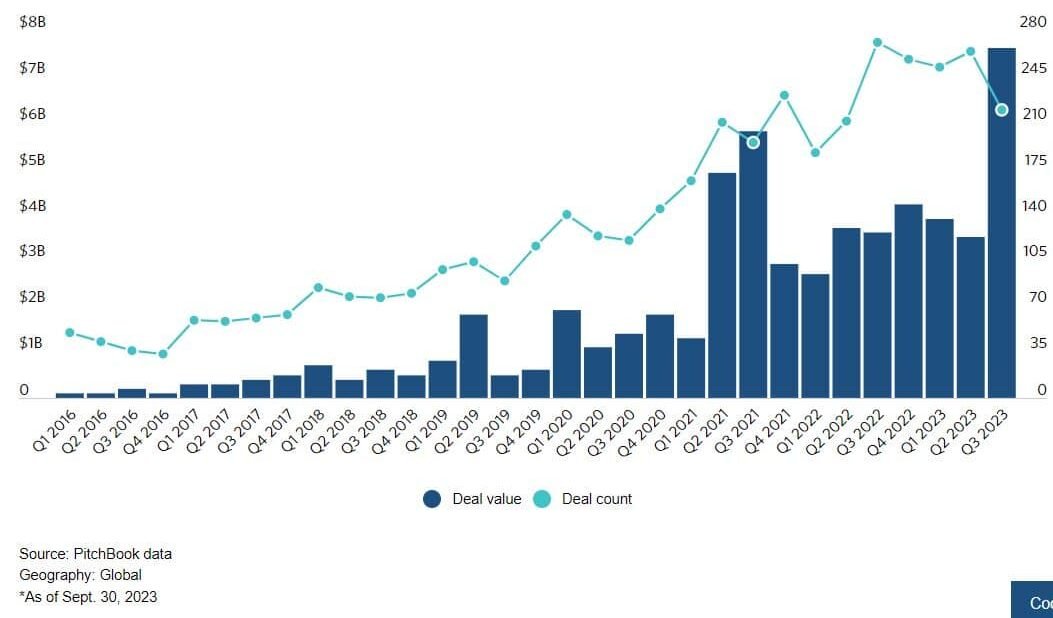

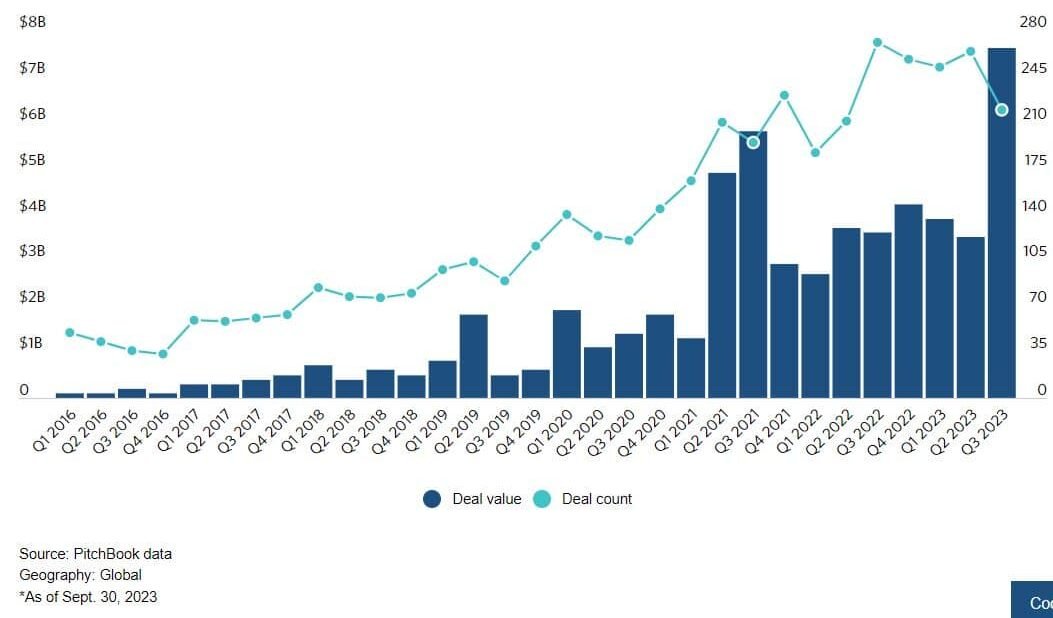

Climate-tech startups focusing on carbon and emissions technology garnered $7.6 billion in venture capital (VC) funding in the third quarter this year, surpassing the sector’s prior record by $1.8 billion and opposing the downturn trend in fundraising.

The surge in climate-tech companies during the quarter was propelled by a series of large financing rounds supporting the construction of factories, aided by government incentives.

The Spike in Carbon & Emissions Tech VC Funding

According to PitchBook’s Q3 2023 Carbon & Emissions Tech Report, H2 Green Steel closed $1.6 billion in an early-stage round. The company uses hydrogen from renewable sources in making steel. Redwood Materials, a lithium battery recycling company, secured a $997.2 million in Series D round.

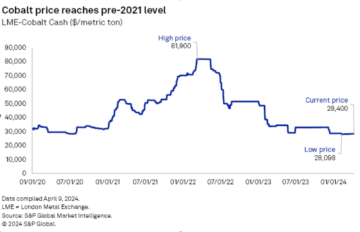

Apart from strong VC deal value for both the manufacturing & chemicals and lithium battery recycling company categories, green mining also witnessed the highest ever quarter for VC value. It saw $394.9 million across eleven deals analyzed.

Quarterly VC Funding in Carbon and Emissions Tech

- A major factor in the spike in deal value is various large deals in the vertical.

Government assistance offers significantly more non-dilutive financial support for decarbonization firms compared to other sectors. This enables climate-tech experts to sidestep the fundraising challenges that have affected a large portion of the VC industry.

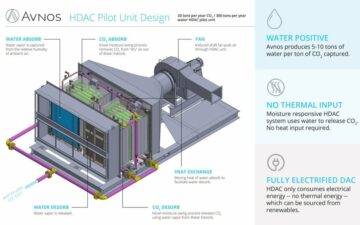

The 1-year-old US Inflation Reduction Act has facilitated substantial advancements in areas such as green hydrogen, electric vehicle supply chains, direct air carbon (DAC) capture, and renewable electric grid infrastructure.

What further drives the growth is automobile companies going full for electric vehicles. Highlighting this trend, a founder of an impact investor firm noted that:

“There’s a natural, inevitable scale-up that’s coming from battery technology in response to an industry that’s fully embraced becoming completely electric.”

Most of the notable transactions completed in Q3 were aimed at facilitating the construction or establishment of new manufacturing facilities. Both the burgeoning sectors of green mining and energy efficiency for buildings experienced their most lucrative quarters for VC deal value.

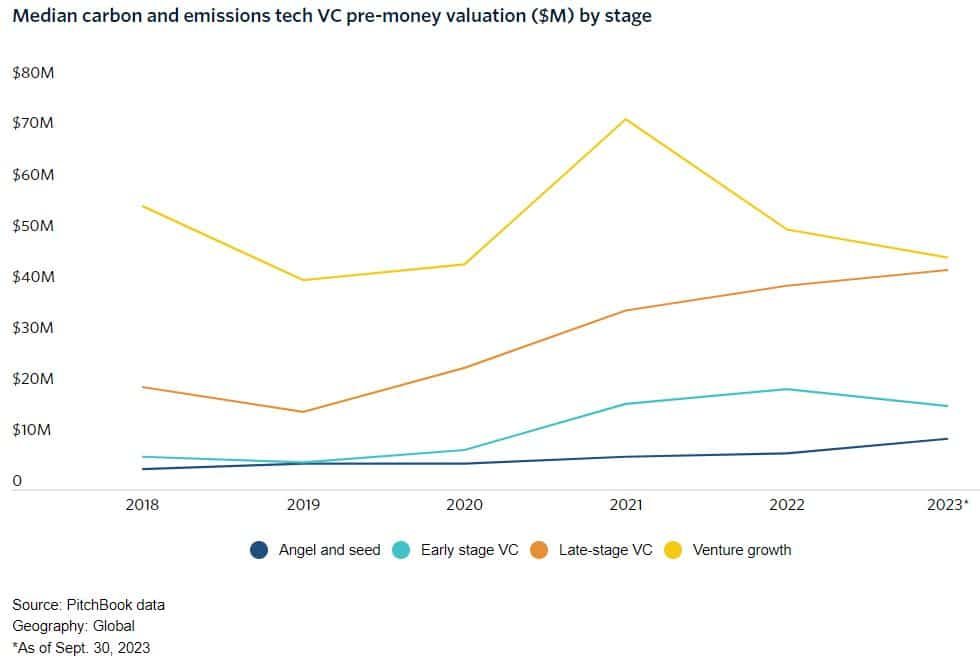

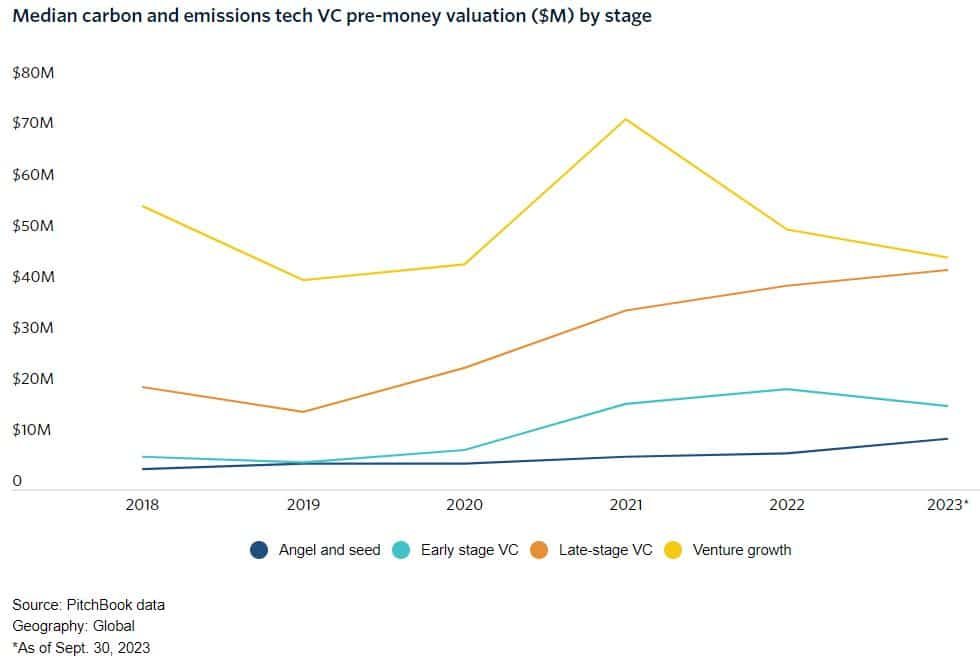

In contrast to sectors like SaaS and fintech, where investors have recalibrated their outlooks following the swift up-rounds of 2021, appraisals for decarbonization enterprises have maintained a relatively steady course.

Pre-seed, seed, and late-stage companies have all reported increased median pre-money valuations in 2023 compared to the previous year.

Here are the details as per Pitchbook data:

- Pre-seed and seed funding increased from $2.0 million to $2.3 million

- Early-stage VC funding decreased from $5.6 million to $4.1 million

- Late-stage VC funding increased from $9.2 million to $10.7 million

- Venture growth funding increased from $11.7 million to $14.5 million

The Force Behind Climate-Tech Firms Defying VC Trend

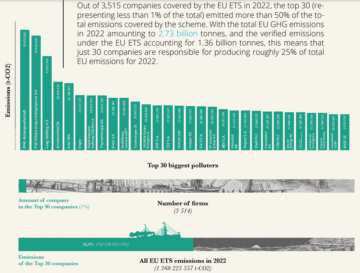

VCs are particularly enthusiastic about low-carbon mineral mining and DAC. This is driven by the growing demand for mineral resources and carbon removal to achieve net zero emissions by 2050.

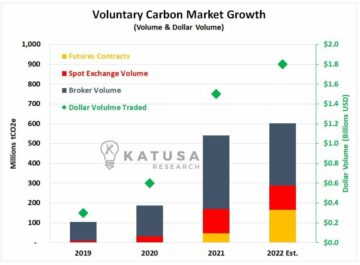

Notably, large companies like Amazon and JP Morgan have invested hundreds of millions of dollars in carbon dioxide removal credits. Other tech giants such as Apple and Microsoft also did the same support for CDR credits.

Moreover, the recent allocation of $7 billion in federal funding for renewable hydrogen hubs across the United States revealed in mid-October, has sustained the inflow of federal funds.

This record-setting quarter comes after two lackluster quarters for climate-tech fundraising had raised concerns about a potential slowdown impacting green emerging technologies. Add to this the disruption caused by the collapse of Silicon Valley Bank, prompting companies to tap lenders for financing.

Despite the broader VC fundraising slowdown, carbon and emissions startups seem undeterred in securing substantial funding as seen above. Median deal sizes in various stages, from pre-seed to venture growth, have all experienced increases in 2023 compared to the previous year.

The impetus for climate-tech startups also stems from the escalating impact of climate change. According to climate experts, 2023 would be the hottest year since at least 1940.

As what the founder of SecondMuse further said, the “changing climate is just getting more real for more people”. This is evidenced by the growing presence of family offices supporting climate-tech companies.

Despite concerns of a slowdown, climate-tech startups surged in Q3, setting records in VC funding. The sector’s growth is driven by government support and a rising focus on carbon reduction technologies.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://carboncredits.com/climate-tech-startups-amass-7-6b-in-q3-setting-new-record-for-vc-funding/

- :has

- :is

- :where

- 1

- 2021

- 2023

- 2050

- 7

- 8

- 9

- a

- About

- above

- According

- Achieve

- across

- Act

- add

- advancements

- affected

- After

- aimed

- AIR

- All

- allocation

- also

- an

- analyzed

- and

- ARE

- areas

- AS

- Assistance

- At

- automobile

- Bank

- battery

- BE

- becoming

- behind

- Billion

- both

- broader

- buildings

- burgeoning

- by

- capital

- carbon

- carbon dioxide

- Carbon Reduction

- categories

- caused

- chains

- challenges

- change

- chemicals

- Climate

- Climate change

- closed

- Collapse

- comes

- coming

- Companies

- company

- compared

- Completed

- completely

- Concerns

- construction

- contrast

- course

- Credits

- data

- deal

- Deals

- decarbonization

- decreased

- defying

- Demand

- details

- DID

- Disruption

- dollars

- DOWNTURN

- driven

- drives

- during

- early stage

- efficiency

- Electric

- electric vehicle

- electric vehicles

- eleven

- embraced

- emerging

- emerging technologies

- Emissions

- enables

- energy

- energy efficiency

- enterprises

- enthusiastic

- establishment

- Ether (ETH)

- EVER

- evidenced

- experienced

- experts

- facilitated

- facilitating

- facilities

- factor

- factories

- family

- Federal

- financial

- financing

- fintech

- Firm

- firms

- Focus

- focusing

- following

- For

- Force

- founder

- from

- full

- fully

- funding

- Fundraising

- funds

- further

- garnered

- getting

- giants

- going

- Government

- government support

- Green

- Grid

- Growing

- Growth

- had

- Have

- highest

- highlighting

- hottest

- http

- HTTPS

- hubs

- Hundreds

- hundreds of millions

- hydrogen

- Impact

- impacting

- in

- Incentives

- increased

- Increases

- industry

- inevitable

- inflation

- invested

- investor

- Investors

- IT

- jpg

- just

- Lackluster

- large

- least

- lenders

- like

- lithium

- low-carbon

- lucrative

- major

- Making

- manufacturing

- materials

- max-width

- million

- millions

- mineral

- Mining

- more

- most

- Natural

- New

- notable

- noted

- of

- Offers

- offices

- on

- or

- Other

- particularly

- per

- Pitchbook

- plato

- Plato Data Intelligence

- PlatoData

- potential

- pre-seed

- presence

- previous

- Prior

- propelled

- Q3

- Quarter

- raised

- real

- recent

- record

- records

- recycling

- reduction

- relatively

- removal

- Renewable

- Reported

- Resources

- response

- Revealed

- rising

- round

- rounds

- SaaS

- Said

- same

- saw

- scale-up

- Sectors

- Secured

- securing

- seed

- Seed funding

- seem

- seen

- Series

- setting

- significantly

- Silicon

- Silicon Valley

- silicon valley bank

- since

- sizes

- Slowdown

- Sources

- spike

- Stage

- stages

- Startups

- States

- steady

- steel

- stems

- strong

- substantial

- such

- supply

- Supply chains

- support

- Supporting

- surge

- Surged

- surpassing

- sustained

- SWIFT

- Tap

- tech

- tech giants

- tech startups

- Technologies

- Technology

- that

- The

- their

- Third

- this

- this year

- to

- Transactions

- Trend

- two

- United

- United States

- us

- us inflation

- US inflation reduction act

- uses

- Valley

- Valuation

- Valuations

- value

- various

- VC

- VC funding

- vehicle

- Vehicles

- venture

- venture capital

- venture capital (VC)

- vertical

- W3

- was

- webp

- were

- What

- witnessed

- would

- year

- zephyrnet

- zero