illustrating the potential for borrowers to reap substantial gains while safeguarding the lender from losses.

It is evident that this intricate process relies extensively on blockchain technology and is most viable in a decentralized setting. Flash loans serve primarily as a tool for investment, tailored to capitalize on brief and highly time-sensitive opportunities that exist for only fleeting moments.

Arbitrage trading and flash loans

One notable use case for flash loans is arbitrage trading, where individuals aim to identify price discrepancies between assets on different cryptocurrency exchanges, promptly exploiting these variations. The swift execution of arbitrage opportunities aligns perfectly with the nature of flash loans, as both are highly time-critical operations.

In summary, crypto flash loans constitute a distinctive and technologically advanced financial instrument within the realm of DeFi. They empower users to access substantial amounts of cryptocurrency without collateral, enabling them to engage in precise and rapid investment strategies, such as arbitrage trading.

These loans are specialized and cater to a specific spectrum of financial activities, differing significantly from conventional loans due to their unique structure and time-sensitive nature.

Other examples

Peer-to-peer (P2P) lending: Some DeFi platforms facilitate P2P lending without collateral. Borrowers and lenders can interact directly on these platforms to negotiate loan terms and interest rates.

Stablecoin loans: Stablecoin lending platforms offer unsecured loans denominated in stablecoins like USDC or DAI. Borrowers don’t need to provide collateral but must repay the borrowed stablecoins with interest.

On-chain credit scoring: Some DeFi protocols use on-chain data and algorithms to assess borrowers’ creditworthiness, allowing them to access unsecured loans based on their transaction history and other factors.

The importance of over-collateralization

Crypto loans often require over-collateralization, which means borrowers must provide collateral worth more than the loan amount they seek. This practice is prevalent in the cryptocurrency lending space for several reasons:

Volatility mitigation: Cryptocurrencies are highly volatile assets. To mitigate the risk of collateral value plummeting during the loan term, lenders often require borrowers to over-collateralize. If the collateral’s value drops significantly, it provides a buffer, allowing lenders to liquidate the assets and recoup the loan amount along with any interest or fees.

Default risk: Over-collateralization reduces the risk of default. If the borrower fails to repay the loan, the lender can seize the collateral, which is typically worth more than the loan principal. This ensures that lenders can cover the loan, even if the borrower defaults.

In conclusion, crypto loans without collateral represent a significant innovation in the world of finance, offering accessibility, speed, and flexibility to borrowers. They play a crucial role in the DeFi ecosystem by providing liquidity and enabling various financial activities, such as trading, investing, and economic inclusion.

However, they aren’t without their challenges, including higher interest rates, default risk, and regulatory uncertainty.

As the DeFi space continues to evolve, it is essential for borrowers and lenders to carefully consider the advantages and disadvantages of unsecured crypto loans and make informed decisions based on their financial goals and risk tolerance. Additionally, ongoing regulatory developments will play a crucial role in shaping the future of this emerging financial sector.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.financebrokerage.com/crypto-loans-without-collateral/

- :is

- :not

- :where

- a

- About

- About Crypto

- access

- accessibility

- acquire

- across

- activities

- Additionally

- advanced

- ADvantage

- advantages

- against

- agreements

- aim

- algorithms

- Aligns

- All

- allow

- Allowing

- along

- also

- amount

- amounts

- an

- analyze

- and

- Another

- answer

- any

- anyone

- arbitrage

- arbitrage opportunities

- ARE

- around

- arrangements

- AS

- assess

- asset

- Assets

- associated

- attracting

- Authorities

- back

- background

- based

- BE

- because

- becoming

- being

- between

- Block

- blockchain

- blockchain technology

- borrow

- borrow funds

- borrowed

- borrower

- borrowers

- both

- boundaries

- buffer

- businesses

- but

- by

- CAN

- capital

- capitalize

- carefully

- case

- cases

- cater

- challenges

- charge

- Collateral

- Common

- commonly

- compared

- complete

- component

- comprehensive

- comprises

- Concern

- conclusion

- Conduct

- connection

- Consider

- constitute

- constrained

- consumer

- Consumer Protection

- continues

- contract

- contracts

- contributing

- conventional

- conversely

- Costs

- cover

- credit

- creditworthiness

- crucial

- crypto

- Crypto collateral

- Crypto Lending

- Crypto Loan

- crypto loans

- crypto-assets

- cryptocurrencies

- cryptocurrency

- Cryptocurrency Exchange

- Cryptocurrency Exchanges

- Cryptocurrency Lending

- cryptocurrency market

- Currency

- DAI

- data

- decentralized

- decisions

- Default

- defaults

- DeFi

- DeFi ecosystem

- DeFi ecosystems

- defi platforms

- DeFi protocols

- delve

- democratize

- Denominated

- developments

- different

- differing

- directly

- disputes

- distinctive

- does

- Dont

- Drops

- due

- during

- Economic

- ecosystem

- Ecosystems

- either

- emerging

- empower

- enabling

- encompass

- enforce

- engage

- enhance

- ensures

- ensuring

- Environment

- Equivalent

- essential

- Ether (ETH)

- Even

- Event

- evident

- evolve

- evolving

- exactly

- exchange

- Exchanges

- execute

- execution

- exist

- Exploit

- exploiting

- extensive

- extensively

- Face

- facilitate

- factors

- facts

- fails

- Fall

- fear

- Fees

- Fiat

- Fiat currency

- finance

- financial

- financial goals

- Financial sector

- financing

- Find

- Flash

- flash loans

- Flexibility

- Focus

- For

- forfeiture

- forms

- fraudulent

- from

- funds

- future

- Gains

- generating

- geographical

- get

- Global

- Goals

- Governments

- gradually

- Growth

- Have

- Held

- High

- higher

- highly

- history

- How

- However

- HTTPS

- ideal

- identify

- if

- illustrating

- immediately

- implement

- importance

- in

- Including

- inclusion

- increased

- individuals

- industry

- informed

- Initiates

- Innovation

- instrument

- interact

- interest

- Interest Rates

- Internet

- internet connection

- into

- intricate

- investing

- investment

- Investments

- Investors

- involve

- involved

- involving

- IT

- ITS

- jpg

- known

- Lack

- lead

- Legal

- lender

- lenders

- lending

- Level

- leverages

- like

- Limited

- liquidate

- Liquidity

- loan

- Loans

- location

- Long

- losing

- loss

- losses

- lower

- major

- make

- Making

- management

- Market

- May..

- means

- minutes

- Mitigate

- model

- Moments

- more

- most

- Move-to-earn

- multiple

- must

- Nature

- Need

- New

- no

- notable

- obliged

- obtain

- occur

- of

- offer

- offering

- often

- on

- On-Chain

- on-chain data

- ONE

- ongoing

- only

- operate

- Operations

- opportunities

- Opportunity

- or

- order

- original

- origination

- Other

- outcomes

- over-collateralization

- p2p

- p2p lending

- paperwork

- part

- participate

- People

- perfectly

- Platforms

- plato

- Plato Data Intelligence

- PlatoData

- Play

- Pledge

- Plenty

- potential

- practice

- precise

- prevalent

- price

- primarily

- primary

- Principal

- process

- processed

- processes

- Profit

- profits

- promote

- protection

- protocols

- provide

- provider

- provides

- providing

- purposes

- question

- Questions

- quickly

- rapid

- Rates

- realm

- reasons

- receive

- Recovers

- reduces

- referred

- Regardless

- regions

- regulations

- regulatory

- relatively

- rely

- remains

- repay

- represent

- require

- required

- Resources

- result

- retains

- return

- Risk

- risks

- Role

- rules

- safeguarding

- same

- sector

- secure

- security

- Seek

- Seize

- send

- sense

- sent

- Sequence

- Series

- serve

- setting

- several

- shaping

- Short

- significant

- significantly

- smart

- smart contract

- Smart Contracts

- some

- Source

- Space

- specialized

- specific

- specified

- Spectrum

- speed

- stablecoin

- Stablecoins

- Still

- Story

- strategies

- structure

- Subsequently

- substantial

- successful

- Successfully

- such

- SUMMARY

- SWIFT

- tailored

- taking

- Technology

- term

- terms

- than

- that

- The

- The Future

- the world

- their

- Them

- There.

- These

- they

- this

- those

- time-consuming

- time-sensitive

- to

- tolerance

- tool

- Traders

- trades

- Trading

- Trading Strategies

- traditional

- transaction

- Transactions

- true

- typically

- Uncertainty

- underserved

- understanding

- Unexpected

- unified

- unique

- unlike

- unsecured

- USDC

- use

- use case

- User

- users

- using

- usually

- utility

- value

- variations

- various

- versatility

- viable

- vital

- volatile

- Volatility

- Vulnerabilities

- webp

- What

- when

- which

- while

- WHO

- will

- with

- within

- without

- world

- worth

- you

- zephyrnet