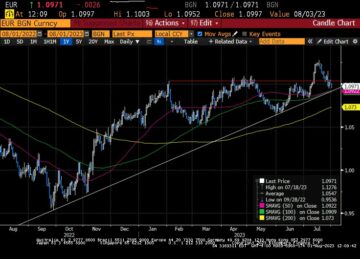

The euro is slightly lower on Wednesday. In the European session, EUR/USD is trading at 1.0685, down 0.16%.

German shows signs of optimism

Germany’s Ifo Business Climate index rose to 89.4 in April, up from a revised 87.9 in March and above the market estimate of 88.9. The index is still in negative territory (100 separates pessimism from optimism) but there are signs of optimism that the eurozone’s largest economy may have bottomed out.

The reading marked a third straight increase, which in the past has indicated that the German economy has turned a corner.

Business confidence is now at its highest level since May 2023, boosted by falling inflation and the expectation that the European Central Bank will soon cut interest rates. The German economy is by no means out of the woods yet but the improvement in business confidence is an encouraging sign.

Eurozone PMIs – services up, manufacturing down

Eurozone and German PMIs for April painted a mixed picture of economic activity, with services improving while manufacturing took a step backwards. The eurozone services PMI improved to 52.9, up from 51.5 in March and above the market estimate of 51.8. The manufacturing PMI fell from 46.1 to 45.6, shy of the market estimate of 46.5.

The German services PMI showed a return to growth after eight straight declines, climbing from 49.8 to 53.3, above the market estimate of 50.6. This is another sign of improvement in the German economy, although manufacturing remains mired in contraction.

Will ECB deliver a series of cuts?

The ECB has signaled that it will start to lower interest rates in June but what happens afterwards is less clear. ECB President Lagarde hasn’t stated what the central bank has planned after June. Some Governing Council members have been more upfront and said they support further cuts before the end of the year. Some members have said they are comfortable with three rate cuts this year but the markets aren’t sure that the ECB will be that aggressive and are no longer fully pricing in three rate cuts this year.

EUR / USD Tehnični

- Obstaja upor pri 1.0729 in 1.0757

- EUR/USD preizkuša podporo pri 1.0684. Spodaj je podpora pri 1.0656

Vsebina je samo za splošne informacije. To ni naložbeni nasvet ali rešitev za nakup ali prodajo vrednostnih papirjev. Mnenja so avtorji; ne nujno družbe OANDA Business Information & Services, Inc. ali katere koli njene podružnice, hčerinske družbe, uradnikov ali direktorjev. Če želite reproducirati ali ponovno distribuirati katero koli vsebino, ki jo najdete na MarketPulse, nagrajeni storitvi spletnega mesta z novicami in analizami forexa, blaga in globalnih indeksov, ki jo proizvaja OANDA Business Information & Services, Inc., dostopajte do vira RSS ali nas kontaktirajte na info@marketpulse.com. Obiščite https://www.marketpulse.com/ izvedeti več o utripu svetovnih trgov. © 2023 OANDA Business Information & Services Inc.

- Distribucija vsebine in PR s pomočjo SEO. Okrepite se še danes.

- PlatoData.Network Vertical Generative Ai. Opolnomočite se. Dostopite tukaj.

- PlatoAiStream. Web3 Intelligence. Razširjeno znanje. Dostopite tukaj.

- PlatoESG. Ogljik, CleanTech, Energija, Okolje, sončna energija, Ravnanje z odpadki. Dostopite tukaj.

- PlatoHealth. Obveščanje o biotehnologiji in kliničnih preskušanjih. Dostopite tukaj.

- vir: https://www.marketpulse.com/news-events/central-banks/euro-edges-lower-despite-stronger-german-business-confidence/kfisher

- :ima

- : je

- :ne

- $GOR

- 1

- 100

- 2012

- 2023

- 4

- 400

- 45

- 46

- 49

- 5

- 50

- 51

- 52

- 6

- 8

- 87

- 89

- 9

- a

- O meni

- nad

- dostop

- dejavnost

- nasveti

- podružnice

- po

- potem

- agresivni

- Alpha

- Čeprav

- an

- Analiza

- Analitik

- in

- Še ena

- kaj

- april

- SE

- At

- Avtor

- Avtorji

- Nagrada

- nazaj

- Banka

- BE

- premagati

- bilo

- pred

- spodaj

- Povečana

- Pasovi

- široka

- poslovni

- poslovno klimo

- vendar

- nakup

- by

- Osrednji

- Centralna banka

- jasno

- Podnebne

- Plezanje

- COM

- udobna

- komentar

- Blago

- zaupanje

- kontakt

- vsebina

- krčenje

- prispeva

- Kotiček

- Svet

- člani sveta

- prevleke

- Cut

- kosi

- vsak dan

- Pade

- poda

- Kljub

- Direktorji

- navzdol

- ECB

- Predsednik ECB

- Predsednica ECB Lagarde

- Gospodarska

- Gospodarstvo

- robovi

- 8

- spodbujanje

- konec

- Lastniški vrednostni papirji

- oceniti

- Eter (ETH)

- EUR / USD

- Euro

- Evropski

- Evropska centralna banka

- Evroobmočje

- PMI storitev v evroobmočju

- pričakovanja

- izkušen

- Falling

- finančna

- Finančni trg

- Najdi

- Osredotočite

- za

- forex

- je pokazala,

- iz

- v celoti

- temeljna

- nadalje

- splošno

- nemški

- Nemško gospodarstvo

- nemški PMI

- PMI nemških storitev

- Globalno

- svetovnih trgih

- upravljanje

- Rast

- se zgodi

- Imajo

- najvišja

- zelo

- njegov

- HTTPS

- if

- izboljšalo

- Izboljšanje

- izboljšanju

- in

- Inc

- Vključno

- Povečajte

- Indeks

- naveden

- indeksi

- inflacija

- Podatki

- obresti

- Obrestne mere

- vlaganjem

- naložbe

- IT

- ITS

- jpg

- junij

- Lagarde

- Največji

- manj

- Stopnja

- kot

- več

- nižje

- Makroekonomsko

- velika

- proizvodnja

- marec

- označeno

- Tržna

- MarketPulse

- Prisotnost

- max širine

- Maj ..

- pomeni

- člani

- mešano

- več

- nujno

- negativna

- negativno ozemlje

- novice

- št

- zdaj

- of

- uradniki

- on

- na spletu

- samo

- Komentarji

- Optimizem

- or

- ven

- preteklosti

- pesimizem

- slika

- načrtovano

- platon

- Platonova podatkovna inteligenca

- PlatoData

- prosim

- pmi

- Prispevkov

- Predsednik

- cenitev

- Proizvedeno

- publikacije

- objavljeno

- namene

- območje

- Oceniti

- Cene

- reading

- ostanki

- Odpornost

- vrnitev

- ROSE

- rss

- Je dejal

- Vrednostni papirji

- iskanju

- Iščem Alpha

- prodaja

- Serija

- Storitev

- Storitve

- Zasedanje

- delitev

- je pokazala,

- Razstave

- podpisati

- Znaki

- saj

- spletna stran

- nekoliko

- Rešitev

- nekaj

- Kmalu

- Začetek

- navedla

- Korak

- Še vedno

- naravnost

- močnejši

- odvisnih družb

- podpora

- Preverite

- Ozemlje

- Testiranje

- da

- O

- Tukaj.

- jih

- tretja

- ta

- letos

- 3

- do

- vzel

- Trgovanje

- Obrnjen

- us

- v1

- obisk

- Sreda

- Kaj

- ki

- medtem

- bo

- zmago

- z

- Woods

- delo

- bi

- leto

- še

- jo

- zefirnet