Car-shoppers are largely satisfied with

subscription-based infotainment services, but value and exposure

matter most. Data security and privacy remain issues.

Want to create a social-media firestorm? Announce that popular

in-car features will require a subscription – on top of what people

already are paying for the vehicle. General Motors and BMW have

recently sparked controversy by announcing efforts to grow

subscription-based products and services in future vehicles – which

<span/>reportedly weren’t

greeted well by consumers.

But here’s the rub: The perceived outrage doesn’t match reality.

Once consumers experience connected services, they are

overwhelmingly satisfied and likely to resubscribe, according to a

recent global consumer survey of <span/>nearly 8,000 consumers conducted by

S&P Global Mobility.

“Consumers are welcoming to the idea of subscriptions, because

it gives them exposure to features or technology that they may not

have had in the past,” said Yanina Mills, senior technical research

analyst at S&P Global Mobility.

In a subset of about 4,500 respondents who had experienced a

free trial or an existing subscription on a model year 2016 vehicle

or newer, 82% said they would <span/>definitely or probably consider purchasing

subscription-based services on a future new vehicle purchase.

Exposure sells subscriptions

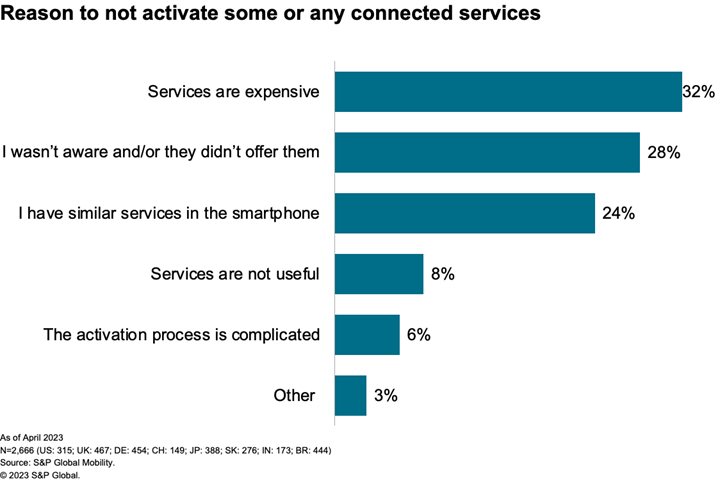

Fumbled introductions are one thing. Selling <span/>subscriptions in the

here and now is another. More than one in four respondents – 28% to

be exact – either did not know that connected services were

available, and/or noted the dealer did not offer (or even mention)

them. Improving education at point-of-sale is essential for

category growth.

In-vehicle exposure is even better than education for growing

demand and fostering satisfaction and retention with these services

and brands. 45% of respondents had the service activated at the

dealership, typically as part of a free trial period. That improves

the odds of growing subscribers. “It’s all a matter of exposure,”

Mills said.

<span/>That’s because,

once exposed, consumers are pretty happy with their connected

services subscriptions. <span/>The vast majority of previous-subscriber

respondents said they were likely to renew. Satisfaction is high as

well, as 85% of respondents would recommend their service to a

friend. Among individual brands, Audi Connect and BMW

ConnectedDrive consistently perform well, scoring high in most

global markets for the third survey year in a row.

So, how could OEMs do better in rolling out new connected ideas?

When it comes to subscription-based connected services, Mills says, “Marketing is everything. Implementation is everything.”

In GM’s case, they touted the benefits of their new infotainment

system, to be found in its next generation of EVs. According to the

automaker, GM wishes to “manage the overall in-vehicle experience

in a more holistic way.” A major goal is to “reduce complexity and

feature duplication,” eliminating the redundancy between native

onboard infotainment and the customer’s smartphone.

But that came with a big tradeoff: Getting rid of the Apple

CarPlay and Android Auto user interfaces. The media focused on that

detail, in terms of erasing any of the new infotainment system’s

advantages. <span/>After

all, these very popular smartphone mirroring apps come standard on

<span/>almost every new

vehicle today.

Fanni Li, connected car services research lead at S&P Global

Mobility, says that GM is quite aggressive in this area, but warns

that making the change could risk GM customer satisfaction. Also at

stake: GM’s desire to generate $20 to <span/>$25 billion yearly through subscription

services by 2030.

Subscriptions need to add value

So, how to get it right? Paid functional upgrades have been

available in the market for only about three years. Despite that

short <span/>timeframe,

more than half of respondents already want such an upgrade in their

next vehicle.

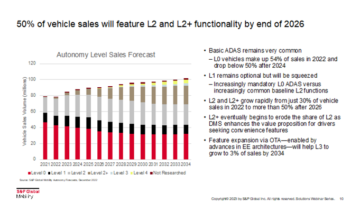

But not all subscription-based upgrades are created equal.

Enhanced navigation and advanced driver-assist system (ADAS)

functionality top the desirability list. “For a lot of those

features, when you buy them in full at the dealership, the initial

investment is overwhelming,” according to Mills. A subscription

brings their cost into reach.

As seen in previous S&P Global Mobility consumer surveys,

safety features prove very popular – although there are differences

in appeal by region. For instance, at a country level, Brazil

respondents have the lowest threshold for price points for paid

updates in all subscription schemes, while Japan respondents

reported the highest threshold for <span/>pricing they’d be willing to pay for the

same updates, closely followed by the UK.

But there are some pan-global trends worthy of note. Paid

upgrade safety features, such as high-beam assist and driving-video

recorder, earned the highest satisfaction – 89% – of all connected

services. Likewise, navigation and safety/security features were

the ones most desired in respondents’ next vehicles.

Less expensive comfort features, such as heated seats and a

heated steering wheel, prove less popular for subscriptions.

Compared to more novel and higher-priced technology features, these

less-expensive options have less perceived value when structured as

a subscription – especially when they have long been available as

standard on upper-trim models. As Mills notes, “When everything

becomes a subscription, it becomes overkill.”

Getting heated over seats

BMW may have crossed that line with their expansion of connected

services. Many observers boiled down the complex model- and

market-specific program to one common theme – surprisingly charging

owners to use heated seats that were already installed in their

cars.

S&P Global Mobility survey data suggests, however, that this

furor was a tempest in a teapot. Fewer than 30% of survey

respondents are willing to pay for heated seats or a heated

steering wheel by monthly subscription, anyway. Value-wise, these

features are <span/>relatively affordable to buy in a single

payment, reducing the need to spread out payments over a

subscription.

“The frequency of usage is an important factor,” Mills observed. “If you have a feature that you only use once or twice, you’re not

going to renew that feature.” Using heated seats or a heated

steering wheel is very climate-dependent, so usage can vary by

season.

Smartphone vs Native

While ADAS functionality or heated seats can’t be provided by

smartphones, many infotainment services are. And consumers are

accustomed to using their smartphone for navigation and

entertainment features – from maps to music to hands-free

texting.

As consumers pare down their subscriptions, features that are

redundant between the vehicle and the phone <span/>likely are the first to go – and the

smartphone <span/>almost

always wins. S&P Mobility found that Gen Z and Millennial

respondents are most likely to drop connected-services

subscriptions because of similar services on their smartphones.

GM’s elimination of Apple CarPlay and Android Auto takes the

smartphone out of the equation. This could improve their <span/>odds of gaining and

retaining subscriptions. But given that 89% of current

connected-services subscribers resubscribe anyway, the potential

modest increase in subscriptions isn’t the primary reason for GM

going native. GM sees an opportunity in consumer usage data.

“GM cannot get consumers’ usage data from the infotainment

system if users only connect via third party apps like Apple

CarPlay and Android Auto,” Li said. “Having this data on their own

will become one of the competitive advantages for OEMs.”

Privacy and Trust

But when it comes to vehicle data usage, Mills says, “It’s a

delicate balance for automakers.” While accessing consumer data

also improves features like EV-specific routing and range

estimates, consumers are concerned about data privacy. 37% of

respondents worry about security issues, while 32% fail to

understand the value that a connected service would provide from

the shared data.

Turns out the best way to win over consumers is to give them

something for free. 74% of respondents are willing to share data in

exchange for free services, with Gen Z and Millennials being the

most (80%) likely. Again, there are regional differences: Consumers

living in Japan are the most reluctant, with just 58% being willing

to share data for free services, whereas 90% of consumers in India

are willing to make that exchange.

But who do consumers trust with their data? OEMs are the most

trusted, with 31% of consumers feeling comfortable with them.

That’s higher than the trust level associated with technology

companies (23%). The difference in trust <span/>likely stems from how much data is

available to each respective entity. As Mills notes, for

automakers, “That amount of data is limited. It doesn’t go to the

depth of where your personal devices go.”

In other words, your smartphone apps already know far more about

you than your SUV <span/>likely ever will.

Subscription-based connected services provide great potential

for OEMs. High consumer satisfaction and renewal rates show that

buyers are willing to subscribe. But proper marketing and

implementation are essential for success, especially regarding

concerns of value and data privacy.

(Disclosure: The survey was in the field in March – well after BMW

had been involved in the heated-seat issue, but before GM had

announced its plans for a new native architecture designed around

offering connected car services)

SURVEY: ADVANCED DRIVER ASSISTANCE SYSTEMS

SURVEY: PREMIUM AUDIO ENTERS THE MASS MARKET

FOR MORE CONSUMER SURVEY INSIGHTS

LISTEN TO THE PODCAST ON THIS SUBJECT

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: http://www.spglobal.com/mobility/en/research-analysis/what-connectedcar-services-are-consumers-willing-to-pay-for.html

- :is

- :not

- :where

- ][p

- 000

- 2016

- 2030

- 500

- 8

- a

- About

- accessing

- According

- activated

- ADAs

- add

- advanced

- advantages

- affordable

- After

- again

- aggressive

- All

- already

- also

- Although

- always

- among

- amount

- an

- analyst

- and

- android

- Announce

- announced

- Announcing

- Another

- any

- anyway

- appeal

- Apple

- apps

- architecture

- ARE

- AREA

- around

- article

- AS

- assist

- Assistance

- associated

- At

- audi

- audio

- auto

- automakers

- available

- Balance

- BE

- because

- become

- becomes

- been

- before

- being

- benefits

- BEST

- Better

- between

- Big

- Billion

- BMW

- boiled

- brands

- Brazil

- Brings

- but

- buy

- buyers

- by

- came

- CAN

- cannot

- car

- cars

- case

- Category

- change

- charging

- closely

- come

- comes

- comfort

- comfortable

- Common

- Companies

- compared

- competitive

- complex

- complexity

- concerned

- Concerns

- conducted

- Connect

- connected

- connected car

- Consider

- consumer

- consumer data

- Consumers

- controversy

- Cost

- could

- country

- create

- created

- Crossed

- Current

- customer

- Customer satisfaction

- data

- data privacy

- data security

- data security and privacy

- dealer

- Demand

- depth

- designed

- desire

- desired

- Despite

- detail

- Devices

- DID

- difference

- differences

- disclosure

- Division

- do

- doesn

- down

- driver

- Drop

- each

- earned

- Education

- efforts

- either

- eliminating

- enhanced

- Enters

- Entertainment

- entity

- equal

- especially

- essential

- estimates

- Ether (ETH)

- Even

- EVER

- Every

- everything

- exchange

- existing

- expansion

- expensive

- experience

- experienced

- exposed

- Exposure

- factor

- FAIL

- far

- Feature

- Features

- fewer

- field

- First

- focused

- followed

- For

- fostering

- found

- four

- Free

- free trial

- Frequency

- friend

- from

- full

- functional

- functionality

- future

- gaining

- Gen

- Gen Z

- General

- General Motors

- generate

- generation

- get

- getting

- Give

- given

- gives

- Global

- global markets

- GM

- Go

- goal

- going

- great

- greeted

- Grow

- Growing

- Growth

- had

- Half

- happy

- Have

- having

- here

- High

- higher

- highest

- holistic

- How

- How To

- However

- HTML

- HTTPS

- idea

- ideas

- if

- implementation

- important

- improve

- improves

- improving

- in

- Increase

- india

- individual

- initial

- installed

- instance

- interfaces

- into

- introductions

- investment

- involved

- isn

- issue

- issues

- IT

- ITS

- Japan

- just

- Know

- largely

- lead

- less

- Level

- li

- like

- likely

- likewise

- Limited

- Line

- List

- living

- Long

- Lot

- lowest

- major

- Majority

- make

- Making

- manage

- managed

- many

- Maps

- March

- Market

- Marketing

- Markets

- Mass

- Match

- Matter

- May..

- Media

- mention

- Millennial

- Millennials

- mirroring

- mobility

- model

- models

- modest

- monthly

- monthly subscription

- more

- most

- Motors

- much

- Music

- native

- Navigation

- Need

- New

- newer

- next

- note

- noted

- Notes

- novel

- now

- observed

- Odds

- of

- offer

- offering

- on

- Onboard

- once

- ONE

- ones

- only

- Opportunity

- Options

- or

- Other

- out

- Outlook

- over

- overall

- overwhelmingly

- own

- owners

- paid

- part

- party

- past

- Pay

- paying

- payment

- payments

- People

- perceived

- perform

- period

- personal

- phone

- plans

- plato

- Plato Data Intelligence

- PlatoData

- podcast

- points

- Popular

- potential

- Premium

- pretty

- previous

- price

- primary

- privacy

- probably

- Products

- Products and Services

- Program

- proper

- protection

- Prove

- provide

- provided

- published

- purchase

- purchasing

- range

- Rates

- ratings

- RE

- reach

- Reality

- reason

- recent

- recently

- recommend

- reduce

- reducing

- regarding

- region

- regional

- remain

- Reported

- require

- research

- respective

- respondents

- retaining

- retention

- Rid

- right

- Risk

- Rolling

- routing

- ROW

- s

- S&P

- S&P Global

- Safety

- Said

- same

- satisfaction

- satisfied

- satisfied with

- says

- schemes

- scoring

- Season

- security

- seen

- sees

- Selling

- Sells

- senior

- separately

- service

- Services

- Share

- shared

- Short

- show

- similar

- single

- smartphone

- smartphones

- So

- some

- something

- sparked

- spread

- stake

- standard

- steering

- steering wheel

- stems

- structured

- subscribe

- subscribers

- subscription

- subscriptions

- success

- such

- Suggests

- Survey

- system

- takes

- Technical

- Technology

- terms

- texting

- than

- that

- The

- the UK

- their

- Them

- theme

- There.

- These

- they

- thing

- Third

- this

- those

- three

- threshold

- Through

- to

- today

- top

- touted

- Trends

- trial

- Trust

- trusted

- Twice

- typically

- Uk

- understand

- Updates

- upgrade

- upgrades

- Usage

- use

- User

- users

- using

- value

- Vast

- vehicle

- Vehicles

- very

- via

- vs

- want

- Warns

- was

- Way..

- welcoming

- WELL

- were

- weren

- What

- Wheel

- when

- whereas

- which

- while

- WHO

- will

- willing

- win

- Wins

- wishes

- with

- words

- worry

- would

- year

- yearly

- years

- you

- Your

- zephyrnet