The concept of Purchase Order (PO) Flip has emerged as a transformative solution in financial operations, revolutionizing the way businesses handle their procurement and billing processes. By automating the conversion of purchase orders into invoices, PO Flip offers a seamless, error-reducing, and time-saving approach to managing transactions. This article delves into the world of PO Flips, exploring its workings, benefits, and its importance to modern businesses.

What is a PO Flip?

A PO Flip is an automated process that converts a purchase order (PO) into an invoice, which is then transmitted to the purchaser who issued the PO. This process is instantaneous, and hence the term ‘flip’. PO Flips allow suppliers to convert purchase orders into invoices quickly, saving time and reducing the risk of human error in the invoicing process.

What is a Purchase Order?

A purchase order stands at the heart of every procurement process, marking the formal commencement of a buyer-seller relationship. Think of it as the blueprint for a transaction, a document that sets the stage for subsequent business interactions. The document is more than just a list of items to be purchased; it’s a detailed proposal that encapsulates the buyer’s needs and expectations.

A well-crafted PO is exhaustive in its details. It includes the buyer’s contact information, ensuring clear communication channels are established right from the start. Shipping details are outlined, along

with clarity on logistical expectations like delivery locations and timelines. Also crucial to this document are the payment terms, which define the financial terms between the two parties, including payment schedules and conditions.

Vendor data in the PO serves as an essential reference, offering insights into the seller’s information and affirming the legitimacy of the transaction. The PO specifies the order information in great detail. This includes not just the products or services being purchased but also their prices, quantities, and any other critical specifications.

The specificity in a PO is not mere formality; it’s a critical component that ensures accuracy and alignment between buyer and seller expectations. This level of detail becomes particularly vital in a PO Flip process, where the quality and precision of information in the PO directly influences the accuracy and efficacy of the subsequent invoice generated from it.

How does a PO Flip work?

When a supplier fulfills an order detailed in a purchase order, they typically need to generate an invoice reflecting the actual delivery. This process is usually fraught with manual effort and prone to errors.

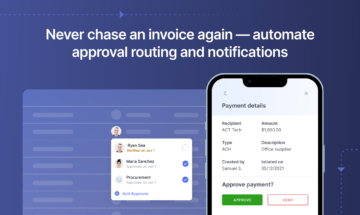

However, with a PO Flip, the conversion from purchase order to invoice is an automated, seamless process. Using automation software, each line item from the purchase order is electronically and accurately replicated onto an invoice. The system automatically populates relevant fields such as quantities delivered, product specifications, and pricing, ensuring that the invoice is a precise reflection of the original order.

This automated process brings a remarkable change in process efficiency. Where once invoicing could take days, or even weeks, with a PO Flip, it is accomplished in moments. The instantaneous nature of this process drastically cuts down the time from order fulfillment to invoice issuance, accelerating the entire payment cycle.

Furthermore, the PO Flip significantly reduces the margin for human error. Manual data entry, a frequent source of mistakes in traditional invoicing, is virtually eliminated. The precision of automated data transfer ensures that invoices are accurate reflections of terms agreed-upon in the purchase order, thus maintaining consistency and reliability in financial transactions.

The PO Flip also enhances transparency and ease of transaction for both buyers and sellers.

- For suppliers, the PO Flip means less time spent on administrative tasks like manual data entry and document-handling, and more focus on core business activities.

- For buyers, it results in quicker invoice processing and payment, streamlining the entire procurement process and facilitating better cash flow management.

In essence, the PO Flip is more than a technological tool; it is a transformative process that redefines the efficiency and accuracy of procurement and payment workflows. By automating the critical step of invoice generation, it opens the door to a more efficient, error-free, and expedited procurement process.

Key Components in a PO Flip

Each of these components plays a role in ensuring the PO Flip process is efficient, accurate, and seamless. By paying attention to these details, businesses can leverage PO Flip to enhance their procurement efficiency significantly:

- Procurement Software for Data Collection and Flipping: This software acts as the backbone of the PO Flip process. It automates the conversion of purchase orders into invoices, ensuring accuracy and speed. The software’s ability to capture data accurately and perform the ‘flip’ is crucial for streamlining the entire procurement cycle.

- Buyer Contact Information: Having the buyer’s contact information readily available in the system ensures smooth communication throughout the procurement process. It facilitates timely updates, queries, and clarifications, thereby avoiding misunderstandings or delays.

- Shipping Details: Accurate shipping details are essential for ensuring that the delivery meets the buyer’s logistical requirements. This includes the destination address, preferred shipping method, and expected delivery dates, all of which are vital for synchronizing the supply chain.

- Clearly Defined Payment Terms: Payment terms detail the financial agreement between the buyer and seller. This covers aspects such as payment deadlines, acceptable payment methods, and any potential late fees. Clearly defining these terms in the PO helps avoid financial disputes and facilitates smoother transaction processing.

- Comprehensive Vendor Data: Having complete vendor information, including the company name, address, tax identification, and contact details, ensures that the invoice generated is fully compliant and can be processed without legal or procedural hitches.

- Detailed Order Information: This includes specifics of the products or services ordered, such as descriptions, prices, quantities, and any other special requirements. Detailed order information is crucial for ensuring that the invoice accurately reflects what was agreed upon in the purchase order, thereby preventing discrepancies and potential disputes.

Benefits of a PO Flip

Transitioning to using PO Flips to manage purchase orders and invoices offers several benefits, such as:

- Streamlined Three-Way Matching Process: PO Flip revolutionizes the traditional three-way matching process, where invoices, goods receipts, and purchase requisitions are manually compared for accuracy. For instance, consider a scenario where a business orders 100 units of a product. With PO Flip, once the goods are received and the invoice is generated, the system automatically verifies that the quantity delivered matches the quantity ordered, enhancing accuracy and preventing fraud.

- Reduction in Manual Data Entry Errors: Manual entry of data from POs to invoices is prone to errors like mistyping or misinterpretation of information. PO Flip automates this data transfer, thereby significantly reducing such errors. For example, if a PO specifies a specific product model number, the PO Flip system ensures this exact detail is replicated in the invoice, eliminating any chance of manual error.

- Timely Payments of Supplier Invoices: By expediting the invoice generation process, PO Flip ensures that suppliers receive their payments faster. In a typical procurement cycle without PO Flip, it might take days to generate an invoice after delivery. With PO Flip, this process is instantaneous, enabling quicker invoice processing and payment, thereby improving supplier relationships.

- Opportunity for Early Payment Discounts: Many suppliers offer discounts for early payments as an incentive. With the PO Flip, the time between goods delivery and invoice generation is significantly shortened. This efficiency allows businesses to capitalize on these discounts, leading to cost savings. For example, a supplier might offer a 2% discount for payments made within ten days; PO Flip can help businesses consistently meet such early payment terms.

- Prevention of Duplicate Invoicing and Invoice Fraud: PO Flip also serves as a powerful tool against invoice fraud and duplications. Since invoices are generated directly from the purchase orders, there’s a single source of truth, reducing the chances of duplicate or fraudulent invoices being processed. For instance, if a fraudulent entity attempts to submit an invoice for goods never ordered, the PO Flip system would immediately flag this discrepancy, as there would be no corresponding purchase order.

When should businesses use a PO Flip?

The PO Flip applies whenever there are purchase orders that regularly need to be converted to invoices efficiently. More specifically, they might be useful in some of the should contemplate implementing PO Flip in several scenarios:

- High Volume of Transactions: Companies processing a large number of purchase orders and invoices are prime candidates for PO Flip. In such environments, the time and effort saved by automating the conversion of POs to invoices can be substantial.

- Businesses Seeking Enhanced Efficiency: Organizations looking to streamline their procurement processes can greatly benefit from PO Flip. For example, a manufacturing company dealing with numerous parts suppliers can reduce the time between order placement and payment, thus ensuring a smoother supply chain operation.

- Error Reduction Goals: If a business frequently encounters errors in its invoicing process due to manual data entry, PO Flip can be a game-changer. It significantly reduces human errors, ensuring that the invoices precisely match the original purchase orders.

- Speeding Up Payment Processes: Companies that aim to expedite their payment cycles to improve cash flow and maintain healthy supplier relationships will find PO Flip particularly useful. Faster invoice processing directly translates to quicker payments.

- Managing Complex Procurement Processes: Businesses with intricate procurement processes involving various goods and services can leverage PO Flip for better organization and accuracy in their transactions.

Several tools and software solutions are available for implementing PO Flips, such as Ariba Network by SAP. This platform is one of the most widely used, and it provides a dynamic and user-friendly interface where businesses can easily convert their purchase orders into invoices. For example, a retailer can utilize Ariba Network to manage its vast network of suppliers, ensuring that invoices are generated and processed efficiently.

Besides Ariba Network, there are various other such digital tools available that facilitate the PO Flip process. These tools offer features like automatic data capture, electronic invoice generation, and integration with existing financial systems.

Some businesses may opt for customizable solutions that can be tailored to fit their specific needs. These solutions can be particularly beneficial for companies with unique procurement processes or those operating in specialized industries.

When selecting a tool for PO Flip, it’s important to consider its ability to integrate with the existing procurement and financial systems of the organization. Seamless integration ensures a smooth workflow and minimizes the need for manual intervention.

In summary, the decision to use PO Flip and the selection of appropriate tools should be based on a business’s specific needs, the volume of transactions, and the complexity of their procurement processes. The right implementation not only streamlines operations but also contributes to better financial management and supplier relations.

Conclusion

The PO Flip represents a significant leap in procurement efficiency and accuracy. By automating the conversion of purchase orders into invoices, it not only saves time but also enhances the accuracy and reliability of the invoicing process. With the ability to streamline operations, reduce errors, and expedite payments, PO Flip is an invaluable tool for modern businesses looking to optimize their procurement processes. As technology continues to evolve, adopting such innovations is key to staying competitive and efficient in today’s dynamic business landscape.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://nanonets.com/blog/what-are-po-flips/

- :has

- :is

- :not

- :where

- $UP

- 100

- 2%

- a

- ability

- accelerating

- acceptable

- accomplished

- accuracy

- accurate

- accurately

- activities

- acts

- actual

- address

- administrative

- Adopting

- After

- against

- agreed

- Agreement

- aim

- alignment

- All

- allow

- allows

- also

- an

- and

- any

- applies

- approach

- appropriate

- ARE

- article

- AS

- aspects

- At

- Attempts

- attention

- Automated

- automates

- Automatic

- automatically

- automating

- Automation

- available

- avoid

- avoiding

- Backbone

- based

- BE

- becomes

- being

- beneficial

- benefit

- benefits

- Better

- between

- billing

- blueprint

- both

- Brings

- business

- businesses

- but

- BUYER..

- buyers

- by

- CAN

- candidates

- capitalize

- capture

- Cash

- cash flow

- chain

- Chance

- chances

- change

- channels

- clarity

- clear

- clearly

- collection

- commencement

- Communication

- Companies

- company

- compared

- competitive

- complete

- complex

- complexity

- compliant

- component

- components

- concept

- conclusion

- conditions

- Consider

- consistently

- contact

- contact details

- continues

- contributes

- Conversion

- convert

- converted

- Core

- Corresponding

- Cost

- cost savings

- could

- covers

- critical

- crucial

- cuts

- cycle

- cycles

- data

- data entry

- Dates

- Days

- dealing

- decision

- define

- defined

- defining

- delays

- delivered

- delivery

- destination

- detail

- detailed

- details

- digital

- directly

- Discount

- discounts

- discrepancy

- disputes

- document

- does

- Door

- down

- drastically

- due

- dynamic

- each

- Early

- ease

- easily

- efficacy

- efficiency

- efficient

- efficiently

- effort

- Electronic

- electronically

- eliminated

- eliminating

- emerged

- enabling

- encapsulates

- enhance

- enhanced

- Enhances

- enhancing

- ensures

- ensuring

- Entire

- entity

- entry

- environments

- error

- Errors

- essence

- essential

- established

- Even

- Every

- evolve

- example

- existing

- expectations

- expected

- expedite

- Exploring

- facilitate

- facilitates

- facilitating

- faster

- Features

- Fees

- Fields

- financial

- financial management

- financial systems

- Find

- fit

- Flip

- Flips

- flow

- Focus

- For

- formal

- fraud

- fraudulent

- frequent

- frequently

- from

- fulfillment

- fully

- game-changer

- generate

- generated

- generation

- goods

- great

- greatly

- handle

- having

- healthy

- Heart

- help

- helps

- hence

- How

- HTTPS

- human

- Identification

- if

- immediately

- implementation

- implementing

- importance

- important

- improve

- improving

- in

- Incentive

- includes

- Including

- industries

- information

- innovations

- insights

- instance

- integrate

- integration

- interactions

- Interface

- intervention

- into

- intricate

- invaluable

- invoice

- invoice processing

- invoices

- invoicing

- involving

- issuance

- Issued

- IT

- items

- ITS

- just

- Key

- landscape

- large

- Late

- leading

- Leap

- Legal

- legitimacy

- less

- Level

- Leverage

- like

- Line

- List

- locations

- looking

- made

- maintain

- maintaining

- manage

- management

- managing

- manual

- manually

- manufacturing

- many

- Margin

- marking

- Match

- matches

- matching

- May..

- means

- Meet

- Meets

- mere

- method

- methods

- might

- minimizes

- mistakes

- model

- Modern

- Moments

- more

- more efficient

- most

- name

- Nature

- Need

- needs

- network

- never

- no

- number

- numerous

- of

- offer

- offering

- Offers

- on

- once

- ONE

- only

- onto

- opens

- operating

- operation

- Operations

- Optimize

- or

- order

- orders

- organization

- organizations

- original

- Other

- outlined

- particularly

- parties

- parts

- paying

- payment

- payment methods

- payments

- perform

- placement

- platform

- plato

- Plato Data Intelligence

- PlatoData

- plays

- PO

- PoS

- potential

- powerful

- precise

- precisely

- Precision

- preferred

- preventing

- Prices

- pricing

- Prime

- procedural

- process

- processed

- processes

- processing

- procurement

- Product

- Products

- proposal

- provides

- purchase

- purchase order

- purchased

- purchaser

- quality

- quantity

- queries

- quicker

- quickly

- readily

- receipts

- receive

- received

- reduce

- reduces

- reducing

- reduction

- reference

- reflecting

- reflection

- Reflections

- reflects

- regularly

- relations

- relationship

- Relationships

- relevant

- reliability

- remarkable

- replicated

- represents

- Requirements

- Results

- retailer

- revolutionizes

- Revolutionizing

- right

- Risk

- Role

- s

- saved

- saving

- Savings

- scenario

- scenarios

- seamless

- seeking

- selecting

- selection

- Sellers

- serves

- Services

- Sets

- several

- Shipping

- shortened

- should

- significant

- significantly

- since

- single

- smooth

- smoother

- Software

- solution

- Solutions

- some

- Source

- special

- specialized

- specific

- specifically

- specifications

- specificity

- specifics

- speed

- spent

- Stage

- stands

- start

- staying

- Step

- streamline

- streamlining

- submit

- subsequent

- substantial

- such

- SUMMARY

- supplier

- suppliers

- supply

- supply chain

- system

- Systems

- tailored

- Take

- tasks

- tax

- technological

- Technology

- ten

- term

- terms

- than

- that

- The

- the world

- their

- then

- There.

- thereby

- These

- they

- Think

- this

- those

- throughout

- Thus

- time

- timelines

- timely

- to

- today

- tool

- tools

- traditional

- transaction

- Transactions

- transfer

- transformative

- Transparency

- truth

- two

- typical

- typically

- unique

- units

- Unsplash

- Updates

- upon

- use

- used

- useful

- user-friendly

- using

- usually

- utilize

- various

- Vast

- vendor

- virtually

- vital

- volume

- was

- Way..

- Weeks

- What

- whenever

- which

- WHO

- widely

- will

- with

- within

- without

- Work

- workflow

- workflows

- workings

- world

- would

- Your

- zephyrnet