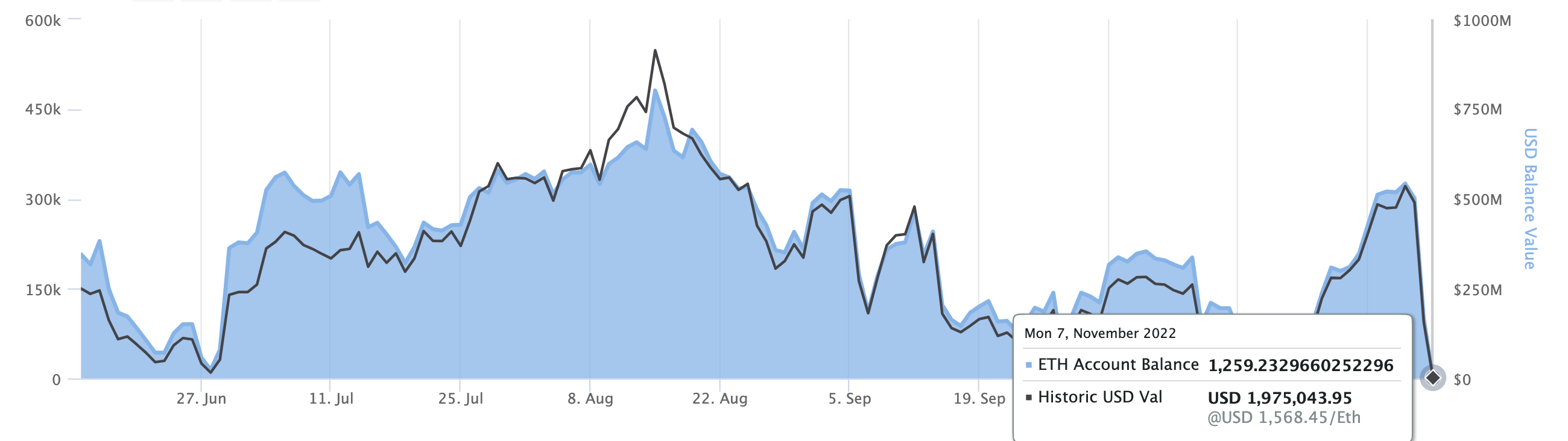

FTX seems to be on the grip of full on panic with one of its ethereum address down from about 300,000 eth to just 1,000 eth according to onchain data.

The balance is now increasing as new deposits are made to the exchange, with it unclear whether these are actual withdrawals, except many transactions are for small amounts which is typical of withdrawals rather than internal movements.

That has sent this address from a peak of one million eth in December 2021 to now its lowest balance ever.

FTX’s bitcoin address has seen even more spectacular movements in going from 20,000 BTC to precisely zero.

They moved them seemingly internally once, but then the coins are scattered to many addresses in small amounts.

That does not preclude FTX from itself doing it, even the scattering, but in that case it would only be to obfuscate so they can’t be tracked. In the current circumstances, that would raise the question why.

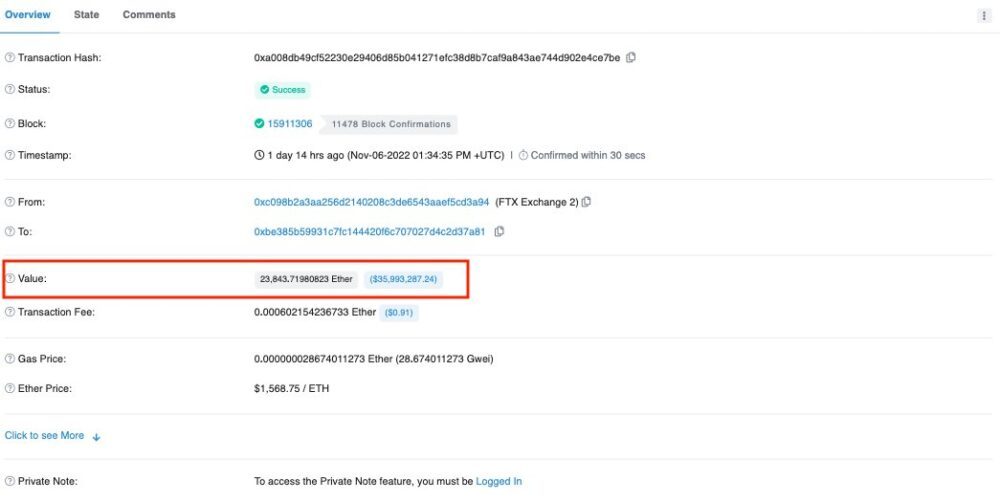

Big withdrawals have been confirmed, however. PeckShield, better known as an auditor of smart contracts, highlights a close to $300 million stablecoins withdrawal, including 24,000 eth.

PeckShield also points out that 100 million BITdao tokens were transferred from FTX to Alameda Research. That led Ben Zhou, the co-founder of BYBIT, to protest as they have a swap deal whereby Bitdao keeps the FTTs and Alameda keeps the BITs for three years. The former threatened to sell the FTTs, with Zhou stating:

“Bitdao community is questioning the sudden dump of $bit token caused by Alameda dumping and breaching the 3 yr mutual no sale public commitment. Nothing is confirmed but bitdao community would like to confirm a proof of fund from Alameda.”

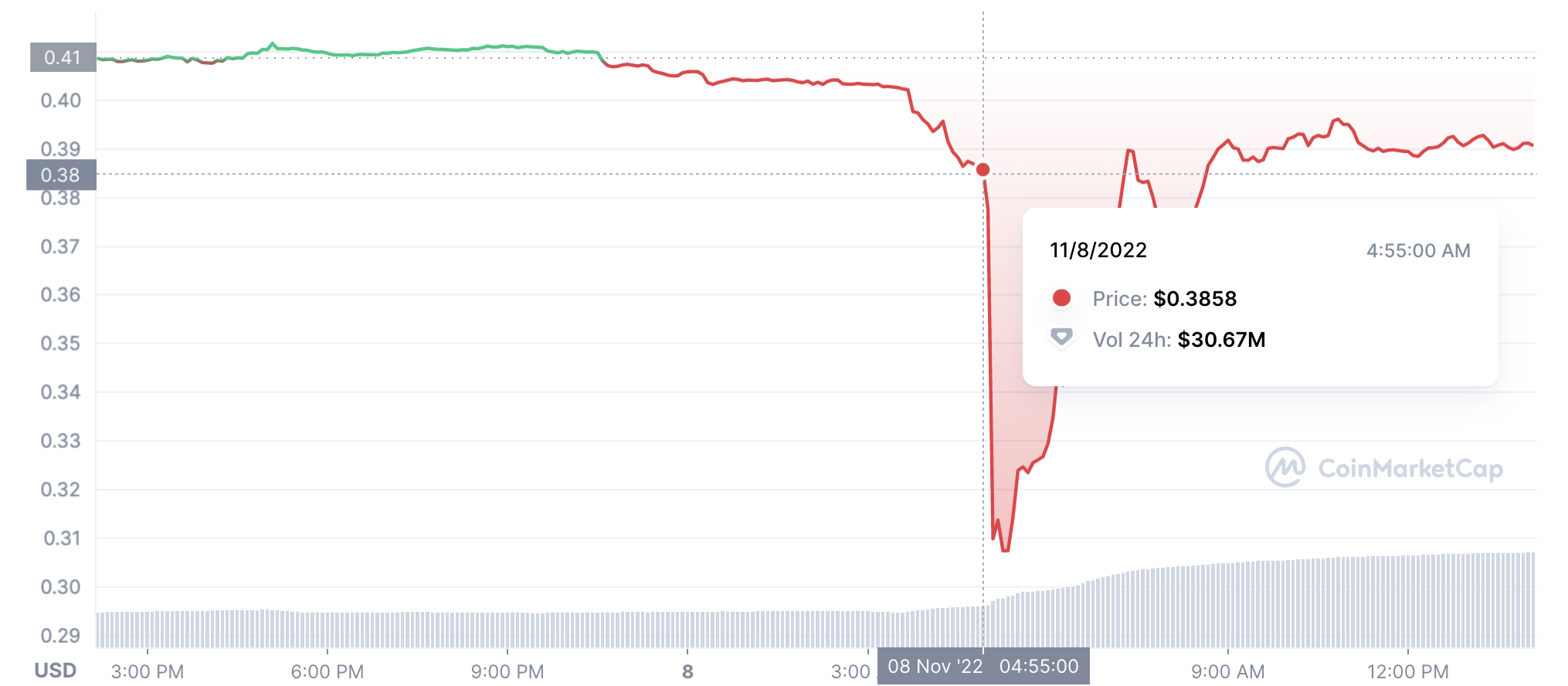

Bit initially dived some 20% from 40 cent to 30 cent, but has now largely recovered to 39 cent. That’s probably because Caroline Ellison, the CEO of Alameda Research, stated in reply to Zhou:

“Busy at the moment but that wasn’t us, will get you proof of funds when things calm down.”

The onchain address shows Alameda still has that 100 million Bit, providing a clear example as to why care needs to be exercised because a movement does not necessarily mean a sale.

Yet, there is intense activity both at FTX and Alameda with the brunt being born by Sol of Solana, down from $38 on November the 5th to $25, now trading at $28.

FTX was an initial investor in Sol and one of its chief proponent, with it also holding many of those coins.

Some $52 million worth of Sol were liquidated earlier today according to DefiLama, but BNB fell about 10% too before recovering.

FTT is seeing the worst of it all, down 32% from $25 to $17 with it losing 25% just today. That’s FTX’s token which Binance is selling at the tune of about half a billion worth.

The entire market cap of FTT is now $2.3 billion, so $500 million is about 25% of the entire value of its circulating supply.

Alameda Research holds/held about $6 billion worth of FTT in loans and assets, indicating as of yesterday they were 2x leveraged over the entire FTT market cap, and now 3x leveraged.

Alameda claimed they had repaid many of those loans, but sharks are clearly circling to see if they can margin call what was once just a market maker, and now appears to play collaterals on defi.

As an example, FTX US redeemed 2,000 wBTC from Compound with it very unclear what this exchange is doing on defi, but it is thought the relationship between Alameda and FTX is almost merged, so it isn’t clear which one closed this position exactly.

Nor is it clear whether either of them will be able to survive this speculative attack, the first for a major exchange since Bitfinex came under market frenzy in 2016 following a hack.

FTX is a very new exchange, and in being so close to Alameda is a new development for exchanges overall.

It has not undergone any market test so far, and sooner or later of course it was going to come under intense scrutiny as all prominent exchanges have.

Making this a Proof of Keys testrun and not a bank run. That’s because banks are fractional reserves. A bank by definition can not satisfy a bank run. A bank run therefore pretty much guarantees a bankruptcy.

Crypto exchanges are not meant to be fractional reserves. They are meant to be able to meet all withdrawals, even 100% of assets. A Proof of Keys testrun therefore is not necessarily a self-fulfilling prophecy in regards to bankruptcy, as long as the exchange does have all the assets and can meet withdrawals.

If it doesn’t, we better find out as with volatile cryptos, fractional reserve-ing means sooner or later the exchange will blow up, especially if price gains.

Depositors therefore should not feel bad for withdrawing and where the exchange is concerned, such withdrawals are not an attack, but a natural right of depositors and a Proof of Solvency.

Where Alameda is concerned that’s different. Their positions are obviously under attack. They’re leveraged over the entire FTT market cap. Sharks will naturally want to see if they can withstand the heat, and there there’s room for speculation whether they can or not, hence people will take positions.

For FTX though, such Proof of Keys test should be a ritual really for all exchanges, especially new ones, but it takes effort so you need a catalyst which in this case is provided by the far more speculative Alameda.

- Bitcoin

- blockchain

- blockchain compliance

- blockchain conference

- coinbase

- coingenius

- Consensus

- crypto

- crypto conference

- crypto mining

- cryptocurrency

- decentralized

- DeFi

- Digital Assets

- ethereum

- featured

- machine learning

- news

- non fungible token

- plato

- plato ai

- Plato Data Intelligence

- Platoblockchain

- PlatoData

- platogaming

- Polygon

- proof of stake

- Trustnodes

- W3

- zephyrnet