The ETH whales show sustained accumulation according to the on-chain data and this pattern represents a departure from the whale sell-off trend which impacted the network for months so let’s read more today in our latest Ethereum news.

The data from Santiment shows that the ETH Whales show sustained accumulation over the past two weeks and they broke out a sustained ownership downtrend after the start of the year and are back to owning over 12% of the supply. The ETH whales are defined as addresses that hold between 1000 and 10,000 ETH which is between $3 million and $30 million worth of coins at today’s prices. As of Thursday, whale ownership sat at 12.07% of ETH and up from 11.92% about 10 days earlier.

Whales have hardly ever shown sustained accumulation in months but the concentration among the holders surged in December and then dropped since. The accumulation is associated with the higher prices as it means given crypto has become scarce for the market. Bitcoin’s price broke higher after what seemed to be a $1.6 billion whale buy and the ETH price is yet to react positively but it is in a week-long decline.

As earlier reported, Ethereum’s consensus layer deposit contract contains over 12 million ETh and over 10% of Ethereum’s supply. Over 360,000 validators locked 32 ETH in the contract that will allow the funds to be moved from the mainnet to the Beacon Chain which is a running PoS version of Ethereum with which the mainnet is set to merge in the future. The deposit contract for the ETH consenSys layer known as eTH 2.0 exceeded 12 million ETH which is worth about $34 billion at current prices. This means that about 10% of the entire ETH supply is locked in the consensus layer deposit contract.

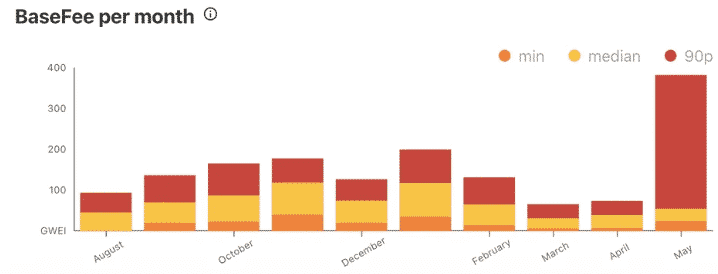

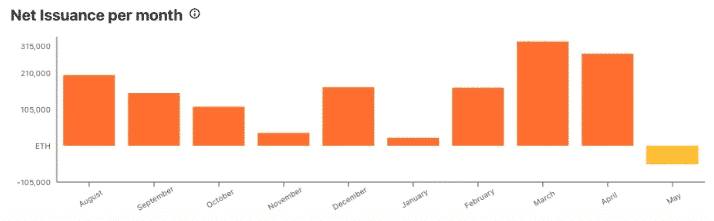

Ethereum Foundation Trent Van Epps emphasized that not only the Merge will make the chain more secure, but it will also reduce the ETH network’s energy use by 99.95% and the Merge can reduce the annual issuance of ETH to a net 0% down from the current 3-5%. in addition to more than 12 million, ETH locked in the deposit contract for the Beacon Chain at 2.18 million coins have been destroyed since Improvement Proposal 1559 was launched in August. The upgrade sought to stabilize the network transaction fees and intruded a base fee ETH Burn.

- $3

- 000

- 10

- 11

- About

- According

- addition

- addresses

- among

- annual

- AUGUST

- beacon chain

- become

- Billion

- buy

- chain

- Coins

- concentration

- Consensus

- ConsenSys

- contains

- contract

- crypto

- Current

- data

- destroyed

- down

- dropped

- emphasized

- energy

- ETH

- Eth 2.0

- eth price

- ethereum

- Ethereum News

- Fees

- Foundation

- funds

- future

- higher

- hold

- holders

- HTTPS

- issuance

- IT

- known

- launched

- locked

- Market

- million

- Month

- months

- more

- net

- network

- news

- On-Chain

- ownership

- Pattern

- PoS

- price

- proposal

- React

- reduce

- represents

- running

- secure

- set

- So

- start

- supply

- today

- today’s

- transaction

- use

- Watch

- whales

- What

- worth

- year