Ethereum risks dropping further after breaking below the $1K price point in a 2018-like bearish cycle so let’s read more today in our latest Ethereum news.

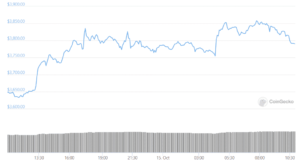

Ethereum risks dropping further after the latest crash below $1,000 with the ongoing sell-off on the market bringing a lot more pain for cryptocurrencies. Ether reached $975 which is the lowest point since 2021 and lost 80% of its value from the high of November 2021. The decline appeared amid the concerns about the FED 75 basis points rate hike which is a move that pushed most cryptos and stocks into a bear market. Analyst at data resource Econometrics warned there will be even more downsides coming:

“The Federal Reserve has barely started raising rates, and for the record, they haven’t sold anything on their balance sheet either.”

The investors and traders were watching Ether’s price in the past few days and feared a breakdown below $1000 which will trigger more liqudations of leveraged bets and in turn, this will put more pressure on Ethereum. The fears appear due to the Babel Finance and Celsius network as a part of lending platforms which stopped withdrawals due to citing market volatility. They intensified, even more, when Three Arrows Capital failed to shore up collateral to cover bets. This came less than a month after Terra’s algorithmic stablecoin collapsed.

The events coincided with the massive capital withdrawal from Ethereum’s blockchain ecosystem with the total TVL unwind happening in two parts. Ethereum’s TVL across the DEFI projects dropped by $94 billion after the Terra crash back in May and then by another $30 billion by mid-June. CheckMate and CryptoVizArt analysts added:

“The deleveraging event that is underway is observably painful, and is akin to a form of mini-financial crisis. However, with this pain comes the opportunity to flush excessive out leverage, and allow for a healthier rebuild on the other side.”

FED’s hawkish policies and the DEFI market implosion suggested extending a bearish move on the Ether market. From a technical perspective, ETH’s price has to regain $1000 as its psychological support which if it gets broken to the downside, it can have the token eye the $830 as a new target. The same level served as resistance back in 2018 which preceded a 90% drop to around $80 in 2018. in the meantime, the ETH/USD pair can drop to as low as $420 if Ether’s correction turns out similar to the 2018 bear cycle when the drawdown reached 90%.

- $1000

- 000

- 2021

- a

- About

- across

- added

- algorithmic

- Amid

- analyst

- Another

- around

- basis

- Bear Market

- bearish

- below

- Billion

- blockchain

- Breakdown

- capital

- coming

- cover

- Crash

- crisis

- cryptocurrencies

- data

- DeFi

- Drop

- dropped

- ecosystem

- ETH

- ETH/USD

- Ether

- ethereum

- Ethereum News

- ETHUSD

- Event

- events

- eye

- fears

- Fed

- Federal

- federal reserve

- finance

- form

- from

- further

- healthier

- High

- However

- HTTPS

- Investors

- IT

- latest

- lending

- Level

- Leverage

- locked

- Market

- massive

- meantime

- Month

- more

- most

- move

- network

- news

- ongoing

- Opportunity

- Other

- Pain

- part

- perspective

- Platforms

- Point

- points

- policies

- pressure

- price

- projects

- pushed

- raising

- Rates

- reached

- record

- Reserve

- resource

- risks

- same

- similar

- since

- So

- sold

- stablecoin

- started

- Stocks

- support

- Target

- Technical

- Terra

- The

- three

- today

- token

- Traders

- Underway

- value

- Volatility

- weekly

- withdrawal